The Bottom Line: Sustainable MFs and ETFs posted an average of -4.25% in February; 31 of 60 top and bottom performers employ ESG integration exclusively.

February 2020 Sustainable Investment Funds Performance Scorecard

Summary

The US stock market at the end of February, based on the S&P 500, suffered the second-worst week since 1941 and one of the fastest 10% declines on record. After reaching a record high on February 19th and registering a year-to-date gain of 4.81%, stock markets and bond markets in the US became infected by the coronavirus as news spread that Covid-19, as the disease is now branded, spread past China to South Korea and Italy. At the same time, a flight to quality lifted bond prices.

The universe of 3,749 sustainable mutual funds and ETFS, now extending from money market funds, fixed income funds, equity funds and even commodity funds, posted an average decline of -4.25%. In February, only 26% of sustainable funds delivered zero to positive rates of return while the range of returns extended from 11.7% recorded by the best performing Invesco Solar ETF to a -14.88% recorded by another thematic fund that integrates ESG, the Amplify Seymour Cannabis ETF. At the same time, the Sustainable (SUSTAIN) Large Cap Equity Fund Index, the Sustainable (SUSTAIN) Foreign Equity Fund Index and Sustainable (SUSTAIN) Bond Fund Index recorded returns of -7.89%, -6.97% and 1.46%, in that order. The two SUSTAIN equity fund indices outperformed their corresponding conventional indices while the SUSTAIN Bond Fund Index lagged behind.

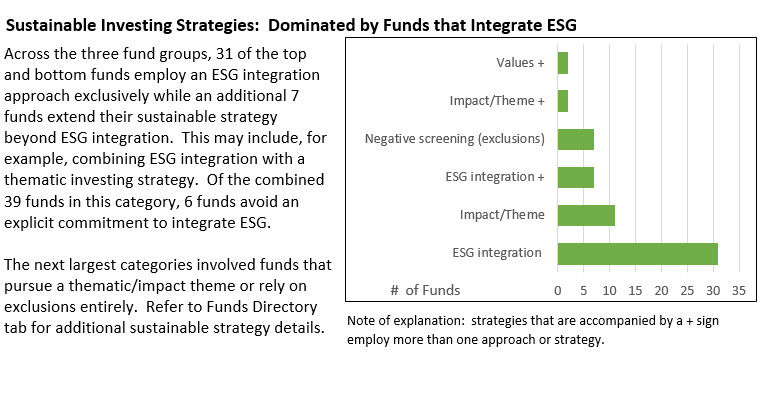

Across the three fund categories, 31 of the top and bottom performing funds employ an ESG integration approach exclusively while an additional 8 funds extend their sustainable strategy beyond ESG integration. For example, this may include funds that combine ESG integration with a thematic investing strategy. Of the combined 39 funds in this category, 6 funds sourced to five management firms avoid an explicit commitment to integrate ESG.

