Trillium Mutual Funds: Portfolio 21 Global Equity Fund and Trillium Small/Mid Cap Fund

Trillium Asset Management, LLC

12/31/2017 Semi-annual Report as of 3/12/2018

Observations:

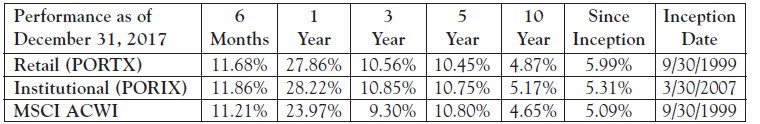

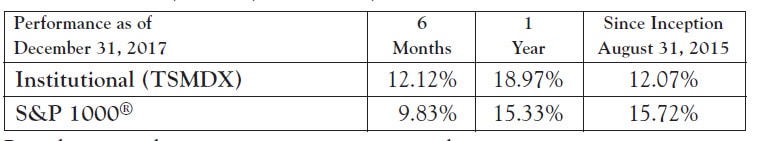

- Portfolio 21 Global Equity, except for slightly lagging the MSCI ACWI Index over the 5-year interval to 12/31/2017, has exceeded the performance of its designated benchmark during the 1-year, 3-year, 10-year and since inception time intervals. Trillium’s companion Small/ Mid-Cap Fund is relatively new. It was launched as of 8/21/2015 and so far it is beating its designated S&P 1000 Index by 3.64% over the 1-year time frame to 12/31/2017. Even when the fund’s performance is evaluated relative to what might be considered a more appropriate small-cap-to-mid-cap index, like the Russell 2500, the fund still outperforms albeit at a narrower margin of 2.16% as the Russell 2500 Index delivered a one-year return of 16.81%.

- The funds’ report reflects on the challenge of increasing income inequality in the U.S., provides commentary on the nature of individual performance leaders and laggards and new investments that reflect, in part, on the firm’s social and environmental considerations, as may be applicable. Moreover, each fund discloses its environmental impact relative to its designated index in terms of total carbon emissions and carbon footprint, based on calculations provided by Trucost. The report also discloses Trillium’s shareholder advocacy initiatives, including its advocacy in favor of corporate governance reform at Facebook via a shareholder proposal requesting that Facebook’s Board issued a report on the merits of establishing a Risk Oversight Board Committee. Such a committee, according to Trillium, would help protect shareholder value by introducing a dedicated and systematic approach to risk management.

Principal Sustainable Investment Strategy:

Hover over the fund group name or refer to the Sustainable Investment Strategies Directory under the Investment Research tab.

Portfolio 21 Global Equity Fund

Report Commentary:

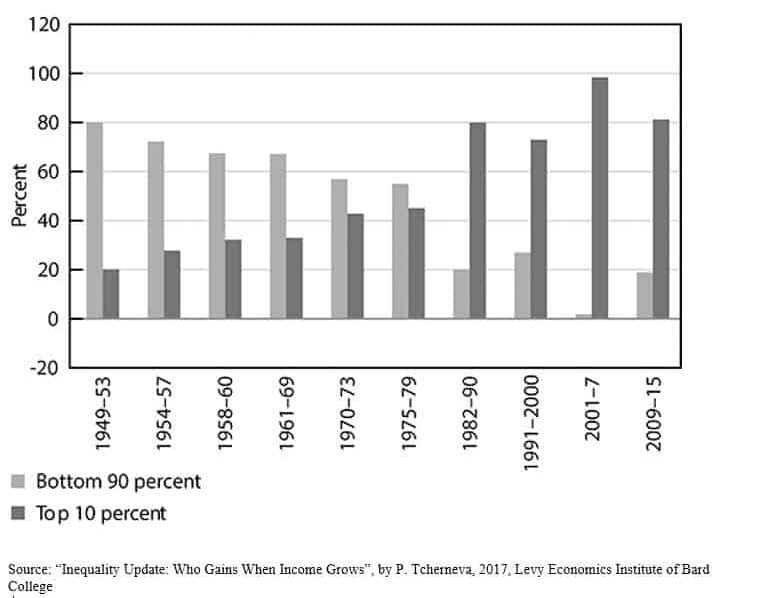

There are many charts that will purport to show you how over/undervalued the markets now are and delineate all sorts of reasons for what will occur in 2018 and beyond. Some will end up being right, some wrong, but we believe few areas indisputably important as the one that follows. Asset owners have enjoyed the fruits of this long bull market but the same bull market has exacerbated income inequality to historic proportions in the U.S. No one can say for sure how this gap will ultimately manifest but, unless addressed, we have trouble seeing a happy ending.

