The Bottom Line: An expanding universe of sustainable high yield funds adds to investor options but sustainable strategies can be nuanced and challenging to compare.

Expanding universe of sustainable high yield funds adds to investor options

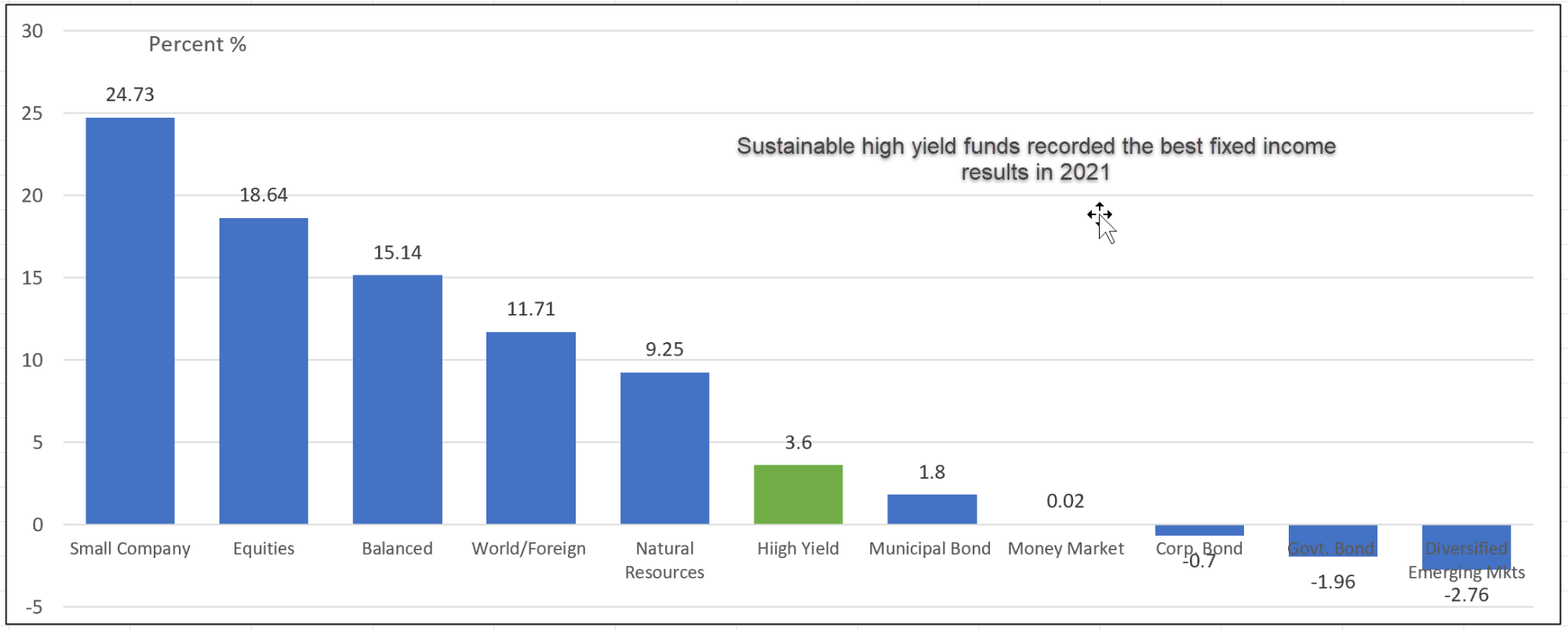

Sustainable mutual funds and ETFs across all asset classes ranging from money market funds to equity funds turned in low double digit performance results in 2021, recording an average gain of 11.5%. Returns varied considerably, however, by asset class and security type. These ranged from -2.76% recorded by diversified emerging market funds to a high of 24.73% achieved by small company stock funds. Refer to Chart 1. Corporate bond funds experienced a narrow -0.70% decline on average while government funds came in at an even lower -1.96%. Fixed income fund results overall were disappointing as investors reacted to concerns about rising inflation and higher yields drove bond prices lower. Yet even within fixed income some segments managed to deliver positive returns. The best sustainable fixed income fund performance results in 2021 were recorded by high yield mutual funds and ETFs. The segment, consisting of at least ten funds investing in below investment-grade securities¹, registered an average gain of 3.6%. Results ranged from a high of 5.7% to a low of 2.6%. Posting lower but positive returns in 2021 and strong results during the previous two consecutive calendar years, the sustainable high yield segment, in addition to performance attributes, now offers to sustainable investors a greater variety of fund options that cover management firms, fund types and investing approaches, varying cost options and sustainable investing strategy alternatives—even as these may be puzzling for investors to sort out and differentiate outcomes. Nevertheless (and this is not to downplay their riskier profile), adding a high yield fund to the fixed income segment of a sustainable portfolio can lift the portfolio’s expected return while reducing the standard deviation or risk relative to the expected returns.

