The Bottom Line: Sustainable actively managed bond mutual funds and ETFs suffered a significant drop in 2022 but 2023 is projected to be much brighter.

0:00

/

0:00

Listen to this article now

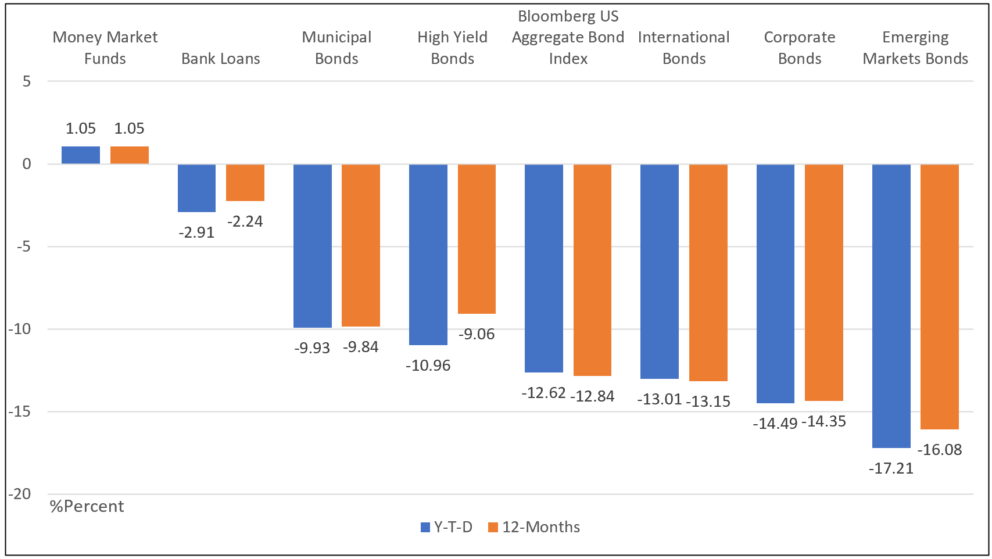

Performance of selected sustainable actively managed fixed income funds: Y-T-D and 12-M Notes of Explanation: Average Y-T-D and trailing 12-month total returns to November 30, 2022. Data source: Morningstar Direct. Research by Sustainable Research and Analysis LLC.

Notes of Explanation: Average Y-T-D and trailing 12-month total returns to November 30, 2022. Data source: Morningstar Direct. Research by Sustainable Research and Analysis LLC.

Observations:

- For fixed income securities, calendar year 2022 performance results are likely to be the worst year since the start of the Bloomberg US Aggregate Bond Index series that goes back to 1976. The same applies to sustainable fixed income funds that through the end of November posted an average drop of 10.89% year-to-date and 10.71% over the trailing 12-months. When sustainable index funds are excluded, the corresponding total return results are -10.72% and -10.54%, respectively. At the same time, the Bloomberg US Aggregate Bond Index posted drops of -12.62% and -12.84% and if anything, the index is likely to end the year even lower.

- In calendar year 2022 the bond market went through a huge resetting of interest rates. After years of negative to zero yields to stimulate economic growth, surging and persistent inflation prompted central banks to raise interest rates. In the US, the Federal Reserve began a gradual shift to tighter monetary policy with a 25-basis-point rate hike in March 2022 as economic growth recovered. But the Fed shifted to rapid tightening by summer as inflation surged on the back of supply/demand imbalances, a resilient economy, and the spike in oil prices due to the war in Ukraine. 10-year Treasury yields, which stood at 1.52% at the end of 2021 gained 216 basis points to close November at 3.68% while 3-month Treasury yields were at 4.37%.

- Against this backdrop, higher risk bonds and funds, those holding longer dated lower quality securities, suffered greater declines. Except for money market funds that recorded average gains of 1.05% over the first eleven months of the year and trailing 12-months, all other fixed income categories registered declines over the same intervals. Excluding money market funds, average returns year-to-date varied from a high of -2.91% recorded by bank loan funds to an average decline of 26.75% posted by sustainable corporate bond funds. These funds pursue varying sustainable investing approaches.

- The simultaneous declines by equities as well as bonds also had a significant impact on balanced as well as target date fund investors whose exposures to fixed income for near-date retirement funds can be as high as 60%.

- That said, 2023 is projected to be much brighter for bonds in part because the yields on investment grade bonds are now much higher. Still, it’s not likely to be smooth sailing due to continued central bank tightening policies, the uncertain path for the economy and ongoing political uncertainties.