The Bottom Line: Sustainable investors considering infrastructure funds on the back of the $1.2 trillion Infrastructure Investments and Jobs Act (BIF) should proceed with caution.

Summary

Sustainable investors considering investing in infrastructure funds on the back of the $1.2 trillion Infrastructure Investments and Jobs Act (BIF)signed into law by President Biden on November 15th, now have for consideration a short list of four infrastructure funds. That said, the four funds are relatively new, having been launched in the last two years. Considering their limited operating history, short performance track records and higher than average expense ratios, investors may wish to limit their initial exposures to these funds. On the other hand, they may wish to consider exercising patience and instead of making an investment decision at this time, resolve to monitor these funds over a period of six-to-twelve months.

The $1.2 trillion Infrastructure Investments and Jobs Act (BIF) signed into law on November 15th includes $550 billion in new spending for a broad range of physical infrastructure

On November 15th, President Biden signed into law the $1.2 trillion Infrastructure Investments and Jobs Act (BIF) infrastructure plan. The law includes $550 billion in new spending for a broad range of physical infrastructure on top of a five-year reauthorization of expiring traditional surface-transportation infrastructure programs for highways, rail and transit.

The BIF covers fiscal years 2022-2026. Much of the funding will flow to or through state governments. The goal is to harness existing state government programs and offices to help properly and expeditiously allocate the designated funds to address infrastructure needs. The Department of Transportation (DOT) will be the primary federal department responsible for the infrastructure effort and the DOT secretary will retain wide discretion to allocate a significant portion of the funds — approximately $120 billion. In addition to DOT, other federal agencies will also deliver programs and funds within their jurisdiction. For example, the Department of Energy will manage modernizing and strengthening of the electric grid. The Department of Commerce will supervise the expenditure of tens of billions of dollars to deploy rural broadband. The Environmental Protection Agency is tasked with a major investment in clean drinking water programs to be implemented by the states, tribes and territories. In addition to $284 billion allocated to transportation, including road and bridge improvement and replacement, public transit and passenger and freight rail, to mention just a few, water system upgrades (including lead pipe replacement) have been allocated $55 billion, broadband deployment to connect the unconnected has been allocated $65 billion, electric grid modernization and power generation innovation is allocated $73 billion, environmental remediation of hazardous sites and abandoned mines, $21 billion, western water storage, conveyance, repairs and upgrades: $8.3 billion, and resiliency, including coastal and flood mitigation, cybersecurity, drought and weatherization, $46 billion

Sustainable investors considering some level of exposure to infrastructure investments have a short list of mutual funds from which to choose, but the funds have a limited operating history

For sustainable investors considering some level of exposure to infrastructure investments, there is now a short list of mutual funds that, on the basis of their principal investment strategies, specifically target investments in infrastructure-related companies. These are still early days and the list per Morningstar is currently limited to four actively managed mutual funds comprised of 14 share classes that were launched within the last two years. In addition to investing in infrastructure-related companies that, for example, include renewable energy technology plants and systems that establish the funds’ sustainability credentials, the funds also qualify portfolio securities based on sustainability criteria. The criteria are either set out explicitly in each fund’s prospectus or Statement of Additional Information, or both, or via other forms of disclosure such as the manager’s website.

Each of the sustainable funds invests in equity securities, but these are not limited to securities of companies listed for trading in the US. In fact, three funds disclose foreign holdings that range from 49% to 65% of portfolio holdings¹. These funds, in turn, hedge foreign currency risks.

The four funds, managed by BlackRock, Goldman Sachs, Kayne Anderson and TCA Advisors, range in size from $10.3 million reported by the recently launched BlackRock Infrastructure Sustainable Opportunities Fund to $468.6 million attributable to the Goldman Sachs Clean Energy Income Fund that sourced 94% of the fund’s assets to various internal Goldman wealth management platforms. Each of the funds pursues an ESG Integration approach, but strategies vary. Of the four funds, BlackRock offers the most expansive and explicit form of ESG Integration by also combining exclusions and alignment with the US Sustainable Development Goals (SDGs). Refer to Table 1 as well as Table 2.

