SUSTAIN Index Gains but Only One Constituent Fund Beat the S&P 500 in October

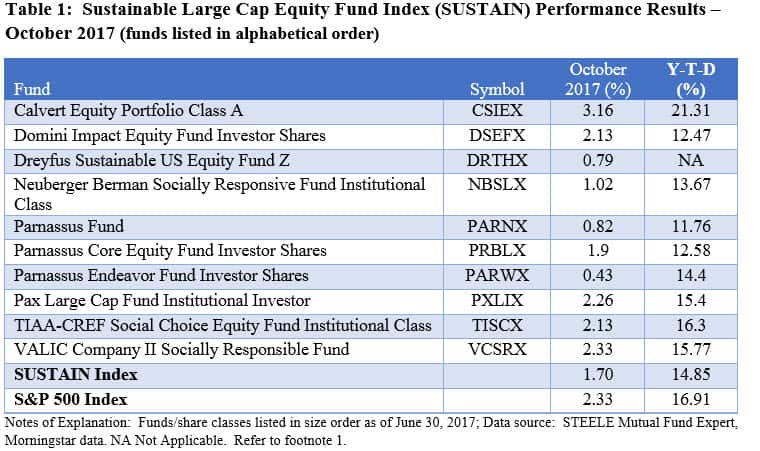

The SUSTAIN Large Cap Equity Fund Index, which tracks the total return performance of the ten largest actively managed large cap US oriented equity mutual funds that employ a sustainable investing strategy beyond absolute reliance on exclusionary practices, registered a gain of 1.7% in October versus the S&P 500 Index which generated a strong 2.33% total return. The SUSTAIN Index, which was reconstituted after the close of business on September 29, 2017, lagged the non-ESG large cap securities market index as only one constituent fund, Calvert Equity A, beat the performance of the index while a second, the VALIC Company II Socially Responsible Fund, matched the benchmark at 2.33%. For the year-to-date interval, the SUSTAIN Index is up 14.85% but trails by 2.06% the performance of the S&P 500 which is up 16.91%[1]. Refer to Table 1.

Only One Component Fund Registered a Gain in Excess of the S&P 500 Index

The ten component funds produced returns for the month ranging from a low of 0.43% registered by the Parnassus Endeavor Fund-Investor Shares to a high of 3.16% delivered by Calvert Equity-A. Calvert continues to outperform the S&P 500 since the start of the year, benefiting from its growth tilt and above index exposure to the technology and basic materials sectors in particular. At the same time, the fund profited from its 0% exposure to the energy sector which recorded a decline of almost 1% in October and 9.28% drop on a year-to-date basis. Calvert is one of 6 SUSTAIN constituent funds that does not have exposure to the fossil fuel sector for environmental reasons. At the other end of the range, Parnassus Endeavor-Investor Shares managed to eke out a narrow but positive return of 0.43%. Its significant 31% exposure to health care relative to about 15% for the S&P 500 was likely a drag on performance as the sector was down around 0.84% for the month with some individual stocks in the funds falling lower.

Sustainable Funds Trail the S&P 500 Since Start of Year

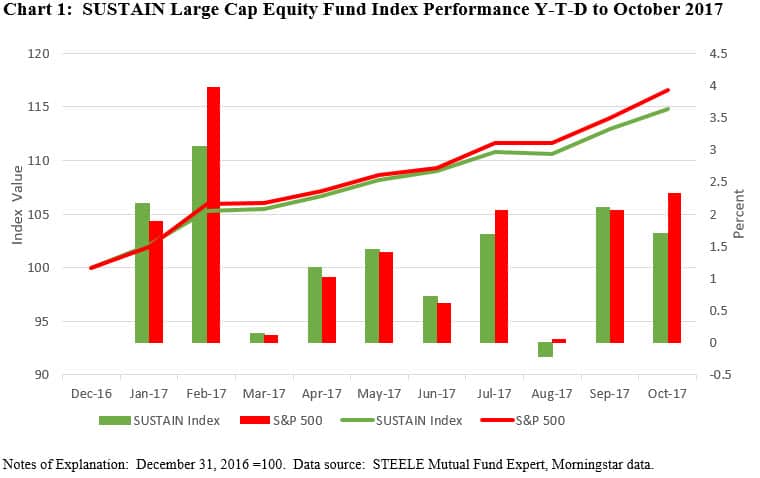

Since the start of the year, only the Calvert Equity A is outperforming the S&P 500 Index. The returns range from a low of 11.76% to a high of 16.3%, excluding Calvert. The gap between the performance of the SUSTAIN Index and the S&P 500 is narrow by widening to 1.77% year-to-date. Refer to Chart 1.