Chart 1: Average total returns for selected fund categories-2021

Notes of Explanation: Fund categories include mutual funds and ETFs. Source: Morningstar Direct

Notes of Explanation: Fund categories include mutual funds and ETFs. Source: Morningstar Direct

¹ With some exception to reflect high yield mandates, based on the Morningstar universe of sustainable funds that otherwise excludes high yield investment vehicles that integrate material ESG factors into investment analysis, for example high yield funds managed by T. Rowe Price, JP Morgan and Lord Abbot, to mention just a few.

Actively managed and index tracking high yield fund choices available to investors

At least ten sustainable high yield investment funds with almost $2 billion in assets are available to investors. Refer to Table 1. These funds are offered by nine investment management firms pursuing a range of sustainable investing strategies. Four funds are index tracking ETFs that employ mechanical ESG screening approaches, positive in three of the four funds and negative or exclusionary in each instance, and carry the lowest expense ratios. The second best performing high yield sustainable investment vehicle in 2021, the Xtrackers JPMorgan ESG USD High Yield Corporate Bond ETF (ESHY), assigns greater weights to higher ESG scoring issuers while eliminating lower scoring firms and firms engaged in certain activities such as thermal coal tobacco and weapons to mention just a few. The fund’s expense ratio is the lowest in the group at 2 bps. That said, the fund’s performance lags its peer group over the trailing three and five-year intervals although it should be noted that the fund changed its underlying index effective as of May 12, 2020.

Among the six actively managed funds, the AXS Sustainable Income Fund I Shares (AXSKX)recorded the best 2021 gain of 5.7%. The fund integrates ESG into investment decision making but also excludes issuers deemed inconsistent with the goals and objectives expressed in the UN Global Compact or Sustainable Development Goals, particularly as it relates to climate change risk. The fund reorganized on or about October 16, 2020. AXS along with the other five actively managed funds employs a more investigative and analytic approach to sustainable investing. One fund, the Federated Hermes SDG Engagement High Yield Credit Fund pursues an impact or outcomes-oriented strategy that aligns investee companies with at least one United Nations Sustainable Development Goals (SDGs). The institutional-only AXSKX fund, that charges 62 bps and is at the lower range for actively managed high yield sustainable funds, was launched in 2019 and posted a 2.58% return in 2021.

Sustainable investing strategies can be nuanced, challenging to compare and to differentiate outcomes

Regardless of fund types, the sustainable investing strategies pursued by the ten funds can be nuanced, challenging to compare and outcomes are difficult to calibrate unless fund management firms offer some form of transparent reporting. This is illustrated when comparing the iShares ESG Advanced High Yield Corporate Bond ETF (HYXF) and the Nuveen ESG High Yield Corporate Bond ETF (NUHY). Both funds track indices created by MSCI and integrate MSCI ESG scores. The iShares ETF qualifies eligible securities based entirely on negative screens or exclusions that set the bar on ESG scores at the top of the ESG rating average scale. Nuveen on the other hand, not only excludes a dissimilar set of companies but also sets the bar lower at the mid-level of MSCI’s average ESG rating scale. Moreover, the index optimizes its holdings to maximize the overall ESG rating. Currently, the firms do not offer any supplemental outcomes-based reporting.

In the end, lower expense ratios are preferred, however, investors have to evaluate the tradeoffs between the realization of their sustainable investing preferences and fund expenses.

Table 1: Sustainable high yield funds, selected total returns, assets and expense ratios(Listed in 12-months total return performance order)

Fund Name | Symbol | 12-Month Return (%) | 3-Year Average Return (%) | 5-Year Average Return (%) | Assets ($M) | Expense Ratio |

AXS Sustainable Income I# | AXSKX | 5.7 | 5.67 | 4.09 | 51.9 | 0.99 |

Xtrackers JPMorgan ESG USD HY Corp Bd ETF& | ESHY | 5.09 | 5.69 | 4.06 | 24.2 | 0.2 |

RBC BlueBay High Yield Bond I | RGHYX | 4.1 | 9.75 | 6.97 | 296.7 | 0.58 |

RBC BlueBay High Yield Bond A | RHYAX | 3.88 | 9.5 | 6.69 | 3.6 | 0.83 |

Calvert High Yield Bond R6 | CYBRX | 3.71 | 52.3 | 0.71 | ||

Calvert High Yield Bond I | CYBIX | 3.64 | 7.23 | 4.98 | 377.7 | 0.77 |

iShares ESG Advanced Hi Yield Corp Bd ETF | HYXF | 3.48 | 8.05 | 5.81 | 144.2 | 0.35 |

