Introduction and Summary

Two recent strikes against ESG integration and complementary proxy voting actions, demonstrated by a provision in the April 10, 2019 Executive Order signed by President Trump on Promoting Energy Infrastructure and Economic Growth that calls for a Department of Labor (DOL) review of ESG practices as well as a previous week’s hearing by the U.S. Senate Committee on Banking, Housing and Urban Affairs focused on investment manager environmental and social engagements, are exploiting an increasingly common misunderstanding that conflates ESG integration for the purpose of properly evaluating investment risks and opportunities with social or ethical investing practices. Even as ESG integration gains traction in the US, these initiatives could potentially restrain efforts to adopt ESG integration more broadly, and in retirement plans, such as 401(k) plans, more specifically. In part, a response to such efforts should include additional emphasis on the adoption of formal and widely accepted sustainable investing definitions, training, education as well as improved disclosures and transparency around ESG integration, its meaning and practices.

Trump’s April 10, 2019 Executive Order Calls for Department of Labor Review

An Executive Order on Promoting Energy Infrastructure and Economic Growth issued on April 10, 2019 by President Trump includes a section entitled “Environmental, Social, Governance Issues; Proxy Firm; and Financing Energy Projects Through the United States Capital Markets,” that directs the Secretary of Labor to conduct a “review of available data filed with the Department of Labor by retirement plans subject to the Employee Retirement Income Security Act of 1974 (ERISA) in order to identify whether there are discernible trends with respect to such plans’ investments in the energy sector.” The Secretary of Labor has also been directed to “complete a review of existing Department of Labor guidance on the fiduciary responsibilities for proxy voting to determine whether any such guidance should be rescinded, replaced, or modified to ensure consistency with current law and policies that promote long-term growth and maximize return on ERISA plan assets.” Both reviews are to be completed within 180 days and the Executive Order calls for the delivery of an update to the Assistant to the President for Economic Policy.

U.S. Senate Committee on Banking, Housing and Urban Affairs recently conducted hearing on the application of ESG principles

It may not be entirely coincidental that the Executive Order provision to initiate a review of these topics followed by just a short 5 days a hearing held by the U.S. Senate Committee on Banking, Housing and Urban Affairs to consider the Application of Environmental, Social, and Governance Principles in Investing and the Role of Asset Managers, Proxy Advisors, and Other Intermediaries. At that hearing, which included appearances by former Senator Phil Gramm, James R. Copland from the Manhattan Institute and John Streur of Calvert Research and Management, Republican U.S. Senator Mike Crapo from Idaho, Chairman of the Committee, made it clear that he was concerned about asset managers and funds, other than socially responsible funds, that target specific environmental or social impact objectives both in terms of their investments and proxy voting actions affecting investors that do not expect asset managers to engage companies on social and environmental issues on their behalf. Chairman Crapo set his sights, in particular, on proxy voting practices, noting that since the 2014 proxy season, “institutional shareholders support for inclusion of environmental and social proposals has increased from 19 to 29 percent while retail shareholder support has increased marginally to only 16 percent.” He added that in the “2018 proxy season, ESG proposals were the largest category of shareholder proposals on proxy ballots with 15 percent of proposals climate-related and 14 percent related to political contributions.” In the end, Senator Crapo observed that it “is important to understand how institutional investors are voting the shares of the money they manage to make sure that retail investors’ interests are being reflected in these voting decisions.” It should be noted that of the four 2018 proposals that garnered support in excess of 50%, three sought the publication of reports on the impact of climate change policies and one on methane emissions management[1]. Such information aligns with a need on the part of investors for increased risk disclosures consistent with ESG integration investment practices.

An assault on the strategy of ESG integration as well as proxy voting practices

Taken together, along with last year’s DOL apparent waffling on its previous position regarding ESG and fiduciary responsibility,[2] these developments represent an assault on the strategy of ESG integration as well as proxy voting practices aligned with ESG investing. They have the potential to restrain efforts to adopt ESG integration generally, and in retirement plans such as 401(k) plans more specifically, as a strategy to inform financial analysis when such factors are relevant and material to investment decisions. These attacks are taking advantage of an increasingly common misunderstanding that conflates ESG integration for the purpose of properly evaluating investment risks with social or ethical investing practices. Even as the elements of what constitutes E, S and G are still being debated, the idea of ESG integration, in line with the CFA Institute’s definition, is to take into consideration, in a systematic and consistent manner, any relevant and material environmental, social and governance risks or opportunities. The consideration of ESG issues in investment analysis is intended to complement and not serve as a substitute for traditional fundamental analysis that might otherwise ignore or overlook such risks or opportunities. On the other hand, ethical or social investing relies primarily on screening out or excluding companies from investment portfolios for a variety of reasons, including ethical, religious, social as well as other strongly held beliefs, such as environmental concerns or involvement on the part of companies in specific business activities. These may include companies involved in the production or manufacturing of tobacco, firearms, alcohol, or even fossil fuel companies, to mention a few. Such approaches also involve company engagements and proxy voting in an effort to influence behavior.

