Summary

- Market Summary: Economic growth momentum and a sturdy fundamental backdrop of strong corporate earnings, low unemployment and contained inflation overcame a number of challenges to bolster stock results in the US. The Federal Reserve also fueled momentum, with news that it remains accommodative on the monetary policy front. Interest rates are being lifted slowly and predictably while the Fed’s balance sheet is being trimmed in a similarly deliberative fashion.

- SUSTAIN Equity Fund Index gained 2.79% in August, lagging behind the S&P 500 by 47 basis points and widening the difference between the two indexes to 4.60% since December 31, 2016.

- SUSTAIN Bond Fund Indicator recorded an increase of 0.66% in August, beating the Bloomberg Barclays U.S. Aggregate Bond Index and expanding the year-to-date outperformance by 0.24% or 24 basis points.

- Diverging results were on display by sustainable equity funds during the recent short market correction to recovery cycle: Returns ranged from a high of 3.4% to a low of -3.8%.

Market Summary: Economic growth momentum and a sturdy fundamental backdrop bolster stock results in the US while the Federal Reserve remains accommodating

Economic growth momentum and a sturdy fundamental backdrop of strong corporate earnings, low unemployment and contained inflation overcame a number of challenges to bolster stock results in the US and contribute to the above average 3.26% total return achieved by the S&P 500 Index in August. In fact, the S&P 500 along with the Nasdaq Composite Index on August 24th both finally surpassed the record closes achieved on January 26th of this year. The Federal Reserve also fueled momentum, with news that it remains accommodative on the monetary policy front. Interest rates are being lifted slowly and predictably while the Fed’s balance sheet is being trimmed in a similarly deliberative fashion. Against this backdrop, the Bloomberg Barclays US Aggregate Bond Index posted a 0.64% gain for the month. This was the benchmark’s best showing since May.

SUSTAIN Equity Fund Index gained 2.79% in August, lagging behind the S&P 500 by 47 basis points

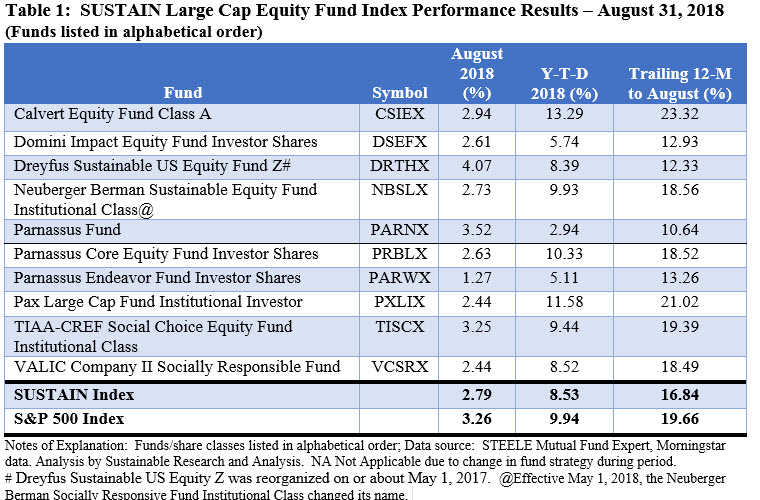

The SUSTAIN Large Cap Equity Fund Index, which tracks the total return performance of the ten largest actively managed large-cap U.S. equity oriented mutual funds that employ a sustainable investing strategy beyond absolute reliance on exclusionary practices, registered a gain of 2.79% in August. This was 47 basis points behind the increase of 3.26% posted by the S&P 500 Index, which also served to widen the difference between the two indexes to 4.60% since December 31, 2016. Refer to Table 1.

Only two of the ten funds that comprise the index exceeded the performance of the S&P 500. These included the Dreyfus Sustainable US Equity Fund Z, up 4.07% and the Parnassus Fund, up 3.52%. This marks the third month in a row in which the Dreyfus fund outperformed the S&P 500 and the first time since the fund’s reorganization on or about May 1, 2017 that it landed as the top performing index constituent for the month. Dreyfus benefited from its overweight exposure to the best performing Technology sector. At 36.5% of the fund’s assets, Technology investments in the fund were 13.9% higher than the 22.6% weighting for Technology in the S&P 500. The fund’s performance, which apparently was not adversely affected by a 5.61% position in non-US investments, also benefited from stock picks, the largest three of which included Microsoft Corp. (MSFT), representing 7.3% of net assets, Alphabet Inc. (GOOG), at 5.22% of net assets and Apple Inc. (AAPL) at 5.05% of net assets. Each of these stocks posted August gains ranging from a low of 0.08% to a high of 19.6% in the case of AAPL. Apple’s rising stock price led the firm to become the first American public company to cross the $1 trillion in value on Thursday before the end of the month when Apple’s stock price passed $207.04. Shares surged after Apple reported earnings that topped forecasts and projected a healthy outlook.

