Summary

- Sustainable funds closed August at $310.5 billion, up $6.5 billion of which $2.9 billion is sourced to market movement and $2.05 billion to net positive cash flows, for a combined total of $4.95 billion; repurposed funds added $1.54 billion.

- Sustainable funds registered an average gain of 2.14%, ranging from 17.17% to -3.87% while the SUSTAIN Equity Fund Index added 2.79%, lagging behind the S&P 500 by 47 basis points.

- The top 20 sustainable fund groups held 88.2% of segments assets under management while largest 10 funds account for $157.4 billion and 51% of the segment’s assets and 10 sustainable ETFs hold $5.7 billion, a mere 3.6% of the equivalent number of mutual funds.

- The largest monthly net gains were recorded by Washington Mutual, Parnassus and Calvert funds while largest monthly declines were recorded by Aberdeen, Morgan Stanley and Ariel funds.

- Repurposed funds include DWS ESG Liquidity Fund, first ESG money market fund and two Allianz equity funds.

- New funds launched in August include the DWS Xtrackers ETF and Impact Shares YWCA Women’s Empowerment ETF.

[ihc-hide-content ihc_mb_type=”show” ihc_mb_who=”reg” ihc_mb_template=”4″ ]

Sustainable funds close August at $310.5 billion, up $6.6 billion of which $2.9 billion is sourced to market movement and $2.2 billion to net positive cash flows

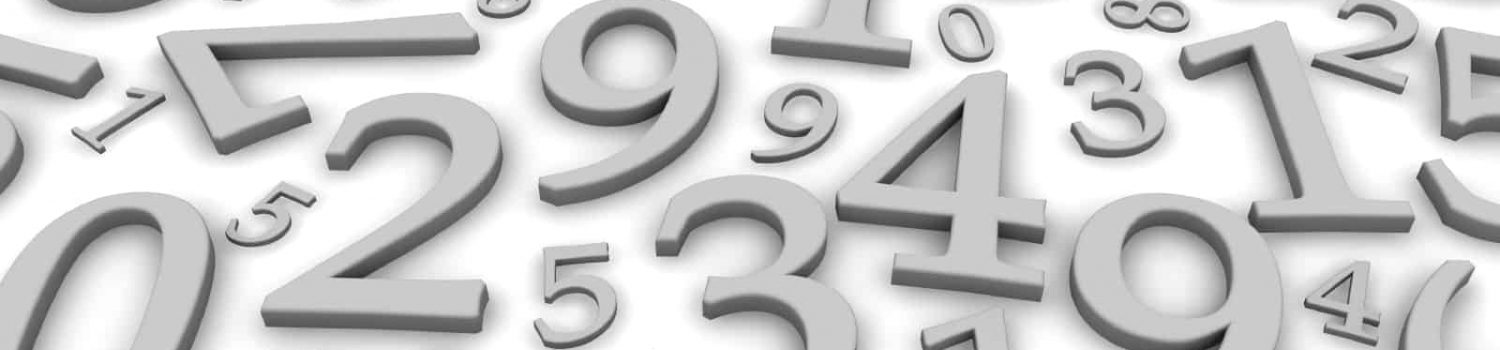

The net assets of 1,061 sustainable funds[1], including mutual fund share classes, exchange-traded funds (ETFs) and exchange-traded notes (ETNs), ended the month of August with $310.6 billion in assets under management versus $303.9 billion at the end of July. The increase in net assets for the month, in the amount of $6.5 billion, was sourced to market movement that contributed $2.9 billion, net cash flows that contributed an estimated $2.05 billion, the second highest after January’s $2.2 billion, and repurposed funds that shifted $1.5 billion. The net assets of sustainable funds reached another month-end all-time high. Since the beginning of the year this segment has added $60.2 billion in net assets, of which an estimated 69% is attributable to repurposed mutual funds, or existing funds that have adopted a sustainable strategy or investment approach by formally amending their prospectus. Refer to Chart 1.

Mutual fund assets stood at $301.4 billion as of the end of August while ETFs and ETNs closed the month at $9.1 billion for an increase of $240 million relative to last month. The relative proportion of the two segments remain unchanged at about 97% and 3%, respectively. Assets sourced to institutional only mutual funds versus all other funds gained $2.2 billion to $102.7 billion, or 34% of the segment’s assets, versus $100.5 billion at the end of June.

