The Bottom Line: In a rising rate environment, the latest sustainable ultra-short bond ETF listing adds to number of offerings with potential for higher returns.

0:00

/

0:00

Listen to this article now

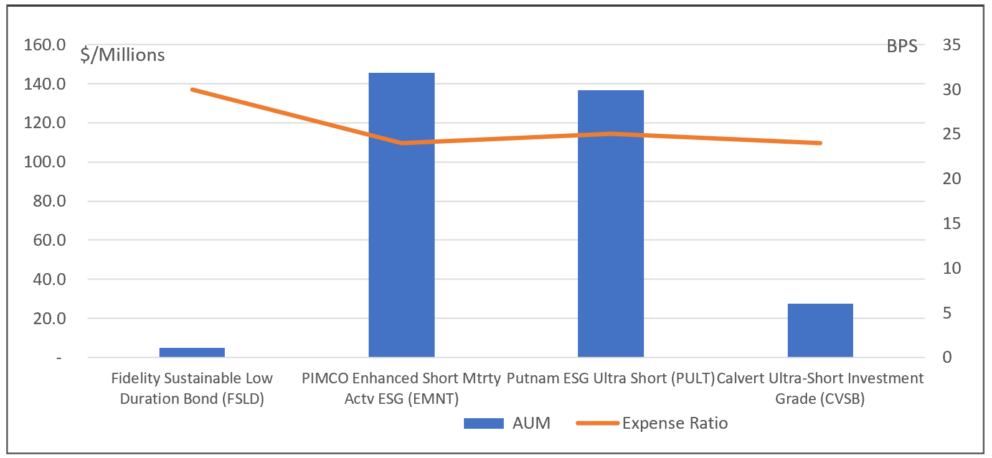

Sustainable ultra-short bond ETFs: AUM and expense ratios

Sources: Notes of Explanation: AUM as of February 28, 2023, except CVSB and PULT as of March 2, 2023. AUM sources: Morningstar Direct, Putnam and Calvert. Otherwise, Sustainable Research and Analysis LLC.

Observations:

- Morgan Stanley is the latest firm to launch an ultra-short sustainable bond ETF with its listing on January 30, 2023 of the actively managed Calvert Ultra-Short Investment Grade ETF (CVSB). Morgan Stanley Investment Management Inc., whose parent company, Morgan Stanley, acquired Eaton Vance and Calvert Asset Management on March 1, 2021, is the fund’s investment advisor.

- Against a backdrop of rising interest rates that now key off the Federal Reserve’s target range of 4.5% to 4.75% from nearly zero up until March 2022, the newest sustainable ultra-short bond ETF lifts to four the number of ETFs available in the market today, including funds managed by PIMCO, Fidelity Investment Management & Research and Putnam Investments that introduced its own Putnam ESG Ultra Short ETF (PULT) less than two months ago on January 18, 2023. PIMCO’s Enhanced Short Maturity Active ETF was launched in 2019 while Fidelity’s offering came to market in April 19, 2022. The funds carry expense ratios that range from 24 basis points to 30 basis points.

- These sustainable ETF offerings, all actively managed, completement 11 sustainable actively managed ultra-short mutual funds/share classes currently in operation that make up four mutual funds managed by Calvert Research and Management, Fidelity and Palmer Square Capital Management. Expense ratios for these mutual fund counterparts are higher, ranging from a low of 25 basis points to a high of 72 basis points. In total, the sustainable ultra-short bond segment has attracted about $1.1 billion in assets under management as of February 28, 2023, including $150.5 million in ETFs, which just more than doubled in size, and $985.30 million in mutual funds.

- Ultra-short bond funds are not money market funds. They seek to maximize income without maintaining a stable net asset value. Normally, their portfolios maintain an average portfolio duration of less than one year and they invest in high-grade short term instruments such as obligations of the U.S. government, its agencies and instrumentalities, mortgage-backed bonds, domestic corporate debt obligations, taxable municipal debt securities, securitized debt instruments (such as mortgage- and asset-backed securities), repurchase agreements, certificates of deposit, bankers acceptances, commercial paper, and other money market instruments. Some non-investment grade investments may also be permitted and can stimulate higher returns. Ultra-short bond funds take on more credit and interest rate risk relative to money market funds and are managed to achieve higher risk adjusted total returns, in some cases doing so with some exposure to non-investment grade securities.

- Among the four currently listed ETFs, only the PIMCO Enhanced Short Maturity Active ESG ETF (EMNT) has been in operation for more than one-year. The fund registered a total return of 83 basis points over the trailing twelve-month period through the end of February.

- Sustainable strategies vary among the four ETFs. They include approaches that take into account relevant ESG risks and opportunities and the application of minimum ESG standards, with some variations, at one end of the range, to seeking out issuers that manage ESG risk exposures adequately and that are not exposed to excessive ESG risk through their principal business activities within the context of the Calvert Principles for Responsible Investment, a framework for considering ESG factors that maintains a tilt toward responsible investing outcomes and also relies on exclusions and issuer engagements.