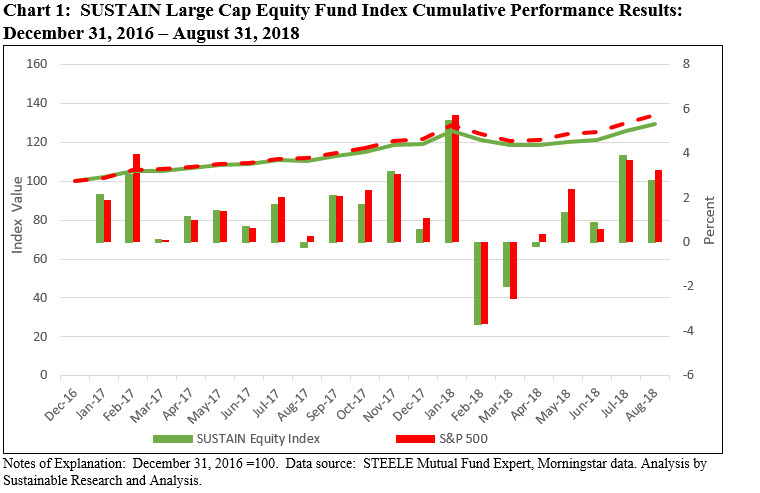

As the intervals for evaluation are extended, the performance of the SUSTAIN Equity Fund Index relative to the S&P 500 produces a wider gap. This is the case for the year-to-date results, trailing 12-month results and total return results since the inception of the index as of December 31, 2016. Refer to Chart 1.

While not the lowest performing constituent fund in August, Domini Impact Equity Fund Investor Shares posted a return of 2.61%, trailing behind the S&P 500 by 65 basis points. Except for the previous month when Domini it was up 4%, the fund has been a persistent underperformer relative to the S&P 500. The fund trailed the S&P 500 by 4.2% year-to-date and 6.73% over the last twelve months. Longer term, the fund’s performance was also eclipsed by the S&P 500 and stands in stark contrast to the performance achieved by the firm’s Impact International Equity Fund that’s managed in a similar manner by using a two-step process that combines social, environmental and governance analysis conducted by Domini and Wellington’s active portfolio management.

Perhaps then, Domini’s announcement in early September that it has made a decision to replace Wellington Management Company, which has managed the fund since May 2009, is not entirely surprising. According to the firm’s announcement, Wellington will be replaced as subadvisor to the fund by State Street Global Advisors effective December 1, 2018.

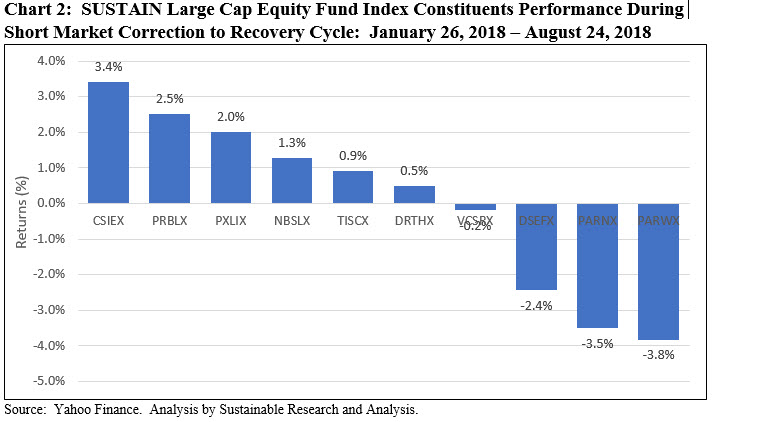

Diverging results on display by sustainable equity funds during recent short market correction to recovery cycle

During the short cycle from January 26 to August 24 when stocks in the US shifted from market correction to full recovery, sustainable funds tracked by SUSTAIN index reflected diverging results, ranging from a positive 3.4% posted by the Calvert Equity Fund Class A to a low of -3.8% posted by the Parnassus Endeavor Fund Investor Shares. Refer to Chart 2.

SUSTAIN Bond Fund Indicator Recorded an Increase of 0.66% in August and Beat the Bloomberg Barclays U.S. Aggregate Bond Index