SUSTAIN Index Reconstituted With the Addition of the Dreyfus Sustainability Core Index

The SUSTAIN Index was reconstituted following the close of business on September 31, 2017 with the deletion of the Sentinel Sustainable Core Opportunities Fund Class A and the substitution of the Dreyfus Sustainable US Equity Fund Z in advance of the October 30, 2017 completion of the sale of Sentinel mutual funds to Touchstone Investments. In the process, the Sentinel Sustainable Core Opportunities Fund was reorganized into the existing Touchstone Sustainability and Impact Equity Fund that pursues an expanded global investment strategy, including developed and developing countries. The newly added Dreyfus Sustainable US Equity Fund invests in US companies and is aligned with the focus and parameters of the SUSTAIN Index. The fund invests in companies that demonstrate attractive investment attributes and sustainable business practices and have no material unresolvable environmental, social and governance issues. A company is considered to be engaging in “sustainable business practices” if it engages in such practices in an economic sense (i.e., the durability of the company’s strategy, operations and finances), and takes appropriate account of material externalities caused by or affecting its business. The investment manager, Newton Investment Management (North America) Limited, an affiliate of The Dreyfus Corp., may also invest in companies when it believes it can promote sustainable business practices through ongoing company engagement and active proxy voting.

The $318.6 million Dreyfus Sustainable US Equity Fund is not a new fund. It is a successor to the Dreyfus Third Century Fund, the oldest sustainable mutual fund in continuous operation that was launched in 1972 to pursue a socially responsible investment strategy.

SUSTAIN Index Explained

The index, which was initiated as of June 30, 2017 with data back to December 31, 2016, tracks the total return performance of the ten largest actively managed large cap domestic equity mutual funds that employ a sustainable investing strategy beyond absolute reliance on exclusionary practices for religious, ethical or social reasons. While methodologies vary, to qualify for inclusion in the index, funds must actively apply environmental, social and governance (ESG) criteria to their investment processes and decision making. In tandem with their ESG integration strategy, funds may also employ exclusionary strategies along with impact oriented investment approaches as well as shareholder advocacy.

Multiple funds managed by the same management firm may be included in the index, however, a fund with multiple share classes is only included in the index once, based on the largest share class in terms of assets. The index is equally weighted, it is calculated monthly and rebalanced once a year as of December 31.

The combined assets associated with the ten funds stood at $21.2 billion and represent about 13.7% of the entire sustainable US equity sector that is comprised of 220 funds/share classes, including actively managed funds and index funds, with $154.4 billion in assets under management[2].

[1] With all share classes combined, total net assets=$30.8 billion or 20% of the sustainable US equity sector.

[2] Adjusted to exclude Dreyfus Sustainable US Equity Z which was reorganized on or about May 1, 2017.

SUSTAIN Large Cap Equity Fund Index Gains 1.7% in October but Lags the S&P 500

The SUSTAIN Large Cap Equity Fund Index, which tracks the total return performance of the ten largest actively managed large cap US oriented equity mutual funds that employ a sustainable investing strategy beyond absolute reliance on exclusionary practices, registered a gain of 1.7% in October versus the S&P 500 Index which generated a strong 2.33%…

Share This Article:

SUSTAIN Index Gains but Only One Constituent Fund Beat the S&P 500 in October

The SUSTAIN Large Cap Equity Fund Index, which tracks the total return performance of the ten largest actively managed large cap US oriented equity mutual funds that employ a sustainable investing strategy beyond absolute reliance on exclusionary practices, registered a gain of 1.7% in October versus the S&P 500 Index which generated a strong 2.33% total return. The SUSTAIN Index, which was reconstituted after the close of business on September 29, 2017, lagged the non-ESG large cap securities market index as only one constituent fund, Calvert Equity A, beat the performance of the index while a second, the VALIC Company II Socially Responsible Fund, matched the benchmark at 2.33%. For the year-to-date interval, the SUSTAIN Index is up 14.85% but trails by 2.06% the performance of the S&P 500 which is up 16.91%[1]. Refer to Table 1.

