Summary

Dominated by 56 funds that take into account information about environmental, social and governance (ESG) issues when making investment decisions, 60 funds, including 55 sustainable mutual funds and four ETFs and one ETN[1], organized into three broad asset categories covering US equities, international equities and fixed income, produced returns in November ranging from -9.45% to a high of 23.68%. This was against a backdrop of strong US stock market performance in November during which stock indices posted a series of record highs to close November with their strongest monthly gains since June. The S&P 500 Index added 3.63% as investors reacted favorably to positive US economic news ahead of the Thanksgiving holiday while continuing to shrug off geopolitical and domestic political uncertainties, including US-China trade, Brexit as well as unrest in Hong-Kong and impeachment proceedings in the US. Stocks in the US eclipsed their counterparts overseas. The MSCI ACWI ex US index gained 2.44% while emerging markets backtracked with regional variations. US rates rose across the yield curve and intermediate investment-grade bonds end the month -0.05% lower.

Funds managed by Eaton Vance appear for the first time in both the top and bottom performing tables. Effective October 16, 2019 the investment management firm repurposed 78 funds with $75.2 billion in assets by amending their prospectuses to reflect that as part of each fund’s research process, “portfolio management may consider financially material environmental, social and governance (“ESG”) factors. Such factors, alongside other relevant factors, may be taken into account in the Fund’s securities selection process.” Eaton Vance is one of several conventional investment management firms that have recently re-purposed a large number of existing funds by adopting similar non-committal ESG language in fund prospectuses. A total of eight funds of the 56 noted above that account for ESG considerations in investment decisions fall into this category.

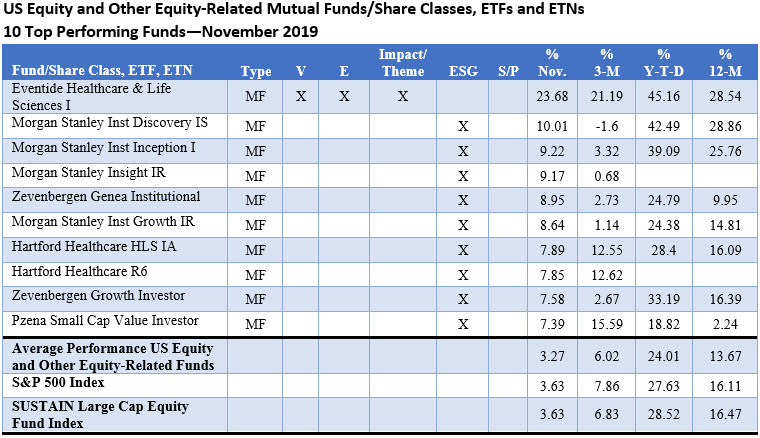

US Equity Funds/Sector Equity and Other Equity and Equity-Related Funds

The average performance of the top 10 performing funds, registering an increase of 10.0%, exceeded the average performance of the segment by a wide margin. The cohort’s performance was lifted by the 23.68% gain recorded by the top performing Eventide Healthcare & Life Sciences Fund I with its concentrated healthcare portfolio (98.07% in healthcare) invested in US and foreign equities. The fund employs a values-based approach with a focus on impact and negative screening. By way of comparison, the NASDAQ Biotechnology Index was one of the top performing indices in November, up 11.44%. Also concentrated, but with a focus on the technology sector and investing in high growth stocks, the second best performing fund, the Morgan Stanley Institutional Discovery Fund IS, was up 10.01%. Other leading funds in November included two funds with exposures to healthcare, large cap technology as well as small cap stocks.

The 10 lagging funds encompassed a mixed range of strategies including cannabis, energy, commodities and real estate. The Amplify Seymour Cannabis ETF, which gave up -11.68% last month, was again the poorest performing fund in November with its -9.45% total return. This actively managed ETF which integrates ESG, seeks to provide investment exposure to global companies principally engaged in the emerging cannabis and hemp ecosystem.

