The Bottom Line: 54 of the top and bottom sustainable fund performers in May across three investment categories employ ESG integration, ESG-Mixed or ESG-Consideration strategies.

Summary

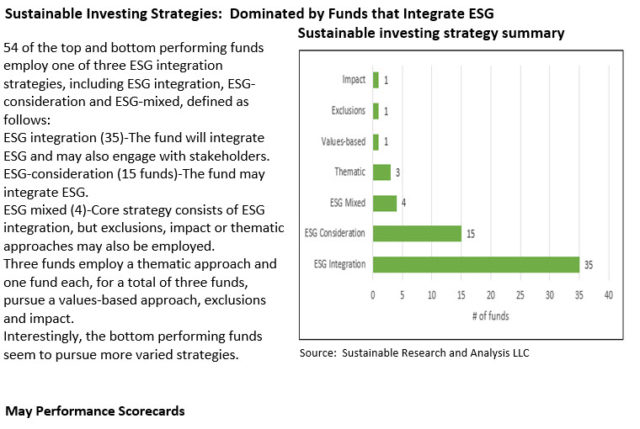

Sustainable mutual funds and ETFs,[1] a combined total of 4,464 funds/share classes with almost $2.6 trillion in assets at the end of May, recorded an average increase of 4.43% in the same month. Average returns posted by funds that comprise the three sectors featured in the May Performance Scorecard ranged from 2.72% recorded by fixed income funds to 6.22% recorded by US equity and sector equity funds. International funds generated an average return of 4.86%. 54 of the top and bottom performing funds employ one of three ESG integration strategies, including ESG integration, ESG-consideration and ESG-mixed. Three funds employ a thematic approach and one fund each, for a total of three funds, pursue a values-based approach, exclusions and impact. Interestingly, the bottom performing funds seem to pursue more varied strategies.

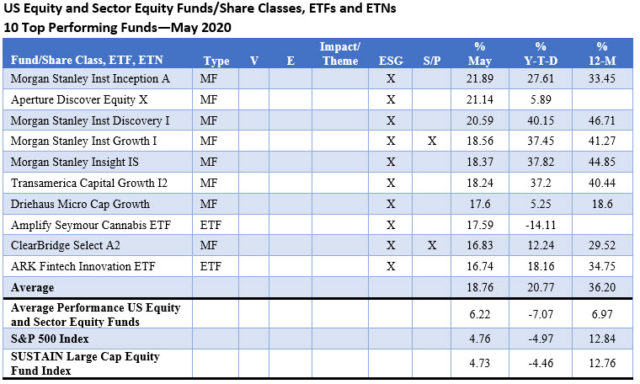

US Equity and Sector Equity Funds-Average Performance 6.22%

There was a wide 20.11% variation between the average of the top and bottom performing equity funds in May. Leading funds were largely dominated by small cap funds, but two ESG integrating ETFs focused on the Fintech and cannabis themes also found their way into the range of the top 10 performing equity and equity sector funds. Bringing up the rear were real estate funds that stood out and dominated the field of the 10 bottom performers.

Regardless of their ranking, the top and bottom performing funds were dominated by funds that integrate ESG factors into investment decisions. Of 19 funds in total, two funds equivocate on ESG integration, having adopted prospectus language to the effect that “…management may consider information about Environmental, Social and Governance (ESG) issues in its fundamental research process and when making investment decisions.” Further, six of the funds explicitly refer to company engagement practices. The one remaining fund, the Knights of Columbus Global Real Estate Fund I, qualifies on the basis of a Christian-values based orientation that relies on an exclusionary approach.

