Boston Common International Fund

Boston Common Equity Fund

9/30/2017 Annual Report filed as of 12/7/2017

Observations:

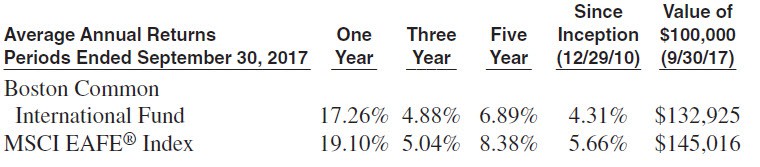

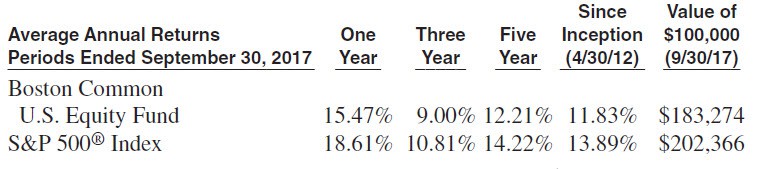

- The two funds managed by Boston Common Asset Management trailed behind their respective non-ESG benchmarks during the latest 1, 3, 5-year and since inception intervals.

- The annual reports detail the fund management company’s commitment to focus on environmental, social and governance (ESG) areas and, in particular, how Boston Common advances the strongly held belief that shareholders in public equities should be more than just disengaged market participants. The firm engages with portfolio companies around the world to create impact and its activities and outcomes are summarized in the annual reports. Also, ESG considerations inform the management company’s discussion regarding purchases and sales during the reporting period.

Principal Sustainable Investment Strategy

The funds seek out companies with sound governance and a history of responsible financial management that are capable of consistent profitability over a long time horizon. The funds integrate environmental, social, and governance (ESG) criteria into the stock selection process and express a preference for best-in-class firms with innovative approaches to the environmental and social challenges their industries, society, and the world face. Best-in-class refers to firms that Boston Common views as having better records on ESG criteria than other firms in the same industry or sector. Boston Common endeavors to integrate financial and sustainability factors into its investment process because it believes that ESG research helps identify companies that will be successful over the long-term. The funds seek to identify companies that demonstrate a high level of environmental responsibility, commitment to social standards and adherence to best practices in corporate governance. As a result, Boston Common believes ESG research helps improve portfolio quality and financial return potential.

Boston Common avoids companies that have a history of using forced labor, child labor, or sweatshops. These criteria apply to a company’s suppliers as well if the company does not seek to remedy them. The funds avoid companies with a history of illegal employment discrimination.

The funds avoid investing in companies that directly support governments that suppress or deny human rights including foreign governments where the US Government has current sanctions in force. Under the human rights lens, Boston Common is also committed to helping defend the rights of Indigenous Peoples. It seeks companies that respect the lands and cultures of Indigenous Peoples, and operate in line with the international standards of the United Nations Declaration on the Rights of Indigenous Peoples, ILO Convention 169, and Free Prior and Informed Consent.Boston Common also uses its voice as a shareowner to raise environmental, social, and governance issues with the management of select portfolio companies through a variety of channels. These may include engaging in dialogue with management, participating in shareholder proposal filings, voting proxies in accordance with our proxy voting guidelines, and participating in the annual shareholder meeting process. Through this effort, the firm seeks to encourage company managements toward greater transparency, accountability, disclosure and commitment to ESG issues.

Report Commentary

Fund Shareowner Engagement

Shareowners in public equities should be more than just disengaged market participants. As investors, our unique access to corporate managements enables us to demand transparency and accountability. We can use this voice more intentionally, to embolden companies to lengthen their planning horizons and manage risk and opportunity for the long-term.

At Boston Common, we engage tenaciously with portfolio companies around the world to help navigate complex issues like climate change and supply chain management. Our team brings the mature voice of experienced investors to the table, as we look to create impact in public equities.

Our first engagement report “Achieving Impact in Public Equities”1 released this past September, highlights our 2016 engagement results on Environmental, Social and Governance (ESG) issues. We engaged at some level 195 companies, 60% of these engagements being led by Boston Common. Our engagement efforts led to 44 significant changes or commitments on products, processes or practices with companies.

Creating Impact in Public Equities is a task we approach with intentionality. We know that we must continue to think creatively and boldly to both mitigate long-term risks and contribute to a just, sustainable world. This report shows how we approach this challenge (Figure 1) and highlights several outcomes (Figure 2). We encourage you to access this publication; and thank you for joining us in our Pursuit of Financial Return & Social Change.

Figure One: Our Engagement Framework

Our experienced team combines investment-grade financial acumen, with a deep understanding of corporate sustainability issues. We have meaningfully improved corporate practices in the U.S. and abroad through:

- Sustained dialogue with senior management;

- Supporting the widespread adoption of industry-specific best practices;

- Creation of standards and metrics to measure sustainability; and

- Effective use of proxy voting and shareholder resolutions.

Our environmental, social and governance focus areas for the coming year will remain similar to those in 2016. We will continue to seek sustainable energy and water use, more responsible financial institutions, greater implementation of sustainability governance at all major companies, more attention to human rights, diversity and supply chain concerns.

With the U.S. pulling out of the Paris Agreement, and the potential roll back of corporate regulation on environmental and human rights issues, it is more important than ever for engaged investors to make the case for responsible corporate practices.

Figure Two: Key Global Impacts in 2016

- Over 23 out of the 28 of the world’s largest banks now have policies to enhance due diligence for carbon-intensive sectors, and to increase funding for renewable energy.

- Fashion retailer VF Corp (owners of Timberland and Wrangler), conducted its first water risk assessment covering 75% of its supply chain and prioritizes water conservation in China and India.

- PepsiCo adopted new global reformulation goals to reduce salt, sugar, saturated fat and transfat, one of 22 companies to improve management of obesity and/or under-nutrition issues following assessment by the Access to Nutrition Index.