Households’ Share of Average Income Growth: 1949-2015 Expansions

One of the founding principles of the Fund has been to invest in firms which generate high returns on invested capital (ROIC). These companies take the incremental returns and reinvest them back into their businesses, creating further high returns and ultimately a virtuous circle.

Looking forward, the impacts of the President Trump tax package are still unsure and will play out over the year. Given our ROIC focus, we would look for Fund companies to possibly benefit by being predisposed to invest tax savings and/or repatriated funds into their businesses, increasing their competitive advantages.

Financial Performance Leaders:

Australian Health Care leader Blackmores saw shares rise nearly 80% in the second half. The stock gained on strong demand for health and wellness products in China thanks to a growing middle class and aging population. The company’s biggest market opportunity remains China where its trusted reputation for effective natural vitamins, minerals, herbal and nutritional supplements is highly valued.

San Francisco based New Resource Bank announced a merger with Amalgamated Bank in Q4, lifting its stock price 35%. New Resource Bank is a triple-bottom-line bank serving values-driven businesses and nonprofits that are building a more sustainable world. The combination with Amalgamated will create the largest values-based bank in the U.S.

BYD Company saw its Hong Kong shares rise over 40% in the second half helped in part by China’s announcement that all vehicles in the country would be electrified by 2030. BYD Co. is a global leader in new energy vehicles (NEVs) as well as rechargeable batteries.

Financial Performance Laggards:

Henry Schein (HSIC) had a tough second half, down 24% as investors worried about a possible threat from Amazon and a slowdown in dental consumables. HSIC distributes consumable products and small equipment to dental, animal health and medical practitioners. But, maybe, more importantly, it also provides value-added service such as software and technology to these customers making Amazon less of a threat than perhaps thought.

U.S. pharmaceutical giant Merck saw its stock drop 11% over 6 months. After good news early in the year from its immunotherapy drug Keytruda, the rest of the year was without catalysts and results were a bit lackluster. That being said we see the company’s pipeline being in good shape which should bode well for 2018.

CVS stock was down 9% in the second half as investors first worried about Amazon’s possible entry into the healthcare industry and then about CVS’ response: it announced a merger with Aetna. Though there are many moving parts to the deal, we like the initiative CVS has taken to broaden its scope and look forward to the results of the combination.

New Positions:

The Fund was able to strengthen its Consumer Staples holdings by adding Orkla, a leading supplier of branded goods to grocery, specialized retail and bakery sectors mainly in the Nordic and Baltic regions. The company is committed to improving the nutritional profile of its food products, having established nutrition and health objectives across its portfolio. It has also established a goal to sustainably source key raw materials by 2020.

Another addition was Bright Horizons Family Solutions. The company provides childcare, early education and other services both domestically and abroad. Bright Horizons has a reputation for high quality and dependability, key in the childcare area. All its daycare centers meet or exceed voluntary accreditation standards and the company often utilizes above average adult-to-child ratios.

Continued volatility around the Brexit allowed us to add what we view as another high quality name in British Land Co. The company has transitioned from playing the boom/bust real estate cycle to becoming a more long-term holder of properties. British Land has focused on creating places where people want to live, work and shop. Understanding that strong ties to the community, flexible workspaces and efficient buildings help attract and retain shoppers/tenants is key to its strategy and its competitive advantage.

