Summary

• The S&P 500 Index gained 8.01%, posting the best monthly results since October 2015

• Model portfolios: Underlying funds rebalanced to reflect their risk based allocation ratios

• The strong January 2019 performance results recorded by both stocks and bonds almost reversed in their entirety December’s declines and lifted the total returns of the three model portfolios to a range from a low of 2.26% to a high of 7.59%.

• Sustainable mutual funds and ETF/ETNs gained an average of 6.96% in January; as for similarly managed sustainable funds, the reconstituted SUSTAIN Large Cap Equity Fund Index posted a gain of 7.6% in January, the best monthly result since the index was started as of December 31, 2016, but lagged behind the S&P 500 by 36 basis points. The SUSTAIN Fixed Income Index posted a gain of 1.2% versus 1.06% for the Bloomberg Barclays US Aggregate Index.

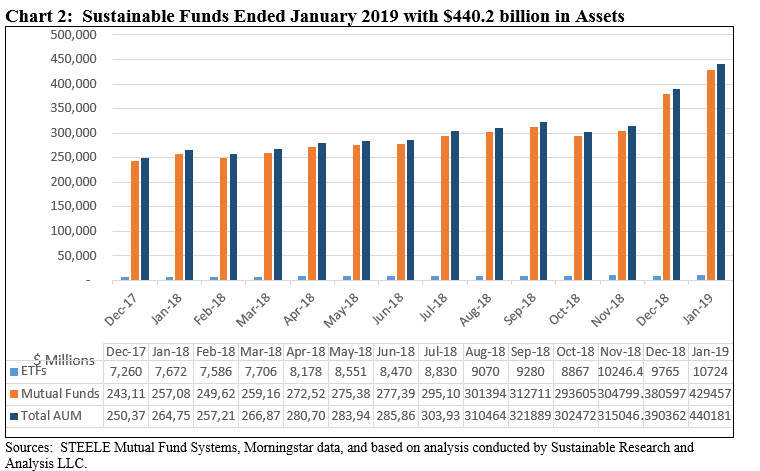

• Sustainable funds reached another new all-time high at January with $440.2 billion in AUM but net cash outflows pull out $1.7 billion

The S&P 500 Index gained 8.01%, posting the best monthly results since October 2015

The S&P 500 Index and the Dow Jones Industrial Average gained 8.01% and 7.30%, respectively, posting the best monthly results since October 2015 and helping to erase all but about 1.2% of December’s 9.2% decline in the case of the broader S&P 500. All eleven sectors that make up the S&P index registered gains that ranged from 3.57% for Utilities to a high of 12.48% achieved by Industrials. The turnaround in stocks is being attributed to a shift in the stance of the Federal Reserve Board’s Chairman Jerome Powell based on remarks made on January 4, 2019 that the central bank would be patient before raising interest rates further. This came about two weeks after the Federal Open Market Committee hiked rates by one-quarter of a percentage point to a range of 2.25% to 2.5% while also indicating that rates were anticipated to rise at least twice in 2019. The Fed’s modified posture was also reflected in comments that the central bank might also be flexible regarding the pace with which it would reduce its balance sheet which had been shrinking by as much as $50 billion a month. The Fed’s position was reinforced following the two-day January 29-30 FOMC meeting when it was announced that a decision was reached to maintain the target range for the federal funds rate at 2.25% to 2.5%. In response, 10-year Treasury yields dropped to end the month at 2.63%, down 6 basis points from the close of 2.69% at year-end 2018 while the Bloomberg Barclays US Aggregate Index gained 1.06%. This elevated the trailing 12-month return for investment-grade intermediate bonds to 2.25% versus -2.31% for the S&P 500 Index. High yield bonds rose 4.39%.

There was also a recovery in Asian and European stocks in January, with the MSCI AC, ex-Japan GR Index and MSCI EAFE NR Index registering gains of 7.29% and 6.57%, respectively, even as Europe and China’s economies are facing headwinds. These strong gains were still eclipsed by a double digit increase of 14.52% achieved in Latin America, according to the S&P Latin America 40 Total Return Index. In general, growth stocks outperformed value stocks while small capitalization stocks, especially micro-cap stocks, exceeded the performance large and mid-cap stocks.

