Equity Markets Push Higher, Delivering Strong 1Q Results; Fixed Income Pauses

The US equity market pushed higher, but adding the smallest monthly gain so far this year of 0.12%, but closing the quarter with a strong 6.07% total return. Stock prices continued to benefit from strong corporate earnings and improved business and consumer confidence over the last year, undoubtedly reinforced by the US election that stimulated hopes for tax cuts, increased public spending as well as regulatory reforms. That said, the market may be taking a bit of a pause as investors’ enthusiasm over the likely implementation of the new administration’s policy initiatives is tamped down in light of the failure during the month to repeal and replace the affordable care act. Markets outside the US and Canada were up a stronger 2.75%, reflecting broad based earnings growth, economic confidence (except perhaps in the UK) and rejections of anti-euro politicians in recent European results and optimism about forthcoming elections in France.

[ihc-hide-content ihc_mb_type=”show” ihc_mb_who=”3,4,5″ ihc_mb_template=”4″ ]

Registering a decline of 0.05%, the US fixed income market took a pause in a month when the Federal Reserve announced its third interest rate rise since the 2008 financial crisis and the second in three months, taking the Federal Funds base rate from 0.75% to 1% in an effort to head off inflation. The central bank also confirmed that it is prepared to increase rates several times this year to keep a lid on inflation as it rises above its 2% target level.

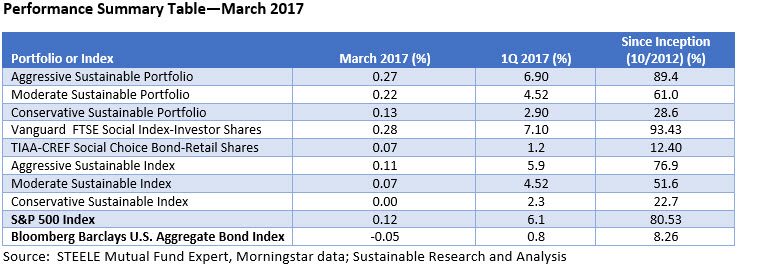

Performance Summary

The Aggressive Sustainable Portfolio (95% stocks/5% bonds) gained 0.27% during the month of March. Although the total return was modest, the Portfolio’s performance was boosted by the Vanguard FTSE Social Index results that exceeded the S&P 500 Index. The Moderate and Conservative Portfolios also experienced gains, edging up 0.22% and 0.13%, respectively. The TIAA-CREF Social Choice Bond Fund-Retail also outperformed its benchmark which produced a small negative return of -0.05% for the month.

The strong stock market performance during the first three months of the year, when the S&P 500 gained 6.1%, benefited the more aggressively configured sustainable portfolios. The Aggressive Sustainable Portfolio added almost 7% while the moderate and conservative portfolios were up 4.52% and 2.9%, respectively.

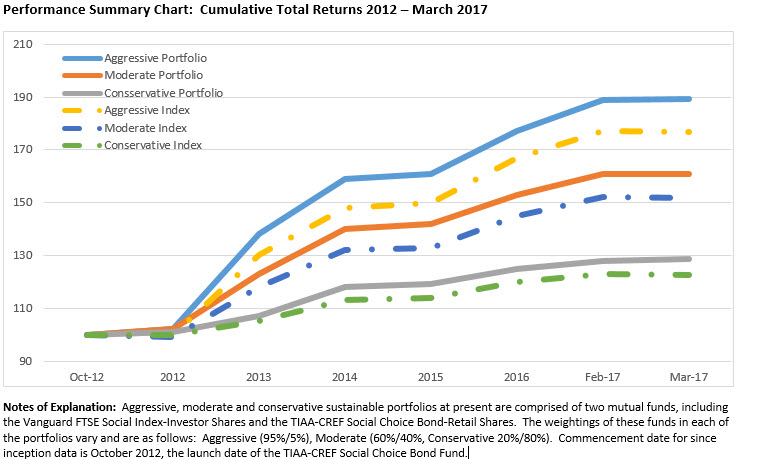

On a cumulative basis, the three portfolios are up 89.4%, 61.0% and 28.6%, respectively as compared to their corresponding indexes which have recorded lower gains of 76.9%, 51.6% and 22.7%.

Monthly Sustainable Fund Flows

Sustainable funds, including mutual funds, ETFs and ETNs, added just $590 million to end the month with $203.8 billion in assets under management, or an increase of 0.6%. ETFs stood at $5.1, up slightly from almost $5.0 billion at the end of February while mutual funds closed the month with assets in the amount of $198.7 billion. Almost the entire gain during the month accrued to the benefit of mutual funds.

Equity funds accounted for $186.7 billion in assets under management, or 91.6%, while fixed income funds stood at $17.1 billion.

[/ihc-hide-content]