Summary

Global markets across all major asset classes posted gains in June, notwithstanding trade concerns and fears of an economic slowdown. Stocks and bonds in the US and overseas recovered from May’s declines to produce strong returns in June.

Equity Funds and All Other Funds

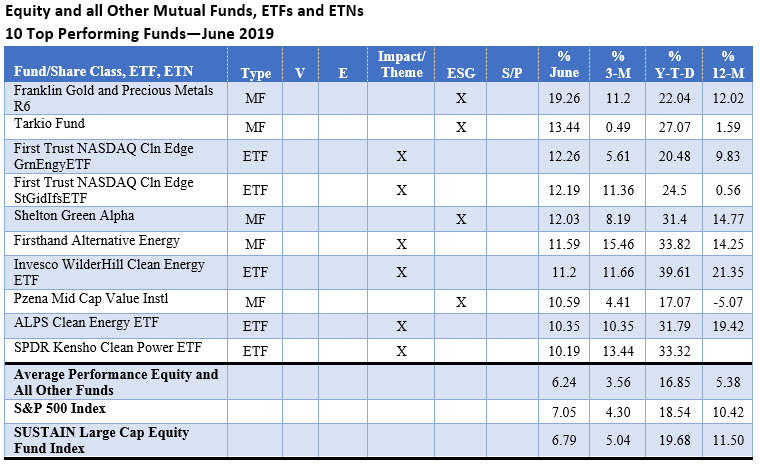

Gold and precious metals funds led the performance rankings for the month, with the Franklin Gold and Precious Metals Fund R6, which integrates ESG factors, posting the highest return of 19.26% in June. Thematic clean and alternative energy funds also performed strongly, recording gains up to 12.26%.

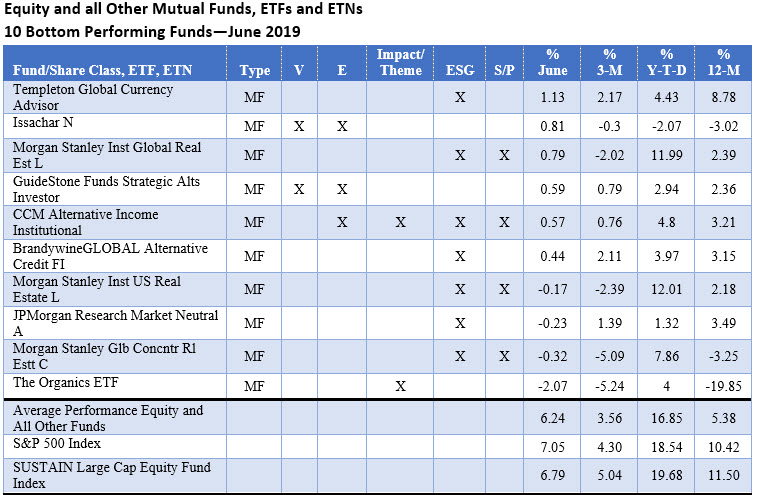

At the other end of the range, global real estate and market neutral strategies were some of the few categories that generated negative results in June, however, the thematic Janus Henderson Organics ETF was the worst performing fund with its total return of -2.07%.. The fund seeks exposure to companies globally that can capitalize on the increasing desire for naturally-derived food and personal care items, including companies that service, produce, distribute, market or sell organic food, beverage, cosmetics, supplements, or packaging.

Fixed Income Funds

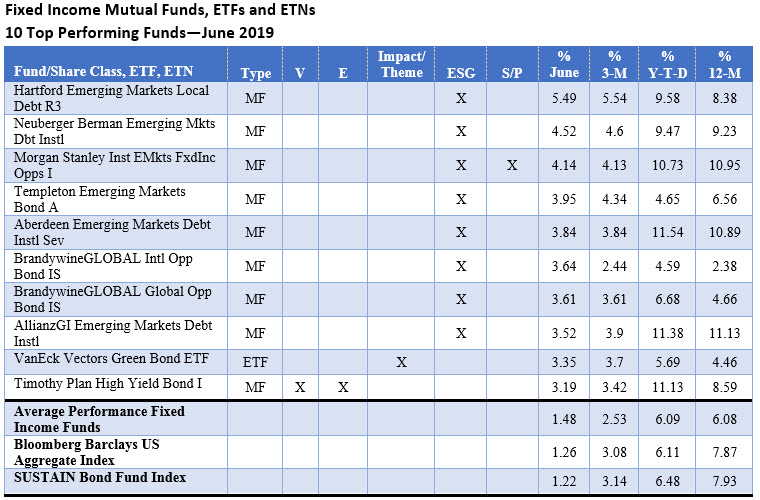

Emerging market and high yield bond funds posted the strongest returns in June, led by Hartford Emerging Markets Local Debt Fund R3, which integrates ESG. The fund produced the best results in June with its 5.49% total return. The Van Eck Green Bond ETF, a thematic fund, posted a surprising 3.35% return to end up in the top 10 performing bond funds.