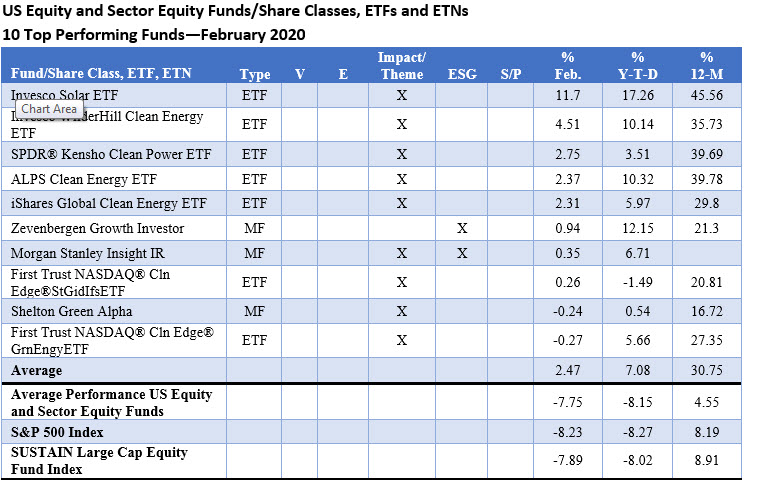

US Equity and Sector Equity Funds/Share Classes: Average Performance -7.75%

While US equity and sector equity dropped -7.75%, the top 10 performing funds recorded a gain of 2.47% as eight of the top performing funds posted positive results, led by Invesco Solar ETF that gained 11.7%. This thematic fund was also the best performing sustainable fund in February within a universe of 3,749 funds/share classes tracked throughout February. In fact, seven of the top 10 performing mutual funds and ETFs are thematic funds that invest principally in alternative energy companies, including solar and clean energy or clean power.

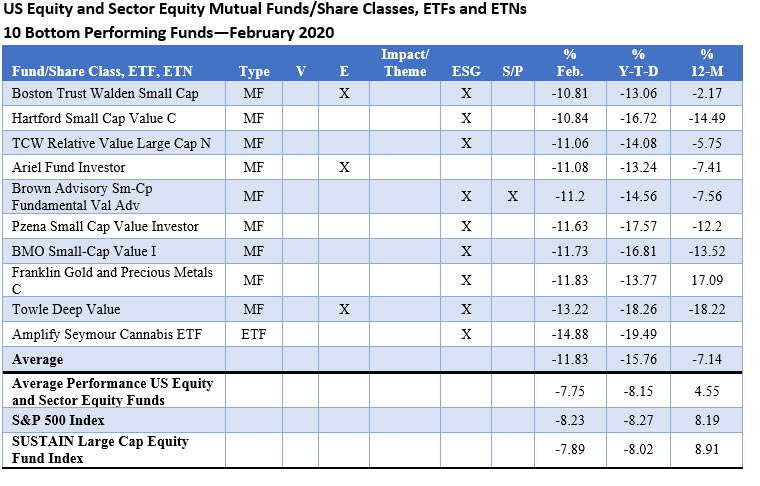

On the other hand, the 10 bottom performing funds recorded an average return of -11.83%. This cohort was dominated by funds that integrate ESG and invest in small value stocks, but two specialty funds, one investing in gold and precious metals while the other in cannabis, also found their way to the list of laggards in February.

