The Bottom Line: Special Purpose Acquisition Companies (SPACs) include sustainable investing options but structural considerations are a deterrent while current valuations have reached lofty levels.

Special Purpose Acquisition Companies (SPACs) include sustainable investing options but structural considerations are a deterrent while current valuations may be lofty

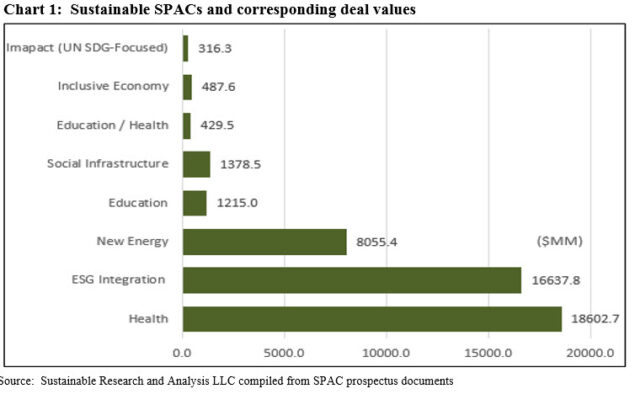

The very hot market for SPACs, or special purpose acquisition companies, has also introduced potential investment opportunities for sustainability-minded retail and institutional investors[1]. In more recent years, in addition to SPACs established solely to raise capital through an initial public offering for the purpose of acquiring unspecified existing companies, a significant number of SPAC offerings have been issued with an investing strategy focused on social and environmental themes, the achievement of impact as well as the integration of ESG in the investment process. In fact, according to research conducted by Sustainable Research and Analysis, the SPAC universe, which consists of 533 listed entities with a combined deal value of $171.0 billion, also includes 163 SPACs, or 31% outstanding SPACs as of mid-March 2021 based on deal value that can be classified under one of these sustainable investing strategies. Refer to Chart 1. That said, caution is advised before investing, for at least two reasons. First, SPACs have two years to search for a private company with which to merge or negotiate an outright acquisition and in that way bring the company public. As a result, all other considerations aside, the fulfillment of a given SPAC’s business objectives may not ultimately entirely align with the expectations of sustainable investors. Second, legitimate concerns have been raised about whether SPAC issuance has gone too far and caution flags have surfaced regarding their current lofty valuations.

SPACs are publicly traded companies with no commercial operations. Rather, these are shell companies established solely to raise capital through an initial public offering (IPO) for the purpose of acquiring unspecified existing companies. They are commonly referred to as blank check companies. SPACs are formed by a founder(s), usually, but not always, experienced business executives with strong reputations and operational track records who provide the initial Capital. SPACs raise cash in an IPO and then have two years to search for a private company with which to merge or negotiate an outright acquisition and in that way bring the company public.

The SPAC market may be infected by “irrational exuberance”

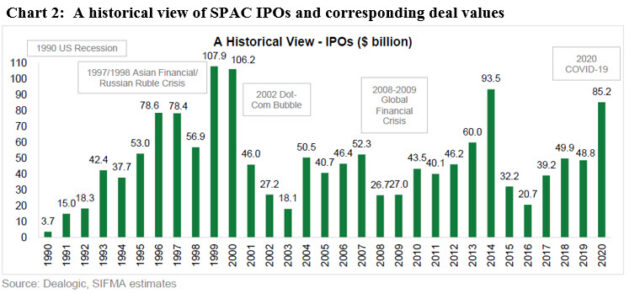

During 2020 there were 248 SPAC initial public offerings for total proceeds of $82.4 billion, which was a high water mark for SPACs offerings based on tracking since 1990, and nearly six times the level of prior years. Refer to Chart 2. While becoming a publicly listed company provides significant benefits, companies have been electing to remain private longer for various reasons, including the complexities of the traditional IPO process as well as its inherent uncertainty for the companies pursuing it. This dynamic has helped mold the current market opportunity for SPACs by generating a meaningful backlog of potential IPO candidates. In fact in 2020, a very strong year for IPOs during which time $85.2 in deal value was realized, SPACs almost surpassed that level but just missed out by about $2.8 billion.

