Introduction and Summary

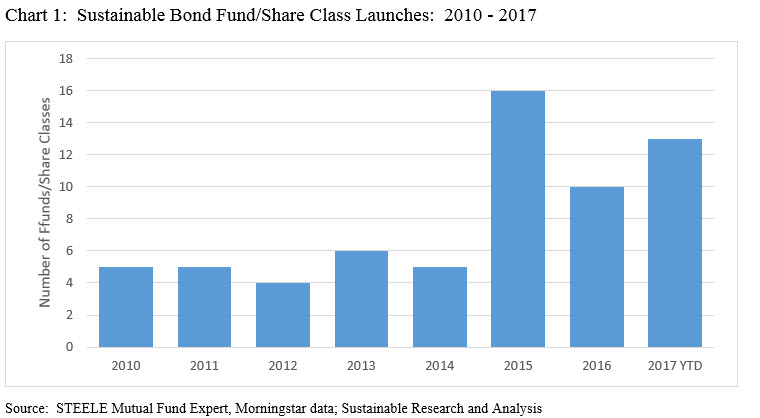

Over the course of the previous two calendar years, the greatest number of sustainable fixed income or bond mutual funds and share classes, a total of 26, were added to an already existing stable of sustainable bond offerings the first of which was introduced as early as 1982. Based on the number of launches so far in 2017 when 13 new funds/share classes were introduced through the end of May, the record of 2015 and 2016 is likely to be exceeded. See Chart 1. Significantly, the new funds were launched or repurposed by investment management firms that have not traditionally operated in the sustainable fixed income mutual fund space. These include firms such as BlackRock, J.P. Morgan, John Hancock and PIMCO, to name just four that are changing the landscape of the sector by introducing more robust sustainable investing strategies and options while moving away from a focus on ethical and religious mandates that rely almost entirely on exclusionary practices. Since these funds are relatively new, it’s too early to evaluate their performance results net of fees.

New Fixed Income Sustainable Fund Launches

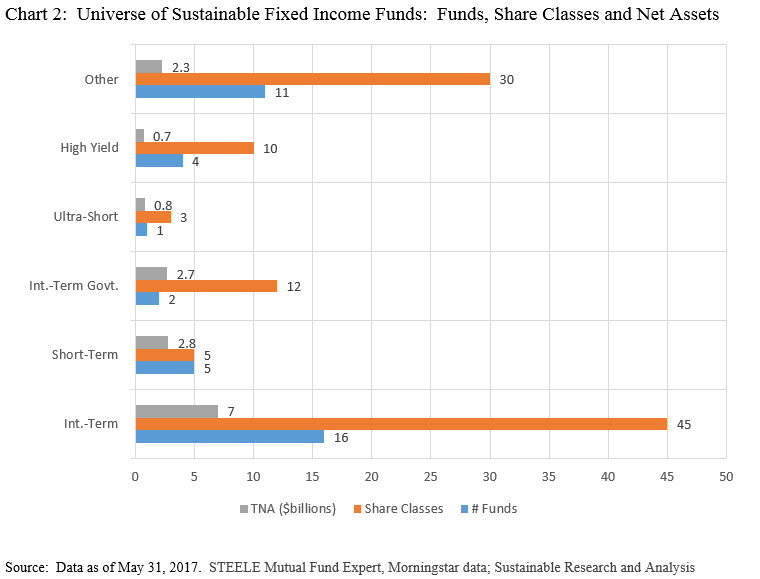

In 2016 and 2015 a total of 26 funds and share classes were launched. This is more than in any previous year and represents a greater number even than the prior five years combined. These new offerings included 7 share classes offered by already existing funds. At the same time, 19 funds and share classes were launched by investment advisory firms that have not previously managed or distributed mutual funds in the sustainable bond sector. So far in 2017, 13 new funds/share classes have been added. These include newly launched funds and share classes as well as repurposed fixed income funds. Including the new funds and share classes added through the end of May 2017, investors can choose from 110 available sustainable bond funds and share classes. These funds are distributed by 26 different firms featuring both retail and institutional share classes that have accumulated $16.2 billion in assets managed across 12 fixed income investment categories and varying sustainable strategies. Refer to Chart 2. Of these, institutional funds represent $9.1 billion in assets or about 56% of net assets. The remainder is sourced to retail investors.

Growth in Sustainable Assets Under Management

According to the 2014 Global Sustainable Investment Review, an estimated $21.4 trillion in worldwide assets under management are linked to SRI investments[i]. This represents a strong increase of 57% over the last two years when $13.6 trillion was sourced to sustainable strategies. According to a more recent report focused just on the US market as of early 2016, assets sourced to sustainable strategies reached $8.7 trillion, or an increase of 33% since 2014[ii]. While these numbers are likely inflated due largely to confusion over terminology, lack of industry standards and definitions as well as double counting, it’s difficult to argue that the trend in favor of SRI investing, or sustainable investing, is experiencing a strong upswing.

Available Sustainable Bond Fund Strategies

As also noted in Chart 2, sustainable investing bond funds straddle 12 different traditional bond fund categories or investment objectives but these are dominated by five categories. These include intermediate-term, intermediate-term government, short-term, ultra-short and high-yield funds that, based on assets under management, represent $13.9 billion and account for about 86% of sustainable bond assets. Seven other bond fund categories make up the rest, for a total of $2.3 billion or 14% of total net assets.

Changing Profile of Sustainable Fixed Income Mutual Funds

The expansion in the number and type of sustainable fixed income funds since 2015 is, in part, attributable to the addition of new share classes on the part of investment managers that have been offering sustainable investing products for some years. These include a total of seventeen managers that have been offering sustainable investing bond mutual funds through the end of 2014. But contributing more meaningfully to the expansion has been the entry of new managers with a variety of robust sustainable investing strategies that combine one or more of the following strategies: Exclusions, ESG integration, impact investing and bondholder advocacy. In fact, nine new managers entered the sustainable fixed income sphere since 2015 by launching ten new bond fund offerings consisting of 30 share classes. These included two firms, PIMCO and J.P. Morgan that repurposed funds already in existence. Refer to PIMCO and JPMorgan New Product Profiles. On top of that, one fund firm already operating in the space expanded its offerings by launching a core bond fund. As of May 31, 2017, a total of 26 firms manage mutual fund products, an increase of 31% over the previous 27 months.

The new entries are changing the landscape of the sector by introducing more robust sustainable investing strategies and options while moving away from a focus on ethical and religious mandates that rely almost entirely on exclusionary practices. Such strategies have historically delivered below market-based rates of return, net of expenses. Since the new crop of funds are relatively new, it’s too early to evaluate how their performance results might evolve over time.

[i] Source: 2012 Global Sustainable Investment Review, Global Sustainable Investment Alliance

[ii] Source: US SIF Foundation, 2016 Trends Report on Sustainable, Responsible, and Impact Investing