The Bottom Line: US stocks declined 1.0% in January while sustainable (ESG-oriented) securities market indices regained leadership but actively managed sustainable funds turned mixed results.

During a month when US stocks declined 1.0%, sustainable (ESG-oriented) securities market indices regain their leadership in January and outperform their conventional counterparts[1]

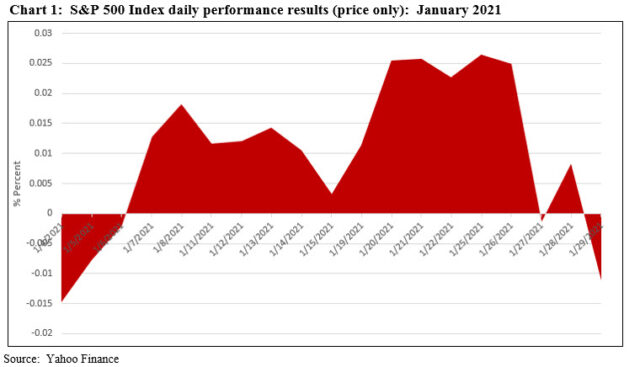

Stocks in January posted a decline of 1.0% even as the month began on a strong note with gains as high as 2.5% recorded by the S&P 500. This followed the surprise Democratic sweep in the run-off elections for two Senate seats in Georgia that gave Democrats control of the Senate and elevated stimulus expectations for President-elect Joe Biden’s $1.9 trillion American Rescue Plan that would come on top of the bi-partisan $900 billion stimulus package that was adopted in late December. Investors seemed to shrug off the storming of the US Capital building and continuing concerns regarding coronavirus lockdowns. That is, until January 26th when US equities lost momentum and began to slump as long-dated US Treasury yields came under upward pressure, culminating in a -1.1% decline for the S&P 500 on January 29th. Refer to Chart 1. The technology heavy Nasdaq Composite still ended the month in positive territory, adding 1.4%. Also posting positive returns with progressively higher values were midcap, small cap and microcap stocks that delivered returns of 1.5%, 6.3% and 14.2%, respectively. Large cap and midcap growth stocks outperformed value stocks, but that relationship didn’t hold up in the case of small cap and microcap stocks.

Broad international markets, as measured by the MSCI ACWI ex USA Index, eked out a narrow gain of 0.2%. The benchmark was buoyed by emerging markets that were up 3.1%, and in particular, growth stocks that added 5.3%. China and Taiwan recorded gains of 7.4% and 6.5%, in that order. MSCI EAFE Index declined -1.1%, dragged lower by the performance of France and Germany that saw drops of -3.1% and 1.8%, respectively.

Against a backdrop of rising yields as 10-year Treasuries picked up 14 bps, 6 bps in the last four days of the month, to end January at 1.07%, U.S. and global market bonds closed the month lower. The Bloomberg Barclays US Aggregate Bond Index dropped -0.72% while its universal counterpart posted a slightly lower decline of 0.6%. Longer maturities turned in worse results while lower rated corporate bonds, for example Caa rated, gained 1.5%.

Sustainable (ESG-oriented) securities market indices regain their leadership in January and outperform their conventional counterparts