International Equity Funds

International sustainable funds posted an average gain of 1.7% while the top performing funds generated an average gain of 5.1%. The $24.5 million blended large cap-oriented Baillie Gifford Positive Change Equity Fund Institutional led the peer group with its concentrated portfolio of securities that the manager believes has the potential to deliver positive impact as well as strong financial returns. The fund, which also benefited from its 36% exposure to US equities, was the only top performing fund focusing exclusively on positive impact outcomes.

Bottom performing funds, largely invested in emerging markets, posted negative returns ranging from -2.52% to -1.24% as emerging markets dropped -0.14% in November. That said, results varied by region from -4.13% in Latin America to a gain of 0.53% in Asia, bolstered by China that was up 1.78%. One fund in this group, the $2.2 million ESG integrator Schroder Emerging Markets Small Cap Fund, -1.49%, announced that it was closing in December.

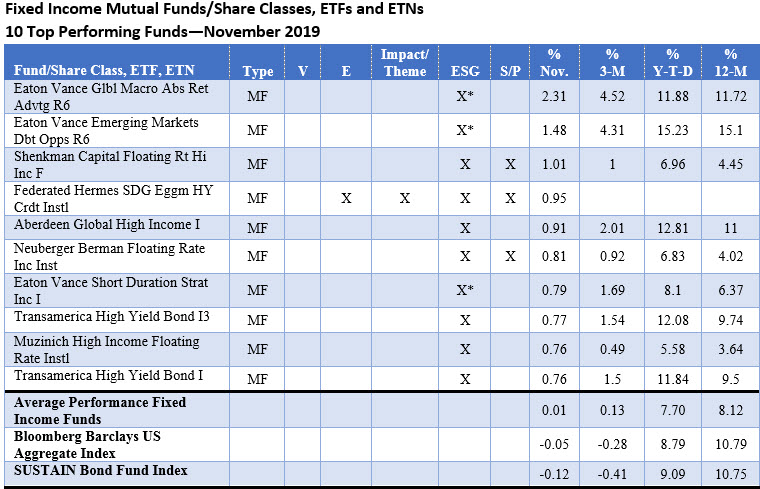

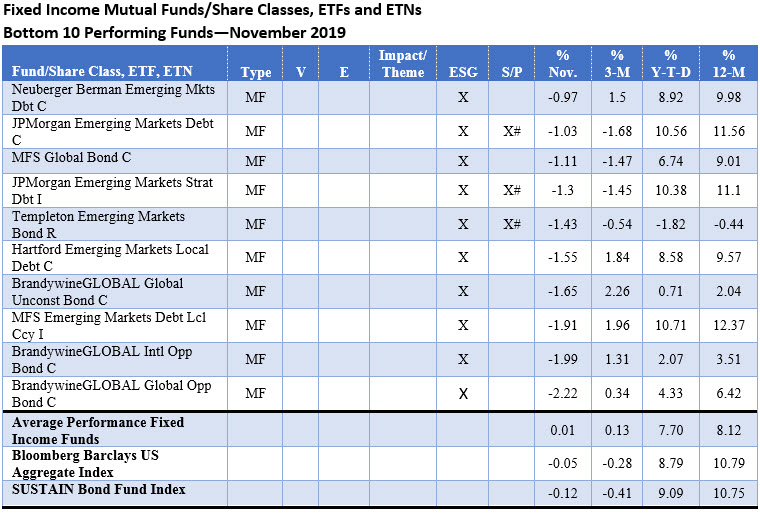

Fixed Income Funds

While investment grade intermediate-term bonds in the US posted a -0.05% return in November, US corporate high yield and global high yield bonds managed to eke out a narrow gains of 0.33% and 0.08%. The top performing bond funds, which included a number of high yield mutual funds, did even better and recorded an average return of 1.06%. These were led by Eaton Vance Global Macro Absolute Return Advantage Fund R6, a recent addition to the sustainable investing landscape that effective October 16, 2019 amended its prospectus to reflect that as part of its research process financially material ESG Factors may be considered in the fund’s securities selection process alongside other relevant factors.

Eaton Vance is not the only firm to have recently adopted prospectus language that seems to equivocate on ESG. MFS Emerging Markets Debt Local Currency Fund I, one of the fixed income laggards this month with a return of -1.11%, adopted similar prospectus language just a month earlier.