Model portfolios: Underlying funds rebalanced to reflect their risk based allocation ratios

The three model portfolios were rebalanced as of December 31, 2018 to bring the underlying funds back into alignment with their corresponding risk-based allocation ratios, as reflected in Table 1.

The strong gains achieved through the end of December 2018 by investing in the underlying portfolios, including the Domini Impact International Equity-Investor Shares, TIAA-CREF Social Choice Bond-Retail Shares and Vanguard Social Index-Investor Shares, were reallocated to reflect the percentages shown above while the underlying funds remain unchanged for 2019.

The strong January 2019 performance results recorded by both stocks and bonds almost reversed in their entirety December’s declines and lifted the total returns of the three model portfolios to a range from a low of 2.26% to a high of 7.59%. At the same time, relative results varied in sync with the performance of the underlying funds relative to their conventional indexes. The Domini Impact International Equity Investor Shares achieved the widest performance margin relative to its non-ESG MSCI EAFE Index and picked up 1.02% while the Vanguard FTSE Social Index Investor Shares managed to outperform the S&P 500 Index by a narrow 0.6% or 6 basis points. For the fourth month in a row, the TIAA-CREF Social Choice Bond Fund Retail Shares lagged the Bloomberg Barclays US Aggregate Index, this time by 23 basis points. Given these results, the two equity dominated model portfolios outperformed their conventional benchmarks while the third ended the month very slightly behind.

The Aggressive Sustainable Portfolio (95% stocks/5% bonds) and Moderate Sustainable Portfolio (60% stocks/40% bonds) recorded excess index returns of 0.28% and 0.08%, respectively, while the Conservative Sustainable Portfolio (20%/80%) lagged its index by 0.12%.

The results for the trailing three-month and 12-month intervals are also mixed. Over the three month interval to January, while each of the three portfolios achieved positive results, only the Aggressive Portfolio beat its conventional index. For the longer trailing 12-month period, each of the portfolios posted negative results, and the Aggressive, as well as Conservative portfolios, achieved returns that exceeded their respective benchmarks; and the portfolio results since inception as of October 2012 have been expanding their lead relative to their corresponding indexes since peaking in August-September of the prior year. Refer to Table 2 and Chart 1.

Sustainable mutual funds and ETFs gain an average of 6.96% in January

Sustainable funds, on average, generated strong results in January. 1,319 funds ranging from money market funds to equity funds posted an average gain of 6.96% with only a single fund recording a negative return. This was the small and very volatile iPath Global Carbon ETN that was down -11.27% while the best performing fund was the Invesco Solar ETF. The fund was up 24.8%, reversing a decline of 26.2% in 2018 as solar stocks suffered from a cyclical downturn. This came ahead of the announcement by NASA scientists on February 6, 2019 that the Earth’s average surface temperature in 2018 was the fourth highest in nearly 140 years of record-keeping and a continuation of an unmistakable warming trend.

As for similarly managed sustainable funds, the reconstituted Sustainable (SUSTAIN) Large Cap Equity Fund Index posted a gain of 7.6% in January, the best monthly result since the index was started as of December 31, 2016, but lagged behind the S&P 500 by 36 basis points. At the same time, the Sustainable (SUSTAIN) Fixed Income Index posts gain of 1.2% versus 1.06% for the Bloomberg Barclays US Aggregate Index.

