The Bottom Line: The absence of widely accepted definitions and standards in sustainable finance is illustrated in the wide variations of referenced assets under management.

0:00

/

0:00

Listen to this article now

Sustainable assets under management

Observations:

- The absence of widely accepted definitions and standards in the sustainable finance sphere has contributed to confusion, misunderstanding and, more recently, skepticism on the part of investors and other stakeholders. Estimates regarding the size of the sustainable investing market, growth trends and dominant strategies have also been distorted by the absence of standardization in this sphere of investing.

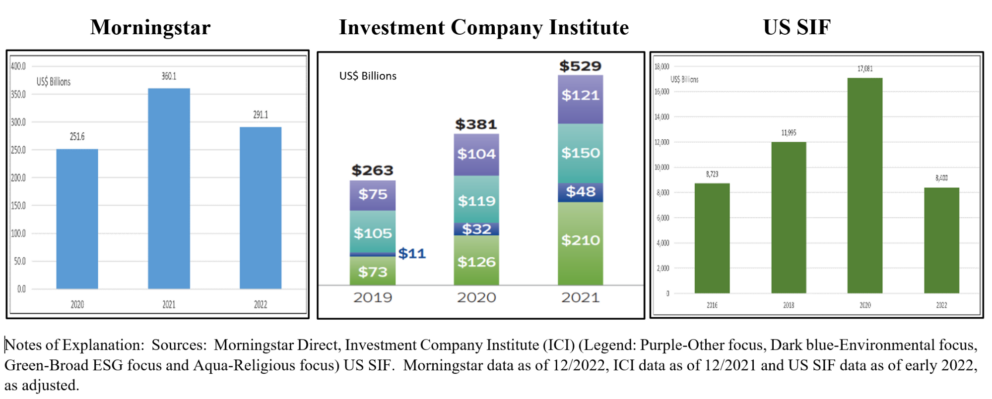

- This is illustrated in data compiled and disseminated by four frequently cited authoritative sources: Principles for Responsible Investment (PRI), US SIF-The Forum for Sustainable and Responsible Investment, The Investment Company Institute (ICI) and Morningstar. While the base line dates vary, three of the four sources with a focus on the US market report that sustainable assets under management range from a low of $291 billion to an approximate high of $8.4 trillion, or a range of $8.1 trillion.

- At the low end of the range is Morningstar which reports $291.1 billion in sustainable mutual fund and ETF assets under management as of December 2022. To qualify for inclusion as a sustainable fund, Morningstar considers the centrality of a fund’s sustainability principles to its investment management process or about how it is applying those principles in practice.

- Higher by 82%, The Investment Company Institute reports that sustainable fund assets reached $529 billion at the end of 2021. The latest available data is also compiled based on sustainable assets sourced to mutual funds and ETFs, but the ICI’s ESG criteria screens and stratifies sustainable funds using four defined categories that include a broad ESG focus, environmental focus, religious values, and other focus. The ICI reports on ESG assets in its annual Mutual Fund Factbook and the 2023 edition has not been published yet.

- At the other end of the range is US SIFs estimate of $8.4 trillion in sustainable assets under management at the start of 2022 that relies on surveys and research capturing portfolio data extending beyond mutual funds and ETFs to include, for example, pooled investment funds, separate accounts, etc. The US SIF, which recently amended its estimate due to changes in its methodology for collecting the data, dropped its estimate from $17.1 trillion at the start of 2020 by $8.7 trillion.

- The staggering 51% decline in the estimate by US SIF of assets subject to sustainable investing approaches was recently attributed by one publication to the fact that institutions were “being more careful about how they classify their assets¹.” More likely is that US SIF was not rigorous in its methodology and in the process of inflating the ESG numbers may inadvertently stimulated new investment product introductions on the one hand while also fueling a growing alarm over ESG and contributing to the resultant politicization of the investing approach. This, notwithstanding the outsized role of ESG integration that largely focuses on investment risk and opportunities rather than values-based or impact investing–considerations that should be factored into investment decision making by fiduciaries when these are relevant and material.

- Still, it’s clear that sustainable fund offerings and assets under management have expanded and investors have more choices today to consider and align with their sustainability preferences. That said, investment managers should be more transparent regarding their sustainable investing approaches and investors should conduct due diligence, consult fund offering documents and engage with their advisers or investment managers to understand a fund’s approach to sustainable investing to ensure alignment with their sustainability preferences.

¹ Corporate Knights, You Down with ESG, Winter 2023.