- A $1.7 trillion investor coalition led by Boston Common united in a joint call to action directed at 17 banks financing the Dakota Access Pipeline, including directly engaging the impacted indigenous tribe.

- Google, Microsoft, and Samsung under the Electronic Industry Citizenship Coalition’s new Raw Materials Sourcing Initiative joined 22 other companies to ensure the mining of cobalt does not involve child labor or contravene other environmental and social red lines.

- Mitsubishi UFJ Financial Group, Standard Chartered and PNC Financial adopted better guidance and/or assessment criteria with clients that risk the world’s ability to achieve the Paris Agreement goals.

- Statoil sold off its oil sands operations in Canada.

- Air Liquide, BMW, and National Grid reported steps to improve operational energy efficiency including energy and water use, emissions and waste.

- Leading U.S. pharmacist CVS Health added 100 chemicals of concern to its Restricted Substances List for its CVS brand products. In April 2017, CVS announced its intention to remove all parabens, phthalates and the most prevalent formaldehyde donors across nearly 600 beauty and personal care products by the end of 2019.

Investment Outlook

Europe. With a favorable view of profit growth and valuation, we maintain an overweight to Europe ex. UK, continuing to focus on environmental solutions providers as well as companies with sustainable corporate practices. In the past six months, we added Dutch bank ING Groep. After divesting its insurance and other businesses, ING is focused on retail and commercial banking in the Netherlands, Belgium, and Germany. The group has a solid balance sheet that positions it to potentially benefit from rising loan demand and higher interest rates in the Eurozone and is an ESG leader among European banks. We also bought Umicore, a Belgian specialty chemical company that is the world’s largest recycler of precious and valuable metals, a top-three manufacturer of catalytic converters, and has a rapidly expanding energy and surface technologies business. Umicore’s expertise and leading position in cathode technology should generate substantial value as lithium-ion batteries proliferate to power electric vehicles and to store renewable energy.

Japan’s economy has been experiencing solid growth as business sentiment recently reached a ten year high. With the unemployment rate at 2.8%, full employment has not produced wage pressure as an aging workforce, a structural shift to lower-paid temporary and female workers, and ingrained expectations of stable prices have kept wages flat over the past 20 years. The Bank of Japan’s (“BOJ”) determination to promote inflation will likely lead to looser monetary policy compared to Europe and the U.S. We are encouraged by the BOJ’s efforts to revive inflation and as Japan’s expansionary monetary policy continues to diverge from other developed countries now moving towards normalization, we expect the Yen will weaken and aid the country’s export-led growth efforts.

Prime Minister Abe performed well in October’s general election, winning a new four-year term. A fresh mandate for his set of aggressive, pro-growth policies should help build on the current momentum in Japan, including incremental attention to the rights of minority shareholders. We currently have more exposure to Japan than at any point in the past seven years, although we remain underweight. We have been adding to those Japanese companies with sustainable growth drivers and progressive management teams, such as Daikin and Orix. Air conditioning manufacturer Daikin’s valuation looks attractive for a global leader benefiting from demand for more energy efficient air conditioning in developed and emerging markets. Financial services provider Orix has exhibited improving profitability and innovative efforts to finance renewable energy projects. Orix may move to a more shareholder-friendly approach to capital management and the stock’s dividend yield looks attractive.

Investor sentiment has improved for Asia Pacific & Emerging Markets. In June, Australia reported its 26th consecutive year without a recession, surpassing the record held by the Netherlands that ended in 2008. Australia’s impressive achievement is owed partially to a booming demand for commodities driven by China’s industrial development. Commodity-oriented countries Brazil and Russia have experienced the most pronounced turnarounds, while China and India have been the fastest growing large EM countries. Indian growth recently moderated after the country instituted two major reforms: demonetization and sales tax centralization. China has recently slowed as it pushes to rebalance its economy from infrastructure and investment to more environmentally benign consumption and services.

In September, China announced a requirement that new energy vehicles (NEVs), mostly battery electric and plug-in hybrid cars, must account for at least 10% of each auto company’s sales by 2019. Generous subsidies, an aggressive mandate, and improvements in EV performance have driven a nearly seven-fold increase in NEV sales over the past two years. Global auto makers are responding to the booming Chinese EV market by retooling their product development strategies.

In summary, with aggregate earnings projected to grow 7% and a dividend yield over 2%, international equities, trading at a price-to-earnings ratio of 14.8x, could deliver mid-to-high single-digit returns over the next few years. Based on our constructive outlook, we have more exposure to cyclical sectors compared to the MSCI EAFE Index. End-market themes within these areas include proliferating semiconductor content, energy efficient products, green chemicals, the electric vehicle supply chain, and the rising middle class in emerging markets. Efficiency improvements and shifts in transport should suppress oil demand, and thus we remain cautious on Energy stocks. In the defensive sectors, we have a preference for healthcare and telecom stocks. Key risks include geopolitical shocks, backsliding on European integration, protectionism, and long-term demographic headwinds.

Management’s Discussion of Fund Performance for the period ending September 30, 2017.

The Fund’s relative performance lagged significantly in November and December of 2016. The Fund struggled amidst the unexpected U.S. election outcome and the subsequent strong, positive price reaction in the international equity markets that focused on the pro-cyclical aspects of expected policy reform: increased infrastructure spending, lighter regulation, and lower taxes. High-quality growth factors (less financial leverage, more stable earnings, and end-market growth) came under pressure while low-quality value stocks appreciated.

Since January, the Fund has experienced solid relative performance. However, it was not enough to close the gap created late last year. A key turning point, Emmanuel Macron’s victory in the French Presidential election, helped boost confidence in Europe’s political stability and refocus investors’ confidence in the strength of the Eurozone’s economic recovery. The Fund was well positioned for improving economic conditions that favored businesses levered to Europe’s rebound, Japan’s nascent recovery, and expanding consumption in the emerging markets. For example, Swedish industrial machinery company Atlas Copco, Japanese lens manufacturer Hoya Corp., and Chinese e-commerce giant Alibaba were all among the top performing Fund holdings over the past twelve months.