Mutual fund assets stood at $301.4 billion as of the end of August while ETFs and ETNs closed the month at $9.1 billion for an increase of $240 million relative to last month. The relative proportion of the two segments remain unchanged at about 97% and 3%, respectively. Assets sourced to institutional only mutual funds versus all other funds gained $2.2 billion to $102.7 billion, or 34% of the segment’s assets, versus $100.5 billion at the end of June.

Explicitly designated sustainable funds are offered by a universe of 117 fund groups that were in in operation at the end of August. This reflects a net increase of one fund group, namely DWS (formerly Deutsche Asset Management) that added one repurposed fund to the segment as well as one newly launched ESG-oriented ETF. The month-over-month increase of 15 funds/share classes to end August at 1,061 funds/share classes is attributable to the DWS additions, the repurposing of 2 Allianz funds consisting of 11 share classes as well as the launch of another ETF by Impact Shares, the Impact Shares YMCA Women’s Empowerment ETF.

Sustainable funds registered an average gain of 2.14%, ranging from 17.17% to -3.87% while the SUSTAIN Equity Fund Index added 2.79%, lagging behind the S&P 500 by 47 basis points

Within a universe of 1,059 sustainable funds with performance for the full month, including mutual funds, exchange-traded funds (ETFs) and exchange-traded notes (ETNs) and their corresponding share classes, returns for the month of August, hampered by the performance of non-US stocks, averaged 0.83% versus last month when sustainable funds, on average, posted a gain of 2.14%. A total of 739 funds, or 70%, posted 0.00 to positive results for the month.

Economic growth momentum and a sturdy fundamental backdrop of strong corporate earnings, low unemployment and contained inflation overcame a number of challenges to bolster stock results in the US. The Federal Reserve also fueled momentum, with news that it remains accommodative on the monetary policy front. Interest rates are being lifted slowly and predictably while the Fed’s balance sheet is being trimmed in a similarly deliberative fashion.

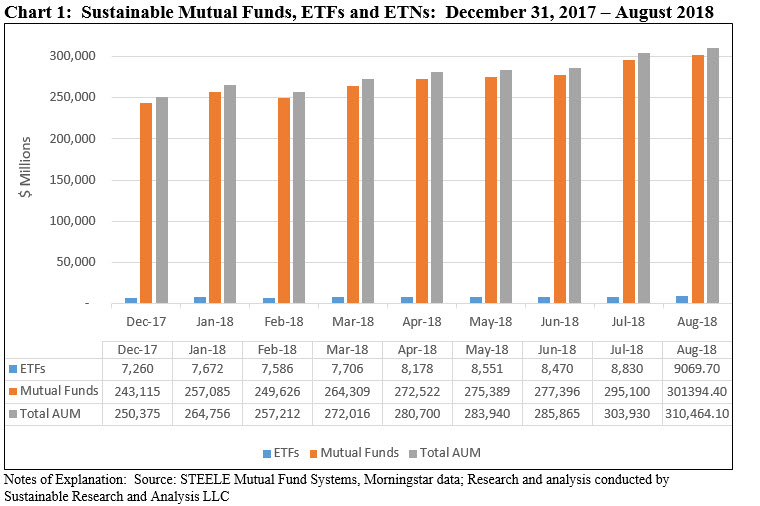

The SUSTAIN Equity Fund Index, which tracks the total return performance of the ten largest actively managed large-cap US, gained 2.79% in August, lagging behind the S&P 500 by 47 basis points and in the process widened the difference between the two indexes to 4.60% since December 31, 2016. Refer to Chart 2. At the same time, the SUSTAIN Bond Fund Indicator recorded an increase of 0.66% in August, beating the Bloomberg Barclays U.S. Aggregate Bond Index. For further details, refer to SUSTAIN Equity Fund Index Up 2.79% in August 2018, Lagging S&P 500 by 47 BPS.

