Summary

The SUSTAIN Large Cap Equity Fund Index, which tracks the total return performance of the ten largest actively managed large cap US oriented equity mutual funds that employ a sustainable investing strategy beyond absolute reliance on exclusionary practices, gained 19.18% and delivered strong absolute total return results in 2017. Still, the SUSTAIN Index lagged the S&P 500 by 265 basis points (bps). The results continue to support the idea that a company’s sustainability strategies and practices can be used to improve fundamental research decisions but environmental, social and governance (ESG) research does not by itself ensure investment gains or losses.

SUSTAIN Large Cap Equity Fund Index Records a Strong 2017 Gain of 19.18% but Lags the S&P 500

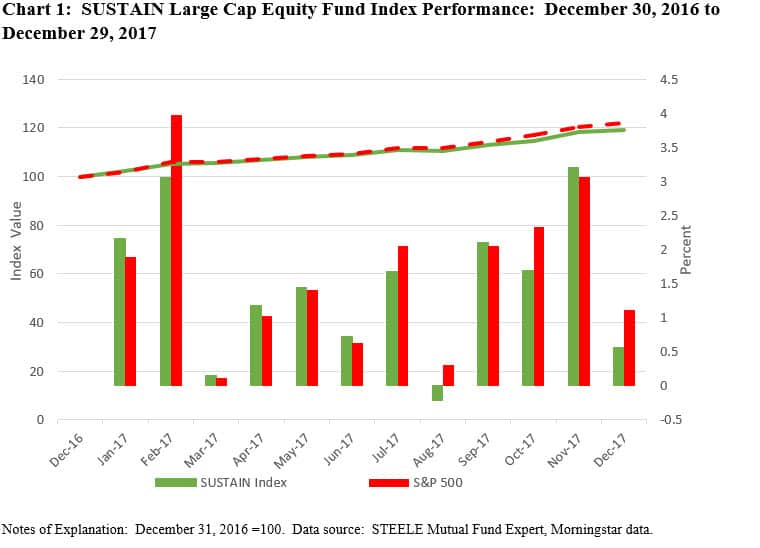

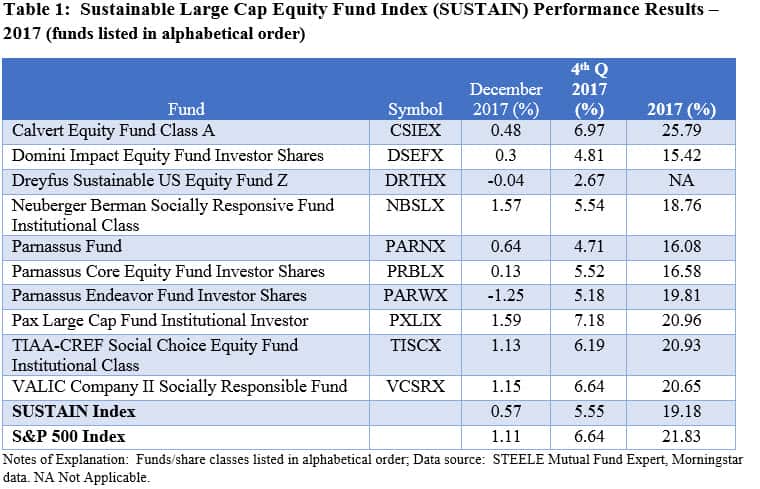

The SUSTAIN Large Cap Equity Fund Index, which tracks the total return performance of the ten largest actively managed large cap US oriented equity mutual funds that employ a sustainable investing strategy beyond absolute reliance on exclusionary practices, delivered strong absolute total return results in 2017. The index was up 19.18% while the ten funds that comprise the index delivered returns that ranged from a high of 25.79% registered by Calvert Equity A to a low of 15.42% achieved by the Domini Impact Equity Investor share class . For each of the funds that has been in operation over the previous five years, the results achieved this year rank second only to the returns posted in 2013 when the S&P was up 32.39%. That said, the S&P 500 Index, up 21.83% for the year, outperformed the SUSTAIN index by 265 bps. The broad securities index was driven to new highs during the year, accompanied by low volatility, due to a combination of positive economic data in the US and abroad, steady job growth, rising corporate earnings, accelerated manufacturing activity and the anticipation of potential legislative tax cuts. These factors overcame continuing geopolitical uncertainties that have spilled over into the new 2018 calendar year. Refer to Chart 1.

Only one of nine funds that comprise the SUSTAIN Index, the Calvert Equity Fund A, outperformed the S&P 500 with a gain of 25.79%. The fund overcame its high 1.09% expense ratio and reversed last year’s significant underperformance by its emphasis in 2017 on growth oriented stocks in the strong performing technology, health care and financial services sectors. At the same time, the fund also benefited from its avoidance of the energy sector which experienced a 2017 decline of about -4.30%. On a 3-year and 5-year basis, however, the fund trails the S&P 500 Index.