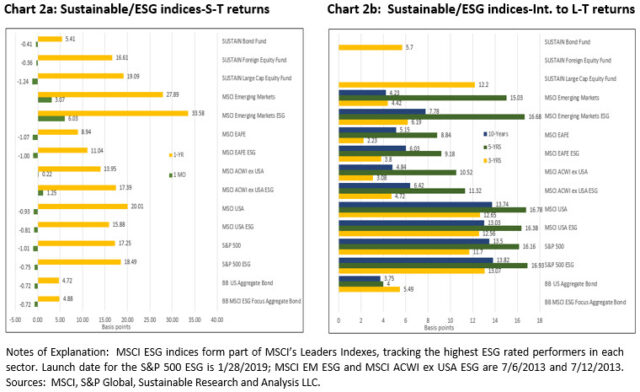

After lagging behind their conventional counterparts for two consecutive months, selected sustainable securities market indices that track stocks as well as bonds bounced back in January 2021. In particular, sustainable indices tracking stocks in the US and overseas exceeded the performance of their conventional counterparts by levels that ranged from 12 bps to 296 bps. Both the MSCI USA ESG Leaders Index and the S&P 500 ESG Index beat their non-ESG counterparts by 12 bps and 26 bps, respectively. At the other end of the range, the MSCI Emerging Markets ESG Leaders Index gained 6.03%, exceeding the MSCI Emerging Markets Index by 296 bps. With a narrower margin, the broader MSCI ACWI ex USA ESG Index outperformed its non-ESG counterpart by 103 bps. Refer to Chart 2a.

As for bonds, the Bloomberg Barclays MSCI US Aggregate ESG Focus Bond Index and the conventional bond benchmark, the Bloomberg Barclays US Aggregate Bond Index, posted equivalent negative returns of -0.72%.

Over longer intervals, based on data availability which is limited to the equity-oriented indices, four of the five ESG indices beat their conventional counterparts. The only exception continues to be the MSCI USA ESG Leaders Index that lags across the one-to 10-year time periods. That said, it should be noted that for some indices the performance measurement period encompasses intervals during which the index results were achieved with the benefit of back-testing. Refer to Chart 2b.

On the other hand, actively managed sustainable funds, measured on the basis of three Sustainable (SUSTAIN) fund indices that track the largest ESG funds by category, turned in mixed results. Actively managed sustainable investment-grade intermediate term funds outperformed while domestic large cap equity and foreign funds lagged their non-ESG primary indices.

Sustainable (SUSTAIN) mutual fund Indices turned in mixed results

The performance of actively managed sustainable funds, on the basis of three Sustainable (SUSTAIN) fund indices that track the largest sustainable funds by category, were mixed in January. Actively managed sustainable investment-grade intermediate term funds outperformed while domestic large cap equity and foreign funds lagged their non-ESG primary index counterparts.

Sustainable (SUSTAIN) Large Cap Equity Fund Index lags S&P 500 Index by 23 bps

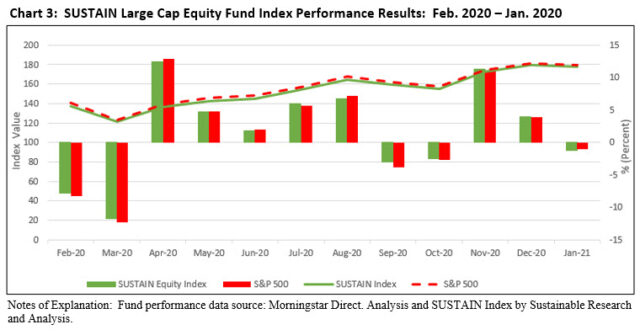

After four consecutive months of outperformance, the SUSTAIN Large Cap Equity Fund Index, which was reconstituted as of year-end 2020, reversed course and lagged the S&P 500 Index by 23 bps. Refer to Chart 3. Only four of the 10 funds that comprise the index outperformed the large cap conventional benchmark. Returns ranged from a high of 0.04% to a low of -2.4%. The best return in January was posted by the TIAA-CREF Social Choice Equity Fund Institutional shares, the only index member to deliver a positive return in January. At the other end of the range, Hartford Capital Appreciation Fund A dropped -2.4%.

The SUSTAIN Large Cap Equity Fund Index continues, since October 2020, to lead the S&P 500 over the previous 1 and 3-year time intervals.