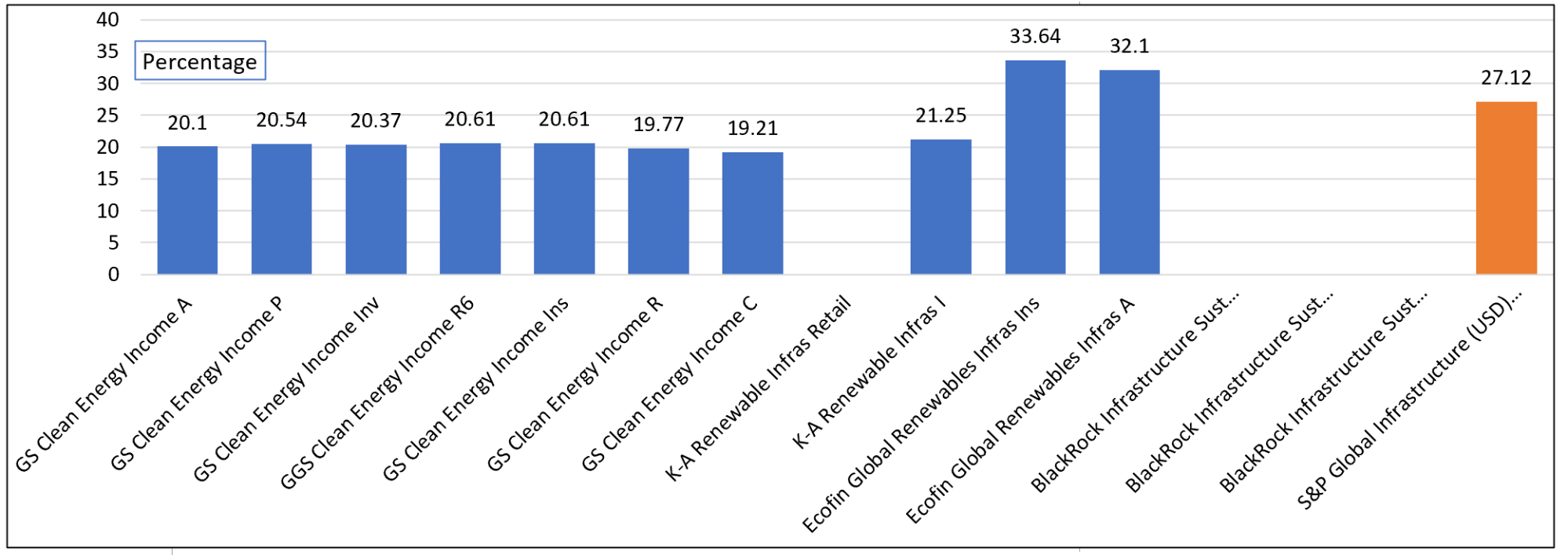

Given their short existence the funds have limited operating histories and performance track records. Over the last twelve months, returns ranged from a low of 19.2% to a high of 33.6%. This compares to a gain of 27.12% posted by the S&P Global Infrastructure (USD) Hedged Index. Refer to Chart 1. In part, performance results are hamstrung by the funds’ higher than average expense ratios for actively managed mutual funds. These range from 0.88% to 2.01% and average 1.15%, or 0.225% higher relative to a universe of 966 sustainable funds/share classes as of October 31st.

The implementation of the Infrastructure Investments and Jobs Act and its unprecedented additional spending above the current infrastructure baseline and its ambitious timetable are expected to generate significant economic benefits and investment opportunities. It will likely stimulate additional infrastructure-specific fund offerings, including lower cost options in the form of passively managed funds and potentially actively managed funds offered with lower expense ratios. Considering their limited operating history, short performance track records and higher than average expense ratios, investors may wish to limit their initial exposures to these funds. On the other hand, they may wish to consider exercising patience and instead of making an investment decision at this time, resolve to monitor these funds over a period of six-to-twelve months.

¹- The BlackRock Infrastructure Sustainable Opportunities Fund, launched in 2021 has not reported holdings as of October 31st.

Chart 1: Performance of sustainable infrastructure funds-12 months ended October 31, 2021

Notes of Explanation: Blanks indicate that fund has not been in existence for time period covered. Sources: Morningstar Direct, S&P Global

Table 1: Sustainable infrastructure funds and their sustainable investing approaches

Fund Name/Advisor/Sub-Advisor | Investment Focus | AUM ($) | Expense Ratio (%) | Sustainable Investing Strategy |

BlackRock Infrastructure Sustainable Opportunities Fund (3-share classes: BINFX, BINAX, BINKX) BlackRock Advisors, LLC/ BlackRock International Limited and BlackRock (Singapore) Limited | Fund invests in the equity securities of infrastructure-related companies or derivatives with similar economic characteristics. | 10.3 | 0.95-1.25 | ESG Integration-Mixed (exclusions and alignment with at least one UN Sustainable Development Goals (SDGs). Refer to expanded description. |

Ecofin Global Renewables Infrastructure Fund (two share classes: ECOAX, ECOIX) TCA Advisors/Ecofin Advisors Limited | Fund focuses its investment activities in equity securities of companies who are developers, owners and operators, in full or in part, of renewable electricity technology plants and systems, and related infrastructure investments. | 312.3^ | 1.00-1.25 | ESG Integration (with a preference for positive and improving ESG trends). Refer to expanded description. |

Goldman Sachs Clean Energy Income Fund (six share classes: GCEBX, GCEGX, GCEDX, GCEJX, GCEPX, GCEHX) Goldman Sachs Asset Management LP | Fund invests in U.S. and non-U.S. equity securities issued by clean energy companies. | 468.6 | 0.88-2.01 | ESG Integration |

Kayne Anderson Renewable Infrastructure Fund (2 share classes: KARIX, KARRX) Kayne Anderson Capital Advisors, L.P. | Fund fuses exclusively on renewable infrastructure and invests only in the companies that own, operate, and develop renewable power assets that generate predictable long-term cash flows from their base business. | 97.4 | 1.01-1.26 | ESG Integration |

Notes of Explanation: ^Predecessor fund with majority of institutional assets merged into newly launched fund as of August 7, 2020. While definitions continue to evolve, sustainable investing refers to a range of five overarching investing approaches or strategies that encompass: values-based investing, negative screening (exclusions), thematic and impact investing and ESG integration. ESG Integration is further divided into ESG Integration, ESG Integration-Mixed and ESG Integration-Consideration. Shareholder/bondholder engagement and proxy voting may also be employed along with one of more of these strategies that are not mutually exclusive. Sources: Morningstar Direct, Sustainable Research and Analysis, as of October 31, 2021.