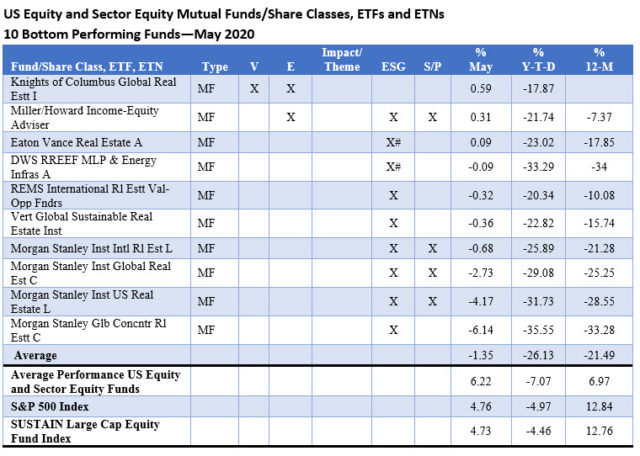

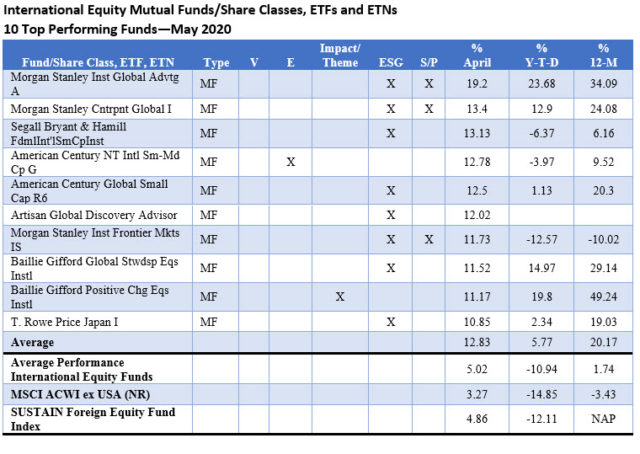

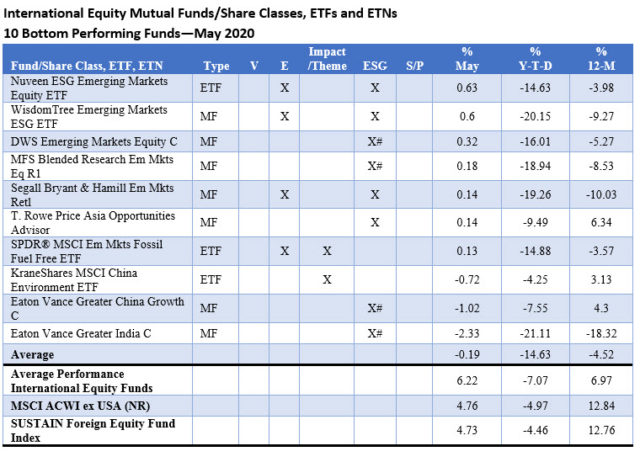

International Equity Funds-Average Performance 4.86%

While small cap funds led the top performing funds category and emerging market funds dominated the bottom performing funds category, there was some diversity in fundamental fund strategies as well as sustainable investing approaches across the two performance categories. Sixteen of the funds employ an ESG integration approach, however, four of these funds disclose in their prospectuses that ESG may be taken into consideration. Further, five funds combine ESG integration with exclusions versus only one such fund in the US and sector equity segment. Three funds pursue thematic themes, including two environmental-themed funds, the SPDR MSCI Emerging Markets Fossil Fuel Free ETF and KraneShares MSCI China Environment ETF. A third, the Baillie Gifford Positive Change Equities Fund, invests in companies that the fund’s portfolio managers consider to have core ambitions of delivering a positive change in at least one of the following areas: social inclusion and education, healthcare, the environment, and addressing basic needs and aspirations of the world’s poorest populations.

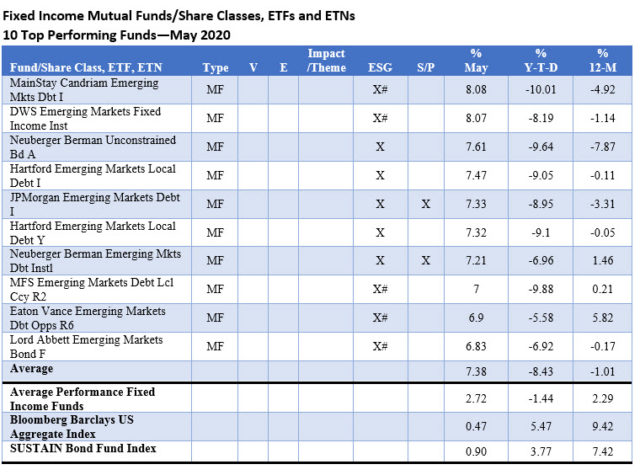

Fixed Income Funds-Average Performance 2.72%.