Regulatory mandates, consumer preferences, and corporate strategies boosted expectations for electric vehicle (EV) penetration and the Fund’s holdings in the EV supply chain experienced a strong rally this year. Chilean lithium producer Sociedad Quimica y Minera de Chile was the Fund’s best performing holding over the last twelve months. Other solid contributors to the Fund’s returns included Japanese conglomerate Panasonic Corp., a major global supplier of lithium ion batteries, and Belgian cathode manufacturer and metal recycler Umicore.

The Fund’s overweight and stock selection within Technology contributed the most to Fund performance from a sector perspective over the past twelve months, helped by Dutch semiconductor equipment manufacturer ASML and Israeli cyber security company Check Point Software. During this same time period, stock selection in the Consumer Discretionary sector was the largest detractor from Fund performance, hurt by earnings disappointments from German media company ProSieben Sat.1 and Japanese holdings Shimano, a bike part manufacturer, and Rakuten, an ecommerce company. Teva Pharmaceutical was the largest individual detractor to the Fund’s performance over the last twelve months due to tougher competition and pricing pressures for U.S. generic drugs and has been sold from the portfolio.

Boston Common Equity Fund -Investment Outlook

Over the course of the last six months, we exited several long-term holdings whose relative prospects we found lagging and redirected the funds within the respective sectors. In Health Care, we sold pharmaceutical giant Roche and bought two new names in this sector. Novo Nordisk is a global leader in diabetes therapies. The company’s approach to access to medicine, product quality and safety, and emissions management, particularly in relation to water, makes Novo Nordisk a strong ESG performer. As a Danish biotechnology manufacturer we purchased the “ADRs” (American Depository Receipts) seeing valuations near a 20-year low in its price-to-earnings multiple. We also purchased Danaher Corp., an “old-line” industrial business that has reorganized and remade itself into a healthcare company with strong science & technology franchises. We see compelling value in its ongoing restructuring to improve margins coupled with attractive organic growth prospects.

We have increased our exposure to Technology as we expect continued revenue and earnings growth from superior capital investment and innovation. As electronic sensors, artificial intelligence and everyday automated conveniences find additional applications, we see increased proliferation in semiconductor content. We bought semiconductor-equipment manufacturer Applied Materials, following on its strong earnings reports and the expected ongoing strength of the semiconductor cycle. We also added to Oracle when the stock fell following an earnings miss. We believe this should largely be a hiccup as the company successfully transitions its business to the internet cloud.

In Utilities, we added to 8Point3 Energy Partners increasing our direct exposure to clean energy assets. 8Point3 (so named because it takes sunlight about 8.3 minutes to reach Earth!) owns solar energy generation assets and offers shareholders above-average yields from its underlying strong and stable cash flows. We initiated a position in American Water Works, a leading provider of municipal water and waste water services that should benefit from any advancement in infrastructure spending. While the current dividend is not reflective of this sector’s yield, we see strong growth over the near term. To fund these purchases we sold electric utility National Grid

Management’s Discussion of Fund Performance for the period ending September 30, 2017.

The Fund’s relative performance lagged significantly in October and November of 2016 impacted by several disappointing earnings reports and the equity markets’ sharp directional change post the U.S. election results. Investors quickly placed a positive spin on the outcome, focusing on the pro-cyclical aspects of expected policy reform: increased infrastructure spending, lighter regulation, and lower taxes. High-quality growth factors (less financial leverage, more stable earnings, and end-market growth) came under pressure while low-quality cyclical stocks appreciated strongly.

Since December, the Fund’s performance has matched the continued advance in the U.S. equity markets. Stock selection within the strongest performing sectors of Technology and Financials was the main driver of positive relative performance. The Fund remains slightly overweight Technology. The top contributor over the last year on a relative basis, Apple, continues to successfully manage its new product cycles. Strength in Internet and Software & Services industries helped propel other technology holdings over the last year including Microsoft, Check Point Software, and Cognizant. Semiconductor-equipment manufacturer ASML was another of the Fund’s key contributors.

The anticipation of a steeper yield curve has been a positive for many financial companies. Large banks that have improved their balance sheets since the financial crisis and performed well on this summer’s “stress” tests are now likely to get permission for larger share buy-backs and dividend payouts. This positive environment for bank earnings resulted in strong performances by JP Morgan Chase, PNC Financial, and Fifth Third Bancorp. Morgan Stanley rallied along with brokerage houses.

From an allocation perspective, the Fund’s underweight to the Energy sector was also beneficial. Longer-term we believe efficiency improvements and shifts in transport will suppress oil demand, and thus we remain cautious on Energy stocks over the course of the last twelve months, many of the Fund’s poorest performing holdings were those impacted by earnings disappointments including pharmacy manager and retailer CVS Health and fast casual restaurant Chipotle Mexican Grill. In most cases, we believe the specific challenges are shorter-term. In the case of auto parts retailer Advanced Auto Parts, we recently added to the Fund’s holdings, believing their business model can prove more resilient than some to competition from online alternatives. Verizon, the Fund’s worst performing holding on a relative basis, was impacted as telecom providers re-introduced unlimited data plans hurting the pricing environment and creating a one-time shock to earnings. The Industrial sector detracted from performance over the course of the last twelve months as the Fund’s holdings did not keep up with the overall strength of this sector. In the last six months, the Consumer Discretionary sector was a particular drag on relative performance as disruption in how individuals purchase entertainment has clouded the near-term outlook for media giant Disney and advertiser/media services companies Interpublic Group and Nielsen Holdings.

The Fund also sold its holdings in Equifax on the announcement of the significant data security breach. We were disappointed by the lack of transparency and poor disclosure on the part of management, understanding that their actions opened the company to both financial and brand equity risk.

