Alger Responsible Sutainable Investing Fund

Fred Alger Management Inc.

9/30/2017 Annual Report filed as of 12/7/2017

Observations:

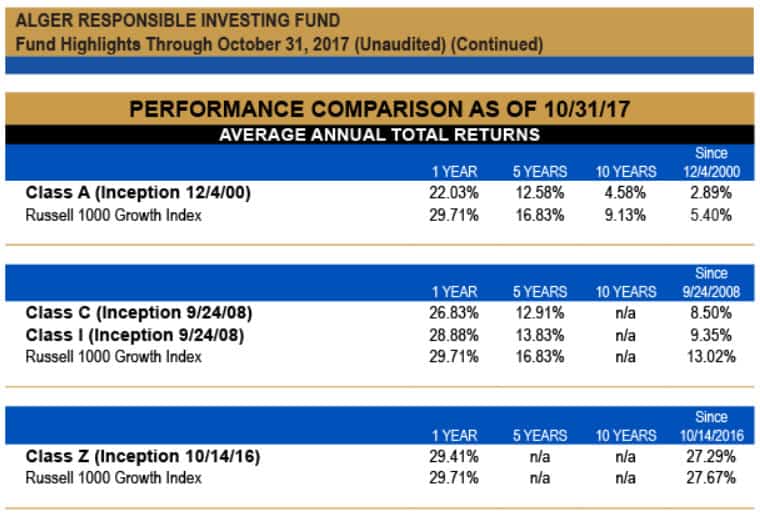

- The fund across its four share classes trailed behind the Russell 1000 Growth non-ESG benchmark during the latest 1, 3, 5-year, 10-year and since inception intervals. The index is newly adopted to reflect that fund’s strategy adopted as of December 30, 2016. More relevant for evaluating the results of this fund over these intervals is the Russell 3000 Growth Index, the fund’s previous benchmark, but the fund’s relative results don’t reflect any material improvement.

- The annual report details the management company’s rationale behind the change in the fund’s strategy from environmental sustainability to a new mandate wherein the fund will invest in companies identified by the manager’s fundamental research as having promising growth potential while demonstrating that they conduct business in a responsible manner relating to environmental, social, and corporate governance (ESG) matters. Details describing the fund’s methodology are not provided, nor is there any information regarding the interval’s performance and any ESG related considerations.

Principal Sustainable Investment Strategy

Refer to the Sustainable Investment Strategies Directory under the Investment Research tab.

Report Commentary

Until December 30, 2016, the fund was named the Alger Green Fund. It maintained a singular focus on environmental sustainability while seeking companies identified by the firm’s fundamental research as having promising growth potential. Under the new mandate, the fund invests in companies identified by the manager’s fundamental research as having promising growth potential while demonstrating that they conduct business in a responsible manner relating to environmental, social, and corporate governance (ESG) matters. The new strategy allows the manager to broaden the universe of investment opportunities being pursued. In addition, we the manager believes that innovative companies that embrace sustainable ESG practices can potentially provide attractive returns for shareholders and support the environment and overall society. On March 1 of this year, the fund’s benchmark was changed from the Russell 3000 Growth Index to the Russell 1000 Growth Index.

During the reporting period, Information Technology and Consumer Discretionary were the largest sector weightings. The largest sector overweight was Industrials and the largest underweight was Consumer Staples. The Information Technology and Consumer Discretionary sectors provided the greatest contributions to relative performance while Health Care and Materials were among sectors that detracted from results.

Apple, Inc.; Amazon.com, Inc.; Microsoft Corp.; Facebook, Inc., Cl. A; and Tesla, Inc. were the top contributors to performance. Shares of Apple performed strongly in response to developments described in the Alger Spectra Fund discussion.

Conversely, General Electric Co.; Celgene Corp.; CVS Caremark Corp.; Mattel, Inc.; and Newell Brands, Inc. were the top detractors from results. Newell Brands is a leading global consumer products company. Its brands include Rubbermaid, Paper Mate, Calphalon, Graco, and Levolor. Newell Brand’s significant Jarden acquisition has been a transformational positive life cycle event. Jarden has an impressive stable of brands such as Coleman,

Rawlings, Marmot, and Yankee Candle. Newell shares detracted from performance late in the reporting period after the company lowered earnings guidance due to increased spending to stimulate categories where revenue growth has been sluggish. The company also cited increased resin import costs associated with Hurricane Harvey’s destruction in Texas. A resin is a very important component of Newell’s plastic products.

