The Bottom Line: Assets attributable to sustainable funds gained $255.1 billion, 16% month-over-month increase, to end January 2020 with $1.87 trillion in assets—another new high.

Another new high: Assets attributable to sustainable funds gained $255.1 billion, or 16% month-over-month to end January 2020 with $1.87 trillion in net assets

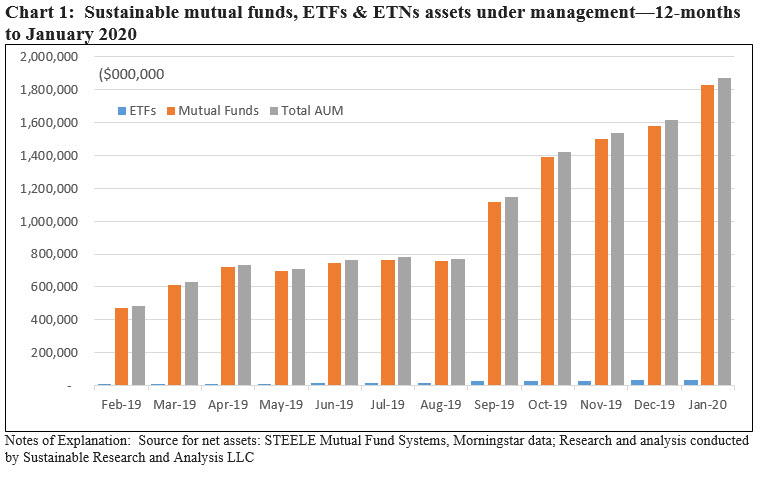

Net assets of sustainable mutual funds and ETFs(1) reached another all-time high of $1.87 trillion at the end of January, or an increase of $255.1 billion. Mutual funds contributed $250.5 billion or 98% of the increase to end the month at $1.83 trillion. Exchange-traded funds, on the other hand, ended January at $38.3 billion with the addition of $4.6 billion. Refer to Chart 1.

The month-over-month increase in assets was again attributable largely to fund re-brandings, while market deprecation and net cash outflows both had negative impacts on flows due to divergent stock and bond market results.

Fund re-brandings added $319.3 billion, estimated net outflows, including money market funds, pulled -$59.2 billion while market movement contributed to an estimated decline of -$5.0 billion

Including money market funds, which now account for a whopping 30.9% of assets sourced to sustainable strategies adopted by mutual fund and ETFs, up from 19% the previous month, sustainable fund assets experienced estimated net outflows of -$59.2 billion in January and market depreciation was an estimated -$5.0 billion. Outflows were the largest over the previous 12 months. Excluding money market funds, net outflows were an estimated -$51.4 billion.

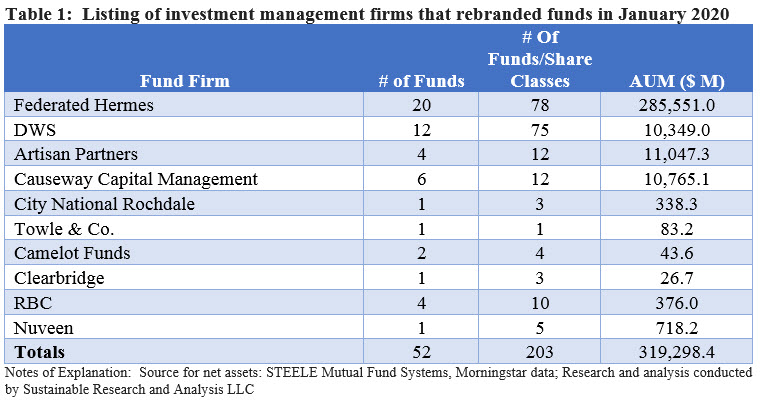

Re-brandings in January ticked up materially, dominated by funds that adopted ESG integration approaches and adding $319.3 billion in net new assets sourced to 10 firms and 52 mutual funds. Refer to Table 1.

This was the second highest level since September 2019, and importantly, $285.6 billion of the total was attributable entirely of 20 money market funds managed by Federated Hermes.

In the process, the overall profile of the sustainable funds segment was transformed yet again. Sustainable money market funds, accounting for almost 31% of sustainable fund assets, eclipse by a ratio of 2.2X the level of conventional money market funds to total conventional mutual fund and ETF industry. That said, this is likely a transitionary phenomenon during an interval when sustainable fund assets are growing at triple digit rates due largely to fund re-brandings.