Calvert High Yield Bond A | CYBAX | 3.39 | 6.95 | 4.68 | 55.9 | 1.02 |

Pax High Yield Bond Institutional | PXHIX | 3.34 | 8.47 | 5.77 | 558.9 | 0.72 |

Pax High Yield Bond A | PXHAX | 3.09 | 8.23 | 5.51 | 7.2 | 0.96 |

Pax High Yield Bond Investor | PAXHX | 2.94 | 8.19 | 5.48 | 172.5 | 0.96 |

Nuveen ESG High Yield Corporate Bd ETF | NUHY | 2.76 | 102.1 | 0.3 | ||

Calvert High Yield Bond C | CHBCX | 2.62 | 6.16 | 3.9 | 4.9 | 1.77 |

Federated Hermes SDG Engagement HY Credit IS | FHHIX | 2.58 | 50.5 | 0.62 | ||

BlackRock Sustainable High Yield Bd Inv A | BSHAX | 0.1 | 0.83 | |||

FlexShares ESG & Climate HY Corp Cr^ | FEHY | 29.7 | 0.23 | |||

BlackRock Sustainable High Yield Bd K | BSHKX | 49.4 | 0.53 | |||

BlackRock Sustainable High Yield Bd Ins | BSIHX | 0.1 | 0.58 | |||

Federated Hermes SDG Engagement HY Credit R6 | FHHRX | 0 | 0.57 | |||

Average/Totals | 3.59 | 7.63 | 5.27 | 1981.9 | 0.71 | |

Bloomberg US Corporate High Yield Index | 5.28 | 8.83 | 6.3 | |||

Bloomberg Global High Yield Index | 0.99 | 6.75 | 5.21 |

Notes of Explanation: ^Fund commenced operations in September 2021. #Fund reorganization as of October 2020. &Effective May 12, 2020, the fund changed its underlying index to the JP Morgan ESG DM Corporate High Yield USD Index from the Solactive USD High Yield Corporate Bond. Universe constructed based on fund mandate. Data sources: Morningstar Direct; Sustainable Research and Analysis.

Table 2: Summary of sustainable investing strategies

Fund Name/Investment Manager | Summary of Sustainable Investing Strategy |

AXS Sustainable Income Fund AXS Investment LLC/SKY Harbor Capital Management, LLC | ESG Integration, including engagement to inform decision making. Exclusions. Fund excludes issuers inconsistent with the goals and objectives expressed in the UN Global Compact or Sustainable Development Goals, particularly as it relates to climate change risk. |

Xtrackers JPMorgan ESG USD High Yields Corp Bd ETF DBX Advisors LLC | ESG screening. Fund tracks the J.P. Morgan ESG DM Corporate High Yield USD Index using a representative sampling strategy that relies on positive and negative screening. -Positive screening. Issuers with the best scores are more heavily weighted. Green bonds categorized as green by the Climate Bond Initiative receive upgraded scores. –Negative screening. Issuers with the lowest scores are excluded. Issuers involved in thermal coal, tobacco, weapons, oil sands or UN Global Compact principle violation are excluded from the index regardless of their ESG score. |

RBC BlueBay High Yield Bond RBC Global Asset Management (U.S.) Inc./BlueBay Asset Management LLP | ESG Integration, including engagement to gain insight and /or influence evolving ESG practices and/or improve ESG disclosure. -Exclusions. Also exclude issuers with high ESG risks and Product-based restrictions exclude issuers and sectors to avoid investments that may contribute to the production or distribution of certain goods associated with significant environmental and societal risks. Conduct-based restrictions exclude issuers who do not adequately address ethical, environmental, and societal risk in their operations: Non-compliance with the UN Global Compact Principles; Producers of controversial weapons, including, but not limited to, cluster munitions, anti-personnel mines, chemical and biological weapons and depleted uranium; Tobacco producers; and Certain levels of involvement thresholds in thermal coal mining and power generation. |

