Assessment Monitor

Synopsis

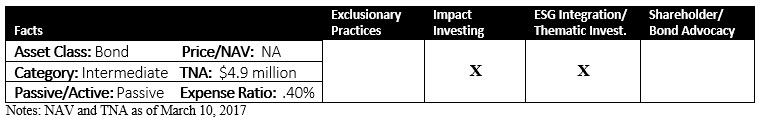

On March 3, 2017 Van Eck Associates Corp.launched the VanEck Vectors Green Bond ETF, an index fund that seeks to replicate as closely as possible, before fees and expenses, the price and yield performance of the S&P Green Bond Select Index. The index is market value weighted and designed to capture the most liquid and tradable segment of green-labeled bonds issued globally.

This is the first green bond ETF available in the USand, with an expense ratio that is currently limited to 0.40% (unless extended beyond September 1, 2018, the fee waiver of 0.07% will kick up the expense ratio to 0.47%), it is the cheapest available managed green bond fund option open to retail investors.

Having just been launched, the fund is still quite small at $4.9 million as of March 10, 2017. It’s not fully diversified as it only holds 41 securities out of a possible total of 189 bonds registered by the index as of February 17, 2017. The fund is also trading at a slight premium to its net asset value (NAV) and its trading costs are likely to be higher than average until the fund gains some heft.

This fund could be an attractive entry point for investors interested in green bonds. That said, the fund bears monitoring over the next three months while it gains traction and until such time as the portfolio is fully deployed across the S&P index constituents and preferably it reaches about $50 million in assets.

Analysis

Van Eck Associates Corp. is a New York based manager of mutual funds and ETFs with about $42.14 billion in assets under management as of January 31, 2017. The firm launched the VanEck Vectors Green Bond ETF, an index fund that seeks to replicate as closely as possible, before fees and expenses, the price and yield performance of the S&P Green Bond Select Index. The index is market value weighted and designed to capture the most liquid and tradable segment of green-labeled bonds issued globally.

The index is designed to provide a broad measure of the performance of the investable green bond market consisting of fixed-income securities issued globally, both taxable and tax-exempt, that raise funds specifically to finance new and existing projects with environmental sustainable benefits.For a bond to be eligible for inclusion in the index, the issuer of the bond must self-qualify the bond as green and provide the rationale behind it, such as the intended use of proceeds. As an additional filter, the

bond must be flagged as green by Climate Bonds Initiative (CBI), London-based green bond standards setting not-for-profit organization, to be eligible for inclusion in the index. The index is comprised of supranational, corporate, government related, sovereign and securitized green bonds, and may include both investment grade and below investment grade rated securities, or junk bonds.The maximum weight of below investment grade bonds in the index is capped at 20%.

The index has no specific restriction on the market of issue for green bonds denominated in G10 currencies, which are the U.S. dollar, the Euro, the Japanese yen, the British pound sterling, the Swiss franc, the Australian dollar, the New Zealand dollar, the Canadian dollar, the Swedish krona and the Norwegian krone. Bonds issued in non-G10 currencies in the native market of that currency will be excluded from the index. Bonds issued in non-G10 currencies in global markets will be eligible for inclusion in the index.

Further, the index includes bonds across sectors, countries, currencies and maturities. No more than 10% of the index can be focused in a single issuer. As of February 17, 2017, the index consisted of 189 bonds issued by 99 issuers and the weighted average maturity of the index was approximately 7.3 years. As of the same date, approximately 54% of the index was comprised of Regulation S securities and 18% of the Index was comprised of Rule 144A securities.

The index is rebalanced monthly. Bonds that are no longer rated or have defaulted are removed from the index at the next rebalancing.

Alternative Mutual Fund Offerings

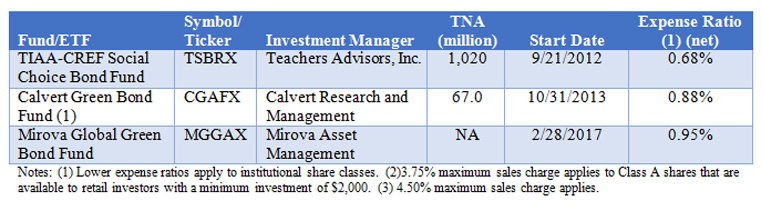

At this point, investors interested in a dedicated green bond fund have a limited number of options—none optimal. Beyond the just launched Mirova Global Green Bond Fund, only two funds that are invested in at least around 10% of net assets in green bonds are currently available in the market. While the TIAA-CREF Social Choice Bond Fund offers the best management/price combination, this fund is not a dedicated green bond fund and only about 9.5% of the fund’s total assets are currently invested in green bonds. While it’s effectively managed, the fund’s retail class expense ratio is 28 bps higher than the Van Eck Vectors Green Bond ETF. The Calvert Green Bond Fund, on the other hand, is just too expensive given the 88 bps expense ratio and upfront sales charge.

Green Bond Mutual Funds

Bottom Line

This fund could be an attractive entry point for investors interested in green bonds. Available options in the form of mutual funds are either not sufficiently invested in green bonds or are too expensive. That said, the Van Eck Vectors Green Bond ETF is newly launched, it bears monitoring over the next three months or so while it gains traction and/or until such time as the portfolio is fully deployed across the S&P index constituents and preferably it reaches about $50 million in assets.