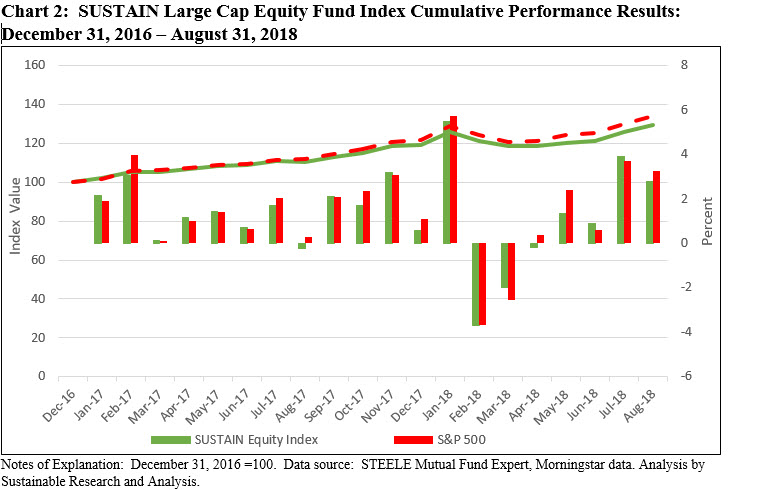

Market movement and net positive cash flows add $2.9 billion and $2.05 billion, respectively, for a combined total of $4.95 billion; repurposed funds add $1.54 billion

Market movement contributed an estimated $2.9 billion and estimated cash inflows, excluding repurposed funds, contributed an estimated $2.05 billion, for a combined addition of $4.95 billion in August. This represents a 1.7% increase due to these factors in August versus an estimated gain of only 0.056% for mutual funds and ETFs combined over the same interval as these two segments added $200.1 billion. Repurposed funds shifted $1.54 billion, or about 0.51% relative to July’s net assets. The net assets of sustainable funds reached another month-end all-time high. Since the beginning of the year this segment has added $60.2 billion in net assets, of which an estimated 70% is attributable to repurposed mutual funds, or existing funds that have adopted a sustainable strategy or investment approach by formally amending their prospectus. Refer to Chart 3.

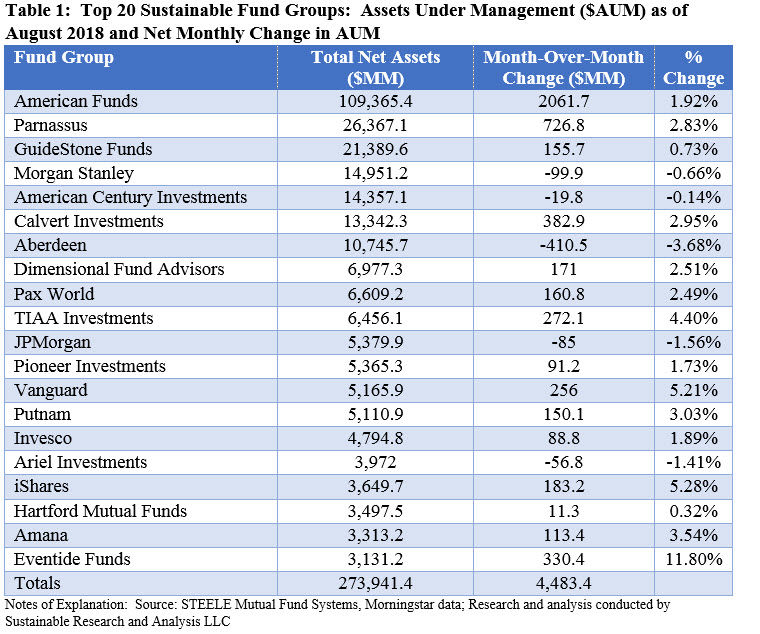

Top 20 sustainable fund groups held 88.2% of segments assets under management

The top 20 sustainable fund groups held $273.9 billion assets under management, accounting for 88.2% of the segment’s assets versus 88.7% the prior month. The top 20 funds added a net of $4,483.4 million, representing 69% of the segment’s net gain of $6.5 billion. Refer to Table 1.

There was no shift in the standing of the top 10 fund groups. At the same time, Eventide Funds displaced Neuberger Berman as the 20th largest fund group with its net addition of $330.4 million in August versus Neuberger’s August net addition of $45 million. Also, Vanguard Funds now ranks 13th, eclipsing Putnam after adding a net of $256 million.

