Fund Assessment

High Conviction

TIAA-CREF Fund Review

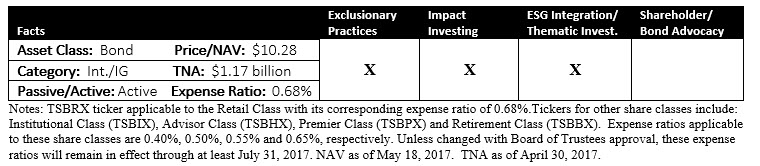

This $1.17 billion actively managed fixed income fund, which is advised by Teachers Advisors, Inc., a wholly owned indirect subsidiary of TIAA, is an intermediate-term investment grade fixed income mutual fund that pursues a unique sustainable investing mandate, through a combination of strategies that relies on external ESG research as well as a proprietary approach, including (1) exclusions from certain companies significantly involved in certain business activities, such as tobacco, military weapons, firearms, nuclear power and gambling, (2) impact investing, including investments in green bonds, and (3) the integration of environmental, social and governance (ESG) criteria. Offered by a firm that has been engaged in sustainable investing since the 1970’s, the fund forms part of a suite of sustainable mutual funds available to the public since the launch of the Social Choice Equity Fund in 1999.

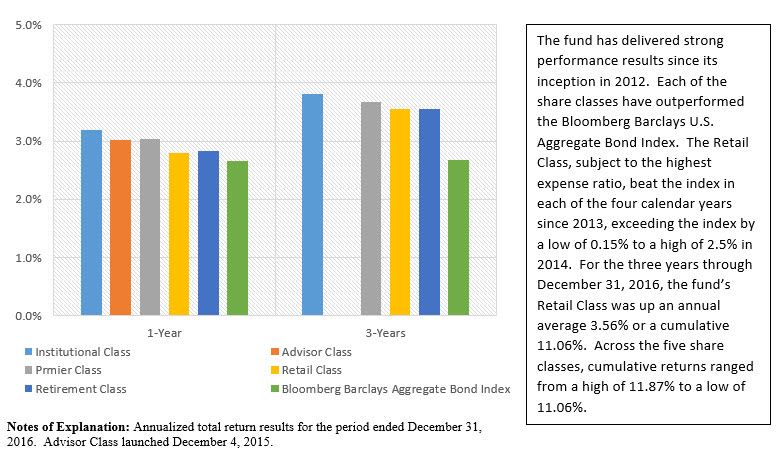

The Social Choice Bond Fund commenced operations on September 21, 2012 and has produced a strong track record since its inception. Under the helm of the same two portfolio managers, the fund has consistently outperformed its benchmark, the Bloomberg Barclays Aggregate Bond Index, over a period during which the fund has been experiencing successive gains in assets under management. Since its inception, the fund’s Retail Class has gained 2.93% versus the 1.93% average annual total rate of return turned in by the index, or an excess return of 1.0%. The other share classes have delivered even better results given their lower expense ratios. Each of the four share classes have outperformed Bloomberg Barclays Aggregate Bond Index in each of the four years since their inception in 2013. See Exhibit 1. The fund’s overall return is bolstered by its lower expense ratio as compared to a universe of investment grade fixed income funds. The Retail Class is subject to an expense ratio of 0.68%, or 68 bps, which drops down to as low as 0.40% applicable to the Institutional Class with a minimum initial investment of $2.0 million. The expense ratios of the Advisor Class and Premier Class are less competitive, however, given the fund’s distinctive and proprietary sustainable investing strategy as well as the fund’s historical excess returns relative to its benchmark, this is deemed an acceptable trade-off.

Ready To Gain A Competitive Edge? In-depth sustainable investment management analysis, research, opinions and sustainable fund ratings

The fund’s option adjusted duration stood at 5.98 as of May 17, 2017, and it reported a turnover ratio of 107% which is slightly lower than the median for the universe of investment grade bond funds[1].

The fund is available in the form of five share classes directed at institutional, intermediary and retail investors, but the bulk of the fund’s assets are sourced to institutional investors who account for about 80% of the fund’s assets as of March 31, 2017. This is viewed positively as it contributes to the stability of the fund’s asset base.

TSBRX Financial Analysis

The fund invests at least 80% of its assets in bonds. For these purposes, bonds include a broad range of investment-grade bonds and fixed-income securities, including, but not limited to: U.S. Government securities or its agencies (investments in these securities are considered to be consistent with the fund’s investment and social objectives), corporate bonds, taxable municipal securities and mortgage-backed or other asset backed-securities. These may also include foreign government bonds. The fund may also invest in other fixed-income securities, including those of non-investment-grade quality and non-rated securities. These accounted for 7.9% and 2.8% of the fund’s fixed income assets as of September 30, 2016, respectively.

The fund pursues a unique sustainable investing mandate, through a combination of strategies that relies on external ESG research as well as a proprietary approach. The strategies are, as follows:

Exclusion

The fund will not generally invest in companies significantly involved in certain business activities, including but not limited to, the production of alcohol, tobacco, military weapons, firearms, nuclear power and gambling.

ESG Integration

The fund’s investments are subject to ESG criteria. The ESG criteria are implemented based on data provided by independent research firms. All corporate issuers must meet or exceed minimum ESG performance standards to be eligible for investment by the fund. The evaluation process favors companies with leadership in ESG performance relative to their peers. Typically, environmental assessment categories include climate change, natural resource use, waste management and environmental opportunities. Social evaluation categories include human capital, product safety and social opportunities. Governance assessment categories include corporate governance, business ethics and government & public policy. How well companies adhere to international norms and principles and involvement in major ESG controversies (examples of which may relate to the environment, customers, human rights & community, labor rights & supply chain, and governance) are other considerations.