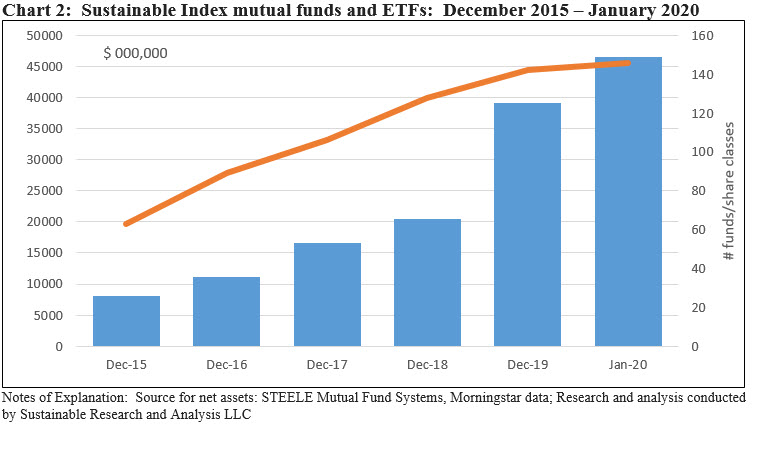

Sustainable index funds added $7.4 billion

Sustainable index funds, including mutual funds and ETFs added $7.4 billion, or 19%, in net assets, closing January at $46.6 billion. Refer to Chart 2.

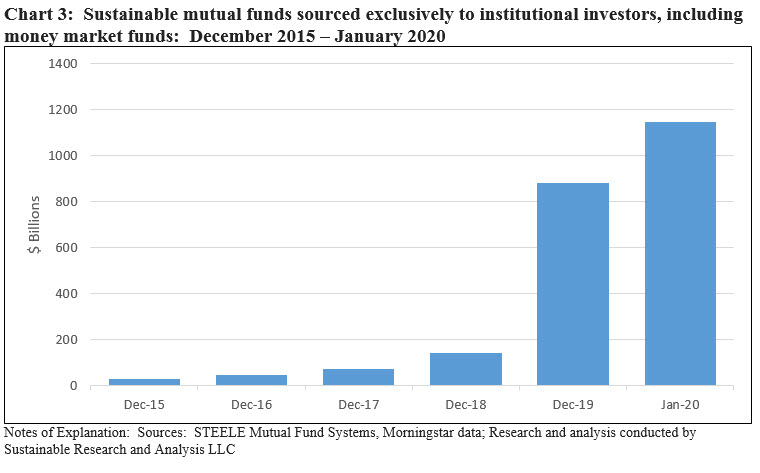

Institutional only mutual funds, including money market funds, jump to $1.1 trillion, or 61.4% of net assets but a much lower 47.1% if money funds are excluded

Excluding money market funds that are largely offered to institutional investors, institutional only funds continued to gain assets on the back of fund re-brandings. Institutional only funds gained $20.2 billion in January and account for 47.1% of net assets at the end of January versus 44.9% at the end of the previous month. When combined with money market fund assets that are largely sourced to institutional investors, institutional only assets rise to $1.1 trillion, or 61.4% of net assets. Refer to Chart 3.

It should be noted that this likely represents a floor for the level of institutional investor participation in sustainable funds as such investors also invest in funds through other share classes as well as ETFs.

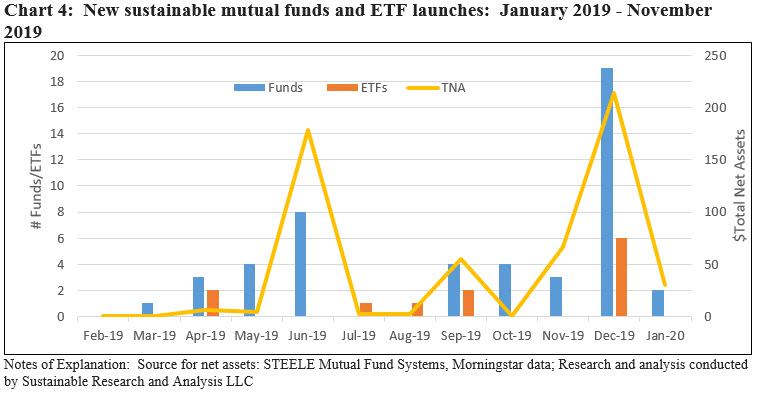

New fund launches: Two funds added in January

Two sustainable funds came to market in January, including a sustainable senior loan fund launched by Morgan Stanley and a prime money market fund introduced by UBS.

