Summary

- During a volatile March month that reflected shifting investor sentiments, the SUSTAIN Large Cap Equity Fund Index registered a decline of -2.00%, or 54 basis points (bps) ahead of the S&P 500 Index which dropped -2.54%.

- The SUSTAIN Index was bolstered by the performance of 7 of the 10 member funds that exceeded the results achieved by the non-sustainability oriented S&P 500 Index.

- U.S. bonds in the aggregate were a brighter spot for investors during the month. The BBgBarc U.S. Aggregate Bond Index recorded an increase of +0.64% while a cohort of five sustainable corporate intermediate-term bonds recorded a +0.50% gain.

- SUSTAIN equity funds and bonds funds posted negative returns in the first quarter.

SUSTAIN Equity Fund Index Declines -2.0% in a Volatile Month, Exceeding the Performance of the S&P 500 by 54 basis points

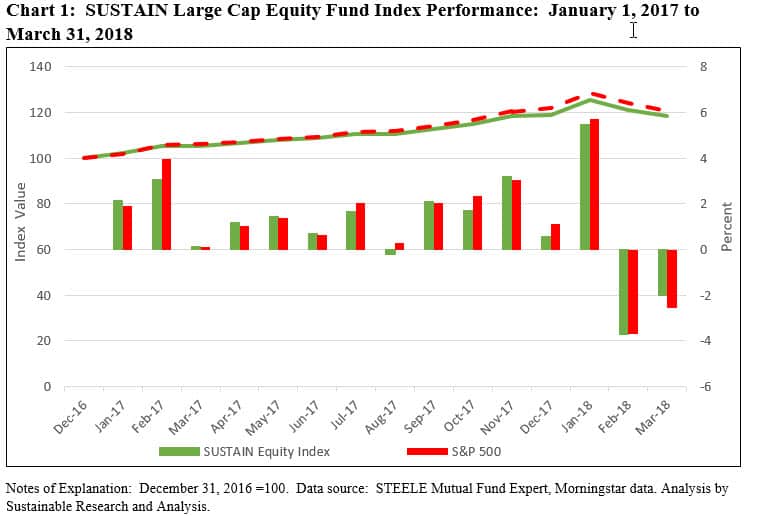

The SUSTAIN Large Cap Equity Fund Index, which tracks the total return performance of the ten largest actively managed large-cap U.S. oriented equity mutual funds that employ a sustainable investment strategy beyond absolute reliance on exclusionary practices, gave up -2.00% in March versus a decline of -2.54% for the S&P 500 Index and an even steeper drop of -3.59% delivered by the Dow Jones Industrial Average (DJIA). The SUSTAIN Index, while lagging over the trailing 12-month period, is also ahead of the S&P 500 for the first quarter, posting a slight total return decline of -0.483% as compared to the -0.76% for the S&P 500 Index. Refer to Chart 1.

March continued to reflect shifting investor sentiments that began to surface at the end of January due to concerns around trade, inflation, interest rates, and in March growing fears that social network companies and other internet firms might face revenue constraints if they were to become subject to new regulations designed to protect customer data and user privacy. These concerns were likely accentuated by deepening anxiety about the lack of strategic and thoughtful leadership emanating from Washington D.C. and likely reflected in a dramatic uptick in volatility that began at the very end of the first month. The S&P 500 Index moved up or down by more than 1% during nine trading days in March, 12 trading days in February and in contrast, only two trading days in January, for a total of 23 trading days during the first quarter. This is already triple the number of volatile days in all of 2017.

In general, larger value stocks outperformed growth stocks in March by around 94 basis points, but both market segments sustained declines in excess of 2% while diverging in terms of their performance across the quarter. A slight blend-to-value tilt on the part of the underlying funds may have helped the SUSTAIN Equity Fund Index outperform the S&P 500 Index.