The top 10 performing fixed income funds, propelled by their exposure to emerging markets debt, achieved an average return of 7.38% versus an average of 2.72% posted by the entire universe of taxable and municipal bond funds on a combined basis—a total of X funds. The same 10 funds explicitly integrate ESG factors, however, five of the funds disclose that they may do so.

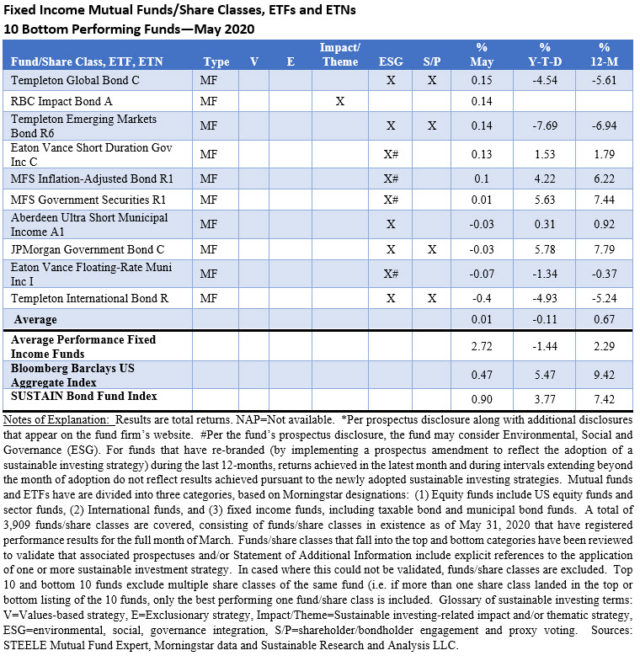

The 10 bottom performing funds barely managed to eke out a positive average result in May, posting an average of 0.01% on the basis of returns that ranged from -0.4% to 0.15%. The field, dominated by shorter maturity funds, was also filled by funds integrating ESG, including four funds that may do so. One fund, the RBC Impact Bond A, pursues an impact strategy. The adviser selects investments that seek to generate returns while simultaneously achieving positive aggregate societal impact outcomes in the following areas: affordable quality shelter, small business growth, health and well-being, environmental sustainability, quality education, community development, reduced inequalities and neighborhood revitalization.

[1] While definitions continue to evolve, sustainable investing refers to a range of five overarching investing approaches or strategies that encompass: values-based investing, negative screening (exclusions), thematic and impact investing and ESG integration. These are not mutually exclusive and shareholder/bondholder engagement and proxy voting may be also be employed by any of the foregoing strategies.

Sustainable Funds Performance Scorecard: May 2020

The Bottom Line: 54 of the top and bottom sustainable fund performers in May across three investment categories employ ESG integration, ESG-Mixed or ESG-Consideration strategies.

Share This Article:

The Bottom Line: 54 of the top and bottom sustainable fund performers in May across three investment categories employ ESG integration, ESG-Mixed or ESG-Consideration strategies.

Summary

Sustainable mutual funds and ETFs,[1] a combined total of 4,464 funds/share classes with almost $2.6 trillion in assets at the end of May, recorded an average increase of 4.43% in the same month. Average returns posted by funds that comprise the three sectors featured in the May Performance Scorecard ranged from 2.72% recorded by fixed income funds to 6.22% recorded by US equity and sector equity funds. International funds generated an average return of 4.86%. 54 of the top and bottom performing funds employ one of three ESG integration strategies, including ESG integration, ESG-consideration and ESG-mixed. Three funds employ a thematic approach and one fund each, for a total of three funds, pursue a values-based approach, exclusions and impact. Interestingly, the bottom performing funds seem to pursue more varied strategies.