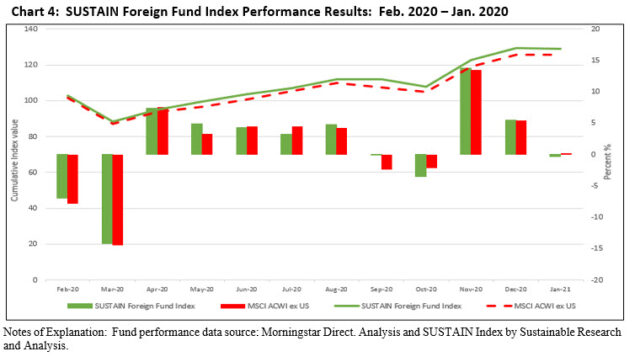

Sustainable (SUSTAIN) Foreign Equity Index lags MSCI ACWI ex USA Index by 58 bps

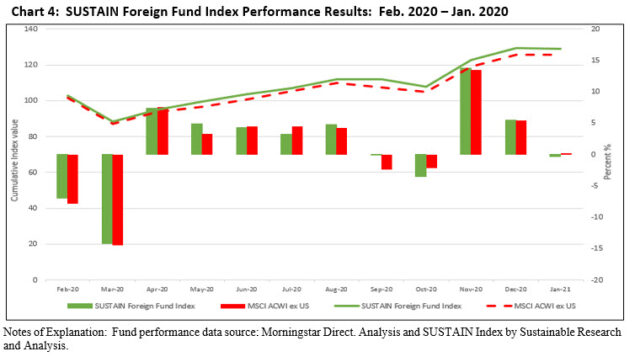

Also reversing course after two consecutive months of outperformance, the SUSTAIN Foreign Equity Fund Index, which was reconstituted as of year-end 2020, posted a total return of -0.36% and lagged its conventional counterpart, the MSCI ACWI ex USA Index by 58 bps. Refer to Chart 4. Only three of 10 constituent funds outperformed, with results ranging from -1.55% posted by Morgan Stanley Institutional International Advantage Fund I to a high of 0.83% recorded by GMO International Equity Allocation Fund III.

The SUSTAIN Foreign Equity Fund Index beats the MSCI ACWI, ex USA Index by 266 bps over the trailing twelve-month interval.

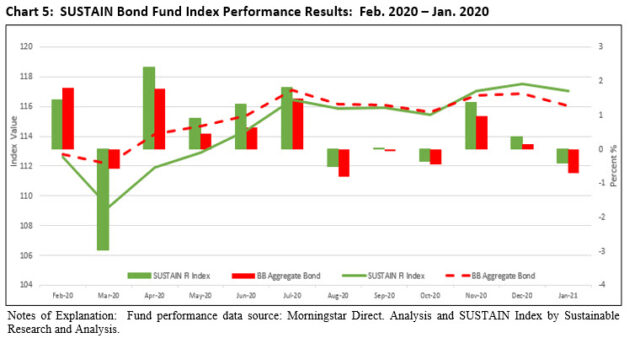

Sustainable (SUSTAIN) Bond Fund Index outperforms the Bloomberg Barclays Aggregate US Bond Index by 31 bps

The Sustainable (SUSTAIN) Bond Fund Index, also reconstituted as of year-end 2020, was powered higher by the performance of nine of the 10 constituent funds that outperformed the Bloomberg Barclays US Aggregate Bond Index with returns ranging from -0.56% to 0.12%. At the low end of the range was the JPMorgan Core Bond Fund R6 while the best return was delivered by the Neuberger Berman Strategic Income Fund I.

The SUSTAIN Bond Fund Index, which reversed course after two successive monthly gains, posted a narrow -0.4% decline versus -0.71 delivered by its non-ESG conventional counterpart benchmark. It also continues to lead the conventional index over the trailing 12-month to January 29th. Refer to Chart 5.

[1] While definitions continue to evolve, sustainable investing refers to a range of five overarching investing approaches or strategies that encompass: values-based investing, negative screening (exclusions), thematic investing, impact investing and ESG integration. Shareholder/bondholder engagement and proxy voting may also be employed along with one of more of these strategies that are not mutually exclusive.

Sustainable (ESG-oriented) securities indices regained their leadership in January

The Bottom Line: US stocks declined 1.0% in January while sustainable (ESG-oriented) securities market indices regained leadership but actively managed sustainable funds turned mixed results.