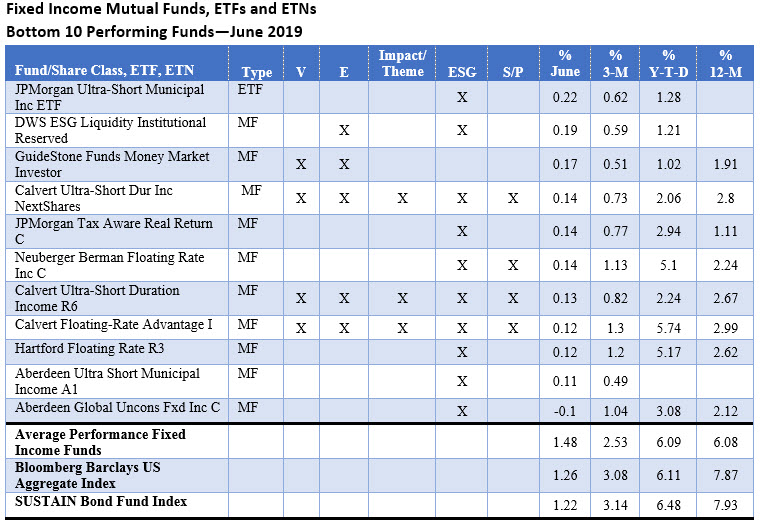

Ultra-short, floating rate and liquidity funds led the rear, with returns that ranged from a low of -0.1% to 0.22% generated by the lowest ten ranking funds/share classes.

Sustainable Investing Strategies

Funds employing ESG integration strategies, either exclusively or in combination with exclusions, impact/thematic and shareholder/bondholder engagement approaches, dominated the leaders and laggards tables as 29 funds fall into this category. Funds employing an impact/thematic approach either exclusively or in combination with other strategies, comprised the second most common sustainable strategy among the leading and lagging funds in June—with 12 funds falling into this category. Interestingly, the segment consisting of the top 10 equity and all other mutual fund categories is dominated by the impact/thematic approach due to the strong performance clean and alternative energy funds in June.

June Performance Scorecards

Notes of Explanation covering equity and all other funds: Results are total returns. For funds that have rebranded (by adopting via a prospectus amendment a sustainable investing strategy) during the last 12-months, returns for periods longer than one-month may not reflect results achieved pursuant to the newly adopted sustainable investing strategies. Equity funds include all US and international equity as well as all other funds, except for fixed income funds, a total of 1,669 funds/share classes, ETFs, ETNs with performance for the full month of June 2019. Blanks for other time periods indicate that the fund was not in operations during the entire time interval. Top 10 defined as top 10 funds, excluding multiple share classes of the same fund (i.e. if more than one share class landed in the top of bottom listing of the 10 funds only the best performing one fund/share class is included. V=Values-based strategy, E=Exclusionary strategy, Impact/Theme=Impact and/or thematic strategy, ESG=environmental, social, governance integration, S/P=shareholder/bondholder engagement and proxy voting. Sources: STEELE Mutual Fund Expert, Morningstar data and Sustainable Research and Analysis.

Notes of Explanation covering fixed income funds. Results are total returns. For funds that have rebranded (by adopting via a prospectus amendment a sustainable investing strategy) during the last 12-months, returns for periods longer than one-month may not reflect results achieved pursuant to the newly adopted sustainable investing strategies. Fixed income funds include short and long-term taxable and tax-exempt bond funds and ETFs, a total of 538 funds/share classes, ETFs, ETNs with performance for the full month of June 2019. Blanks for other time periods indicate that the fund was not in operations during the entire time interval. Top 10 defined as top 10 funds, excluding multiple share classes of the same fund (i.e. if more than one share class landed in the top of bottom listing of the 10 funds only the best performing one fund/share class is included. V=Values-based strategy, E=Exclusionary strategy, Impact/Theme=Impact and/or thematic strategy, ESG=environmental, social, governance integration, S/P=shareholder/bondholder engagement and proxy voting. Sources: STEELE Mutual Fund Expert, Morningstar data and Sustainable Research and Analysis.

June 2019 Sustainable Investment Funds Performance Scorecard

Summary Global markets across all major asset classes posted gains in June, notwithstanding trade concerns and fears of an economic slowdown. Stocks and bonds in the US and overseas recovered from May’s declines to produce strong returns in June. Equity Funds and All Other Funds

Share This Article:

Summary

Global markets across all major asset classes posted gains in June, notwithstanding trade concerns and fears of an economic slowdown. Stocks and bonds in the US and overseas recovered from May’s declines to produce strong returns in June.