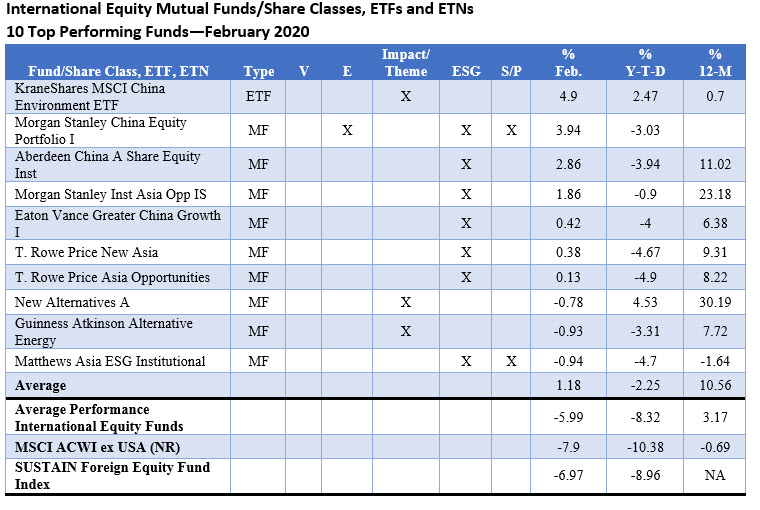

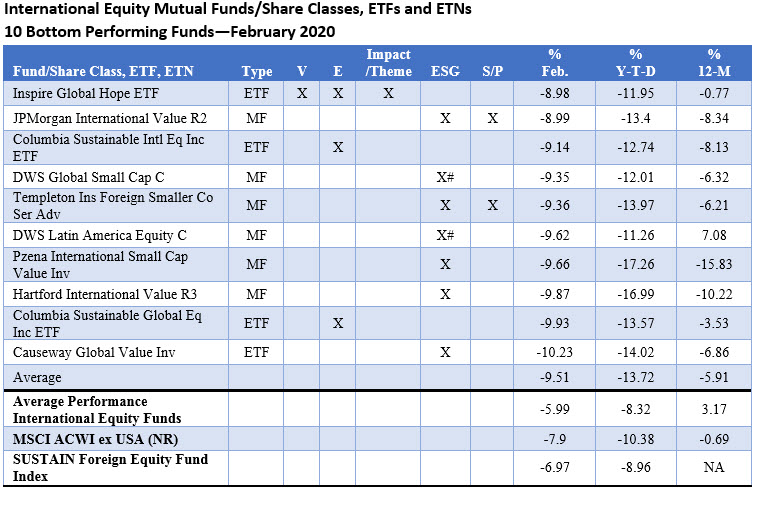

International Equity Funds: Average Performance -2.45%

The top 10 performing international equity funds are dominated by mutual funds and ETFs that integrate ESG. That said, China-focused funds and Asia-focused funds, and in particular funds that emphasize environmentally beneficial products and services, delivered stronger returns as these investment vehicles benefited from China’s 0.97% return in February per the MSCI China Index. For example, the leading fund, Krane Shares MSCI China Environment ETF invests in companies that provide exposure to Chinese issuers that focus on contributing to a more environmentally sustainable economy by making efficient use of scarce natural resources or by mitigating the impact of environmental degradation. The fund was up 4.9%.

The list of the top 10 funds included two funds managed by T. Rowe Price that just in February adopted prospectus language to reflect the explicit adoption of ESG integration in investment decisions.

Funds that fell into the lower end of the range were dominated by ESG integrators investing in value-oriented small cap stocks, two categories that lagged their larger cap growth oriented counterparts.