Performance Results

Aspiration Redwood Fund

9/30/2017 Annual Report filed as of 12/8/2017

Observations

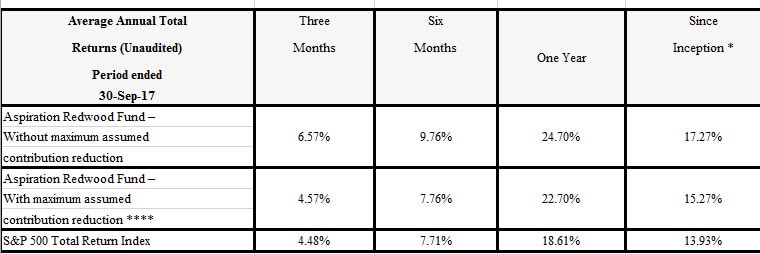

- The fund, which began operations on November 16, 2015 (for the Investor Class Shares) and is managed by Aspiration Fund Adviser, LLC and sub-advised by UBS Asset Management (Americas) Inc., has been outperforming its S&P 500 benchmark index. The fund features a unique fee structure and clients of the adviser may pay a fee in the amount they believe is fair ranging from 0% to 2.00% of the value of the .

- The fund reiterates its sustainable strategies, but outcomes/impacts are not reported either qualitatively or quantitatively.

Principal Sustainable Investment Strategy

The Sub-Adviser will employ both a positive and negative screening process in selecting securities for the Fund. The positive screening process will identify securities of companies that are fundamentally attractive and that have superior valuation characteristics. In addition, the positive screening process will also include material, fundamental sustainability factors that the Sub-Adviser believes confirm the fundamental investment case and can enhance the ability to make good investment decisions. The sustainability factors are material extra-financial factors that evaluate the environmental, social and governance performance of companies that, along with more traditional financial analytics, identify companies that the Sub-Adviser believes will provide sustained, long-term value. The Sub-Adviser believes that the sustainability strategy provides the Fund with a high quality portfolio and mitigates risk.

The Sub-Adviser also applies a negative screening process that will exclude from the Fund’s portfolio securities with more than 5% of sales in industries such as alcohol, tobacco, defense, nuclear, GMO (Genetically Modified Organisms), water bottles, gambling and pornography, and will entirely exclude all firearms issuers and companies within the energy sector as defined by MSCI and its Global Industry Classification Standard (GICS).

Report Commentary

Two years ago, we launched the Aspiration Redwood Fund — challenging a conventional wisdom among some on Wall Street that you had to sacrifice your values to make money.

Refusing to accept the status quo, we set out to demonstrate that you can in fact do well while doing good. And in these past two years, we have done just that1:

- Outperformed the S&P 500 by 6%! (for the one-year period ending September 30, 2017)2

- Top 2% of all large cap equity funds in America (according to Morningstar for the one-year period ending September 30, 2017)3

- Five out of Five Globes for the top Sustainability rating (according to Morningstar as of September 30, 2017)4

- According to Barron’s 2017 Funds with Sustainable Goals ranking, Aspiration is ranked #2! Among funds that had fewer than $300 million in assets!5

- 100% fossil-fuel and firearm free!

While we are thrilled with what we’ve accomplished together, we are not content to rest on our laurels. We recognize that the stakes have never been higher for giving consumers and investors the ability to combine investment value and personal values.

That’s why we are continuing our pledge to you. We promise to keep the Aspiration Redwood Fund 100% fossil-fuel and firearm free. And we promise to only invest in companies with sustainable environmental, workplace and governance practices to ensure we honor your values while helping build value in your portfolio.

Thank you again for your investment in the Aspiration Redwood Fund. We are proud to be a financial firm you trust and we promise to continue to put your needs first as we offer you innovative and sustainable financial services. If you ever have any questions, please contact us at hello@aspiration.com.

1One year performance returns and rankings referenced below are based on one year total return ending September 30, 2017 without assuming the maximum Pay What is Fair contribution. For more details, please refer to the important disclosures below.

2 Please see the standard performance table illustrating the performance of the Fund, and please refer to the Morningstar ranking for the most recent performance information as compared to the S&P 500.

3 The Fund received the top two percent ranking from Morningstar based on a comparison of 1,307 funds within Morningstar’s Large Blend category. The Fund’s rating was based on one year total return performance from September 30, 2016 to September 30, 2017. The Large Blend category is comprised of US-based companies with a market capitalization of $10 billion or more.

4 The Fund received five out of five globes and a sustainability rating by Morningstar as of August 31, 2017, which is the most recent ranking information available. The rating is within the Morningstar Large Blend category based on a comparison of 1,390 funds for the one-year period ending September 30, 2017, which is the most recent ranking information available. Sustainalytics provides company-level analysis in the calculation of Morningstar’s Sustainability Score based on information provided in the Fund’s prospectus.

5 The Fund ranked number two according to Barron’s List of Funds with Sustainable goals, but did not qualify for their primary rankings list. This ranking is based on one-year total return as of September 30, 2017 and includes 55 actively managed U.S. stock funds with a sustainable mandate, but with fewer than $300 million in assets or lower sustainability ratings.

Performance Results

First Trust Global Wind Energy ETF (FAN)

9/30/2017 Annual Report filed as of 12/8/2017

Observations

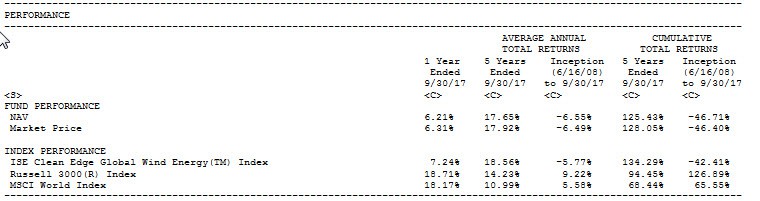

- The fund, which seeks to replicate the price and yield performance (before fund fees and expenses) of the ISE Clean Edge Global Wind Energy Index, lagged the index on a market and NAV basis over the 1-year, 5-year and since inception periods.