Sustainable funds reach another new all-time high at January with $440.2 billion in AUM but net cash outflows pull out $1.7 billion

Sustainable funds reached an all-time high of $440.2 billion in assets as of January 31, 2019 with the net addition of $49.8 billion in January versus $390.4 at year-end 2018. Mutual funds accounted for 98% of the gain, and ended the month with $429.5 billion while exchange-traded funds and exchange-traded notes ended the first month of the year with $10.7 billion, up $958.6 million. The assets were distributed across 1,236 mutual funds/share classes and 91 ETFs/ETNs offered by 125 separate firms. Since the start of 2018 or a 13-month interval, this net increase is second only to the $74.9 billion gain recorded in December 2018. While the gain was in part linked to the strong market performance in January, the biggest contributor, as was the case in December, was sourced to repurposed funds. Four firms repurposed a total of nine funds offering 32 share classes with a combined total of $$21.5 billion in assets valued as of January 31, 2019. Market movement contributed another $30 billion while net cash flows were negative, with outflows removing $1.7 billion. This compares to net cash outflows in the amount of $3.9 billion recorded in December. Refer to Chart 2.

As noted, four firms repurposed 9 funds in January, including two firms with first-time sustainable fund offerings. These included, in order of repurposed net assets, Franklin Templeton Investments ($10.8 billion), JP Morgan ($9.9 billion), Shenkman Funds ($713.1) million and Artisan Partners ($50.7 million).

First-time sustainable offerings are managed by Milwaukee, Wisconsin-based Artisan Partners. The firm is a global, publicly traded NYSE listed investment management focusing that was founded in 1994 and manages $105.4 billion in assets as of January 31, 2019. The second firm is Shenkman Capital. Founded in 1985 and located in New York City, Shenkman is a privately owned actively managed firm specializing in high yield management with about $27.3 billion in assets under management as of September 28, 2018.

New funds also contributed to the expansion of sustainable assets during the month, adding just $10.6 million. Calvert introduced seven new share classes to existing funds and Neuberger Berman launched one new share classes. In addition, one new fund was launched January, the Mirova International Sustainable Equity Fund with three share classes. This fund, managed by Ostrum Asset Management U.S., LLC, formerly, Natixis Asset Management U.S., LLC, adds to Mirova’s two existing sustainable fund offerings which together reported $129.9 million in net assets and ten target date funds that are branded under the Natixis name. For further details regarding these and other sustainable fund strategies, refer to the Investment Research/Basics/Glossary of Terms tab.

Monthly Sustainable Model Portfolios Performance Summary: January 2019

Summary• The S&P 500 Index gained 8.01%, posting the best monthly results since October 2015• Model portfolios: Underlying funds rebalanced to reflect their risk based allocation ratios• The strong January 2019 performance results recorded by both stocks and bonds almost reversed in their entirety December’s declines and lifted the total returns of the three model portfolios…

Share This Article:

Summary

• The S&P 500 Index gained 8.01%, posting the best monthly results since October 2015

• Model portfolios: Underlying funds rebalanced to reflect their risk based allocation ratios

• The strong January 2019 performance results recorded by both stocks and bonds almost reversed in their entirety December’s declines and lifted the total returns of the three model portfolios to a range from a low of 2.26% to a high of 7.59%.

• Sustainable mutual funds and ETF/ETNs gained an average of 6.96% in January; as for similarly managed sustainable funds, the reconstituted SUSTAIN Large Cap Equity Fund Index posted a gain of 7.6% in January, the best monthly result since the index was started as of December 31, 2016, but lagged behind the S&P 500 by 36 basis points. The SUSTAIN Fixed Income Index posted a gain of 1.2% versus 1.06% for the Bloomberg Barclays US Aggregate Index.

• Sustainable funds reached another new all-time high at January with $440.2 billion in AUM but net cash outflows pull out $1.7 billion

The S&P 500 Index gained 8.01%, posting the best monthly results since October 2015