After adjusting for December’s State Street’s sustainable money market fund launch, January saw an 89% decline in new fund launches. Refer to Chart 4.

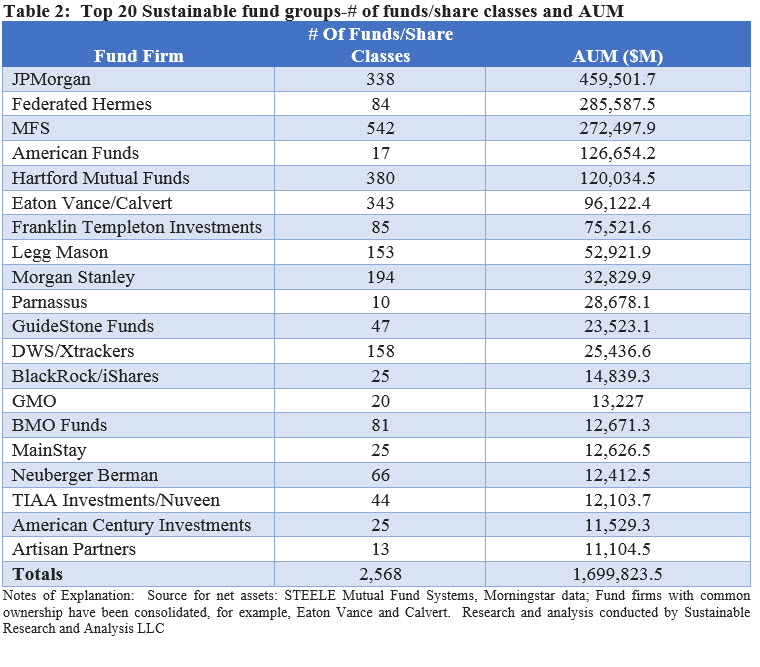

Top 20 sustainable fund firms: 2,568 funds/share classes and $1.7 trillion in assets

The profile of the top 20 fund firms changed yet again, as Federated Hermes and Artisan Partners displace Brown Advisory and Transamerica from the ranks of the top 20 firms. On a combined basis, these firms control almost $1.7 trillion in sustainable fund assets, or 90.9% of the segment’s total at the end of January.

Federated Hermes not only rebranded its name (effective in early February), but in January the firm rebranded 20 money market funds with $285.6 billion in assets. Artisan Partners, a Milwaukee, WI based asset manager with $97.1 billion in assets under management, re-branded 13 funds with $11.1 billion in net assets. Both firms adopted ESG integration approaches in the management of its re-branded funds. Refer to Table 2.

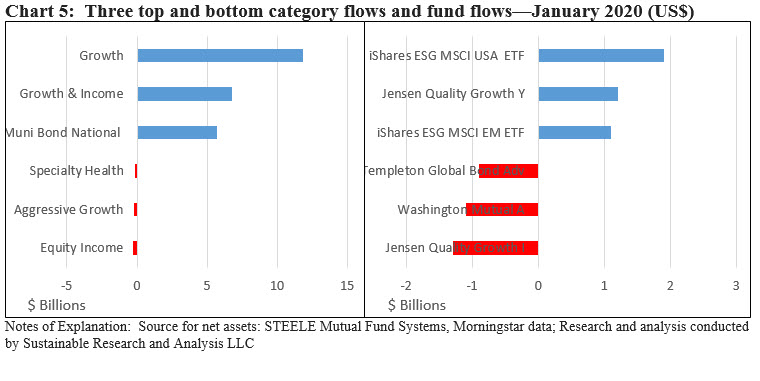

Investment category and fund flows: January’s top three categories and funds/share classes

Investment category and fund flows: January’s top three categories and funds/share classes

Refer to Chart 5 for the largest positive and negative net cash flows by investment category and individual fund/share classes.

(1) While definitions continue to evolve, sustainable investing refers to a range of five overarching investing approaches or strategies that encompass: values-based investing, negative screening (exclusions), thematic and impact investing, ESG integration and shareholder/bondholder engagement and proxy voting. These are not mutually exclusive.