- On its face, FAN qualifies for classification as a sustainable fund since it invests in public companies throughout the world that are active in the wind energy industry. Wind power is a clean renewable fuel source that doesn’t pollute the air with atmospheric emissions that cause acid rain, smog or greenhouse gas emissions. But index funds generally don’t provide any qualitative or quantitative information regarding the nature of any societal or, in this instance, environmental outcomes that may be desired by sustainable investors. FAN is no exception. In fact, sustainable investors who may embrace a thematic fund such as FAN for both investment reasons and because it advances a sustainable investing strategy may wish to take into consideration the fact that some of the companies held by FAN include US firms such as Duke Energy, NextEra and NRG or Germany’s RWE AG—all of which are also nuclear power plant operators or a firm like GE which is engaged in the construction of nuclear power plants.

Principal Sustainable Investment Strategy

The fund, which seeks to replicate the price and yield performance (before fund fees and expenses) of the ISE Clean Edge Global Wind Energy Index. The fund invests in public companies throughout the world that are active in the wind energy industry. Wind power is a clean renewable fuel source that doesn’t pollute the air with atmospheric emissions that cause acid rain, smog or greenhouse gas emissions.

Report Commentary

The majority of the Fund’s performance came from its holdings domiciled in France. French securities were given an allocation of 5.3%, had a return of 47.8%, and contributed 2.4%. The Fund’s holdings amongst Germany were the least contributing with a -1.7% contribution, stemming from their high allocation of 13.9% and low return of -11.1%. Brazilian securities were the worst performing securities however with a -35.5% return. The Fund’s currency

exposure led to a 3.2% contribution, primarily impacted by the Euro (2.1% contribution) and the Japanese Yen (-0.2% contribution). On a relative basis, the Fund underperformed the benchmark primarily due to the Fund underperforming the benchmark amongst German securities by -37.8% creating -5.4% of drag. The Fund’s holdings in France reversed 1.1% of drag as the Fund outperformed the benchmark by 16.9%.

Performance Results

John Hancock International ESG Equity Fund

9/30/2017 Annual Report filed as of 12/272017

Observations

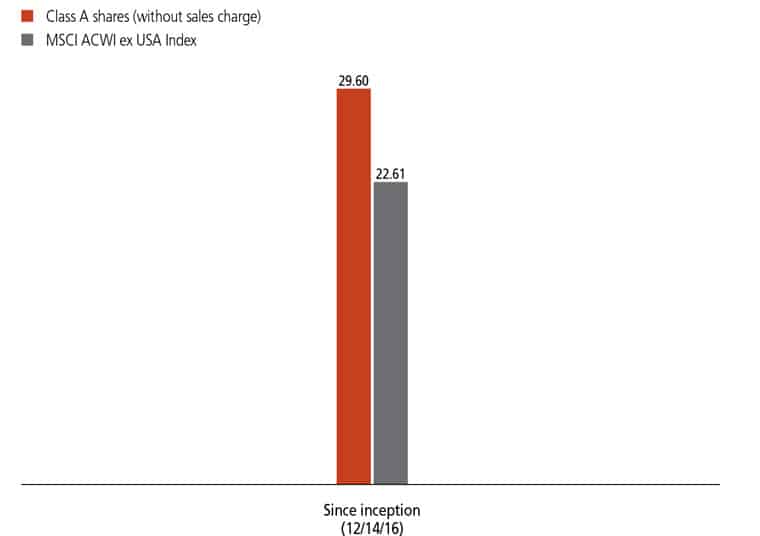

- The International ESG Equity Fund, managed by Boston Common Asset Management, is one of 3 Harford ESG oriented funds filing an annual report as of December 27. From its inception on December 14, 2016, through October 31, 2017, the fund’s Class A shares generated a total return of 29.60% (excluding sales charges) and outpaced the gain of its benchmark, the MSCI ACWI ex-USA Index. In addition to stock selection and sector positioning, the fund’s overweight position in the emerging markets positioned it to benefit from this segment’s outsize return (unlike the Boston Common International Fund whose mandate is focused on developed markets).

- The interview with Portfolio Manager Praveen S. Abichandani, CFA, Boston Common Asset Management offers insights into Boston Common’s investment management process and informs readers on how ESG attributes are considered in fundamental research. Also, the interplay between ESG and active shareholder engagement.

Principal Sustainable Investment Strategy

The manager seeks companies meeting its sustainability criteria with high-quality characteristics, including strong or improving environmental, social, and governance (ESG) records.

The fund primarily invests in a diversified portfolio of equity securities of foreign companies in a number of developed and emerging markets outside of the United States. The fund defines foreign companies as companies: (i) that are organized under the laws of a country outside the United States; or (ii) that have a minimum of 50% of their assets, or that derive a minimum of 50% of their revenue or profits, from businesses, investments, or sales outside of the United States.

The manager seeks to preserve and build capital over the long term through investing in a diversified portfolio of international-developed and emerging- market stocks of companies it believes are high quality and under-valued. The manager looks for companies with sound governance and a history of responsible financial management that, in its opinion, are capable of consistent profitability over a long time horizon. The manager seeks to fully integrate ESG criteria into the stock selection and portfolio construction process and expresses a preference for best-in-class firms with innovative approaches to the environmental and social challenges their industries, society, and the world face. “Best-in-class” refers to firms that the manager views as having better records on ESG criteria than other firms in the same industry or sector.

The manager seeks to identify companies with a demonstrated overall high level of accountability to all stakeholders, including providing safe, desirable, high-quality products or services and marketing them in responsible ways. ESG criteria reflect a variety of key sustainability issues that can influence company risks and opportunities and span a range of metrics including board diversity, climate change policies, water management policies, and supply chain and human rights policies. The fund may focus its investments in a particular sector or sectors of the economy. The fund will avoid investments that in the judgment of the manager have material direct revenues from production of nuclear power, tobacco, and/or weapons/firearms.