Environmental Performance:

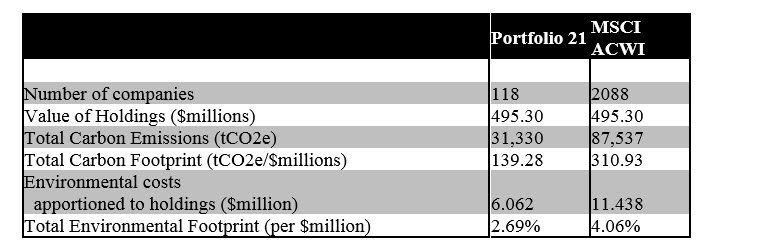

Portfolio 21 invests in industry leaders across the globe that effectively address and mitigate their environmental impact. One such measure that we evaluate is carbon intensity, which can be quantified by computing the average emission rate of a given pollutant from a given source relative to the intensity of a specific activity. Utilizing data from Trucost, a leading global research and environmental data provider, the carbon intensity of Portfolio 21 and its benchmark, the MSCI ACWI, was calculated for nine greenhouse gases and then converted into tons of carbon dioxide equivalents. At the close of 2017, Portfolio 21 achieved a 55% lower carbon footprint than the MSCI ACWI.

While low relative carbon intensity is an essential characteristic of companies held in Portfolio 21, we also consider other environmental impacts measures. We measure and rate the impact companies have on water use, waste, land and water pollutants, air pollutants, and natural resource use. To determine the overall environmental impact of Portfolio 21 and its benchmark, Trucost weights a company’s environmental impact by revenue and the amount of environmental impact the company contributes to the portfolio based on Portfolio 21’s ownership share. The companies in the portfolio are then summed, creating the environmental impact apportioned to the portfolio. This is then normalized by the total revenue apportioned by each holding to create the data presented in the chart below. At the close of 2017, Portfolio 21 had a 34% lower environmental footprint than the MSCI ACWI.

Advocacy:

Over the second half of 2017, the Trillium shareholder proposal advocacy team engaged about 300 companies through both individual initiatives and collaborative efforts with other investors. This included filing 39 shareholder proposals. Trillium and our clients are working to influence change in corporate behavior that we believe benefits investors, society, and the environment.

In October, Trillium filed a shareholder at Verizon Communications asking the company to look at ways to link executive pay to data privacy and cybersecurity. Given that Verizon and its subsidiaries struggle with malicious intrusions and their central role in handling very personal information, we believe top executives should be meaningfully incentivized to do more to improve privacy and security protections and that the company should have ways of keeping management accountable for failures. We also filed a diversity disclosure shareholder proposal at CVS Health Corporation asking the company to disclose EEO-1 data, a standard report on diversity metrics, and policies/programs focused on increasing diversity in the workplace.

At Facebook, we are concerned that its founding philosophy of “Move Fast and Break Things” has created far too many risks and unintended consequences for the company and society. Whether it be fake news, privacy concerns, negative mental health impacts, censorship, terrorism incitement, or platform monopoly issues, we believe it is time for Facebook to take a step back and examine the “big picture” by establishing a board committee on risk. To promote this approach and foster a conversation with investors and the board, we filed a shareholder proposal making this request in October.

Performance Results:

Trillium Small/Mid Cap Fund

New Positions:

In the second half of 2017, we initiated a few new positions including Lamb Weston and Tallgrass Energy. Lamb Weston is a leading global supplier of value added frozen potato and sweet potato products (mostly fries) and vegetable products to restaurants and retailers around the world. Lamb Weston began trading as a public company in November 2016, spinning off from its parent company Conagra Foods. Lamb Weston has a unique and favorable category exposure, which leaves it more insulated from current trends that are pressuring traditional packaged food companies, such as the move to the perimeter of the store and increasing acceptance of private label. In reality, Lamb Weston’s fates are more dependent on restaurants and food-away-from-home. Its industry is fairly consolidated which provides positive pricing discipline. Its product is one of the most affordable and the most profitable on many restaurant menus, and there are growth opportunities internationally and through innovation which should support its growth goals. Though the company is new and still establishing its own ESG protocols and initiatives, they inherited a robust set of environmental management policies, supply chain programs and sustainable farming practices from ConAgra.

