The Bottom Line: Sustainable real estate funds still not fully recovered from severe declines during Q1 of 2020, but category expanded, led by ESG Integration.

Sustainable real estate funds have still not fully recovered from the severe declines experienced during the first quarter of the year, but category, led by ESG Integration, has expanded

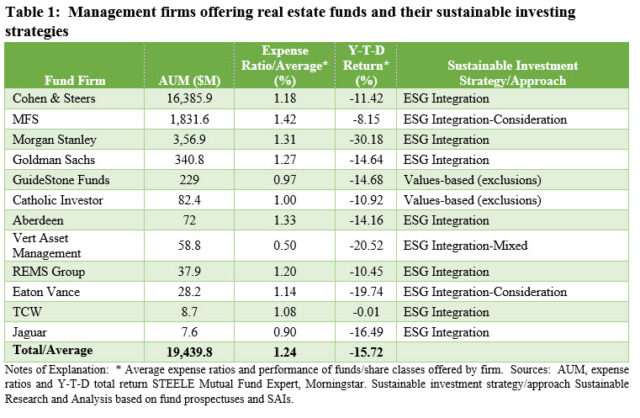

Sustainable real estate funds have still not fully recovered from the severe declines experienced during the first quarter of the year as the spread of COVID-19 led to widespread economic and social shutdowns. On a year-to-date basis, the segment lags all other investment categories with an average return of -15.72%. Recent increases in seven-day infection rates across the US and Europe to levels exceeding the highs reached in August of this year, as we move into the winter season, are likely to extend the period of recovery. Still, during the course of the year, the number of real estate funds adopting sustainable investing strategies via re-brandings, on top of existing funds, increased by a net of 10 funds to 21 funds (84 funds/share classes) and $19.4 billion in assets under management at the end of September. These funds are managed by twelve firms that have largely adopted ESG Integration approaches to investment management. In fact, ESG Integration is employed by seven managers with 88.5% of the real estate fund assets under management, followed by 9.6% of assets that are pursuing an ESG Integration-Consideration approach.

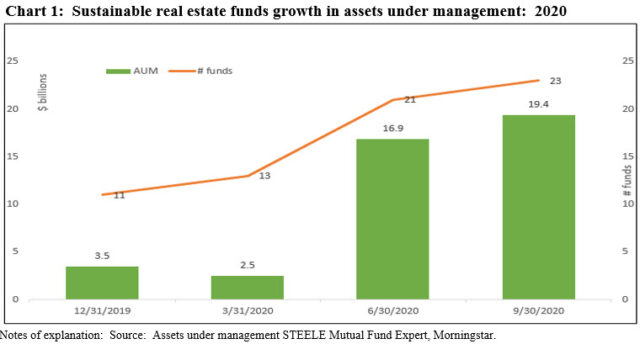

The sustainable real estate funds objective category expanded rapidly during the course of 2020 due largely to re-brandings

The subset of sustainable real estate funds started the year with 11 funds, 40 fund/share classes and $3.5 billion in assets under management. Due largely to re-brandings, the sustainable real estate funds objective category expanded rapidly during the course of 2020, rising to 23 funds, 90 funds/share classes, at the end of the second quarter and settling down at 21 funds, 84 funds/share classes, by the end of September 2020. The drop is attributable to the liquidation during the third quarter of two funds consisting of six share classes managed by Morgan Stanley and Transamerica with combined assets of $19.0 million. Still, assets under management expanded by 8X. Fund firms like Cohen & Steers and Goldman Sachs, in particular, led the re-brandings parade by explicitly amending fund prospectus language to reflect their adoption of ESG integration in investment decisions. Refer to Chart 1.

Performance results: Hard hit in the first quarter, sustainable real estate funds posted a year-to-date average decline of -15.72%

During the first quarter, the universe of 44 funds/share classes gave up an average of -28.66%, with results ranging from a low of -37.76% to a high of -20.02%. Real estate securities partly recovered in the second quarter, with markets responding positively to massive and unprecedented fiscal and monetary relief and stimulus policies and as economies began to slowly reopen. The listed real estate market was also supported by mostly intact earnings and dividends, and encouraging rent collection data outside of retail and hotel landlords and certain office companies. The universe of sustainable funds benefited, gaining an average of 10.87% in the second quarter and 2.94% in the third quarter. That left the expanded universe of sustainable real estate funds with an average year-to-date decline of -15.72% and a trailing twelve-month drag of -15.72%.

These returns are net of expenses, which rank at the higher end of the range across all sustainable investment company categories, including ETFs and index funds. The average expense ratio applicable to sustainable real estate funds is 1.24% as of September 2020, ranking this objective category as the fourth most expensive out of 39 categories. Real estate funds expense ratios range from a low of 0.5% levied by the $58.8 million Vert Global Sustainable Real Estate Fund to 2.12% charged by the $1.4 million Goldman Sachs International Real Estate Securities Fund C (fund AUM=$117.7 million).

ESG Integration approach dominates the segment, followed by ESG Integration-Consideration

The twelve firms offering real estate funds at the end of Q3 2020 have largely adopted ESG Integration approaches to investment management. ESG Integration is employed by seven managers with 88.5% of the real estate fund assets under management, followed by 9.6% of assets that are subject to an ESG Integration-Consideration approach. Refer to Table 1 and definitions below. Two firms, including the legacy GuideStone Funds Global Real Estate Securities Fund, in operation since 2006, employ a values-based approach that relies entirely on exclusions. Only one fund, the Vert Asset Management Global Sustainable Real Estate Fund publishes an impact report that describes the fund’s ESG scores relative to the REIT universe, excluded companies, portfolio alignment with UN SDGs, engagement initiatives, proxy voting record as well as CO2 emissions reduction. While this is positive, the presentation of data covering ESG scores and CO2 emissions lack clarifying details and limit an investor’s ability to make comparisons across funds.

ESG Integration definitions: ESG Integration-The fund will integrate ESG and may also engage with stakeholders, ESG Integration-Consideration-The fund may integrate ESG. ESG Integration-Mixed-Core strategy consists of ESG integration, but exclusions, impact or thematic approaches may also be employed.