The manager selects stocks through bottom-up, fundamental research, while maintaining a disciplined approach to valuation and risk control. The manager may sell a security when its price reaches a set target, if it believes that other investments are more attractive, when in its opinion ESG performance significantly deteriorates, or for other reasons it may determine.

The manager employs active shareowner engagement to raise environmental, social, and governance issues with the management of select portfolio companies. Through this effort, the manager seeks to encourage company managements toward greater transparency, accountability, disclosure, and commitment to ESG issues.

Report Commentary

How would you describe the investment environment during the time of the fund’s inception on December 14, 2016, to the end of the reporting period on October 31, 2017?

Global equity markets performed very well in this interval, as favorable market conditions fueled a persistently high appetite for risk among investors. Economic growth continued to accelerate across the world, with better-than-expected data out of regions that had previously been sources of concern, such as China and Europe. Improving corporate earnings provided additional fuel for market performance, as did the hope for a reduction in the corporate tax rate in the United States. Not least, investors remained confident that economic growth—while exceeding expectations—would not strengthen to a point that would prompt global central banks to take a more aggressive approach to tightening monetary policy. Together, these developments helped propel the fund’s benchmark—the MSCI ACWI ex-USA Index—to a return of 22.61% in the abbreviated reporting period.

How would you describe your investment approach?

We combine traditional fundamental stock research with analysis of environmental, social, and governance (ESG) factors. The core of our philosophy is the view that companies attentive to ESG issues tend to be better-managed, higher-quality businesses, and are therefore in a better position to generate superior market performance over time.

We invest with a long-term time horizon and an emphasis on quality from both a traditional point of view (strategic and financial) and from an ESG perspective. We look for companies with positive ESG attributes (after exclusions for certain revenue sources) and strive to invest in those that are generating attractive returns on invested capital from sustainable business models with limited financial leverage. At the same time, we avoid companies whose business models we consider unsustainable and whose financial reporting and managerial accountability we find untrustworthy.

While we prefer to buy the stocks of the strongest companies from an ESG perspective, we will not invest in a company with a weak investment outlook even if it has a compelling ESG profile. In industries where we are unable to find enough companies that are attractive from both an investment and ESG standpoint, we invest in companies with above-average ESG scores and use active shareholder engagement to urge their management teams to improve their policies and operations.

Can you provide some examples of your investment process at work?

Our approach to the financials sector helps illustrate the traits we look for when we invest in individual companies. Many global banks fund projects that lead to increased carbon emissions (e.g., financing coal-fired power plants). To avoid investing in companies with these types of lending practices, we conducted an extensive analysis of the 62 largest global banks—including meetings with many management teams—to learn more about how they look at this issue. Our findings have played a role in determining which financial stocks we should hold and which we should put on review until their practices conform to our standards. Fortunately, we have seen banks becoming increasingly aware of the financial and reputational risks associated with inattention to environmental issues. Credit rating agencies have begun to take these factors into account, as well. We believe this is a positive development that indicates an expanding awareness of climate issues while also broadening our potential investment universe.

Another area of potential change involves the labeling of food products in the emerging markets. Whereas labeling standards in the United States can help consumers decide what they should eat, we haven’t yet seen an adoption of similar practices in the developing world. This has led us to work with a number of major global food producers to encourage them to adopt better labeling voluntarily. We believe this represents a prime example of our willingness to engage companies and encourage them to gravitate toward the ESG standards we seek.

We believe these aspects of our approach help provide insight into our process at work. Looking ahead, we will continue managing the fund in a way that integrates both ESG and traditional financial metrics while also using active engagement to make already good companies better through shareholder advocacy.

What factors helped and hurt the fund’s results in the period?

The fund’s Class A shares returned 29.60%, excluding sales charges, from its inception through October 31, 2017, outperforming the return of the benchmark in the same interval. The outperformance was broad based, with returns above or in line with those of the index across all of the major sectors. The largest margins of outperformance occurred in materials, financials, consumer staples, and energy. The fund also gained a modest benefit from its sector allocations.

Among individual positions, the chemical company Sociedad Química Y Minera de Chile SA (SQM) was the largest contributor to returns. SQM is the leading producer of lithium in the world, which put it in a strong position to capitalize on the rapid adoption of electric vehicles. BYD Company Ltd., one of the largest electric car producers in China, was a further beneficiary of rising demand in this area. China was also home to another of the fund’s top performers, Alibaba Group Holding Ltd. The internet giant has experienced robust growth across multiple business lines, fueling a substantial gain in its stock price. Naspers Ltd. (South Africa), Shiseido Company, Ltd. (Japan), and Unilever NV (United Kingdom) were additional contributors of note.

On the negative side, the Japanese bicycle-components producer Shimano Inc. was a key detractor due to its weaker-than-expected growth. Although the stock experienced fairly modest downside, it nonetheless took away from relative performance at a time of impressive strength in the broader market. Several other Japanese companies, including Astellas Pharma, Inc., Mitsubishi UFJ Financial Group, Inc., and Orix Corp, detracted due to the broader weakness in the country’s stock market relative to the global indexes. Outside of Japan, the leading detractor was Barclays PLC, which underwent a significant restructuring. On balance, however, we are pleased with the results our stock selection process produced since the fund’s inception.

How would you summarize the fund’s positioning at the close of the period?

We hold a positive view on the world economy, and we believe there is more room for cyclical improvement in regions outside the United States. The fund had overweight positions in both the emerging markets and developed Europe, and we have begun to identify a growing number of opportunities in Japan. The portfolio is underweight in commodity-exposed countries (Canada and Australia) and sectors (materials and energy) for both economic and ESG reasons. Conversely, we favor the technology and healthcare sectors on the basis of their hearty secular growth and above-average ESG scores. The overall portfolio tends to be more growth oriented than the benchmark, with a tilt toward higher-quality stocks with less expensive valuations.