Share This Article:

The Bottom Line: US stocks declined 1.0% in January while sustainable (ESG-oriented) securities market indices regained leadership but actively managed sustainable funds turned mixed results.

During a month when US stocks declined 1.0%, sustainable (ESG-oriented) securities market indices regain their leadership in January and outperform their conventional counterparts[1]

Stocks in January posted a decline of 1.0% even as the month began on a strong note with gains as high as 2.5% recorded by the S&P 500. This followed the surprise Democratic sweep in the run-off elections for two Senate seats in Georgia that gave Democrats control of the Senate and elevated stimulus expectations for President-elect Joe Biden’s $1.9 trillion American Rescue Plan that would come on top of the bi-partisan $900 billion stimulus package that was adopted in late December. Investors seemed to shrug off the storming of the US Capital building and continuing concerns regarding coronavirus lockdowns. That is, until January 26th when US equities lost momentum and began to slump as long-dated US Treasury yields came under upward pressure, culminating in a -1.1% decline for the S&P 500 on January 29th. Refer to Chart 1. The technology heavy Nasdaq Composite still ended the month in positive territory, adding 1.4%. Also posting positive returns with progressively higher values were midcap, small cap and microcap stocks that delivered returns of 1.5%, 6.3% and 14.2%, respectively. Large cap and midcap growth stocks outperformed value stocks, but that relationship didn’t hold up in the case of small cap and microcap stocks.

Broad international markets, as measured by the MSCI ACWI ex USA Index, eked out a narrow gain of 0.2%. The benchmark was buoyed by emerging markets that were up 3.1%, and in particular, growth stocks that added 5.3%. China and Taiwan recorded gains of 7.4% and 6.5%, in that order. MSCI EAFE Index declined -1.1%, dragged lower by the performance of France and Germany that saw drops of -3.1% and 1.8%, respectively.

Against a backdrop of rising yields as 10-year Treasuries picked up 14 bps, 6 bps in the last four days of the month, to end January at 1.07%, U.S. and global market bonds closed the month lower. The Bloomberg Barclays US Aggregate Bond Index dropped -0.72% while its universal counterpart posted a slightly lower decline of 0.6%. Longer maturities turned in worse results while lower rated corporate bonds, for example Caa rated, gained 1.5%.

Sustainable (ESG-oriented) securities market indices regain their leadership in January and outperform their conventional counterparts

After lagging behind their conventional counterparts for two consecutive months, selected sustainable securities market indices that track stocks as well as bonds bounced back in January 2021. In particular, sustainable indices tracking stocks in the US and overseas exceeded the performance of their conventional counterparts by levels that ranged from 12 bps to 296 bps. Both the MSCI USA ESG Leaders Index and the S&P 500 ESG Index beat their non-ESG counterparts by 12 bps and 26 bps, respectively. At the other end of the range, the MSCI Emerging Markets ESG Leaders Index gained 6.03%, exceeding the MSCI Emerging Markets Index by 296 bps. With a narrower margin, the broader MSCI ACWI ex USA ESG Index outperformed its non-ESG counterpart by 103 bps. Refer to Chart 2a.

As for bonds, the Bloomberg Barclays MSCI US Aggregate ESG Focus Bond Index and the conventional bond benchmark, the Bloomberg Barclays US Aggregate Bond Index, posted equivalent negative returns of -0.72%.

Over longer intervals, based on data availability which is limited to the equity-oriented indices, four of the five ESG indices beat their conventional counterparts. The only exception continues to be the MSCI USA ESG Leaders Index that lags across the one-to 10-year time periods. That said, it should be noted that for some indices the performance measurement period encompasses intervals during which the index results were achieved with the benefit of back-testing. Refer to Chart 2b.

On the other hand, actively managed sustainable funds, measured on the basis of three Sustainable (SUSTAIN) fund indices that track the largest ESG funds by category, turned in mixed results. Actively managed sustainable investment-grade intermediate term funds outperformed while domestic large cap equity and foreign funds lagged their non-ESG primary indices.

