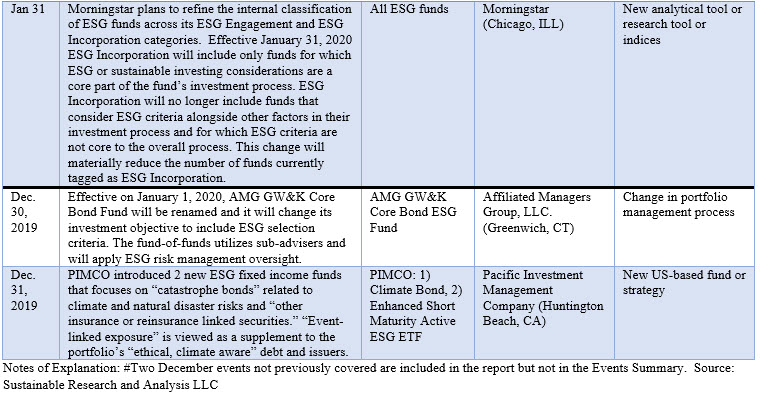

Events Summary

25 events were identified in January 2020#:

-

- Ten events involved new funds or the adoption of sustainable investing strategies in the US

and overseas.- Seven new fund launches were recorded for non-US based products.

- Three were for U.S.-based funds, including one private fund.

- Seven events signaled portfolio management process changes.

- Four events covered the introduced of analytical tools, research tools or indices.

- Two events were linked to personnel changes or additions.

- One event involved an M&A transaction.

- One event involved a change in investment adviser or sub-adviser.

- Ten events involved new funds or the adoption of sustainable investing strategies in the US