Performance Results

TIAA Social Choice Low Carbon Equity Fund

10/31/2017 Annual Report filed as of 12/28/2017

Observations

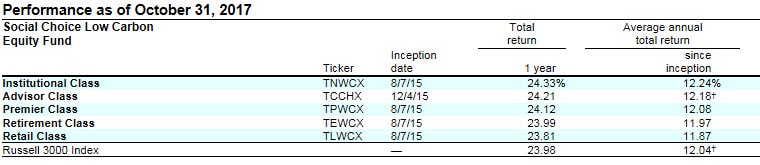

- The Social Choice Equity Fund reports lower than benchmark results over the last 1,5 and 10-year intervals. The performance of the more recently launched Social Choice Low Carbon Equity Fund is mixed with 4 of 5 share classes trailing the Russell 3000 Index during the fiscal year and 3 of 5 share classes lagging the index since inception. The Social Choice International Fund, which was launched in August 2015, outperforms the designated MSCI EAFE Index since inception, however, only 1 share class out of 5 beat the index during the latest 1-year reporting period. The one share class exception is the institutional share class that is subject to a lower expense ratio.

- The reports do provide some linkages to individual companies, their selection or exclusion based on ESG considerations and, in turn, their impact on a fund’s performance. At the same time, the reports do not provide qualitative or quantitative information as to impacts, especially with regard to the Low Carbon Equity Fund. That said, relevant information regarding societal impacts may be found in other reports and research published by TIAA. Teachers Advisors, LLC

Principal Sustainable Investment Strategy

The fund invests in companies whose activities are consistent with the fund’s ESG criteria, which include additional criteria relating to carbon emissions and fossil fuel reserves.

The fund’s investments are subject to certain ESG criteria. The ESG criteria are implemented based on data provided by independent research vendor(s). All companies must meet or exceed minimum ESG performance standards to be eligible for inclusion in the fund. The evaluation process favors companies with leadership in ESG performance relative to their peers. Typically, environmental assessment categories include climate change, natural resource use, waste management and environmental opportunities. Social evaluation categories include human capital, product safety and social opportunities. Governance assessment categories include corporate governance, business ethics and government and public policy. How well companies adhere to international norms and principles and involvement in major ESG controversies (examples of which may relate to the environment, customers, human rights and community, labor rights and supply chain, and governance) are other considerations.

The ESG evaluation process is conducted on an industry-specific basis and involves the identification of key performance indicators, which are given more or less relative weight compared to the broader range of potential assessment categories. Concerns in one area do not automatically eliminate an issuer from being an eligible Fund investment. When ESG concerns exist, the evaluation process gives careful consideration to how companies address the risks and opportunities they face in the context of their sector or industry and relative to their peers. The fund will not generally invest in companies significantly involved in certain business activities, including but not limited to the production of alcohol, tobacco, military weapons, firearms, nuclear power and gambling products and services.

In addition to the overall ESG performance evaluation, the fund favors companies that (1) demonstrate leadership in managing and mitigating their current carbon emissions and (2) have limited exposure to oil, gas, and coal (i.e., fossil fuel) reserves. The determination of leadership criteria takes into consideration company carbon emissions both in absolute terms (e.g., tons of carbon emitted directly into the atmosphere) and in relative terms (e.g., tons of carbon emitted per unit of economic output such as sales). Reserves are fossil fuel deposits that have not yet been extracted.

The Corporate Governance and Social Responsibility Committee (the CGSR Committee) of the Board of Trustees of the Trust (Board of Trustees) reviews the ESG criteria used to determine eligibility of the securities held by the fund and approves the vendor of that service. Advisors seeks to ensure that the fund’s investments are consistent with its ESG criteria, but Advisors cannot guarantee that this will always be the case for every Fund investment. Consistent with its responsibilities, the CGSR Committee evaluates options for implementing the fund’s ESG investment criteria and monitors the ESG vendor(s) selected to supply the ESG-eligible universe. Advisors has the right to change the ESG vendor(s) at any time and to add to the number of vendors providing the universe of eligible companies. Investing on the basis of ESG criteria is qualitative and subjective by nature, and there can be no assurance that the process utilized by the Fund’s vendor(s) or any judgment exercised by the CGSR Committee or Advisors will reflect the beliefs or values of any particular investor.

Report Commentary

Excluding some stocks lifts the fund’s return above its benchmark

Because of its ESG criteria, the fund did not invest in a number of stocks included in the Russell 3000 Index. Avoiding these companies produced mixed results during the twelve-month period, but the net effect was to increase the fund’s return relative to that of its benchmark.

Excluding certain stocks boosted the fund’s relative performance. Chief among them were General Electric, Exxon Mobil and AT&T. General Electric suffered from a stream of bad news, including weak earnings, the announced early departure of CEO Jeff Immelt and the possibility of a dividend cut. Exxon Mobil endured a tough year for oil and gas companies, during which weaker-than-expected earnings disappointed investors. U.S. wireless carrier AT&T lost more video subscribers than expected due to intense competition in the pay-TV space and the impact of recent hurricanes.

Certain stock exclusions detract from the fund’s relative performance

Key detractors among excluded stocks were Apple, Bank of America and JPMorgan Chase. Apple benefited from investor enthusiasm for new versions of the iPhone and increasing sales for iPads, Mac computers and Apple’s services. Stocks of large U.S. banks performed well, helped by improved efficiency that was driven by investments in mobile and online banking platforms. Revenue growth for Bank of

America and JPMorgan Chase was higher than that of their peers. In addition, earnings for the most recent quarter rose for Bank of America and JPMorgan Chase compared to the previous year.

Choosing to overweight some stocks helps the fund outperform

To compensate for the exclusion of some stocks within the Russell 3000 Index, the fund’s managers use quantitative (mathematical) modeling and other techniques in an attempt to match the overall investment characteristics of the portfolio with those of the index and to manage risk.

Leading contributors among the fund’s holdings were overweight positions in NVIDIA, Applied Materials and Caterpillar. Information technology company NVIDIA saw strength in its core gaming business and rapid adoption of products for artificial intelligence, self-driving cars and cryptocurrencies like Bitcoin. Shares of semiconductor giant Applied Materials benefited from record sales and the announcement of a new approach to chip design. Equipment manufacturer Caterpillar gained as the environment for industrial companies improved and metal prices rebounded.