Only One Component Fund Registered a Gain in Excess of the S&P 500 Index

The ten component funds produced returns for the month ranging from a low of 0.43% registered by the Parnassus Endeavor Fund-Investor Shares to a high of 3.16% delivered by Calvert Equity-A. Calvert continues to outperform the S&P 500 since the start of the year, benefiting from its growth tilt and above index exposure to the technology and basic materials sectors in particular. At the same time, the fund profited from its 0% exposure to the energy sector which recorded a decline of almost 1% in October and 9.28% drop on a year-to-date basis. Calvert is one of 6 SUSTAIN constituent funds that does not have exposure to the fossil fuel sector for environmental reasons. At the other end of the range, Parnassus Endeavor-Investor Shares managed to eke out a narrow but positive return of 0.43%. Its significant 31% exposure to health care relative to about 15% for the S&P 500 was likely a drag on performance as the sector was down around 0.84% for the month with some individual stocks in the funds falling lower.

Sustainable Funds Trail the S&P 500 Since Start of Year

Since the start of the year, only the Calvert Equity A is outperforming the S&P 500 Index. The returns range from a low of 11.76% to a high of 16.3%, excluding Calvert. The gap between the performance of the SUSTAIN Index and the S&P 500 is narrow by widening to 1.77% year-to-date. Refer to Chart 1.

SUSTAIN Index Reconstituted With the Addition of the Dreyfus Sustainability Core Index

The SUSTAIN Index was reconstituted following the close of business on September 31, 2017 with the deletion of the Sentinel Sustainable Core Opportunities Fund Class A and the substitution of the Dreyfus Sustainable US Equity Fund Z in advance of the October 30, 2017 completion of the sale of Sentinel mutual funds to Touchstone Investments. In the process, the Sentinel Sustainable Core Opportunities Fund was reorganized into the existing Touchstone Sustainability and Impact Equity Fund that pursues an expanded global investment strategy, including developed and developing countries. The newly added Dreyfus Sustainable US Equity Fund invests in US companies and is aligned with the focus and parameters of the SUSTAIN Index. The fund invests in companies that demonstrate attractive investment attributes and sustainable business practices and have no material unresolvable environmental, social and governance issues. A company is considered to be engaging in “sustainable business practices” if it engages in such practices in an economic sense (i.e., the durability of the company’s strategy, operations and finances), and takes appropriate account of material externalities caused by or affecting its business. The investment manager, Newton Investment Management (North America) Limited, an affiliate of The Dreyfus Corp., may also invest in companies when it believes it can promote sustainable business practices through ongoing company engagement and active proxy voting.

The $318.6 million Dreyfus Sustainable US Equity Fund is not a new fund. It is a successor to the Dreyfus Third Century Fund, the oldest sustainable mutual fund in continuous operation that was launched in 1972 to pursue a socially responsible investment strategy.

SUSTAIN Index Explained

The index, which was initiated as of June 30, 2017 with data back to December 31, 2016, tracks the total return performance of the ten largest actively managed large cap domestic equity mutual funds that employ a sustainable investing strategy beyond absolute reliance on exclusionary practices for religious, ethical or social reasons. While methodologies vary, to qualify for inclusion in the index, funds must actively apply environmental, social and governance (ESG) criteria to their investment processes and decision making. In tandem with their ESG integration strategy, funds may also employ exclusionary strategies along with impact oriented investment approaches as well as shareholder advocacy.

Multiple funds managed by the same management firm may be included in the index, however, a fund with multiple share classes is only included in the index once, based on the largest share class in terms of assets. The index is equally weighted, it is calculated monthly and rebalanced once a year as of December 31.

The combined assets associated with the ten funds stood at $21.2 billion and represent about 13.7% of the entire sustainable US equity sector that is comprised of 220 funds/share classes, including actively managed funds and index funds, with $154.4 billion in assets under management[2].

[1] With all share classes combined, total net assets=$30.8 billion or 20% of the sustainable US equity sector.

[2] Adjusted to exclude Dreyfus Sustainable US Equity Z which was reorganized on or about May 1, 2017.

Sustainableinvest.com

Benefits

Free access to regularly updated original research and analysis focused exclusively on sustainable finance and investing, providing investors with the guidance needed to make informed investment decisions that align with their personal values and financial goals while also contributing to the advancement of positive long-term environmental and social outcomes.

By offering financial support for our current work, either in the form of a one-time or regular contributions, you help to defray some of the costs associated with conducting our research and analysis as well as to maintain the www.sustainablest.wpengine.com website.

Helping us to expand our research capabilities and offerings over time to cover additional relevant topics geared to sustainable investors.

Sign up to free newsletters.

By submitting this form, you are consenting to receive marketing emails from: . You can revoke your consent to receive emails at any time by using the SafeUnsubscribe® link, found at the bottom of every email. Emails are serviced by Constant Contact