Sustainable (SUSTAIN) mutual fund Indices turned in mixed results

The performance of actively managed sustainable funds, on the basis of three Sustainable (SUSTAIN) fund indices that track the largest sustainable funds by category, were mixed in January. Actively managed sustainable investment-grade intermediate term funds outperformed while domestic large cap equity and foreign funds lagged their non-ESG primary index counterparts.

Sustainable (SUSTAIN) Large Cap Equity Fund Index lags S&P 500 Index by 23 bps

After four consecutive months of outperformance, the SUSTAIN Large Cap Equity Fund Index, which was reconstituted as of year-end 2020, reversed course and lagged the S&P 500 Index by 23 bps. Refer to Chart 3. Only four of the 10 funds that comprise the index outperformed the large cap conventional benchmark. Returns ranged from a high of 0.04% to a low of -2.4%. The best return in January was posted by the TIAA-CREF Social Choice Equity Fund Institutional shares, the only index member to deliver a positive return in January. At the other end of the range, Hartford Capital Appreciation Fund A dropped -2.4%.

The SUSTAIN Large Cap Equity Fund Index continues, since October 2020, to lead the S&P 500 over the previous 1 and 3-year time intervals.

Sustainable (SUSTAIN) Foreign Equity Index lags MSCI ACWI ex USA Index by 58 bps

Also reversing course after two consecutive months of outperformance, the SUSTAIN Foreign Equity Fund Index, which was reconstituted as of year-end 2020, posted a total return of -0.36% and lagged its conventional counterpart, the MSCI ACWI ex USA Index by 58 bps. Refer to Chart 4. Only three of 10 constituent funds outperformed, with results ranging from -1.55% posted by Morgan Stanley Institutional International Advantage Fund I to a high of 0.83% recorded by GMO International Equity Allocation Fund III.

The SUSTAIN Foreign Equity Fund Index beats the MSCI ACWI, ex USA Index by 266 bps over the trailing twelve-month interval.

Sustainable (SUSTAIN) Bond Fund Index outperforms the Bloomberg Barclays Aggregate US Bond Index by 31 bps

The Sustainable (SUSTAIN) Bond Fund Index, also reconstituted as of year-end 2020, was powered higher by the performance of nine of the 10 constituent funds that outperformed the Bloomberg Barclays US Aggregate Bond Index with returns ranging from -0.56% to 0.12%. At the low end of the range was the JPMorgan Core Bond Fund R6 while the best return was delivered by the Neuberger Berman Strategic Income Fund I.

The SUSTAIN Bond Fund Index, which reversed course after two successive monthly gains, posted a narrow -0.4% decline versus -0.71 delivered by its non-ESG conventional counterpart benchmark. It also continues to lead the conventional index over the trailing 12-month to January 29th. Refer to Chart 5.

[1] While definitions continue to evolve, sustainable investing refers to a range of five overarching investing approaches or strategies that encompass: values-based investing, negative screening (exclusions), thematic investing, impact investing and ESG integration. Shareholder/bondholder engagement and proxy voting may also be employed along with one of more of these strategies that are not mutually exclusive.

Sustainableinvest.com

Benefits

Free access to regularly updated original research and analysis focused exclusively on sustainable finance and investing, providing investors with the guidance needed to make informed investment decisions that align with their personal values and financial goals while also contributing to the advancement of positive long-term environmental and social outcomes.

By offering financial support for our current work, either in the form of a one-time or regular contributions, you help to defray some of the costs associated with conducting our research and analysis as well as to maintain the www.sustainablest.wpengine.com website.

Helping us to expand our research capabilities and offerings over time to cover additional relevant topics geared to sustainable investors.

Sign up to free newsletters.

By submitting this form, you are consenting to receive marketing emails from: . You can revoke your consent to receive emails at any time by using the SafeUnsubscribe® link, found at the bottom of every email. Emails are serviced by Constant Contact