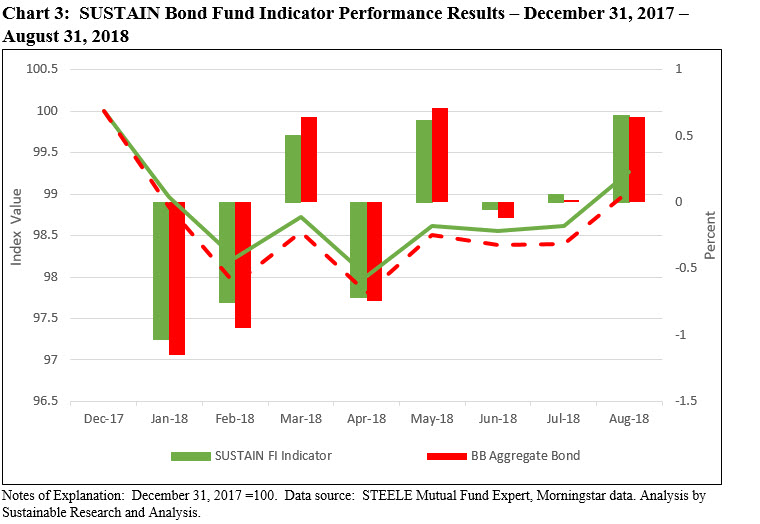

Sustainable investment-grade U.S. oriented bond funds that comprise the Sustainable (SUSTAIN) Bond Fund Indicator recorded a gain of 0.66% in August versus 0.64% delivered by the Bloomberg Barclays U.S. Aggregate Bond Index. The slight gain widened the year-to-date outperformance relative to the non-sustainable bond funds benchmark by 0.24% or 24 basis points. Refer to Chart 3.

Two of the five funds that comprise the SUSTAIN Bond Fund Indicator outperformed their benchmark in August, led by the PIMCO Total Return ESG Institutional Fund that, for the second consecutive month, posted the top monthly return. The fund added 0.81% versus last month’s 0.21% total return. Praxis Impact Bond I generated the next best gain for the month, adding 0.73%. The other three funds posted increases ranging from 0.55% to 0.63%.

Albeit evaluated over a shorter time period, sustainable fixed income funds are so far displaying a better capacity to stay ahead of their non-sustainable securities benchmark, the Bloomberg Barclays U.S. Aggregate Bond Index. Still, that may offer limited comfort to investors as year-to-date results are negative at 0.70% as economic growth and a Federal Reserve policy of lifting interest rates slowly and predictably while trimming its balance sheet in a similarly deliberative fashion has led to rising interest rates and declining bond prices.

The Sustainable (SUSTAIN) Bond Fund Indicator represents the total return performance of a cohort of five sustainable bond funds consisting of similarly managed funds that, like the equity index counterpart, employ sustainable investing strategies beyond absolute reliance on exclusionary practices that track the Bloomberg Barclays U.S Aggregate Bond Index.

SUSTAIN Equity Fund Index Up 2.79% in August 2018, Lagging S&P 500 by 47 BPS

Summary Market Summary: Economic growth momentum and a sturdy fundamental backdrop of strong corporate earnings, low unemployment and contained inflation overcame a number of challenges to bolster stock results in the US. The Federal Reserve also fueled momentum, with news that it remains accommodative on the monetary policy front. Interest rates are being lifted slowly…

Share This Article:

Summary

Market Summary: Economic growth momentum and a sturdy fundamental backdrop bolster stock results in the US while the Federal Reserve remains accommodating

Economic growth momentum and a sturdy fundamental backdrop of strong corporate earnings, low unemployment and contained inflation overcame a number of challenges to bolster stock results in the US and contribute to the above average 3.26% total return achieved by the S&P 500 Index in August. In fact, the S&P 500 along with the Nasdaq Composite Index on August 24th both finally surpassed the record closes achieved on January 26th of this year. The Federal Reserve also fueled momentum, with news that it remains accommodative on the monetary policy front. Interest rates are being lifted slowly and predictably while the Fed’s balance sheet is being trimmed in a similarly deliberative fashion. Against this backdrop, the Bloomberg Barclays US Aggregate Bond Index posted a 0.64% gain for the month. This was the benchmark’s best showing since May.

SUSTAIN Equity Fund Index gained 2.79% in August, lagging behind the S&P 500 by 47 basis points

The SUSTAIN Large Cap Equity Fund Index, which tracks the total return performance of the ten largest actively managed large-cap U.S. equity oriented mutual funds that employ a sustainable investing strategy beyond absolute reliance on exclusionary practices, registered a gain of 2.79% in August. This was 47 basis points behind the increase of 3.26% posted by the S&P 500 Index, which also served to widen the difference between the two indexes to 4.60% since December 31, 2016. Refer to Table 1.