Table 2: Sustainable infrastructure funds and their sustainable investing approaches in detail

BlackRock Infrastructure Sustainable Opportunities Fund: ESG Integration-Mixed To determine the Fund’s investable universe, Fund management will first seek to screen out certain issuers based on environmental, social and governance (“ESG”) criteria determined by BlackRock. Such screening criteria principally includes: (i) issuers engaged in the production of controversial weapons; (ii) issuers engaged in the production of civilian firearms; (iii) issuers deriving revenue from direct involvement in the production of nuclear weapons or nuclear weapon components or delivery platforms, or the provision of auxiliary services related to nuclear weapons; (iv) issuers engaged in the production of tobacco-related products; (v) issuers that derive certain revenue from thermal coal generation, unless such issuers either (a) have made certain commitments to reduce climate impact or (b) derive revenue from alternative energy sources, and issuers that derive more than five percent of revenue from thermal coal mining; (vi) issuers that derive more than five percent of revenue from oil sands extraction, unless the Fund is investing in green bonds of such issuers; and (vii) issuers identified by recognized third-party rating agencies as violators of the United Nations Global Compact, which are globally accepted principles covering corporate behavior in the areas of human rights, labor, environment, and anti-corruption. The Fund’s screening criteria is measured at the time of investment and is dependent upon information and data that may be incomplete, inaccurate or unavailable. This screening criteria is subject to change over time at BlackRock’s discretion. BlackRock next looks to the targets and indicators for each SDG and identifies those goals that are supported by sustainable infrastructure. With respect to its equity investments, BlackRock intends to invest only in companies that align with and advance at least one of the SDGs. BlackRock intends to focus on SDGs related to (i) good health and well-being, (ii) clean water and sanitation, (iii) affordable and clean energy, (iv) industry, innovation and infrastructure, (v) sustainable cities and communities, and (vi) climate action. BlackRock may not consider all SDGs when making investment decisions and there may be limitations with respect to the availability of investments that address certain SDGs. The Fund may gain indirect exposure (through, including but not limited to, derivatives and investments in other investment companies) to issuers with exposures that are inconsistent with the screening and SDG alignment criteria used by BlackRock as described above. Moreover, there is no guarantee that all equity securities held by the Fund will align with the SDGs at all times. The assessment of the level of alignment in each activity may be based on percentage of earnings, a defined total earnings threshold, or any connection to a restricted activity regardless of the amount of earnings received. Where disclosure for segment level earnings are unavailable, Fund management will use revenue as the primary metric. The companies are then assessed by BlackRock based on their ability to manage risks and opportunities including those associated with the infrastructure theme and their ESG risk and opportunity credentials, such as their leadership and governance framework, ability to strategically manage longer-term issues surrounding ESG and the potential impact this may have on a company’s financials. |

Ecofin Global Renewables Infrastructure Fund-ESG Integration The Sub-Adviser incorporates environmental, social and governance risk factors into its security selection and portfolio construction. ESG risk considerations include, but are not limited to, the Sub-Adviser evaluating specific environmental factors of a company’s policy towards carbon and potentially other emissions. From a social perspective, the Sub-Adviser analyzes potential portfolio companies’ metrics such as, but not limited to, the percent of women employed by the company, the existence of an equal opportunity policy, whether the company is a signatory to the UN Global Compact and also seeks to measure and create a positive improvement regarding abatement of other harmful emissions including PM2.5 which disproportionately affects some impoverished communities. In terms of governance, the Sub-Adviser incorporates an analysis of the company’s board composition such as the percent of independent directors and may also assess protection of minority interests. The Sub-Adviser analyzes these factors with a preference for positive and improving trends when considering individual stocks for purchase in the portfolio. |

Goldman Sachs Clean Energy Income Fund-ESG Integration Considers environmental, social, and governance factors as part of the fundamental research and stock selection process. |

Kayne Anderson Renewable Infrastructure Fund-ESG Integration The advisor believes the integration of material environmental, social and governance risks and opportunities is an important consideration in the selection of both public and private market investment opportunities. The advisor is committed to selecting partners to build sustainable companies, deliver value to our clients and contribute to sustainable development globally. Infrastructure companies, specifically renewable infrastructure entities, are well positioned to contribute to the SDGs. The advisor has witnessed an uptick in the number of companies that have made explicit and public commitments to advance the SDGs. |

Notes of Explanation: Sources: Fund’s prospectus, Statement of Additional Information, or both, or via other forms of disclosure, such as the manager’s website.