US Equity and Sector Equity Funds-Average Performance 6.22%

There was a wide 20.11% variation between the average of the top and bottom performing equity funds in May. Leading funds were largely dominated by small cap funds, but two ESG integrating ETFs focused on the Fintech and cannabis themes also found their way into the range of the top 10 performing equity and equity sector funds. Bringing up the rear were real estate funds that stood out and dominated the field of the 10 bottom performers.

Regardless of their ranking, the top and bottom performing funds were dominated by funds that integrate ESG factors into investment decisions. Of 19 funds in total, two funds equivocate on ESG integration, having adopted prospectus language to the effect that “…management may consider information about Environmental, Social and Governance (ESG) issues in its fundamental research process and when making investment decisions.” Further, six of the funds explicitly refer to company engagement practices. The one remaining fund, the Knights of Columbus Global Real Estate Fund I, qualifies on the basis of a Christian-values based orientation that relies on an exclusionary approach.

International Equity Funds-Average Performance 4.86%

While small cap funds led the top performing funds category and emerging market funds dominated the bottom performing funds category, there was some diversity in fundamental fund strategies as well as sustainable investing approaches across the two performance categories. Sixteen of the funds employ an ESG integration approach, however, four of these funds disclose in their prospectuses that ESG may be taken into consideration. Further, five funds combine ESG integration with exclusions versus only one such fund in the US and sector equity segment. Three funds pursue thematic themes, including two environmental-themed funds, the SPDR MSCI Emerging Markets Fossil Fuel Free ETF and KraneShares MSCI China Environment ETF. A third, the Baillie Gifford Positive Change Equities Fund, invests in companies that the fund’s portfolio managers consider to have core ambitions of delivering a positive change in at least one of the following areas: social inclusion and education, healthcare, the environment, and addressing basic needs and aspirations of the world’s poorest populations.

Fixed Income Funds-Average Performance 2.72%.

The top 10 performing fixed income funds, propelled by their exposure to emerging markets debt, achieved an average return of 7.38% versus an average of 2.72% posted by the entire universe of taxable and municipal bond funds on a combined basis—a total of X funds. The same 10 funds explicitly integrate ESG factors, however, five of the funds disclose that they may do so.

The 10 bottom performing funds barely managed to eke out a positive average result in May, posting an average of 0.01% on the basis of returns that ranged from -0.4% to 0.15%. The field, dominated by shorter maturity funds, was also filled by funds integrating ESG, including four funds that may do so. One fund, the RBC Impact Bond A, pursues an impact strategy. The adviser selects investments that seek to generate returns while simultaneously achieving positive aggregate societal impact outcomes in the following areas: affordable quality shelter, small business growth, health and well-being, environmental sustainability, quality education, community development, reduced inequalities and neighborhood revitalization.

[1] While definitions continue to evolve, sustainable investing refers to a range of five overarching investing approaches or strategies that encompass: values-based investing, negative screening (exclusions), thematic and impact investing and ESG integration. These are not mutually exclusive and shareholder/bondholder engagement and proxy voting may be also be employed by any of the foregoing strategies.

Sustainableinvest.com

Benefits

Free access to regularly updated original research and analysis focused exclusively on sustainable finance and investing, providing investors with the guidance needed to make informed investment decisions that align with their personal values and financial goals while also contributing to the advancement of positive long-term environmental and social outcomes.

By offering financial support for our current work, either in the form of a one-time or regular contributions, you help to defray some of the costs associated with conducting our research and analysis as well as to maintain the www.sustainablest.wpengine.com website.

Helping us to expand our research capabilities and offerings over time to cover additional relevant topics geared to sustainable investors.

Sign up to free newsletters.

By submitting this form, you are consenting to receive marketing emails from: . You can revoke your consent to receive emails at any time by using the SafeUnsubscribe® link, found at the bottom of every email. Emails are serviced by Constant Contact