In contrast to the performance of the SUSTAIN Large Cap Equity Fund Index, smaller cohorts of actively managed sustainable bond funds and world funds that are also similarly aligned in that they employ comparable financial and sustainable investment strategies beyond absolute reliance on exclusionary practices, outperformed their designated non-ESG securities market indices by 55 basis points and a significant wider 940 basis points, respectively.

The SUSTAIN Index Performance in December Fell Short of the S&P 500 by 54 Basis Points

The performance of the SUSTAIN index in December, which fell short of the S&P 500 by 54 basis points, detracted from the benchmark’s annual results. While five of ten index constituents beat the S&P 500, in particular Pax Large Cap Fund Institutional Class, up 1.59%, and Neuberger Berman Socially Responsive Institutional share class, up 1.57%, the SUSTAIN index was held back by the performance of two funds that turned in negative results. The first, Parnassus Endeavor Investor shares, recorded a drop of -1.25%. The fund’s highly concentrated approach in sectors and securities, such as Qualcomm Inc., Gilead Sciences Inc., and Mattel Inc., which together account for an estimated 27% of the portfolio, sustained price drops in December. The fund also didn’t benefit from its cash position and its avoidance of energy stocks, which were up around 6.92% in December. The fund’s December results detracted from its 2017 performance, up 19.81%, making it only the second year in the last five that the fund did not outperform its benchmark.

The second fund, the Dreyfus Sustainable US Equity Z shares, gave up -0.04% in December. The fund changed its name from Dreyfus Third Century, modified its fundamental investment objective effective May 1, 2017 and took on a new sub-adviser, Newton Investment Management (North America) Limited. It may still be in the process of transitioning from its previous investment strategy that applied social screening criteria to investment decisions with one that integrates sustainable and environmental, social and governance considerations in the investment process

At the other end of the range in December, the Pax Large Cap Fund Institutional shares recorded a 1.59% gain. The fund’s 8.72% exposure to the Energy sector that scored a 6.92% gain and avoidance of the Utility sector which was down -6.02% for the month, contributed to the fund’s December gain. On the other hand, the fund’s above benchmark exposure to the Health Care sector, up a narrow 0.49% in December, likely didn’t add much to performance nor did the fund’s largest holdings, in Apple Inc., Microsoft Corp. and Amazon.com which were flat to down over the course of the month. The same fund led the SUSTAIN Index for the quarter with its gain of 7.18%. The Neuberger Berman Socially Responsive Institutional share class, up 18.76% for the year, was the second best performing fund in December. Its gain of 1.57% was supported by stock holdings in such companies as Texas Instruments Inc. and Progressive Corp. that together accounted for about 10% of the fund’s assets, its growth bias, avoidance of the Utilities sector and European stock exposure of around 15% given the stronger performance on the part of European stocks in December. Refer to Table 1.

SUSTAIN Index Registers Best Quarterly Performance of the Year

Like the S&P 500 Index, the SUSTAIN Index registered its best quarterly performance of the year. The index gained 5.54%, besting the first quarter’s increase of 5.44%, but that still was insufficient to eclipse the S&P 500 Index that posted a 6.64% gain. Only two funds outperformed the S&P 500, led by the previously mentioned Pax Large Cap Fund Institutional Shares.

The Sustainable Large Cap Equity Fund Index (SUSTAIN Index) Explained

The index, which was initiated as of June 30, 2017 with data back to December 31, 2016, tracks the total return performance of the ten largest actively managed large cap domestic equity mutual funds that employ a sustainable investing strategy beyond absolute reliance on exclusionary practices for religious, ethical or social reasons. While methodologies vary, to qualify for inclusion in the index, funds must actively apply environmental, social and governance (ESG) criteria to their investment processes and decision making. In tandem with their ESG integration strategy, funds may also employ exclusionary strategies along with impact oriented investment approaches as well as shareholder advocacy.

The SUSTAIN Index was reconstituted following the close of business on September 31, 2017 with the deletion of the Sentinel Sustainable Core Opportunities Fund Class A and the addition of the Dreyfus Sustainable US Equity Fund Z in advance of the October 30, 2017 completion of the sale of Sentinel mutual funds to Touchstone Investments. In the process, the Sentinel Sustainable Core Opportunities Fund was reorganized into the existing Touchstone Sustainability and Impact Equity Fund that pursues an expanded global investment strategy, including developed and developing countries.

Multiple funds managed by the same management firm may be included in the index, however, a fund with multiple share classes is only included in the index once, based on the largest share class in terms of assets. The index is equally weighted, it is calculated monthly and rebalanced once a year as of December 31.

The combined assets associated with the ten funds stood at $21.2 billion and represent about 13.7% of the entire sustainable US equity sector that is comprised of 220 funds/share classes, including actively managed funds and index funds, with $154.4 billion in assets under management.