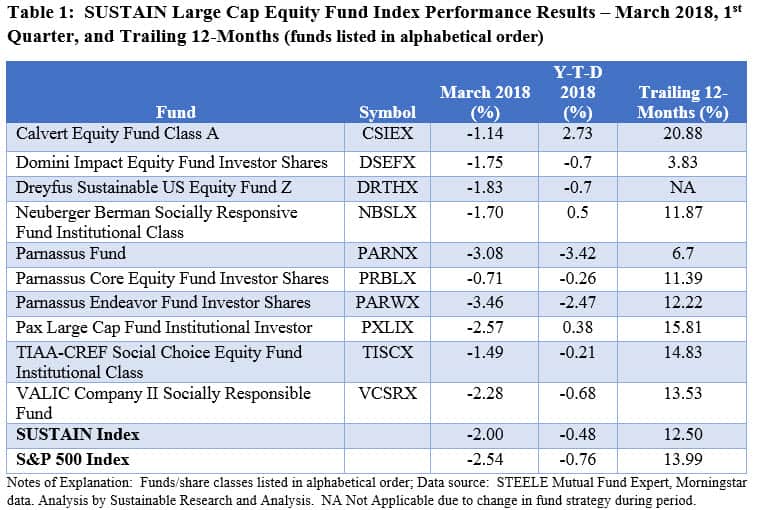

The SUSTAIN Index was bolstered by the performance of 7 of the 10 member funds that exceeded the results achieved by the non-sustainability oriented broad market index. The best and worst performing funds were both managed by Parnassus Investors. Parnassus Core Equity Fund, the largest actively managed sustainable fund with $15.4 billion in net assets, was the best performer in March with its total return of -0.71%. The large cap-blended portfolio is less exposed to the Financials and Information Technology sectors that during the month saw declines of -4.46% and -3.95%, respectively. At the same time, some, but below benchmark level investments in the only three positive performing sectors, Utilities (+3.41%), Real Estate (+3.26) and Energy (1.55%), offered support. The fund also benefited from stock holdings, such as the almost 6% position in Intel Corp. that for the month of March at least, rose around 6% before falling back in early April on news that Apple may replace Intel in its PCs. In contrast, the more concentrated $5.2 billion Parnassus Endeavor Fund was the month’s worst performing fund in the index. Investing in companies offering outstanding workplaces, the fund avoids firms in the extraction, exploration, production, manufacturing, or refining of fossil fuels sectors. The fund didn’t have any exposure to the Utilities, Real Estate and Energy sectors and was also hampered by its concentrated 10.06% exposure to QUALCOMM that was down around -10% in the month on news that Broadcom’s attempts to acquire the company have been blocked. Stock selection aside, the fund’s March performance was depressed due to its overweight exposure to the Healthcare sector which was down -3.21%. Refer to Chart 1.

Not unexpectedly, there is a high correlation between the member funds’ performance results in March and their results for the quarter. The SUSTAIN Index is also slightly ahead of the S&P 500 Index for the quarter, posting a return of -0.48% versus -0.76%, or an advantage of 28 bps, aided by the results achieved on the part of Calvert Equity A (-1.14%), TIAA-CREF Social Equity Fund Institutional (-1.49%), and the Neuberger Berman Socially Responsible Institutional Shares (-1.7%). Each of these funds recorded positive outcomes year-to-date. The quarter’s relative results bring the SUSTAIN Equity Index to within 150 bps of the S&P 500 Index with its year-to-date gain of +12.5% versus +14.0% for the S&P 500.

Sustainable Bond Funds Post Positive Results in March but Slightly Lag the BBgBarc U.S. Aggregate Bond Index

U.S. bonds in the aggregate were a bright spot for investors during the month, given their positive return and recovery from two consecutive months of negative outcomes. The BBgBarc U.S. Aggregate Bond Index posted an increase of 0.64% while a cohort of five sustainable corporate intermediate-term bonds, members of the Sustainable (SUSTAIN) Bond Fund Indicator, recorded a +0.50% gain. Each of the five funds achieved positive results ranging from a low of 0.29% for the PIMCO Total Return ESG Institutional Fund to a high of 0.72% posted by Praxis Impact Bond I. Benefiting from declining interest rates that dropped by 13 basis points from 2.87% on the 10-year Treasury to 2.74% at the end of March, the five bond funds regained some ground after giving up an average -1.0% in January and -0.75% in February. Still, the gain in March was not sufficient to offset these results and the SUSTAIN Bond Fund Indicator remained in the red for the first quarter. It produced a loss of -1.24% versus -1.46% for the BBgBarc U.S. Aggregate Bond Index

The Sustainable (SUSTAIN) Bond Fund Indicator represents the total return performance of a cohort of five sustainable bond funds consisting of similarly managed funds that, like the equity index counterpart, employ sustainable investing strategies beyond absolute reliance on exclusionary practices that track the BBgBarc U.S Aggregate Bond Index.