Sustainable Investing Strategies

Of the 60 top and bottom performing funds listed in the November scorecard, 56 funds have adopted ESG integration approaches either exclusively or in combination with additional sustainable approaches, including negative screening, impact and/or engagement. These observations are based on a review of fund prospectuses as well as supplemental website materials posted by each firm.

The remaining four funds employ an impact or thematic investing approach either exclusively or in combination with one or more companion strategies–other than ESG integration. One of these funds focuses exclusively on achieving impact. The Baillie Gifford Positive Change Equity Fund, which published its first Positive Change Impact Report in mid-2018, provided a comprehensive analysis of the impacts achieved via the holdings within the portfolio. This report was subsequently supplemented by a summary of the fund’s engagement initiatives.

Funds managed by Eaton Vance appear for the first time in both the top and bottom performing tables. Effective October 16, 2019 the investment management firm which also owns Calvert Management, repurposed 78 funds with $75.2 billion in assets by amending their prospectuses

to reflect that as part of each fund’s research process, the “portfolio management may consider financially material environmental, social and governance (“ESG”) factors. Such factors, alongside other relevant factors, may be taken into account in the Fund’s securities selection process.” Eaton Vance is one of several conventional investment management firms that have recently re-purposed a large number of existing funds by adopting similar non-committal ESG language in fund prospectuses, including MFS and DWS. A total of eight funds of the 56 that factor in ESG considerations in investment decisions fall into this category.

November Performance Scorecards

Notes of Explanation: Results are total returns. NAP=Not applicable. *Per prospectus disclosure along with additional disclosures that appear on the fund firm’s website. #Per the fund’s prospectus disclosure, the fund may consider Environmental, Social and Governance (ESG). For funds that have re-branded (by implementing a prospectus amendment to reflect the adoption of a sustainable investing strategy) during the last 12-months, returns achieved in the latest month and during intervals extending beyond the month of adoption do not reflect results achieved pursuant to the newly adopted sustainable investing strategies. Mutual funds and ETFs are divided into three categories, based on Morningstar designations: (1) Equity funds include allocation funds, alternative funds, commodities funds, sector equity and US equity funds, (2) International funds, and (3) fixed income funds, including taxable bond and municipal bond funds. A total of 3,313 funds/share classes are covered, consisting of funds/share classes with performance data for the entire month of November 2019. Funds/share classes that fall into the top and bottom categories have been reviewed to validate that associated prospectuses and/or Statement of Additional Information include explicit references to the application of one or more sustainable investment strategy. In cased where this could not be validated, funds/share classes are excluded (For example, excluded in November was the Columbia India Consumer ETF, a bottom international fund performer). Top 10 and bottom 10 funds exclude multiple share classes of the same fund (i.e. if more than one share class landed in the top or bottom listing of the 10 funds, only the best performing one fund/share class is included. Glossary of sustainable investing terms: V=Values-based strategy, E=Exclusionary strategy, Impact/Theme=Impact and/or thematic strategy, ESG=environmental, social, governance integration, S/P=shareholder/bondholder engagement and proxy voting. Sources: STEELE Mutual Fund Expert, Morningstar data and Sustainable Research and Analysis.

[1] While the definition of sustainable investing continues to evolve, today it refers to a range of five overarching investing approaches or strategies that encompass: values-based investing, negative screening (exclusions), thematic and impact investing, ESG integration and shareholder/bondholder engagement and proxy voting. These are not mutually exclusive.

Sustainable Investment Funds Performance Scorecard: November 2019

Summary Dominated by 56 funds that take into account information about environmental, social and governance (ESG) issues when making investment decisions, 60 funds, including 55 sustainable mutual funds and four ETFs and one ETN[1], organized into three broad asset categories covering US equities, international equities and fixed income, produced returns in November ranging from -9.45% to…

Share This Article:

Summary

Dominated by 56 funds that take into account information about environmental, social and governance (ESG) issues when making investment decisions, 60 funds, including 55 sustainable mutual funds and four ETFs and one ETN[1], organized into three broad asset categories covering US equities, international equities and fixed income, produced returns in November ranging from -9.45% to a high of 23.68%. This was against a backdrop of strong US stock market performance in November during which stock indices posted a series of record highs to close November with their strongest monthly gains since June. The S&P 500 Index added 3.63% as investors reacted favorably to positive US economic news ahead of the Thanksgiving holiday while continuing to shrug off geopolitical and domestic political uncertainties, including US-China trade, Brexit as well as unrest in Hong-Kong and impeachment proceedings in the US. Stocks in the US eclipsed their counterparts overseas. The MSCI ACWI ex US index gained 2.44% while emerging markets backtracked with regional variations. US rates rose across the yield curve and intermediate investment-grade bonds end the month -0.05% lower.