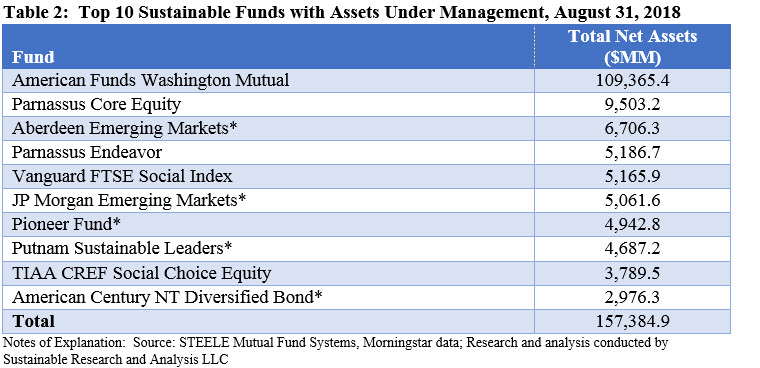

Largest 10 funds account for $157.4 billion and 51% of the segments assets

The 10 largest sustainable funds listed in Table 2, with $157.4 billion in assets under management, account for 51% of the segment’s assets under management. All are equity oriented funds, excepting the recently added American Century NT Diversified Bond that adopted a no-tobacco exclusionary policy. This fund is one of five recently repurposed funds that now rank within the 10 largest funds in the sustainable sector.

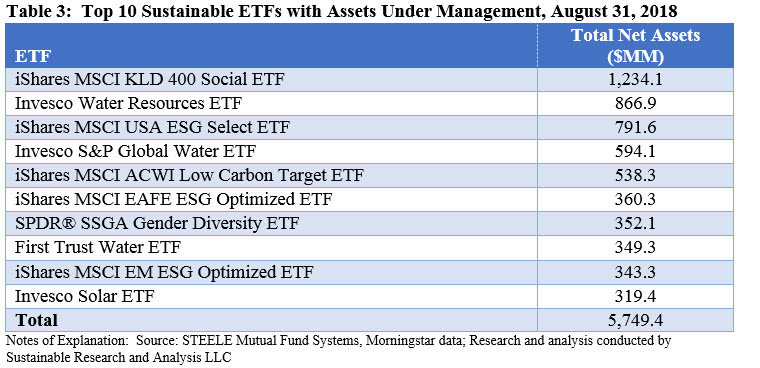

Largest 10 sustainable ETFs hold $5.7 billion, a mere 3.6% of the equivalent number of mutual funds

The 10 largest ETFs listed in Table 3 have amassed $5.7 billion in assets under management and are eclipsed by their top 10 mutual fund counterparts, standing at a mere 3.6% of the top 10 mutual fund assets. The largest of these is the iShares MSCI KLD Social ETF, one of the oldest sustainable ETFs. The ETF seeks to replicate the KLD 400 Social Index, likely the oldest social index in the US that was initially launched in May 1990 as the Domini 400 Social Index.

Largest monthly net gains recorded by Washington Mutual, Parnassus and Calvert funds

The following fund firms and funds contributed to the largest gains attributable to market movement, positive flows or repurposed funds, or some combination these factors:

- The largest monthly net gain, in the amount of $2,061.7 million, was realized by American Funds’ $109.4 billion Washington Mutual Fund, a fund offered by American Funds that excludes companies deriving a majority of their revenues from alcohol or tobacco products. The fund group’s Washington Mutual Fund is the only fund in the group that is explicitly described as a sustainable fund. It continues to account for 35.2% of the sustainable segment’s assets under management.

- The second best monthly net addition was recorded by Parnassus Funds, which added a net of $726.8 million. The second largest sustainable funds group with $9.5 billion spread across 10 funds/share classes, the group’s $17 billion Parnassus Core Equity Fund gained $631 million, or an increase of 3.9% and accounting for about 67% of the group’s gain for the month. This on the back of total return gains in August of 2.65% which was slightly behind the S&P 500’s 3.26% gain.

- The Calvert Funds group, offering 80 funds/share classes, saw a net addition of $382.9 million—the month’s third best net gain excluding repurposed funds. The $1,194.1 million Calvert US Large Cap Core Responsible Index Fund added $177.8 million and accounted for 46.4% of the overall increase. The fund and its 4 share classes posted strong results for the month ranging from 4.19% to 4.26%, depending on expense ratios. While its performance was not as strong, the $310.6 million Calvert US Large Cap Value Responsible Index Fund nevertheless added $44 million.

Largest monthly declines were recorded by Aberdeen, Morgan Stanley and Ariel funds

The following fund firms and funds experienced the largest net outflows, a combination of maret depreciation and cash outflows:

- Aberdeen Funds experienced the largest decline in net assets, giving up a net of $410.5 million. The net assets give up is largely attributable to a drop in the amount of $475.6 million suffered by the $7,181.7 million Aberdeen Emerging Markets Fund. The fund’s institutional share class, which recorded an August drop $465.8 million in assets, or X%, posted a -3.15% total return. An additional $X was sourced to the Institutional Service share class.