The S&P 500 Index and the Dow Jones Industrial Average gained 8.01% and 7.30%, respectively, posting the best monthly results since October 2015 and helping to erase all but about 1.2% of December’s 9.2% decline in the case of the broader S&P 500. All eleven sectors that make up the S&P index registered gains that ranged from 3.57% for Utilities to a high of 12.48% achieved by Industrials. The turnaround in stocks is being attributed to a shift in the stance of the Federal Reserve Board’s Chairman Jerome Powell based on remarks made on January 4, 2019 that the central bank would be patient before raising interest rates further. This came about two weeks after the Federal Open Market Committee hiked rates by one-quarter of a percentage point to a range of 2.25% to 2.5% while also indicating that rates were anticipated to rise at least twice in 2019. The Fed’s modified posture was also reflected in comments that the central bank might also be flexible regarding the pace with which it would reduce its balance sheet which had been shrinking by as much as $50 billion a month. The Fed’s position was reinforced following the two-day January 29-30 FOMC meeting when it was announced that a decision was reached to maintain the target range for the federal funds rate at 2.25% to 2.5%. In response, 10-year Treasury yields dropped to end the month at 2.63%, down 6 basis points from the close of 2.69% at year-end 2018 while the Bloomberg Barclays US Aggregate Index gained 1.06%. This elevated the trailing 12-month return for investment-grade intermediate bonds to 2.25% versus -2.31% for the S&P 500 Index. High yield bonds rose 4.39%.

There was also a recovery in Asian and European stocks in January, with the MSCI AC, ex-Japan GR Index and MSCI EAFE NR Index registering gains of 7.29% and 6.57%, respectively, even as Europe and China’s economies are facing headwinds. These strong gains were still eclipsed by a double digit increase of 14.52% achieved in Latin America, according to the S&P Latin America 40 Total Return Index. In general, growth stocks outperformed value stocks while small capitalization stocks, especially micro-cap stocks, exceeded the performance large and mid-cap stocks.

Model portfolios: Underlying funds rebalanced to reflect their risk based allocation ratios

The three model portfolios were rebalanced as of December 31, 2018 to bring the underlying funds back into alignment with their corresponding risk-based allocation ratios, as reflected in Table 1.

The strong gains achieved through the end of December 2018 by investing in the underlying portfolios, including the Domini Impact International Equity-Investor Shares, TIAA-CREF Social Choice Bond-Retail Shares and Vanguard Social Index-Investor Shares, were reallocated to reflect the percentages shown above while the underlying funds remain unchanged for 2019.

The strong January 2019 performance results recorded by both stocks and bonds almost reversed in their entirety December’s declines and lifted the total returns of the three model portfolios to a range from a low of 2.26% to a high of 7.59%. At the same time, relative results varied in sync with the performance of the underlying funds relative to their conventional indexes. The Domini Impact International Equity Investor Shares achieved the widest performance margin relative to its non-ESG MSCI EAFE Index and picked up 1.02% while the Vanguard FTSE Social Index Investor Shares managed to outperform the S&P 500 Index by a narrow 0.6% or 6 basis points. For the fourth month in a row, the TIAA-CREF Social Choice Bond Fund Retail Shares lagged the Bloomberg Barclays US Aggregate Index, this time by 23 basis points. Given these results, the two equity dominated model portfolios outperformed their conventional benchmarks while the third ended the month very slightly behind.

The Aggressive Sustainable Portfolio (95% stocks/5% bonds) and Moderate Sustainable Portfolio (60% stocks/40% bonds) recorded excess index returns of 0.28% and 0.08%, respectively, while the Conservative Sustainable Portfolio (20%/80%) lagged its index by 0.12%.

The results for the trailing three-month and 12-month intervals are also mixed. Over the three month interval to January, while each of the three portfolios achieved positive results, only the Aggressive Portfolio beat its conventional index. For the longer trailing 12-month period, each of the portfolios posted negative results, and the Aggressive, as well as Conservative portfolios, achieved returns that exceeded their respective benchmarks; and the portfolio results since inception as of October 2012 have been expanding their lead relative to their corresponding indexes since peaking in August-September of the prior year. Refer to Table 2 and Chart 1.

Sustainable mutual funds and ETFs gain an average of 6.96% in January

Sustainable funds, on average, generated strong results in January. 1,319 funds ranging from money market funds to equity funds posted an average gain of 6.96% with only a single fund recording a negative return. This was the small and very volatile iPath Global Carbon ETN that was down -11.27% while the best performing fund was the Invesco Solar ETF. The fund was up 24.8%, reversing a decline of 26.2% in 2018 as solar stocks suffered from a cyclical downturn. This came ahead of the announcement by NASA scientists on February 6, 2019 that the Earth’s average surface temperature in 2018 was the fourth highest in nearly 140 years of record-keeping and a continuation of an unmistakable warming trend.