Funds managed by Eaton Vance appear for the first time in both the top and bottom performing tables. Effective October 16, 2019 the investment management firm repurposed 78 funds with $75.2 billion in assets by amending their prospectuses to reflect that as part of each fund’s research process, “portfolio management may consider financially material environmental, social and governance (“ESG”) factors. Such factors, alongside other relevant factors, may be taken into account in the Fund’s securities selection process.” Eaton Vance is one of several conventional investment management firms that have recently re-purposed a large number of existing funds by adopting similar non-committal ESG language in fund prospectuses. A total of eight funds of the 56 noted above that account for ESG considerations in investment decisions fall into this category.

US Equity Funds/Sector Equity and Other Equity and Equity-Related Funds

The average performance of the top 10 performing funds, registering an increase of 10.0%, exceeded the average performance of the segment by a wide margin. The cohort’s performance was lifted by the 23.68% gain recorded by the top performing Eventide Healthcare & Life Sciences Fund I with its concentrated healthcare portfolio (98.07% in healthcare) invested in US and foreign equities. The fund employs a values-based approach with a focus on impact and negative screening. By way of comparison, the NASDAQ Biotechnology Index was one of the top performing indices in November, up 11.44%. Also concentrated, but with a focus on the technology sector and investing in high growth stocks, the second best performing fund, the Morgan Stanley Institutional Discovery Fund IS, was up 10.01%. Other leading funds in November included two funds with exposures to healthcare, large cap technology as well as small cap stocks.

The 10 lagging funds encompassed a mixed range of strategies including cannabis, energy, commodities and real estate. The Amplify Seymour Cannabis ETF, which gave up -11.68% last month, was again the poorest performing fund in November with its -9.45% total return. This actively managed ETF which integrates ESG, seeks to provide investment exposure to global companies principally engaged in the emerging cannabis and hemp ecosystem.

International Equity Funds

International sustainable funds posted an average gain of 1.7% while the top performing funds generated an average gain of 5.1%. The $24.5 million blended large cap-oriented Baillie Gifford Positive Change Equity Fund Institutional led the peer group with its concentrated portfolio of securities that the manager believes has the potential to deliver positive impact as well as strong financial returns. The fund, which also benefited from its 36% exposure to US equities, was the only top performing fund focusing exclusively on positive impact outcomes.

Bottom performing funds, largely invested in emerging markets, posted negative returns ranging from -2.52% to -1.24% as emerging markets dropped -0.14% in November. That said, results varied by region from -4.13% in Latin America to a gain of 0.53% in Asia, bolstered by China that was up 1.78%. One fund in this group, the $2.2 million ESG integrator Schroder Emerging Markets Small Cap Fund, -1.49%, announced that it was closing in December.

Fixed Income Funds

While investment grade intermediate-term bonds in the US posted a -0.05% return in November, US corporate high yield and global high yield bonds managed to eke out a narrow gains of 0.33% and 0.08%. The top performing bond funds, which included a number of high yield mutual funds, did even better and recorded an average return of 1.06%. These were led by Eaton Vance Global Macro Absolute Return Advantage Fund R6, a recent addition to the sustainable investing landscape that effective October 16, 2019 amended its prospectus to reflect that as part of its research process financially material ESG Factors may be considered in the fund’s securities selection process alongside other relevant factors.

Eaton Vance is not the only firm to have recently adopted prospectus language that seems to equivocate on ESG. MFS Emerging Markets Debt Local Currency Fund I, one of the fixed income laggards this month with a return of -1.11%, adopted similar prospectus language just a month earlier.