Calvert High Yield Bond Calvert Research and Management | ESG Integration; Impact/positive outcomes. Fund seeks to invest in companies and other issuers that provide positive leadership in the areas of their business operations and overall activities that are material to improving long-term shareholder value and societal outcomes. Calvert seeks to invest in companies and other issuers that balance the needs of financial and nonfinancial stakeholders and demonstrate a commitment to the global commons as well as to the rights of individuals and communities. The Calvert Principles for Responsible Investment (Calvert Principles) provide a framework for Calvert’s evaluation of investments and guide Calvert’s stewardship on behalf of clients through active engagement with companies and other issuers. The Calvert Principles seek to identify companies and other issuers that operate in a manner that is consistent with or promote environmental sustainability and resource efficiency, equitable societies and respect for human rights and accountable governance and transparent operations. -Exclusions. No or limited exposure to the following issuers: -Demonstrate poor management of environmental risks or contribute significantly to local or global environmental problems. -Demonstrate a pattern of employing forced, compulsory or child labor -Exhibit a pattern and practice directly or through the company’s supply chain of human rights violations or are complicit in human rights violations committed by governments or security forces, including those that are under U.S. or international sanction for human rights abuses. -Exhibit a pattern and practice of violating the rights and protections of Indigenous Peoples. -Demonstrate poor governance or engage in harmful or unethical business practices. -Manufacture tobacco products. -Have significant and direct involvement in the manufacture of alcoholic beverages without taking significant steps to reduce the harmful impact of these products. -Have significant and direct involvement in gambling or gaming operations without taking significant steps to reduce the harmful impact of these businesses. -Have significant and direct involvement in the manufacture of civilian handguns and/or automatic weapons marketed to civilians. -Have significant and direct involvement in the manufacture of military weapons that violate international humanitarian law, including cluster bombs, landmines, biochemical weapons, nuclear weapons, blinding laser weapons, or incendiary weapons. -Use animals in product testing without countervailing social benefits such as the development of medical treatments to ease human suffering and disease. |

iShares ESG Advanced Hi Yield Corp Bond ETF BlacRock Fund Advisors | ESG Screening. Fund tracks the Bloomberg MSCI US High Yield Choice ESG Screened Index using a representative sampling approach the relies on ESG negative screening and exclusions. –Negative screening. Issuers with an ESG controversy score of less than 3, companies with ESG scores below BB (top of average scale) and companies involved with in adult entertainment, alcohol, gambling, tobacco, genetically modified organisms, controversial weapons, nuclear weapons, civilian firearms, conventional weapons, palm oil, for-profit prisons, predatory lending, and nuclear power based on revenue or percentage of revenue thresholds for certain categories (e.g. $500 million or 50%) and categorical exclusions for others (e.g. nuclear weapons). MSCI ESG Research screens companies with involvement to fossil fuels by excluding the securities of any company in the Bloomberg Class 3 energy sector (i.e., corporate issuers in the energy sector include both independent and integrated exploration and production companies, as well as midstream oil field services, and refining companies) and all companies with an industry tie to fossil fuels such as thermal coal, oil and gas—in particular, reserve ownership, related revenues and power generation. |

Pax High Yield Bond Fund Impax Asset Management LLC | ESG Integration. The advisor focuses on the risks and opportunities arising from the transition to a more sustainable economy. It is believed that capital markets will be shaped profoundly by global sustainability challenges, from climate change to gender equality, and these trends will drive growth for well-positioned companies and create risks for those unable or unwilling to adapt. Companies for its investment portfolios are identified through systematic and fundamental analysis which incorporates long-term risks, including environmental, social and governance (ESG) factors. This process is believed to enhance investment decisions and helps us construct investment portfolios made up of better long-term investments. -Exclusions. Fund seeks to avoid investing in issuers that Impax determines have significant involvement in the manufacture or sale of weapons or firearms, manufacture of tobacco products, or engage in business practices that the adviser determines to be sub-standard from an ESG or sustainability perspective in relation to their industry, sector, asset class or universe peers. |

Nuveen ESG High Yield Corporate Bd ETF Nuveen Fund Advisors, LLC/Teachers Advisors, LLC | ESG Screening. Fund tracks the Bloomberg MSCI U.S. High Yield Very Liquid ESG Select Index using a representative sampling approach the relies on ESG positive and negative screening and exclusions. -Positive Screening. Issuers with BBB ESG ratings (mid-level of average ESG rating scale) and above are eligible and an optimization process is used to select ESG leaders to maximize overall index ESG rating. –Negative screening. Excluded companies are any with significant activities in the following controversial businesses: alcohol production, tobacco production, nuclear power, gambling, and weapons and firearms production. Companies otherwise eligible for inclusion in the underlying index that exceed certain carbon-based ownership and emissions thresholds are excluded from the index. |

Federated Hermes SDG Engagement High Yield Credit Fund Federated Investment/Hermes Investment Management Limited | Impact/Positive outcomes. Investing in companies that contribute to a positive societal impact by seeking those companies that are in alignment with at least one of the United Nations Sustainable Development Goals (SDGs) or willingness to enact changes suggested during company engagements. –Exclusions. Excluded are companies that manufacture tobacco and/or controversial weapons. |