Performance Results (source: annual report)

Hartford Global Impact Fund

Hartford Funds Management Company, LLC (HFMC), sub-advised by Wellington Management Company LLP.

October 31, 2017 Annual Report Filed January 8, 2018

Observations:

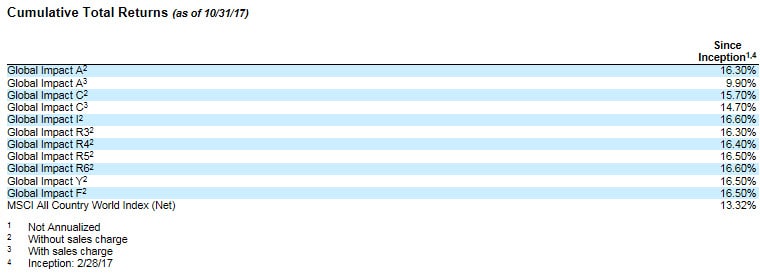

- The fund is relatively new, having been launched 2/28/2017, and its total return performance covers a short seven month period to October 31st. During that interval, the fund and its various share classes, without taking account the impact of sales charges, outperformed its non-ESG benchmark, the MSCI All Country World Index (Net).

- With the exception of a reference to positive performance due to not holding any energy stocks, the annual report provides limited detail regarding the impact of environmental, social and governance (ESG) factors on country, sector and stock selection as these relate to the current portfolio. Some insight is provided in the outlook discussion.

Principal Sustainable Investment Strategy

Refer to the Sustainable Investment Strategies Directory under the Investment Research tab.

Report Commentary

All eleven sectors in the MSCI All Country World Index posted positive returns during the period. The Information Technology (+28%), Materials (+16%), and Industrials (+15%) sectors rose the most, while the Telecommunication Services (+2%), Consumer Staples (+5%), and Energy (+6%) sectors had lagged the broader index during the period.

Security selection in the Telecommunication Services, Healthcare, and Information Technology sectors were the primary drivers of outperformance relative to the MSCI All Country World Index. This was partially offset by weaker stock selection in the Consumer Discretionary and Industrials sectors. Sector allocation, a result of the bottom-up stock selection process, also contributed positively to relative performance, primarily due to underweights to Consumer Staples, Financials, and not holding any Energy equities. On the other hand, overweights to Healthcare and Telecommunication Services detracted from relative returns over the period. On a regional basis, security selection in North America was the primary contributor to benchmark-relative performance, which was partially offset by weaker selection in Emerging Markets.

Square Inc. (Information Technology), PureCircle (Consumer Staples), and Genus (Healthcare) contributed positively to absolute and relative returns over the period. The share price of Square Inc., a U.S.-based financial services, merchant services aggregator and mobile payment company, rose over the period as it expanded its suite of services to include point-of-sales systems, peer-to-peer payments, payroll systems, and small business loans, which investors viewed favorably. PureCircle, a Malaysia-based producer and innovator of stevia sweeteners, saw the price of its stock rise as the market expanded outside of its traditional soda beverage use to other beverages and foods; investors believe the company is well-positioned to take advantage of its vertical integration and diversified product mix. Shares of Genus, a United Kingdom-based company focused on selling products manufactured using biotechnology to cattle and pig farmers, rose over the period as the company expanded its Chinese porcine business with new contracts. The company also announced third quarter 2017 earnings in line with expectations.

Top detractors from absolute and relative performance included Tung Thih Electronics (Consumer Discretionary), Net1 UEPS Technologies (Information Technology), and CT Environmental Group (Utilities). Shares of Tung Thih Electronics, a Taiwan-based maker of advanced driver assistance systems (“ADAS”) for cars, fell over the period due to a slowdown in vehicle sales in China which affected the company’s customer base.

The stock price of Net1 UEPS Technologies, a U.S.-based provider of universal electronic payment systems, fell due to investor caution as the company appointed a new CEO, resulting in an earlier-than-expected retirement of the former CEO. CT Environmental Group, a China-based provider of industrial wastewater treatment and water supply services, also detracted from performance for the period. The stock fell after the company missed June 2017 earnings expectations alongside uncertainty about a potential spinoff of its hazardous and solid waste treatment businesses.