- Morgan Stanley saw a net decline of $99.9 million, with three funds investing in international markets, emerging markets and frontier markets, giving up a combined value of $282.7 million allocated as follows: Morgan Stanley Institutional International Equity Fund (-$108 million), Morgan Stanley Institutional Frontier Markets (-$89.5 million) and Morgan Stanley Institutional Emerging Markets Fund (-$85.2 million). These give ups were, in part, offset by additions experienced across a spectrum of other funds offered by Morgan Stanley funds.

- Ariel Funds endured a net decline of $56.8 million, with the $1,601.9 million Ariel Appreciation Fund accounting for -$42.6 million of the total.

Repurposed funds include DWS ESG Liquidity Fund, first ESG money market fund and two Allianz equity funds

In addition to launching an ETF this month, DWS (formerly Deutsche Asset Management) made its sustainable investing debut this month by repurposing the firm’s existing $358.7 million DWS Variable NAV Money Market Fund consisting of two share classes. This is the second only sustainable money market fund, the first one being the GuideStone Money Market Fund, a values-based offering by Guidestone Funds. That said, the DWS ESG Liquidity Fund, formerly called the DWS Variable NAV Money Market Fund, is the first money fund to employ ESG criteria, combined with exclusionary screens, as part of a company’s selection process.

According to the fund’s prospectus, effective September 1, 2018, in addition to considering financial information, the security selection process also evaluates a company based on ESG criteria. With the exception of municipal securities, a company’s performance across certain ESG criteria is summarized in a proprietary ESG rating which is calculated by an affiliate of the DWS on the basis of data obtained from various ESG data providers. Only companies with an ESG rating above a minimum threshold determined by DWS are considered for investment by the fund. For the complete ESG criteria, refer to DWS Funds in the Sustainable Investment Glossary under the Investment Research tab.

Allianz Funds added to its stable of sustainable fund offerings by repurposing two funds upon the prospectus amendment as of August 27. These include the $1,160.6 million AllianzGI Focused Growth Fund with its seven share classes and the smaller $19.9 million AllianzGI Global Natural Resources Fund with its four share classes, for a combined total of $1,180.5 million. According to the funds’ prospectus, the funds will also consider a company’s environmental, social and corporate governance (ESG) practices as this is believed to offers an additional level of risk management in the investment process. ESG practices are considered and measured by the intrinsic ESG analyst team. The addition of these funds brings to X the number of sustainable fund offerings and shifts Allianz Funds rank to 25th largest within the sustainable funds universe.

New funds include DWS Xtrackers ETF and Impact Shares YWCA Women’s Empowerment ETF

DWS launched the Xtrackers MSCI EAFE ESG Leaders Equity ETF that seeks to replicate the performance of the MSCI EAFE ESG Leaders Index. The fund, managed by DBX Advisors LLC., integrates ESG by restricting eligible companies to firms that that rank highly in terms of environmental, social and governance (ESG) performance relative to their sector peers, relying on MSCI ESG Ratings, MSCI ESG Controversies and MSCI Business Involvement Screening Research to determine eligible companies.

The fund’s July 31, 2018 prospectus also references the Xtrackers MSCI Emerging Markets ESG Leaders Equity ETF and Xtrackers MSCI ACWI ex USA ESG Leaders Equity ETF that have not been launches as yet.

Also this month, Impact Shares added to its stable of thematic ETFs with the launch of the Impact Shares YWCA Women’s Empowerment ETF. The fund seeks investment results that track the performance of the Morningstar Women’s Empowerment Index, designed to measure the performance of U.S. companies that have strong women’s empowerment practices. The index is constructed using company level indicators, scores, and indicator relevance weighting from Equileap, the fund’s ESG research provider, that include certain social criteria identified and compiled by the YWCA USA to measure the strength of women’s empowerment practices and products or services for each company, expressed in the form of a gender diversity score. For the complete ESG criteria, refer to Impact Shares in the Sustainable Investment Glossary under the Investment Research tab.

[1] Morningstar recorded 1,066 funds, including 5 share classes offered by the Franklin Select US Equity Fund with $99.8 million in assets that had been repurposed as of August. These are excluded from the August analysis as their most recent prospectus does not reflect the adoption of a sustainable strategy or approach.