Politics Dominated the Headlines in May, but S&P Continues Upward Trajectory; Bonds Also Rally

Politics dominated the headlines in May and as news of investigations into U.S. president Donald Trump reached investors, the US stock market saw one of its largest downward moves in the year-to-date. But the two-day 2% drop was offset as stock prices continued their upward trajectory. The S&P 500 registered its third best monthly gain, adding 1.4%, the FTSE 100 rallied 5.0% and European stocks added 3.3% as Eurozone uncertainties due to the French election, which had commenced in April were, were resolved for now with the victory of Emmanuel Macron. Attention then turned to Italy where elevated political risk was attached to internal developments that made it seem increasingly likely that a general election would be held by the autumn.

[ihc-hide-content ihc_mb_type=”show” ihc_mb_who=”3,4,5″ ihc_mb_template=”4″ ]

The S&P 500 earnings season came to end and was characterized by robust earnings growth across all sectors. Revenues generally beat analyst estimates and earnings per share surprised even more, with over three-quarters of US companies beating revenue estimates. Earnings growth was seen in almost all sectors, indicating a broad-based higher earnings trend in the US market. The unemployment rate fell in the May labor market release, down to 4.4% which was particularly good news after the dismal payrolls report for the previous month. 211,000 non-farm jobs were added in April vs. the 185,000 jobs expected.

Bonds rallied as well, with global investment-grade bonds returning close to 1.7% and euro and U.S. Treasuries both returning 0.5%. In the U.S. the Bloomberg Barclays U.S. Aggregate Bond Index replicated the previous month’s gain of 0.77%.

Moody’s downgraded China’s sovereign credit rating and changed its outlook from negative to stable. Local market reaction in equities, fixed income and currencies was muted, but the downgrade does reflect the risk associated with China’s rapid accumulation of corporate debt and systemic challenges from the shadow banking system. In May, China signed a trade deal with the US, reversing some of the anti-trade rhetoric from the US, in what was seen as a positive stepping stone to US—China relations. The items covered in the deal span beef and poultry to financial ratings and credit services. The MSCI Asia ex-Japan gained 4% in May.

Sustainable Portfolios Performance Summary

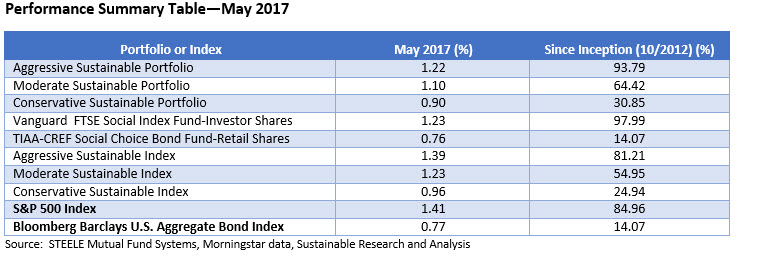

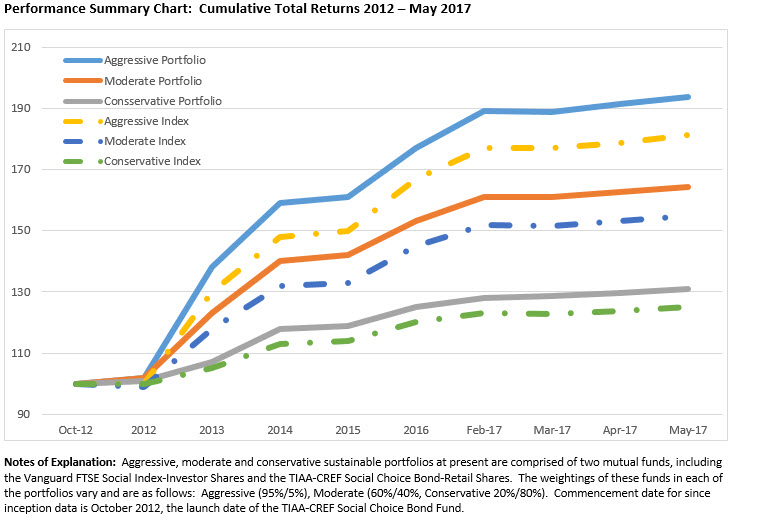

The Aggressive Sustainable Portfolio (95% stocks/5% bonds) gained 1.22% during the month of May, benefiting from the 1.23% increase produced by the Vanguard FTSE Social Index Fund-Investor Shares. Unlike the previous four months, however, the fund did not outperform the S&P 500 Index. This was also the case for the TIAA-CREF Social Choice Bond Fund-Retail which came in at 0.76% or just one basis point (0.01%) below the Bloomberg Barclays U.S. Aggregate Bond Index. Still, the Moderate and Conservative Portfolios experienced gains of 1.10% and 0.90%, respectively.

On a cumulative basis, the three portfolios are up 93.79%, 64.42% and 30.85%, respectively, continuing to perform well ahead of their corresponding indexes which delivered increases of 81.21%, 54.95% and 24.94%, respectively.

Monthly Sustainable Fund Flows

Sustainable funds, including mutual funds, ETFs and ETNs, ended the month of May at about $209.8 billion. This is an increase of almost $3.4 billion relative to the month of April, or 1.6%. ETFs and ETNs stood at $5.5 billion as compared to $204.4 billion for mutual funds, or 97.4% of total sustainable assets.

Mutual funds accounted for 92% of the gain in net assets, driven almost entirely by an increase of $3.1 billion in the value of equity mutual funds that was largely aided by market appreciation.

Fixed income assets, consisting of taxable municipal bond funds along with money market mutual funds, ended the month of April largely unchanged at $17.5 billion in assets under management largely in line with the prior month.

[/ihc-hide-content]