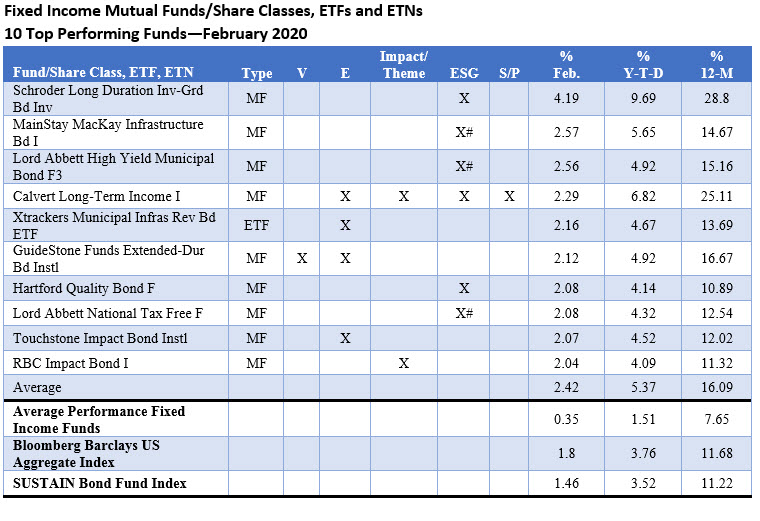

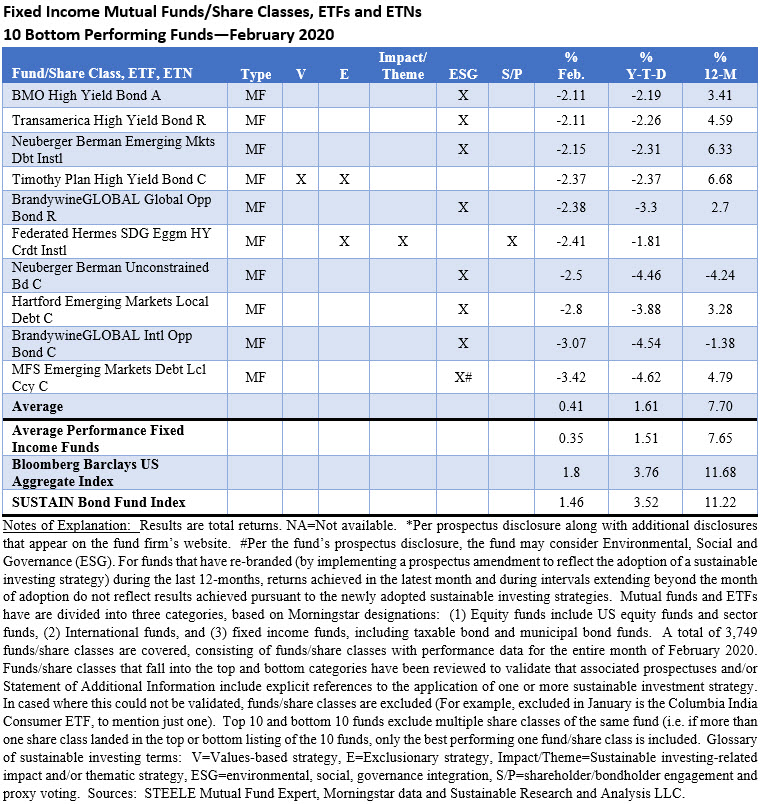

Fixed Income Funds: Average Performance 0.35%

A flight to quality at month-end led to a slide in the 10-year Treasury yield and bolstered domestic bond funds, especially funds investing in long-dated high quality securities, including Treasuries and corporate bonds. The top performing bond funds, which gained an average 2.42%, fell into this category and included funds that account for ESG in their investment decisions. However, three of the six funds that refer to ESG integration approaches in their prospectuses actually equivocate on this point by indicating that ESG factors “may” be taken into account. Four funds in total rely on exclusions, either solely or in combination with other strategies.

Laggards registered an average decline of -2.53%, with results ranging from a low of -3.42% to -2.11% as exposures to emerging markets and high yield bonds suffered from spread widening when investors shifted out of these sectors seeking safer grounds. Again, ESG integration approached dominated within this group of funds.

Sustainable Investment Funds Performance Scorecard: February 2020

The Bottom Line: Sustainable MFs and ETFs posted an average of -4.25% in February; 31 of 60 top and bottom performers employ ESG integration exclusively.

Share This Article:

The Bottom Line: Sustainable MFs and ETFs posted an average of -4.25% in February; 31 of 60 top and bottom performers employ ESG integration exclusively.

February 2020 Sustainable Investment Funds Performance Scorecard

Summary

The US stock market at the end of February, based on the S&P 500, suffered the second-worst week since 1941 and one of the fastest 10% declines on record. After reaching a record high on February 19th and registering a year-to-date gain of 4.81%, stock markets and bond markets in the US became infected by the coronavirus as news spread that Covid-19, as the disease is now branded, spread past China to South Korea and Italy. At the same time, a flight to quality lifted bond prices.

The universe of 3,749 sustainable mutual funds and ETFS, now extending from money market funds, fixed income funds, equity funds and even commodity funds, posted an average decline of -4.25%. In February, only 26% of sustainable funds delivered zero to positive rates of return while the range of returns extended from 11.7% recorded by the best performing Invesco Solar ETF to a -14.88% recorded by another thematic fund that integrates ESG, the Amplify Seymour Cannabis ETF. At the same time, the Sustainable (SUSTAIN) Large Cap Equity Fund Index, the Sustainable (SUSTAIN) Foreign Equity Fund Index and Sustainable (SUSTAIN) Bond Fund Index recorded returns of -7.89%, -6.97% and 1.46%, in that order. The two SUSTAIN equity fund indices outperformed their corresponding conventional indices while the SUSTAIN Bond Fund Index lagged behind.

