The Bottom Line: Investors considering scale in their investment decision making can choose from at least ten firms whose sustainable assets reached almost $230 billion.

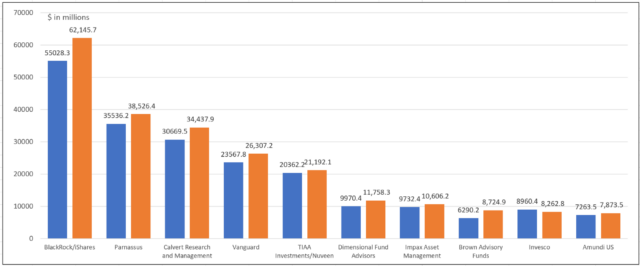

Top 10 sustainable fund firms: Assets under management at YE 2022 and June 30, 2023 Notes of Explanation: Top 10 firms based on assets as of June 30, 2023; iShares and BlackRock funds and TIAA Investments and Nuveen are consolidated; Data applies to mutual funds and ETFFs. Sources: Morningstar and Sustainable Research and Analysis LLC

Notes of Explanation: Top 10 firms based on assets as of June 30, 2023; iShares and BlackRock funds and TIAA Investments and Nuveen are consolidated; Data applies to mutual funds and ETFFs. Sources: Morningstar and Sustainable Research and Analysis LLC

Observations:

- The line-up of the top fund firms offering sustainable mutual funds and ETFs,

- measured based on the top 10 ranked firms, remained stable over the first six months of the year, even as the rank ordering of these top firms shifted slightly in three cases. In total, the top 10 fund firms managed $229.8 billion in client assets at the end of June, up from $207.4 billion as of year-end 2022. These levels represent almost 70% of the segment’s assets under management and 25% of total fund offerings. Total sustainable mutual fund and ETF assets reached $329.2 billion at the end of June, across 1,611 funds/share classes.

- During the past six months, these fund firms added a combined total of $28.8 billion in assets, with all but one firm experiencing a decline. Brown Advisory moved up in its ranking to place 8th in terms of assets under management while Invesco and Amundi US experienced drops in their rankings.

- Within the segment comprising the top 10 firms, BlackRock, including iShares, added $7.1 billion in assets, for a 13% increase. This was followed by Calvert Research and Management that added $3.8 billion, or 12%, and Parnassus that enlarged by almost $3 billion, for an increase of 8%. A big winner for BlackRock was the launch in June of this year of the iShares Climate Conscious & Transition MSCI USA ETF which closed the month with $2.2 billion. This fund seeks to track the investment results of an index composed of U.S. large- and mid-capitalization companies based on their positioning, relative to their sector peers, with respect to the transition to a low-carbon economy, based primarily on current emissions intensity, emissions reduction targets, green business revenue, and/or climate risk management. The initial success of the fund reflects the strong and growing interest in climate-related factors. At the same time, Calvert benefited from its broad family of fund offerings while Parnassus expanded, in part, by adding $1.7 billion in net assets to the Parnassus Core Equity Fund-Institutional Shares.

- Brown Advisory Funds delivered the best percentage gain, adding $2.4 billion in net assets, or a 39% increase over the six-month interval. Its stable of three sustainable funds includes the Brown Advisory Sustainable Growth Fund that added almost $2.0 billion in net assets.

- Only one firm experienced a decline in assts under management. Invesco gave up $697.6 million, registering an 8% decline. Two ETFs offered by the fund firm, Invesco Floating Rating ESG Fund and Invesco Solar ETF, gave up a combined $802 million during the period.