Stock Markets Register Best First Half Year Gains Since 2009

While slowing down in June, collectively, global stock markets registered their best first half year gains since 2009 as twenty-six of the world’s top 30-stock market indexes recorded gains. Strengthening corporate earnings, improving economies and continued support from central banks contributed to the strong year-to-date results. This, despite lowering expectations in the U.S. for fiscal stimulus boosts in infrastructure investing and lower taxes advocated by the Trump administration and some country specific political jolts, such as the U.K and Brazil.

In the U.S., the S&P 500 eked out a slight 0.48% gain to end the first quarter up 2.57%, versus a strong 5.53% in the first quarter, and a gain of 8.2% year-to-date which marked the best half year results since 2013. In addition to investor expectations for improving economic growth, the performance of the broad market has been bolstered by the advance of corporate earnings which increased 14% in the first quarter based on results for companies in the S&P 500. This represents the best quarterly growth rate since 2011. Technology stocks performed even better, as the Nasdaq Composite Index registered a six-month gain of 14%.

The US economy also continues to look healthy, with unemployment now lower than it has been 96% of the time since 1970. Broader measures of unemployment have also been falling sharply. Given the tight labor market, the Federal Reserve (Fed) raised the Federal Funds rate again in June to a new target of 1.00% to 1.25% and announced that it is likely to start reducing the size of its balance sheet “relatively soon”.

Having fallen since March, government bond yields saw a sharp spike upwards at the end of June as investors responded to a less dovish tone from central bankers. The 10-year U.S. Treasury yield, for example, set a 2017 low of 2.135% on June 26 and then jumped 169 bps within 4-days to close the month of June at 2.304%. Neither equities nor bonds reacted well to speeches that suggested the European Central Bank (ECB) could soon begin reducing its quantitative easing (QE) purchases and the Bank of England (BoE) might raise interest rates this year. One of the key questions for the rest of the year will be the extent to which bond and equity markets can withstand a gradual reduction in monetary stimulus, which has helped to support markets in recent years.

Helped by weakness in the dollar and by improving emerging markets growth, emerging market equities have been the best performing equity region and emerging market debt has been the best performing fixed income market so far this year.

Sustainable Portfolios Performance Summary

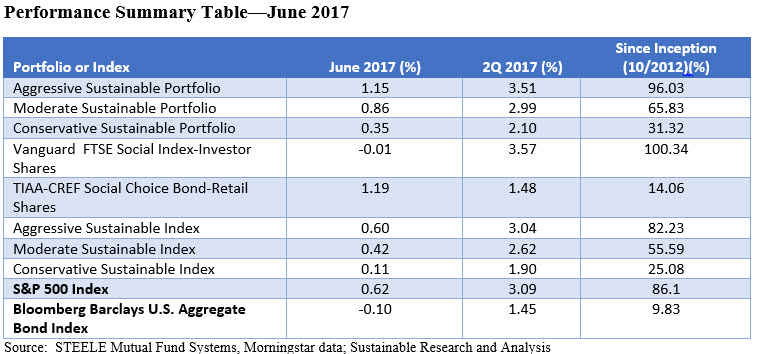

The Aggressive Sustainable Portfolio (95% stocks/5% bonds) produced a strong 1.15% gain during the month of June and outperformed its designated index by 59 bps. The total return almost exceeded by two times the performance of the S&P 500 that ended the month with a 0.62% gain. This was due to the strong performance registered by the Vanguard FTSE Social Index Investor Shares that gained 1.19%. When combined with the slight -0.10% decline realized by the Bloomberg-Barclays Aggregate Bond Index, the Aggressive Sustainable Index recorded a slight gain of 0.60%. The Moderate and Conservative Portfolios also experienced gains, recording increases of 0.86% and 0.35%, respectively. The TIAA-CREF Social Choice Bond Fund-Retail also managed to outperform its benchmark by ending the month with a slight negative return of -0.01%.