The pace of SPAC issuance has continued into 2021 through the end of February. To-date, 189 deals valued at $60.2 billion or 73% of 2020 total have come to market. This is almost 2.5X greater that the 59 IPOs valued at $24.3 billion that were launched during the same time interval last year. Also, SPAC valuations have reached lofty levels, with some seeing significant run ups following announced mergers or acquisitions. At these SPAC IPO volumes and excessively high valuations in some cases, it’s increasingly difficult to argue that “irrational exuberance” has not infected the market for SPACs.

163 sustainable SPACs account for $47.1 billion in deal value, or 31% of the SPAC universe

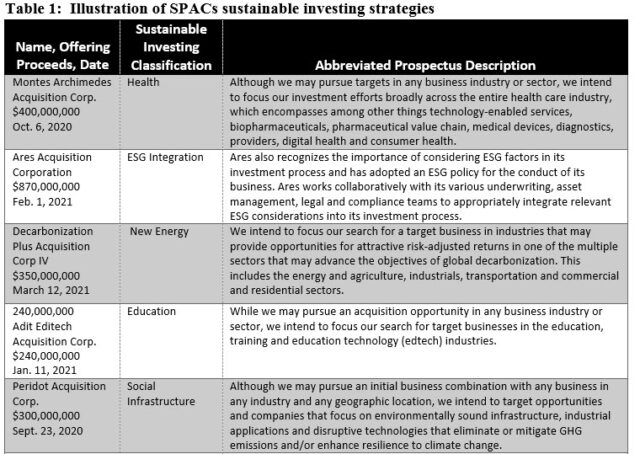

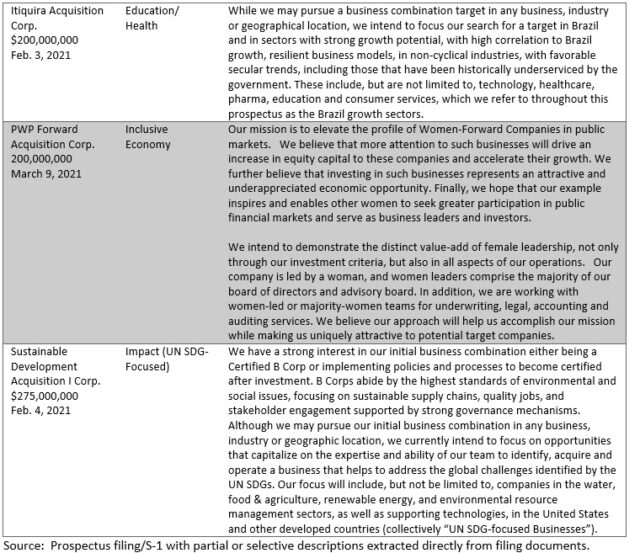

While definitions and commonly accepted industry standards for categorizing investment products and providing related disclosures to investors are still evolving, a review of SPAC prospectus disclosures, illustrated for a selection of offerings set out in Table 1, combined with proposed classification framework[2], served as the basis for cataloguing the existing universe of sustainable SPACs. According to research conducted by Sustainable Research and Analysis, 163 out of 533 listed SPACs or 31% of outstanding SPACs deal value pursue business strategies that are aligned either partially or entirely with sustainable investing strategies that fall into the following categories: health, ESG integration, new energy, education, social infrastructure, education/health, inclusive economy and impact (UN SDG-Focused).

Within these eight sustainable investing-labelled categories, the largest three categories account for 91.9% of deal value. Within this segment, the health sector-oriented SPACs dominate, with a total of 79 SPACs and $18.6 billion in deal value, followed by ESG integration that has been adopted by 42 SPACs and new energy that make up 27 SPACs and $8.1 billion in deal value.

[1] While definitions continue to evolve, sustainable investing refers to a range of five overarching investing approaches or strategies that encompass: values-based investing, negative screening (exclusions), thematic investing, impact investing and ESG integration. Shareholder/bondholder engagement and proxy voting may also be employed along with one of more of these strategies that are not mutually exclusive.

[2] Promoting the Continued Growth and Development of Sustainable Investing in US Mutual Funds and ETFs: A Three-pronged Proposal to Address Misunderstanding and Confusion that Have Arisen in the Sector. Michael Cosack and Henry Shilling, May 2020.