Partly offsetting contributions from these investments were overweight positions in Schlumberger, Kraft Heinz and Baker Hughes, a GE company. Energy giant Schlumberger reported that revenue was below investors’ expectations due to weakness in the company’s international business. Shrinking supermarket shelf space and consumers’ growing preference for fresh, healthy food led to declining sales for consumer staples company Kraft Heinz. The merger of General Electric’s oilfield services division with Baker Hughes created a combined company that began trading on the New York Stock Exchange under a new ticker, BHGE. On the first day of trading, BHGE shares opened lower due to a one-time dividend payment of $17.50 per share.

Performance Results

TCW New America Premier Equities

Annual Report as of 10/31/2017 filed 12/28/2017

Observations:

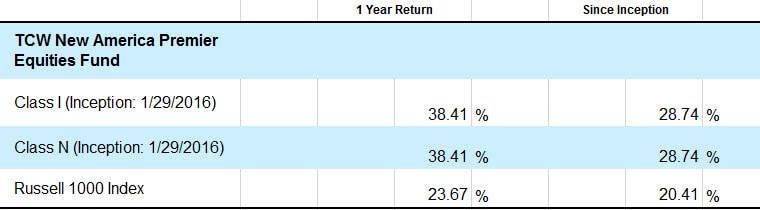

- The fund achieved strong one-year and since inception (1/29/2016) results relative to its Russell 1000 benchmark.

- While qualitative or quantitative impact disclosures are not provided nor is there commentary around individual stocks and ESG related factors, the manager does offer insights into the role of ESG analysis. The manager eschews reliance on macroeconomic forecasts and projections of the future directions markets and emphasizes instead future free cash flows that is a key determinant of the future returns of an investment. The manager goes on to observe the existence of a significant correlation between companies that manage their resources prudently and businesses that sport strong financial metrics. Businesses that meet our rigorous ESG performance requirements typically have higher free cash flow yields, higher total yields, higher margins and lower levels of financial leverage.

Principal Sustainable Investment Strategy

The fund intends to achieve its objective by investing in a portfolio of companies the

portfolio manager believes are enduring, cash generating businesses whose leaders prudently manage their environmental, social, and financial resources and whose shares are attractively valued relative to the free cash flow generated by the businesses.

Report Commentary

For the fiscal year, the Fund benefited from concentrated investments in Transunion, Baxter International, The Trade Desk Inc. and Activision Blizzard Inc. The Fund was negatively impacted by investments in Sealed Air Corporation, Transdigm Corporation, and Conagra Brands Inc. Security selection was the primary driver of the Fund’s outperformance during the period.

As we have indicated in the past we eschew reliance on macroeconomic forecasts and projections of the future direction of markets — our view is that these factors are unknowable. We, therefore, focus on what we think is knowable. We believe in a thorough assessment of investment opportunities at the security level that will provide us, in some cases, with a high probability view of the future free cash flows of a business, which is a key determinant of the future returns of an investment. We believe that we have made good decisions in this respect and that the portfolio of companies is built to weather most market environments.

We believe that controlling risk is an integral part of the portfolio management process. Since its inception, the Fund was able to generate solid returns while exposing our clients to lower risk relative to the broad market. The Fund seeks to outperform the Index in both rising and falling markets with less risk and volatility. We seek to accomplish this objective by investing in a concentrated portfolio of businesses that carefully manage their environmental and social resources and that employ best in class corporate governance practices. We invest in businesses that have high barriers to entry, are stable, generate substantial free cash flow and are managed by prudent leaders.

The traditional fundamental analysis does not capture risks associated with managing environmental resources nor does it assess the performance of businesses from the perspective of resource efficiency. Traditional analysis does not typically assess the risks associated with a heterogeneous workforce nor does it assess the competence, quality and engagement level of the Board of Directors. Our investment framework not only pays close attention to these issues, but we also quantify, score, and rank companies and exclude businesses based on these risk factors. While those risks are not quantified through traditional financial analysis, we have found a significant correlation between companies that manage their resources prudently and businesses that sport strong financial metrics. Businesses that meet our rigorous ESG performance requirements typically have higher free cash flow yields, higher total yields, higher margins and lower levels of financial leverage.

In fast growing businesses or in industries that are undergoing rapid changes it is extraordinarily difficult and often dangerous to make an investment in a business when the long-term cash generation potential of the enterprise has a wide spectrum of outcomes. We seek to avoid companies and industries that are undergoing rapid changes.

What we do seek, however, are stable businesses that have dominant market positions, and whose long-term cash flows we believe can be predicted reasonably well. The qualitative characteristics that we seek, including attractive industry structures, pricing power and dominant market positions, make us confident in our forecast of the future cash flows of the business and therefore provide greater confidence that our valuation of the business is reasonably accurate.

The famed value investor Benjamin Graham once said, “In the short run, the market is a voting machine but in the long run, it is a weighing machine.” Our view is that the market weighs cash flows and in order to consistently purchase a security for less than what it is worth, one should have high confidence in the future free cash flows of a business.

Performance Results

The commentary appearing in this document represents excerpts taken from selected semi-annual and annual reports published by sustainable mutual funds and exchange-traded funds (ETFs) during the past month. The intention of the Round Up is to track relevant commentary and performance results provided by funds that pursue sustainable strategies across varying sectors and asset classes in an effort to better understand how such strategies are directly affecting performance results achieved during the covered reporting periods and also to tease out any information regarding positive societal outcomes achieved through the implementation of these sustainable strategies. These are juxtaposed against the fund’s sustainable investing strategy. Interested readers should consult the funds’ annual and semi-annual reports for the complete text of management’s discussions of investment outlook and fund performance.

The Round-Up is not intended to cover all semi-annual and annual reports filed during the course of the month, but rather to offer a representative sampling by some of the leading sustainable funds in their respective sectors.