The strong stock market performance during the first six months of the year, when the S&P 500 added 9.3%, benefited the more aggressively configured sustainable portfolios. The Aggressive Sustainable Portfolio added almost 7% while the moderate and conservative portfolios were up year-to-date by 8.53% and 4.1%, respectively.

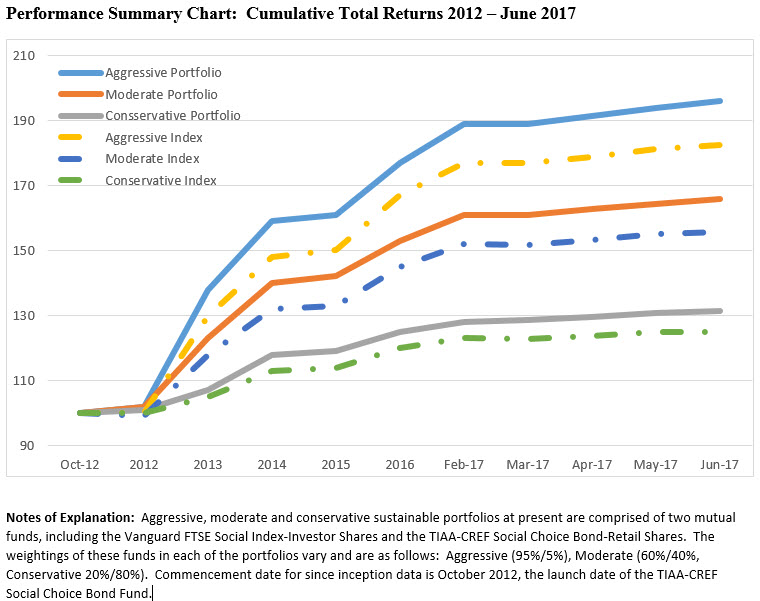

On a cumulative basis since October 2012, the three portfolios are up 96.03%, 65.8% and 31.32%, respectively, comfortably in excess of their corresponding indexes that are up 82.23%, 55.59% and 25.08%.

Monthly Sustainable Fund Flows

Sustainable funds, including mutual funds, ETFs and ETNs, added $1.3 billion in June for a slight increase of 0.61%, closing the quarter at $211.1 billion. ETFs stood at $5.7 billion as compared to $205.5 billion for mutual funds.

Mutual funds accounted for 86% of the gain in net assets, driven in particular by the uptick of almost $1 billion into equity mutual funds. This gain, however, is attributable to the increase in stock prices during the month rather than net new cash inflows.

There was also a slight pick-up in fixed income mutual fund assets, but this segment still represents only 9.4% of total sustainable mutual fund assets. At the end of June, equity funds held $186.2 billion while fixed income funds stood at $19.3 billion.

Sustainable Portfolios Performance Summary: June 2017

While slowing down in June, collectively, global stock markets registered their best first half year gains since 2009 as twenty-six of the world’s top 30-stock market indexes recorded gains. Strengthening corporate earnings, improving economies and continued support from central banks contributed to the strong year-to-date results. This, despite lowering expectations in the U.S. for fiscal…

Share This Article:

Stock Markets Register Best First Half Year Gains Since 2009

While slowing down in June, collectively, global stock markets registered their best first half year gains since 2009 as twenty-six of the world’s top 30-stock market indexes recorded gains. Strengthening corporate earnings, improving economies and continued support from central banks contributed to the strong year-to-date results. This, despite lowering expectations in the U.S. for fiscal stimulus boosts in infrastructure investing and lower taxes advocated by the Trump administration and some country specific political jolts, such as the U.K and Brazil.

In the U.S., the S&P 500 eked out a slight 0.48% gain to end the first quarter up 2.57%, versus a strong 5.53% in the first quarter, and a gain of 8.2% year-to-date which marked the best half year results since 2013. In addition to investor expectations for improving economic growth, the performance of the broad market has been bolstered by the advance of corporate earnings which increased 14% in the first quarter based on results for companies in the S&P 500. This represents the best quarterly growth rate since 2011. Technology stocks performed even better, as the Nasdaq Composite Index registered a six-month gain of 14%.