BlackRock Sustainable High Yield Bond Fund BlackRock Advisors LLC | ESG integration. Reflected in the fund management’s securities selection and weighting based on an issuer’s ability to manage the ESG risks to which its business is exposed. Included in its assessment is the research and development of investment insights related to economic transition, which include target carbon transition readiness and climate opportunities. The fund generally seeks to invest in a portfolio that, in BlackRock’s view (i) has an aggregate ESG assessment that is better than that of the Barclays US High Yield 2% Issuer Capped Index (Benchmark), (ii) has an aggregate carbon emissions assessment that is lower than that of the Benchmark, and (iii) in the aggregate, includes issuers that BlackRock believes are better positioned to capture climate opportunities relative to the issuers in the Benchmark. -Exclusions. (i) issuers engaged in the production of controversial weapons; (ii) issuers engaged in the production of civilian firearms; (iii) issuers engaged in the production of tobacco-related products; (iv) issuers that derive certain revenue from thermal coal generation or more than five percent of revenue from thermal coal mining, unless the Fund is investing in green bonds of such issuers or the issuers have set certain targets to reduce climate impact; (v) issuers that derive more than five percent of revenue from oil sands extraction, unless the fund is investing in green bonds of such issuers or the issuers have set certain targets to reduce climate impact; (vi) issuers identified by recognized third-party rating agencies as violators of the United Nations Global Compact, which are globally accepted principles covering corporate behavior in the areas of human rights, labor, environment, and anti-corruption; and (vii) issuers receiving an ESG rating of CCC or equivalent by recognized third-party rating agencies. |

FlexShares ESG & Climate High Yield Corp Core Index Fund Northern Trust Investments, Inc | ESG Screening. Fund tracks the ESG & Climate High Yield U.S. Corporate Core Index using an optimization approach that increases the aggregate proprietary Northern Trust ESG score for the companies relative to the benchmark, reduces the aggregate carbon emissions intensity of the companies in the fund and improves the aggregate carbon risk rating of the companies in the Underlying Index, each relative to the benchmark. –Positive screening. Companies are ranked using a proprietary ESG Vector Score based on their management of and exposure to material ESG metrics as defined by the Sustainability Accounting Standards Board (“SASB”) Standards and a corporate governance score for each company. NTI calculates and maintains ESG Vector Scores for companies using data from third-party data providers. The SASB Standards identify financially material ESG issues for a company based on its industry classification within the following five dimensions: (i) environmental; (ii) social capital; (iii) human capital; (iv) business model and innovation; and (v) leadership and governance. The preliminary ESG score is then adjusted up or down based on a quantitative assessment of how a company is managing the risks associated with those material ESG issues relative to its peers based on the recommendations of the Task Force on Climate-related Financial Disclosures to evaluate a company through governance, strategy and risk management lenses. The adjusted ESG score generates 80% of the ESG Vector Score. Finally, a distinct corporate governance score is applied to each company with respect to its (i) board and management quality and integrity; (ii) board structure; (iii) ownership and shareholder rights; (iv) remuneration; (v) financial reporting; and (vi) stakeholder governance, which generates 20% of the ESG Vector Score. In addition to applying the ESG Vector Score, the Index Provider uses data from Institutional Shareholder Services ESG Solutions to assess carbon emissions intensity and a carbon risk rating for each company. Carbon emissions intensity measures (i) direct greenhouse gas emissions from sources controlled or owned by the company (e.g., emissions associated with fuel combustion in boilers, furnaces, or vehicles); and (ii) indirect greenhouse gas emissions associated with the purchase of electricity, steam, heat or cooling against the value of the company enterprise wide. The ISS Carbon Risk Rating provides an assessment of a company’s ability to mitigate the risks of transition to a lower carbon economy risk based on its specific baseline carbon risk exposure. -Negative screening/Exclusions. Excluded companies include those which are involved in (i) verified infringement of established international initiatives and guidelines, including United Nations Global Compact Principles and Organisation for Economic Co-operation and Development (OECD) Guidelines for Multinational Entities; (ii) the production of tobacco; and (iii) manufacturing of controversial weapons. Excluded companies also include those which derive a certain percentage of revenue (e.g., 5% or more) from (a) manufacturing of civilian firearms; (b) manufacturing of conventional weapons or providing support services through military contracting; (c) thermal coal extraction; (d) coal-fired energy generation; and (e) the retail sale of tobacco and tobacco related products or services. |

Notes of Explanation: Data sources: Fund prospectus based on research conducted by Sustainable Research and Analysis.