The ESG evaluation process is conducted on an industry-specific basis and involves the identification of key performance indicators, which are given more or less relative weight compared to the broader range of potential assessment categories. Concerns in one area do not automatically eliminate an issuer from being an eligible fund investment. When ESG concerns exist, the evaluation process gives careful consideration to how companies address the risks and opportunities they face in the context of their sector or industry and relative to their peers.

The fund invests in certain asset-backed securities, mortgage-backed securities and other securities that represent interests in assets such as pools of mortgage loans, automobile loans or credit card receivables. These securities are evaluated on the basis of the underlying interests in pools of loans rather than the ESG sponsor of the asset-backed security.

Impact Investing

A portion of the fund’s assets is invested in fixed income instruments in accordance with TIAA’s proprietary Proactive Social Investments (PSI) framework. These investments, which as of March 31, 2016 accounted for 39.8% of the portfolio, provide direct exposure to issuers and/or individual projects with social or environmental benefits that are classified based on the issuer’s mission, ESG performance quality and/or the project to be funded. Within this PSI allocation, the fund seeks opportunities to invest in publicly traded fixed-income securities that finance initiatives in areas including affordable housing, community and economic development, renewable energy and climate change, and natural resources. These investments will be selected based on the same financial criteria used in selecting the fund’s other fixed-income investments.

The four thematic areas are further described, as follows: 1. Affordable housing: investments that support the financing of low- and moderate-income housing loans, transit-oriented development, walkable communities or mixed-use development projects. 2. Community and economic development: investments that support financial services, hospital/medical services, educational services, community centers, urban revitalization, humanitarian, disaster and international aid services, inclusive of underserved and/or economically disadvantaged communities. 3. Renewable energy and climate change: securities that finance new or expand existing renewable energy projects (including hydroelectric, solar and wind, geothermal, and energy from waste, etc.), smart grid and related projects designed to make power generation and transmission systems more efficient, and other energy efficiency projects that result in a reduction of greenhouse gas emissions. 4. Natural resources: investments that support land conservation, sustainable forestry and agriculture, remediation and redevelopment of polluted or contaminated sites, sustainable waste management projects, water infrastructure (including improvement of clean drinking water supplies and/or sewer systems) and sustainable building projects.

The fund also invests in green bonds. These are equivalent to other fixed income securities, both taxable and tax-exempt, except that green bonds raise funds specifically to finance new and existing projects with environmental benefits. As of September 30, 2016, about 9.5% of the fund’s assets were invested in green bonds.

TIAA-CREF Social Choice Bond Fund Performance Results

Exhibit 1: Annualized Performance vs. Index: To December 31, 2016

Expense Ratios

The fund’s shareholders benefit from lower fees. The Retail Class expense ratio falls within the second quartile calculated for a peer group of consisting of 468 investment grade bond funds[2], and is below the expense ratio median of 0.78% while at the same time the expense ratios of the Advisor and Premier shares are less competitive. However, given the fund’s distinctive and proprietary sustainable investing strategy as well as the fund’s historical excess returns relative to its benchmark, this is deemed and acceptable trade-off.

The fund’s investment manager, Teachers Advisors, Inc. is a wholly owned indirect subsidiary of TIAA—formerly TIAA—CREF (Teachers Insurance and Annuity Association—College Retirement Equities Fund), is a Fortune 100 financial services organization offering a wide range of products to the general public while continuing to serve its core constituents in the academic, medical and research fields. Its TIAA Global Asset Management unit is the 22nd largest asset management firm with about $915 billion in assets under management. The firm was recognized again in 2017 as one of the World’s Most Ethical Company by the Ethisphere Institute for the third straight year.

Bottom Line

The fund is a very attractive investment grade intermediate bond ESG option either on a stand-alone basis or as the fixed income component in a broader sustainable investing strategy. This growing $1.17 billion actively managed fixed income fund that commenced operations in 2012 pursues a unique sustainable investing mandate, through a combination of strategies that relies on external ESG research as well as a proprietary approach, including (1) exclusions from certain companies significantly involved in certain business activities, such as tobacco, military weapons, firearms, nuclear power and gambling, (2) impact investing, including investments in green bonds, and (3) the integration of environmental, social and governance (ESG) criteria. The fund has produced a strong performance track record since its inception under the helm of the same two portfolio managers, consistently outperforming the fund’s benchmark, the Bloomberg Barclays Aggregate Bond Index. The fund’s overall return is bolstered by its lower expense ratio as compared to a universe of investment grade fixed income funds. The expense ratios of the Advisor Class and Premier Class of shares are less competitive, however, given the fund’s distinctive and proprietary sustainable investing strategy as well as the fund’s historical excess returns relative to its benchmark, this is deemed and acceptable trade-off.

The fund is available in the form of four share classes directed at institutional, intermediary and retail investors, but the bulk of the fund’s assets are sourced to institutional investors who account for about 80% of the fund’s assets as of March 31, 2017. This is viewed positively as it contributes to the stability of the fund’s asset base.

[1] Based on a universe of investment grade income and corporate bond funds as of March 31, 2017.

[2] Universe of 452 investment grade mutual funds as of March 31, 2017 with a median turnover ratio of 115.8. Data source: Steele Systems, Inc./Morningstar, Inc.