As for similarly managed sustainable funds, the reconstituted Sustainable (SUSTAIN) Large Cap Equity Fund Index posted a gain of 7.6% in January, the best monthly result since the index was started as of December 31, 2016, but lagged behind the S&P 500 by 36 basis points. At the same time, the Sustainable (SUSTAIN) Fixed Income Index posts gain of 1.2% versus 1.06% for the Bloomberg Barclays US Aggregate Index.

Sustainable funds reach another new all-time high at January with $440.2 billion in AUM but net cash outflows pull out $1.7 billion

Sustainable funds reached an all-time high of $440.2 billion in assets as of January 31, 2019 with the net addition of $49.8 billion in January versus $390.4 at year-end 2018. Mutual funds accounted for 98% of the gain, and ended the month with $429.5 billion while exchange-traded funds and exchange-traded notes ended the first month of the year with $10.7 billion, up $958.6 million. The assets were distributed across 1,236 mutual funds/share classes and 91 ETFs/ETNs offered by 125 separate firms. Since the start of 2018 or a 13-month interval, this net increase is second only to the $74.9 billion gain recorded in December 2018. While the gain was in part linked to the strong market performance in January, the biggest contributor, as was the case in December, was sourced to repurposed funds. Four firms repurposed a total of nine funds offering 32 share classes with a combined total of $$21.5 billion in assets valued as of January 31, 2019. Market movement contributed another $30 billion while net cash flows were negative, with outflows removing $1.7 billion. This compares to net cash outflows in the amount of $3.9 billion recorded in December. Refer to Chart 2.

As noted, four firms repurposed 9 funds in January, including two firms with first-time sustainable fund offerings. These included, in order of repurposed net assets, Franklin Templeton Investments ($10.8 billion), JP Morgan ($9.9 billion), Shenkman Funds ($713.1) million and Artisan Partners ($50.7 million).

First-time sustainable offerings are managed by Milwaukee, Wisconsin-based Artisan Partners. The firm is a global, publicly traded NYSE listed investment management focusing that was founded in 1994 and manages $105.4 billion in assets as of January 31, 2019. The second firm is Shenkman Capital. Founded in 1985 and located in New York City, Shenkman is a privately owned actively managed firm specializing in high yield management with about $27.3 billion in assets under management as of September 28, 2018.

New funds also contributed to the expansion of sustainable assets during the month, adding just $10.6 million. Calvert introduced seven new share classes to existing funds and Neuberger Berman launched one new share classes. In addition, one new fund was launched January, the Mirova International Sustainable Equity Fund with three share classes. This fund, managed by Ostrum Asset Management U.S., LLC, formerly, Natixis Asset Management U.S., LLC, adds to Mirova’s two existing sustainable fund offerings which together reported $129.9 million in net assets and ten target date funds that are branded under the Natixis name. For further details regarding these and other sustainable fund strategies, refer to the Investment Research/Basics/Glossary of Terms tab.

Sustainableinvest.com

Benefits

Free access to regularly updated original research and analysis focused exclusively on sustainable finance and investing, providing investors with the guidance needed to make informed investment decisions that align with their personal values and financial goals while also contributing to the advancement of positive long-term environmental and social outcomes.

By offering financial support for our current work, either in the form of a one-time or regular contributions, you help to defray some of the costs associated with conducting our research and analysis as well as to maintain the www.sustainablest.wpengine.com website.

Helping us to expand our research capabilities and offerings over time to cover additional relevant topics geared to sustainable investors.

Sign up to free newsletters.

By submitting this form, you are consenting to receive marketing emails from: . You can revoke your consent to receive emails at any time by using the SafeUnsubscribe® link, found at the bottom of every email. Emails are serviced by Constant Contact