Equity Funds and All Other Funds

Gold and precious metals funds led the performance rankings for the month, with the Franklin Gold and Precious Metals Fund R6, which integrates ESG factors, posting the highest return of 19.26% in June. Thematic clean and alternative energy funds also performed strongly, recording gains up to 12.26%.

At the other end of the range, global real estate and market neutral strategies were some of the few categories that generated negative results in June, however, the thematic Janus Henderson Organics ETF was the worst performing fund with its total return of -2.07%.. The fund seeks exposure to companies globally that can capitalize on the increasing desire for naturally-derived food and personal care items, including companies that service, produce, distribute, market or sell organic food, beverage, cosmetics, supplements, or packaging.

Fixed Income Funds

Emerging market and high yield bond funds posted the strongest returns in June, led by Hartford Emerging Markets Local Debt Fund R3, which integrates ESG. The fund produced the best results in June with its 5.49% total return. The Van Eck Green Bond ETF, a thematic fund, posted a surprising 3.35% return to end up in the top 10 performing bond funds.

Ultra-short, floating rate and liquidity funds led the rear, with returns that ranged from a low of -0.1% to 0.22% generated by the lowest ten ranking funds/share classes.

Sustainable Investing Strategies

Funds employing ESG integration strategies, either exclusively or in combination with exclusions, impact/thematic and shareholder/bondholder engagement approaches, dominated the leaders and laggards tables as 29 funds fall into this category. Funds employing an impact/thematic approach either exclusively or in combination with other strategies, comprised the second most common sustainable strategy among the leading and lagging funds in June—with 12 funds falling into this category. Interestingly, the segment consisting of the top 10 equity and all other mutual fund categories is dominated by the impact/thematic approach due to the strong performance clean and alternative energy funds in June.

June Performance Scorecards

Notes of Explanation covering equity and all other funds: Results are total returns. For funds that have rebranded (by adopting via a prospectus amendment a sustainable investing strategy) during the last 12-months, returns for periods longer than one-month may not reflect results achieved pursuant to the newly adopted sustainable investing strategies. Equity funds include all US and international equity as well as all other funds, except for fixed income funds, a total of 1,669 funds/share classes, ETFs, ETNs with performance for the full month of June 2019. Blanks for other time periods indicate that the fund was not in operations during the entire time interval. Top 10 defined as top 10 funds, excluding multiple share classes of the same fund (i.e. if more than one share class landed in the top of bottom listing of the 10 funds only the best performing one fund/share class is included. V=Values-based strategy, E=Exclusionary strategy, Impact/Theme=Impact and/or thematic strategy, ESG=environmental, social, governance integration, S/P=shareholder/bondholder engagement and proxy voting. Sources: STEELE Mutual Fund Expert, Morningstar data and Sustainable Research and Analysis.

Notes of Explanation covering fixed income funds. Results are total returns. For funds that have rebranded (by adopting via a prospectus amendment a sustainable investing strategy) during the last 12-months, returns for periods longer than one-month may not reflect results achieved pursuant to the newly adopted sustainable investing strategies. Fixed income funds include short and long-term taxable and tax-exempt bond funds and ETFs, a total of 538 funds/share classes, ETFs, ETNs with performance for the full month of June 2019. Blanks for other time periods indicate that the fund was not in operations during the entire time interval. Top 10 defined as top 10 funds, excluding multiple share classes of the same fund (i.e. if more than one share class landed in the top of bottom listing of the 10 funds only the best performing one fund/share class is included. V=Values-based strategy, E=Exclusionary strategy, Impact/Theme=Impact and/or thematic strategy, ESG=environmental, social, governance integration, S/P=shareholder/bondholder engagement and proxy voting. Sources: STEELE Mutual Fund Expert, Morningstar data and Sustainable Research and Analysis.

Sustainableinvest.com

Benefits

Free access to regularly updated original research and analysis focused exclusively on sustainable finance and investing, providing investors with the guidance needed to make informed investment decisions that align with their personal values and financial goals while also contributing to the advancement of positive long-term environmental and social outcomes.

By offering financial support for our current work, either in the form of a one-time or regular contributions, you help to defray some of the costs associated with conducting our research and analysis as well as to maintain the www.sustainablest.wpengine.com website.

Helping us to expand our research capabilities and offerings over time to cover additional relevant topics geared to sustainable investors.

Sign up to free newsletters.

By submitting this form, you are consenting to receive marketing emails from: . You can revoke your consent to receive emails at any time by using the SafeUnsubscribe® link, found at the bottom of every email. Emails are serviced by Constant Contact