We initiated a position in Tallgrass Energy, a pipeline company, as a replacement for ONEOK, which we sold out of the portfolio as its market cap had grown too large. Tallgrass Energy GP (TEGP) is the general partner of Tallgrass Energy Partners, LP (TEP). Tallgrass Energy’s revenue is generated mainly from providing transportation services to third-party oil and natural gas producers, processors, distribution utilities, industrial end-users, power plants and other shippers. The company’s principal business segments are the Pony Express Pipeline, which provides crude oil transportation from Wyoming, CO to Cushing, OK; and the Rockies Express Pipeline (REX), which has a regulated natural gas pipeline system connecting the west (Uinta basin in Utah) to the east (Appalachian area). In addition, TEP and TEGP also run midstream facilities and provide water solutions to the energy industry. Midstream plays – meaning transportation and storage – generally has less exposure to the oil/gas price volatility compared to other energy industries, because 98% of its revenues are fee-based take or pay contracts. The company had a cleaner controversy profile than many of its peers and scored well in terms of policy standards and performances around land usage, accidental release risks, and operational risks.

During the second half we exited some of the Large Cap names whose market cap had outgrown the Fund and reallocated to SMID Caps. We exited ONEOK, our pipeline play, and SBA Communications, the cell tower Specialty REIT (Real Estate Investment Trust), as the market caps were no longer appropriate for our portfolio. We trimmed our positions in larger cap names like First Republic Bank, Xylem, and Ansys, given their strong stock moves, and increased positions of Webster Financial, a regional bank; Trimble, a technology solutions company and Middleby, a restaurant equipment provider. In addition, as mentioned earlier, we took some money off the table in Information Technology overall, trimming strong performers such as IPG Photonics, Rogers Corporation and Zendesk.

Environmental Performance

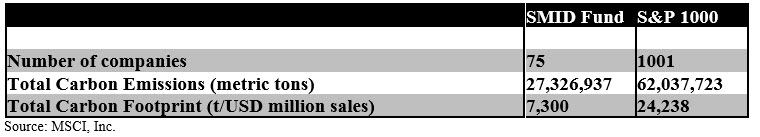

Utilizing data from MSCI, Inc., a leading ESG ratings provider we identified, at the close of 2017, SMID has reported carbon intensity that is 70% less carbon intensive than its benchmark.

Advocacy:

Over the second half of 2017, the Trillium shareholder advocacy team engaged about 300 companies through both individual initiatives and collaborative efforts with other investors. This included filing 39 shareholder proposals. Trillium and our clients are working to influence change in corporate behavior that we believe benefits investors, society, and the environment.

Research from the Williams Institute has shown that LGBT-supportive policies lead to positive business outcomes, lower staff turnover, and increased job satisfaction. Unfortunately, Federal law and 27 states do not provide employment discrimination protection based on sexual orientation or gender identity. That is why Trillium has for decades encouraged companies to adopt non-discrimination policies that protect LGBT employees. In October, we were able to withdraw our proposal at LED lighting company Acuity Brands when the company agreed to add both sexual orientation and gender identity to its code of conduct and business ethics.

Recognizing the importance of workforce diversity, pay equity, discrimination, harassment, abuse, productivity, and other issues, Trillium continues to engage financial and technology companies on these issues. At network and enterprise security company Palo Alto Networks, our racial and gender diversity proposal earned a majority vote (50.9%) in December. The shareholder proposal asked Palo Alto Networks to disclose EEO-1 data, a standard report on diversity metrics, and policies/programs focused on increasing diversity in the workplace. This is the first majority vote in the 2017-2018 shareholder proxy season and is the highest vote ever received for this type of proposal.

Continuing our long-term effort to reduce the use of harmful pesticides and specific chemicals like neonicotinoids, we filed a shareholder proposal at Tractor Supply in November asking the company to conduct a risk assessment to determine if selling products containing the pesticide (which evidence shows is harmful to pollinators) is aligned with its environmental policies and practices.

Performance Results:

The commentary appearing in this document represents excerpts taken from selected semi-annual and annual reports published by sustainable mutual funds and exchange-traded funds (ETFs) during the past month. The intention of the Round-Up is to track relevant commentary and performance results provided by funds that pursue sustainable strategies across varying sectors and asset classes in an effort to better understand how such strategies are directly affecting performance results achieved during the covered reporting periods and also to tease out any information regarding positive societal outcomes achieved through the implementation of these sustainable strategies. These are juxtaposed against the fund’s sustainable investing strategy. Interested readers should consult the funds’ annual and semi-annual reports for the complete text of management’s discussions of investment outlook and fund performance.

The Round-Up is not intended to cover all semi-annual and annual reports filed during the course of the month, but rather to offer a representative sampling by some of the leading sustainable funds in their respective sectors.