Across the three fund categories, 31 of the top and bottom performing funds employ an ESG integration approach exclusively while an additional 8 funds extend their sustainable strategy beyond ESG integration. For example, this may include funds that combine ESG integration with a thematic investing strategy. Of the combined 39 funds in this category, 6 funds sourced to five management firms avoid an explicit commitment to integrate ESG.

US Equity and Sector Equity Funds/Share Classes: Average Performance -7.75%

While US equity and sector equity dropped -7.75%, the top 10 performing funds recorded a gain of 2.47% as eight of the top performing funds posted positive results, led by Invesco Solar ETF that gained 11.7%. This thematic fund was also the best performing sustainable fund in February within a universe of 3,749 funds/share classes tracked throughout February. In fact, seven of the top 10 performing mutual funds and ETFs are thematic funds that invest principally in alternative energy companies, including solar and clean energy or clean power.

On the other hand, the 10 bottom performing funds recorded an average return of -11.83%. This cohort was dominated by funds that integrate ESG and invest in small value stocks, but two specialty funds, one investing in gold and precious metals while the other in cannabis, also found their way to the list of laggards in February.

International Equity Funds: Average Performance -2.45%

The top 10 performing international equity funds are dominated by mutual funds and ETFs that integrate ESG. That said, China-focused funds and Asia-focused funds, and in particular funds that emphasize environmentally beneficial products and services, delivered stronger returns as these investment vehicles benefited from China’s 0.97% return in February per the MSCI China Index. For example, the leading fund, Krane Shares MSCI China Environment ETF invests in companies that provide exposure to Chinese issuers that focus on contributing to a more environmentally sustainable economy by making efficient use of scarce natural resources or by mitigating the impact of environmental degradation. The fund was up 4.9%.

The list of the top 10 funds included two funds managed by T. Rowe Price that just in February adopted prospectus language to reflect the explicit adoption of ESG integration in investment decisions.

Funds that fell into the lower end of the range were dominated by ESG integrators investing in value-oriented small cap stocks, two categories that lagged their larger cap growth oriented counterparts.

Fixed Income Funds: Average Performance 0.35%

A flight to quality at month-end led to a slide in the 10-year Treasury yield and bolstered domestic bond funds, especially funds investing in long-dated high quality securities, including Treasuries and corporate bonds. The top performing bond funds, which gained an average 2.42%, fell into this category and included funds that account for ESG in their investment decisions. However, three of the six funds that refer to ESG integration approaches in their prospectuses actually equivocate on this point by indicating that ESG factors “may” be taken into account. Four funds in total rely on exclusions, either solely or in combination with other strategies.

Laggards registered an average decline of -2.53%, with results ranging from a low of -3.42% to -2.11% as exposures to emerging markets and high yield bonds suffered from spread widening when investors shifted out of these sectors seeking safer grounds. Again, ESG integration approached dominated within this group of funds.

Sustainableinvest.com

Benefits

Free access to regularly updated original research and analysis focused exclusively on sustainable finance and investing, providing investors with the guidance needed to make informed investment decisions that align with their personal values and financial goals while also contributing to the advancement of positive long-term environmental and social outcomes.

By offering financial support for our current work, either in the form of a one-time or regular contributions, you help to defray some of the costs associated with conducting our research and analysis as well as to maintain the www.sustainablest.wpengine.com website.

Helping us to expand our research capabilities and offerings over time to cover additional relevant topics geared to sustainable investors.

Sign up to free newsletters.

By submitting this form, you are consenting to receive marketing emails from: . You can revoke your consent to receive emails at any time by using the SafeUnsubscribe® link, found at the bottom of every email. Emails are serviced by Constant Contact