The Bottom Line: After a challenging year in 2022 the relative total returns of sustainable indices in the first quarter of 2023 recorded improved results.

0:00

/

0:00

Listen to this article now

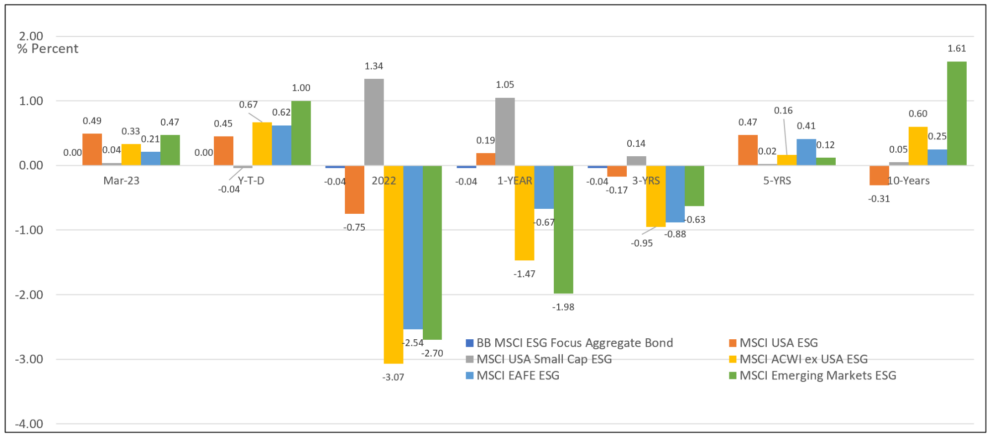

Selected MSCI ESG indices relative performance results to 3-31-2023

Notes of Explanation: Positive or negative ESG performance results are for the selected MSCI ESG Leaders indices relative to their underlying conventional benchmarks, except for the BB MSCI ESG Focus Aggregate Bond Index. Other than calendar year 2022 results, performance is to March 31, 2023. Sources: MSCI and Bloomberg.

Notes of Explanation: Positive or negative ESG performance results are for the selected MSCI ESG Leaders indices relative to their underlying conventional benchmarks, except for the BB MSCI ESG Focus Aggregate Bond Index. Other than calendar year 2022 results, performance is to March 31, 2023. Sources: MSCI and Bloomberg.

Observations:

- After a challenging year in 2022 during which sustainable securities market indices tracking stocks as well as bonds trailed their conventional counterparts, the relative total returns of sustainable indices in the first quarter in 2023 recorded improved overall results.

- Viewed through the prism of six selected MSCI ESG Leaders indices, including two US and three international equity indices and one US investment-grade intermediate ESG Focus index, all six indices registered returns equal to or greater than their conventional counterparts in the month of March while five of the six indices achieved returns equal to or greater than their conventional counterparts.

- In 2022, all but one of the ESG benchmarks underperformed, impeded due to their energy underweighting and technology overweighting in a year when energy, according to the S&P 1500 Energy Total Return Index, was up 63.77% while the technology heavy Nasdaq Composite Index was down 32.54%. Only the MSCI Small Cap ESG Leaders Index outperformed. In the first quarter of 2023, ESG indices benefited as the opposite results unfolded. The technology sector gained 20.77% while energy was down 4.94%.

- Indices matching or outperforming their conventional counterparts in the first quarter include the Bloomberg MSCI ESG Focus Aggregate Bond Index, MSCI USA ESG Leaders Index, MSCI ACWI ex USA Leaders Index, MSCI EAFE ESG Leaders Index and MSCI Emerging Markets ESG Leaders Index. These benchmarks matched or eclipsed their conventional benchmarks by an average of 45 basis points, with a range extending from 0 basis points to 100 basis points. The MSCI Leaders indices attempt to capture the exposure of high environmental, social and governance scoring companies, based on MSCI ESG scores, relative to their sector peers, while maintaining risk and return characteristics similar to their underlying conventional index. MSCI scores, which range from CCC to AAA, measure a company’s management of financially relevant ESG risks and opportunities. While outperforming in 2022, the MSCI USA Small Cap ESG Leaders Index lagged behind its conventional counterpart in the first quarter by a narrow margin of four basis points.

- While they may have narrowed, intermediate to longer-term results delivered by sustainable or ESG indices over the trailing five and 10-year intervals continue to outperform by an average of 24 basis points and 44 basis points, respectively.

- The performance results of sustainable or ESG indices relative to conventional benchmarks can lead and lag in the short-term, defined here as up to 3-years. Yet so far it seems that over the intermediate to long-term investors can still achieve market-based returns or even excess returns via investments in sustainable or ESG indices that aim to track conventional indices. That said, the construction of ESG indices and the nature of the underlying ESG ratings or scores will have an impact on the outcomes.