The US economy also continues to look healthy, with unemployment now lower than it has been 96% of the time since 1970. Broader measures of unemployment have also been falling sharply. Given the tight labor market, the Federal Reserve (Fed) raised the Federal Funds rate again in June to a new target of 1.00% to 1.25% and announced that it is likely to start reducing the size of its balance sheet “relatively soon”.

Having fallen since March, government bond yields saw a sharp spike upwards at the end of June as investors responded to a less dovish tone from central bankers. The 10-year U.S. Treasury yield, for example, set a 2017 low of 2.135% on June 26 and then jumped 169 bps within 4-days to close the month of June at 2.304%. Neither equities nor bonds reacted well to speeches that suggested the European Central Bank (ECB) could soon begin reducing its quantitative easing (QE) purchases and the Bank of England (BoE) might raise interest rates this year. One of the key questions for the rest of the year will be the extent to which bond and equity markets can withstand a gradual reduction in monetary stimulus, which has helped to support markets in recent years.

Helped by weakness in the dollar and by improving emerging markets growth, emerging market equities have been the best performing equity region and emerging market debt has been the best performing fixed income market so far this year.

Sustainable Portfolios Performance Summary

The Aggressive Sustainable Portfolio (95% stocks/5% bonds) produced a strong 1.15% gain during the month of June and outperformed its designated index by 59 bps. The total return almost exceeded by two times the performance of the S&P 500 that ended the month with a 0.62% gain. This was due to the strong performance registered by the Vanguard FTSE Social Index Investor Shares that gained 1.19%. When combined with the slight -0.10% decline realized by the Bloomberg-Barclays Aggregate Bond Index, the Aggressive Sustainable Index recorded a slight gain of 0.60%. The Moderate and Conservative Portfolios also experienced gains, recording increases of 0.86% and 0.35%, respectively. The TIAA-CREF Social Choice Bond Fund-Retail also managed to outperform its benchmark by ending the month with a slight negative return of -0.01%.

The strong stock market performance during the first six months of the year, when the S&P 500 added 9.3%, benefited the more aggressively configured sustainable portfolios. The Aggressive Sustainable Portfolio added almost 7% while the moderate and conservative portfolios were up year-to-date by 8.53% and 4.1%, respectively.

On a cumulative basis since October 2012, the three portfolios are up 96.03%, 65.8% and 31.32%, respectively, comfortably in excess of their corresponding indexes that are up 82.23%, 55.59% and 25.08%.

Monthly Sustainable Fund Flows

Sustainable funds, including mutual funds, ETFs and ETNs, added $1.3 billion in June for a slight increase of 0.61%, closing the quarter at $211.1 billion. ETFs stood at $5.7 billion as compared to $205.5 billion for mutual funds.

Mutual funds accounted for 86% of the gain in net assets, driven in particular by the uptick of almost $1 billion into equity mutual funds. This gain, however, is attributable to the increase in stock prices during the month rather than net new cash inflows.

There was also a slight pick-up in fixed income mutual fund assets, but this segment still represents only 9.4% of total sustainable mutual fund assets. At the end of June, equity funds held $186.2 billion while fixed income funds stood at $19.3 billion.

Sustainableinvest.com

Benefits

Free access to regularly updated original research and analysis focused exclusively on sustainable finance and investing, providing investors with the guidance needed to make informed investment decisions that align with their personal values and financial goals while also contributing to the advancement of positive long-term environmental and social outcomes.

By offering financial support for our current work, either in the form of a one-time or regular contributions, you help to defray some of the costs associated with conducting our research and analysis as well as to maintain the www.sustainablest.wpengine.com website.

Helping us to expand our research capabilities and offerings over time to cover additional relevant topics geared to sustainable investors.

Sign up to free newsletters.

By submitting this form, you are consenting to receive marketing emails from: . You can revoke your consent to receive emails at any time by using the SafeUnsubscribe® link, found at the bottom of every email. Emails are serviced by Constant Contact