The misunderstanding is not surprising as ESG has a definition problem. As reported recently in a joint CFA and PRI publication entitled “ESG Integration in the Americas: Markets, Practices and Data,” a coherent understanding is lacking among asset owners, asset managers, issuers and retail investors of what is meant by ESG…” In the same research article, it is noted that investment practitioners may not be able to quantify the precise impact of ESG, but there was agreement that ESG integration can give a more complete understanding of an investment. Indeed, in equity and fixed income investments, risk management was cited as the most important driver of ESG integration in US capital markets while lack of data and a limited understanding of ESG issues and ESG integration were cited as the greatest barriers to ESG integration in US capital markets[3].

Response to recent strikes against ESG integration and complementary proxy voting actions should include additional emphasis on definitions, training and education

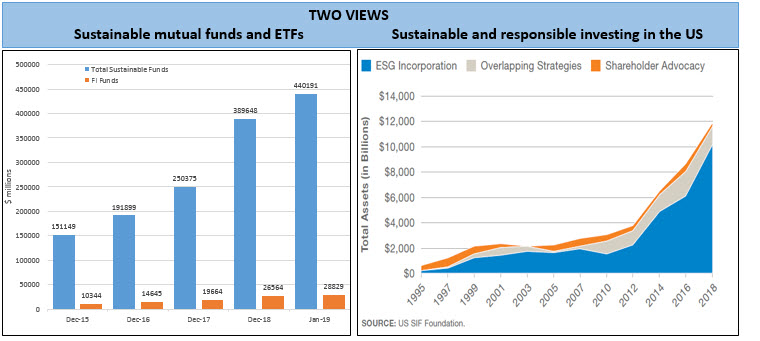

While exact numbers linked to the adoption of ESG integration strategies remain fuzzy, as illustrated by the significant variation that is apparent in the assets under management sourced to sustainable investing strategies in mutual funds and ETFs versus survey date compiled by the US SIF Foundation, it is clear that such strategies are gaining significant traction. (Refer to Table 1). That said, the above described initiatives could potentially restrain efforts to adopt ESG integration more broadly, and in retirement plans, such as 401(k) plans[4], more specifically. In part, a response to such efforts should include additional emphasis on the adoption of formal and widely accepted sustainable investing definitions, training, education as well as improved disclosures and transparency around ESG integration, its meaning and practices.

Table 1: Sustainable Investing AUM: Mutual Funds and ETFs versus US SIF Foundation

Table 1 illustrates that as of January 2019, mutual funds and ETFs assets under management sourced to sustainable investing strategies, including ESG integration, stood at almost $470 billion, an increase of about 127% since 2016, but still this level represents only about 2.2% of long-term mutual fund and ETF assets under management. At the same time, US SIF survey data shows that at the start of 2018, $12 trillion in AUM, including mutual funds and ETFs, is sourced to sustainable investing strategies, up from $8.7 trillion or a 38% increase since 2016. According to US SIF, this represents 26% or one in every four dollars of the $46.6 trillion in assets under professional management. Sources: STEELE Mutual Fund Expert, Morningstar data and analysis by Sustainable Research and Analysis, US SIF Report on US Sustainable, Responsible and Impact Investing Trends 2018.

[1] Refer to article Second Quarter 2018 Sustainable Funds Investing Review.Second Quarter 2018 Sustainable Funds Investing Review.

[2] Refer to article entitled Department of Labor Reiterates Guidance on Fiduciary Responsibility and Social Investments.Department of Labor Reiterates Guidance on Fiduciary Duty and Social Investments

[3] Refer to article entitled ESG Integration Should not be Confused with Responsible Investing Practices.ESG Integration Should Not To Be Confused with Responsible Investing Practices

[4] Refer to article entitled Challenges Remain but 401(k) Plans Make Some Progress in Adding Sustainable Fund Choices.Challenges Remain but 401(k) Plans Make Some Progress in Adding Sustainable Fund Choices