Only two of the ten funds that comprise the index exceeded the performance of the S&P 500. These included the Dreyfus Sustainable US Equity Fund Z, up 4.07% and the Parnassus Fund, up 3.52%. This marks the third month in a row in which the Dreyfus fund outperformed the S&P 500 and the first time since the fund’s reorganization on or about May 1, 2017 that it landed as the top performing index constituent for the month. Dreyfus benefited from its overweight exposure to the best performing Technology sector. At 36.5% of the fund’s assets, Technology investments in the fund were 13.9% higher than the 22.6% weighting for Technology in the S&P 500. The fund’s performance, which apparently was not adversely affected by a 5.61% position in non-US investments, also benefited from stock picks, the largest three of which included Microsoft Corp. (MSFT), representing 7.3% of net assets, Alphabet Inc. (GOOG), at 5.22% of net assets and Apple Inc. (AAPL) at 5.05% of net assets. Each of these stocks posted August gains ranging from a low of 0.08% to a high of 19.6% in the case of AAPL. Apple’s rising stock price led the firm to become the first American public company to cross the $1 trillion in value on Thursday before the end of the month when Apple’s stock price passed $207.04. Shares surged after Apple reported earnings that topped forecasts and projected a healthy outlook.

As the intervals for evaluation are extended, the performance of the SUSTAIN Equity Fund Index relative to the S&P 500 produces a wider gap. This is the case for the year-to-date results, trailing 12-month results and total return results since the inception of the index as of December 31, 2016. Refer to Chart 1.

While not the lowest performing constituent fund in August, Domini Impact Equity Fund Investor Shares posted a return of 2.61%, trailing behind the S&P 500 by 65 basis points. Except for the previous month when Domini it was up 4%, the fund has been a persistent underperformer relative to the S&P 500. The fund trailed the S&P 500 by 4.2% year-to-date and 6.73% over the last twelve months. Longer term, the fund’s performance was also eclipsed by the S&P 500 and stands in stark contrast to the performance achieved by the firm’s Impact International Equity Fund that’s managed in a similar manner by using a two-step process that combines social, environmental and governance analysis conducted by Domini and Wellington’s active portfolio management.

Perhaps then, Domini’s announcement in early September that it has made a decision to replace Wellington Management Company, which has managed the fund since May 2009, is not entirely surprising. According to the firm’s announcement, Wellington will be replaced as subadvisor to the fund by State Street Global Advisors effective December 1, 2018.

Diverging results on display by sustainable equity funds during recent short market correction to recovery cycle

During the short cycle from January 26 to August 24 when stocks in the US shifted from market correction to full recovery, sustainable funds tracked by SUSTAIN index reflected diverging results, ranging from a positive 3.4% posted by the Calvert Equity Fund Class A to a low of -3.8% posted by the Parnassus Endeavor Fund Investor Shares. Refer to Chart 2.

SUSTAIN Bond Fund Indicator Recorded an Increase of 0.66% in August and Beat the Bloomberg Barclays U.S. Aggregate Bond Index

Sustainable investment-grade U.S. oriented bond funds that comprise the Sustainable (SUSTAIN) Bond Fund Indicator recorded a gain of 0.66% in August versus 0.64% delivered by the Bloomberg Barclays U.S. Aggregate Bond Index. The slight gain widened the year-to-date outperformance relative to the non-sustainable bond funds benchmark by 0.24% or 24 basis points. Refer to Chart 3.

Two of the five funds that comprise the SUSTAIN Bond Fund Indicator outperformed their benchmark in August, led by the PIMCO Total Return ESG Institutional Fund that, for the second consecutive month, posted the top monthly return. The fund added 0.81% versus last month’s 0.21% total return. Praxis Impact Bond I generated the next best gain for the month, adding 0.73%. The other three funds posted increases ranging from 0.55% to 0.63%.

Albeit evaluated over a shorter time period, sustainable fixed income funds are so far displaying a better capacity to stay ahead of their non-sustainable securities benchmark, the Bloomberg Barclays U.S. Aggregate Bond Index. Still, that may offer limited comfort to investors as year-to-date results are negative at 0.70% as economic growth and a Federal Reserve policy of lifting interest rates slowly and predictably while trimming its balance sheet in a similarly deliberative fashion has led to rising interest rates and declining bond prices.

The Sustainable (SUSTAIN) Bond Fund Indicator represents the total return performance of a cohort of five sustainable bond funds consisting of similarly managed funds that, like the equity index counterpart, employ sustainable investing strategies beyond absolute reliance on exclusionary practices that track the Bloomberg Barclays U.S Aggregate Bond Index.

Sustainableinvest.com

Benefits

Free access to regularly updated original research and analysis focused exclusively on sustainable finance and investing, providing investors with the guidance needed to make informed investment decisions that align with their personal values and financial goals while also contributing to the advancement of positive long-term environmental and social outcomes.

By offering financial support for our current work, either in the form of a one-time or regular contributions, you help to defray some of the costs associated with conducting our research and analysis as well as to maintain the www.sustainablest.wpengine.com website.

Helping us to expand our research capabilities and offerings over time to cover additional relevant topics geared to sustainable investors.

Sign up to free newsletters.

By submitting this form, you are consenting to receive marketing emails from: . You can revoke your consent to receive emails at any time by using the SafeUnsubscribe® link, found at the bottom of every email. Emails are serviced by Constant Contact