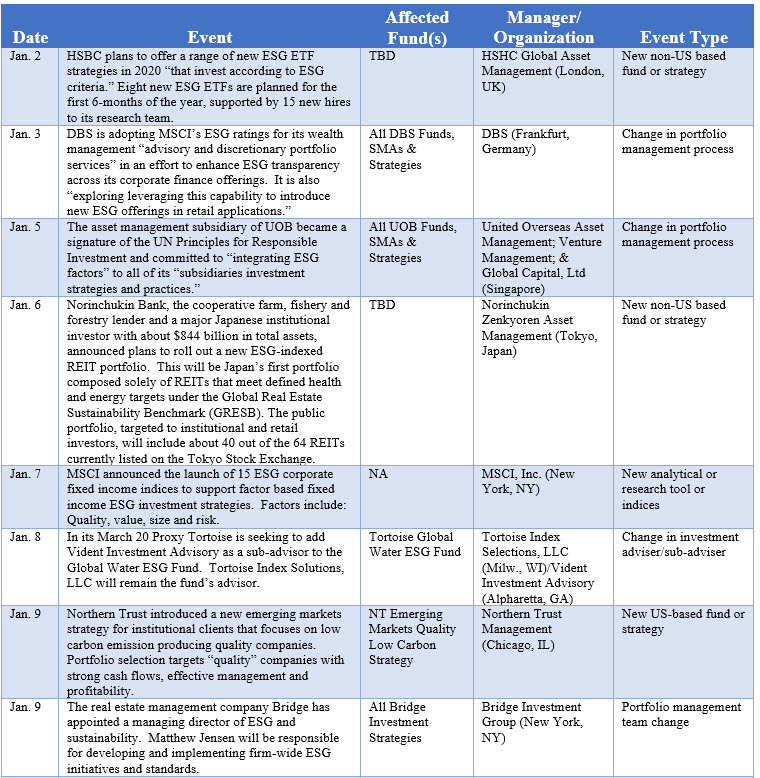

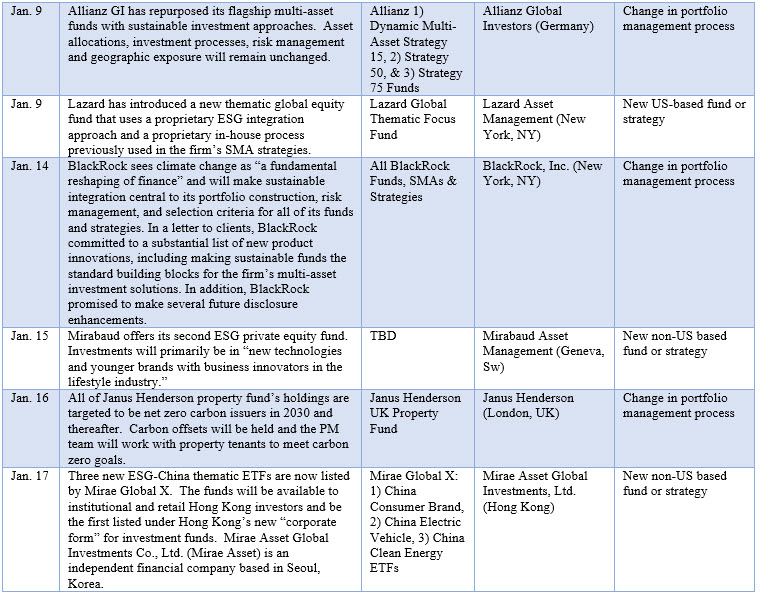

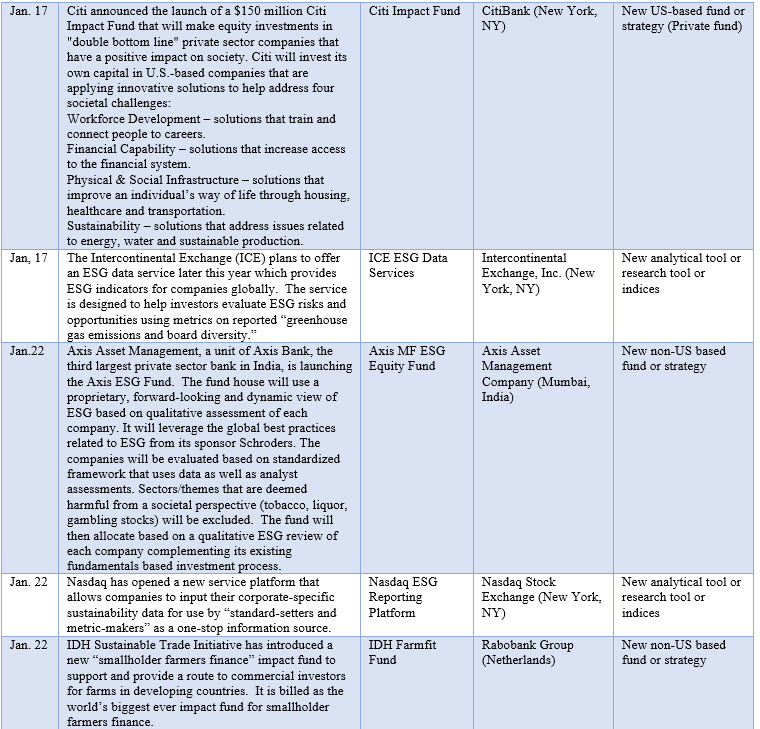

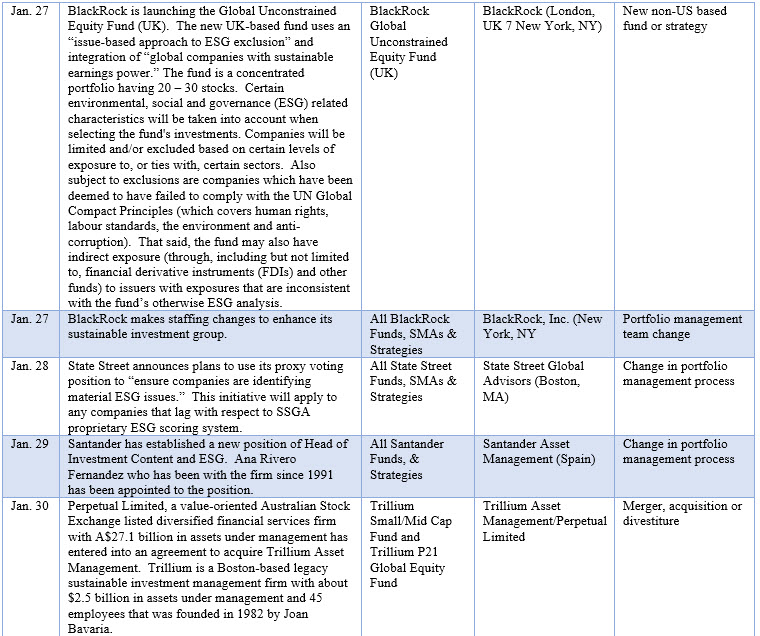

Refer to Table 1 for provides details.

Table 1: January 2020 Events in Ascending Calendar Date Order