Sustainable Investing Strategies

Of the 60 top and bottom performing funds listed in the November scorecard, 56 funds have adopted ESG integration approaches either exclusively or in combination with additional sustainable approaches, including negative screening, impact and/or engagement. These observations are based on a review of fund prospectuses as well as supplemental website materials posted by each firm.

The remaining four funds employ an impact or thematic investing approach either exclusively or in combination with one or more companion strategies–other than ESG integration. One of these funds focuses exclusively on achieving impact. The Baillie Gifford Positive Change Equity Fund, which published its first Positive Change Impact Report in mid-2018, provided a comprehensive analysis of the impacts achieved via the holdings within the portfolio. This report was subsequently supplemented by a summary of the fund’s engagement initiatives.

Funds managed by Eaton Vance appear for the first time in both the top and bottom performing tables. Effective October 16, 2019 the investment management firm which also owns Calvert Management, repurposed 78 funds with $75.2 billion in assets by amending their prospectuses

to reflect that as part of each fund’s research process, the “portfolio management may consider financially material environmental, social and governance (“ESG”) factors. Such factors, alongside other relevant factors, may be taken into account in the Fund’s securities selection process.” Eaton Vance is one of several conventional investment management firms that have recently re-purposed a large number of existing funds by adopting similar non-committal ESG language in fund prospectuses, including MFS and DWS. A total of eight funds of the 56 that factor in ESG considerations in investment decisions fall into this category.

November Performance Scorecards

Notes of Explanation: Results are total returns. NAP=Not applicable. *Per prospectus disclosure along with additional disclosures that appear on the fund firm’s website. #Per the fund’s prospectus disclosure, the fund may consider Environmental, Social and Governance (ESG). For funds that have re-branded (by implementing a prospectus amendment to reflect the adoption of a sustainable investing strategy) during the last 12-months, returns achieved in the latest month and during intervals extending beyond the month of adoption do not reflect results achieved pursuant to the newly adopted sustainable investing strategies. Mutual funds and ETFs are divided into three categories, based on Morningstar designations: (1) Equity funds include allocation funds, alternative funds, commodities funds, sector equity and US equity funds, (2) International funds, and (3) fixed income funds, including taxable bond and municipal bond funds. A total of 3,313 funds/share classes are covered, consisting of funds/share classes with performance data for the entire month of November 2019. Funds/share classes that fall into the top and bottom categories have been reviewed to validate that associated prospectuses and/or Statement of Additional Information include explicit references to the application of one or more sustainable investment strategy. In cased where this could not be validated, funds/share classes are excluded (For example, excluded in November was the Columbia India Consumer ETF, a bottom international fund performer). Top 10 and bottom 10 funds exclude multiple share classes of the same fund (i.e. if more than one share class landed in the top or bottom listing of the 10 funds, only the best performing one fund/share class is included. Glossary of sustainable investing terms: V=Values-based strategy, E=Exclusionary strategy, Impact/Theme=Impact and/or thematic strategy, ESG=environmental, social, governance integration, S/P=shareholder/bondholder engagement and proxy voting. Sources: STEELE Mutual Fund Expert, Morningstar data and Sustainable Research and Analysis.

[1] While the definition of sustainable investing continues to evolve, today it refers to a range of five overarching investing approaches or strategies that encompass: values-based investing, negative screening (exclusions), thematic and impact investing, ESG integration and shareholder/bondholder engagement and proxy voting. These are not mutually exclusive.

Sustainableinvest.com

Benefits

Free access to regularly updated original research and analysis focused exclusively on sustainable finance and investing, providing investors with the guidance needed to make informed investment decisions that align with their personal values and financial goals while also contributing to the advancement of positive long-term environmental and social outcomes.

By offering financial support for our current work, either in the form of a one-time or regular contributions, you help to defray some of the costs associated with conducting our research and analysis as well as to maintain the www.sustainablest.wpengine.com website.

Helping us to expand our research capabilities and offerings over time to cover additional relevant topics geared to sustainable investors.

Sign up to free newsletters.

By submitting this form, you are consenting to receive marketing emails from: . You can revoke your consent to receive emails at any time by using the SafeUnsubscribe® link, found at the bottom of every email. Emails are serviced by Constant Contact