Derivatives were not used in a significant manner in the Fund during the period and did not have a material impact on performance during the period.

What is the outlook?

The Fund seeks to invest in innovative companies whose products and services aim to solve the world’s social issues. During the period, we conducted a research trip to Asia where we expanded our research on the lithium battery supply chain. We believe that electrification will be a dominant theme for the future and be central to energy efficiency improvements. We think that lithium battery technology cost declines will facilitate that paradigm shift and we expect to see China rising as a technology leader in lithium batteries; we continue to monitor potential investments in the area.

Within the Fund’s impact themes, the Fund’s largest absolute weights were in financial inclusion and alternative energy companies at the end of the period relative to the benchmark. On a regional basis, we ended the quarter most overweight to Emerging Markets and most underweight North America relative to the benchmark.

Performance Results (source: annual report)

Saturna Sustainable Equity Fund

Saturna Capital Corp.

11/30/2017 Annual Report filed as of 1/30/2018

Observations:

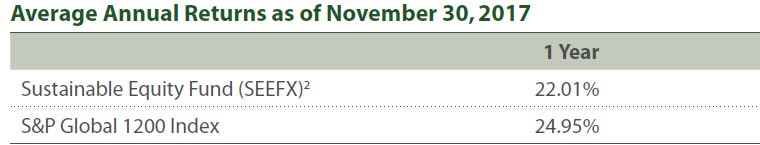

- The fund, which was launched on March 27, 2015, fell behind its non-ESG benchmark, the S&P Global 1200 Index, by 294 basis points (bps) during the 1-year period to October 31, 2017.

- The fund reports the assignment of a Morningstar 5 star sustainability rating, which, according to the fund, is intended to measure how well the issuing companies of the securities within a fund’s portfolio are managing their environmental, social, and governance (“ESG”) risks and opportunities relative to the fund’s Morningstar category peers. At the same time, information is not provided regarding any ESG related positive or negative factors that affected the fund’s performance. That said, the fund highlights its forward views, including the observation that companies that have been responsible from the start will emerge as leaders, and those are the investments we choose.

Principal Sustainable Investment Strategy

Refer to the Sustainable Investment Strategies Directory under the Investment Research tab.

Report Commentary

Looking Forward

The positive shifts we’ve seen in the last year around the globe regarding womens rights and upending the status quo cannot be ignored. Globally, there is for the first time a real conversation occuring about what women have had to endure in the workplace, and it is more than just the pay gap. CEOs are taking seriously their place on the planet and the fact that as stewards of our environment and leaders in their communities, they must run their businesses with a long-term view. Companies that have been responsible from the start will emerge as leaders, and those are the investments we choose.

While markets continue to lift as a result of renewed corporate optimism, we will deploy capital and take cautious advantage of global earnings growth. We hold long-term views on the value of assets and see current trends as opportunities to acquire attractive companies at still reasonable valuations.

The Saturna Sustainable Equity Fund remains focused on stocks that we believe have exceptional long-term sustainability characteristics. Based on our internal research, we believe stocks with superior governance, social, and environmental track records generally have lower associated volatility. To this we add a financial stability assessment. We believe that in the long run these stocks lessen uncertainty for investors and improve the probability of achieving superior returns.

Performance Results (source: Annual report)

The commentary appearing in this document represents excerpts taken from selected semi-annual and annual reports published by sustainable mutual funds and exchange-traded funds (ETFs) during the past month. The intention of the Round Up is to track relevant commentary and performance results provided by funds that pursue sustainable strategies across varying sectors and asset classes in an effort to better understand how such strategies are directly affecting performance results achieved during the covered reporting periods and also to tease out any information regarding positive societal outcomes achieved through the implementation of these sustainable strategies. These are juxtaposed against the fund’s sustainable investing strategy. Interested readers should consult the funds’ annual and semi-annual reports for the complete text of management’s discussions of investment outlook and fund performance.

The Round Up is not intended to cover all semi-annual and annual reports filed during the course of the month, but rather to offer a representative sampling by some of the leading sustainable funds in their respective sectors. The report for January 2018 also includes a December 2017 Alger Responsible Investing Fund filing due to its potential interest to readers.