SUSTAIN Large Cap Equity Fund Index Declines -2.00% in March; Beats S&P 500 Index by 54 BPS

Summary During a volatile March month that reflected shifting investor sentiments, the SUSTAIN Large Cap Equity Fund Index registered a decline of -2.00%, or 54 basis points (bps) ahead of the S&P 500 Index which dropped -2.54%. The SUSTAIN Index was bolstered by the performance of 7 of the 10 member funds that exceeded the…

Share This Article:

Summary

SUSTAIN Equity Fund Index Declines -2.0% in a Volatile Month, Exceeding the Performance of the S&P 500 by 54 basis points

The SUSTAIN Large Cap Equity Fund Index, which tracks the total return performance of the ten largest actively managed large-cap U.S. oriented equity mutual funds that employ a sustainable investment strategy beyond absolute reliance on exclusionary practices, gave up -2.00% in March versus a decline of -2.54% for the S&P 500 Index and an even steeper drop of -3.59% delivered by the Dow Jones Industrial Average (DJIA). The SUSTAIN Index, while lagging over the trailing 12-month period, is also ahead of the S&P 500 for the first quarter, posting a slight total return decline of -0.483% as compared to the -0.76% for the S&P 500 Index. Refer to Chart 1.

March continued to reflect shifting investor sentiments that began to surface at the end of January due to concerns around trade, inflation, interest rates, and in March growing fears that social network companies and other internet firms might face revenue constraints if they were to become subject to new regulations designed to protect customer data and user privacy. These concerns were likely accentuated by deepening anxiety about the lack of strategic and thoughtful leadership emanating from Washington D.C. and likely reflected in a dramatic uptick in volatility that began at the very end of the first month. The S&P 500 Index moved up or down by more than 1% during nine trading days in March, 12 trading days in February and in contrast, only two trading days in January, for a total of 23 trading days during the first quarter. This is already triple the number of volatile days in all of 2017.

In general, larger value stocks outperformed growth stocks in March by around 94 basis points, but both market segments sustained declines in excess of 2% while diverging in terms of their performance across the quarter. A slight blend-to-value tilt on the part of the underlying funds may have helped the SUSTAIN Equity Fund Index outperform the S&P 500 Index.

The SUSTAIN Index was bolstered by the performance of 7 of the 10 member funds that exceeded the results achieved by the non-sustainability oriented broad market index. The best and worst performing funds were both managed by Parnassus Investors. Parnassus Core Equity Fund, the largest actively managed sustainable fund with $15.4 billion in net assets, was the best performer in March with its total return of -0.71%. The large cap-blended portfolio is less exposed to the Financials and Information Technology sectors that during the month saw declines of -4.46% and -3.95%, respectively. At the same time, some, but below benchmark level investments in the only three positive performing sectors, Utilities (+3.41%), Real Estate (+3.26) and Energy (1.55%), offered support. The fund also benefited from stock holdings, such as the almost 6% position in Intel Corp. that for the month of March at least, rose around 6% before falling back in early April on news that Apple may replace Intel in its PCs. In contrast, the more concentrated $5.2 billion Parnassus Endeavor Fund was the month’s worst performing fund in the index. Investing in companies offering outstanding workplaces, the fund avoids firms in the extraction, exploration, production, manufacturing, or refining of fossil fuels sectors. The fund didn’t have any exposure to the Utilities, Real Estate and Energy sectors and was also hampered by its concentrated 10.06% exposure to QUALCOMM that was down around -10% in the month on news that Broadcom’s attempts to acquire the company have been blocked. Stock selection aside, the fund’s March performance was depressed due to its overweight exposure to the Healthcare sector which was down -3.21%. Refer to Chart 1.

Not unexpectedly, there is a high correlation between the member funds’ performance results in March and their results for the quarter. The SUSTAIN Index is also slightly ahead of the S&P 500 Index for the quarter, posting a return of -0.48% versus -0.76%, or an advantage of 28 bps, aided by the results achieved on the part of Calvert Equity A (-1.14%), TIAA-CREF Social Equity Fund Institutional (-1.49%), and the Neuberger Berman Socially Responsible Institutional Shares (-1.7%). Each of these funds recorded positive outcomes year-to-date. The quarter’s relative results bring the SUSTAIN Equity Index to within 150 bps of the S&P 500 Index with its year-to-date gain of +12.5% versus +14.0% for the S&P 500.

Sustainable Bond Funds Post Positive Results in March but Slightly Lag the BBgBarc U.S. Aggregate Bond Index

U.S. bonds in the aggregate were a bright spot for investors during the month, given their positive return and recovery from two consecutive months of negative outcomes. The BBgBarc U.S. Aggregate Bond Index posted an increase of 0.64% while a cohort of five sustainable corporate intermediate-term bonds, members of the Sustainable (SUSTAIN) Bond Fund Indicator, recorded a +0.50% gain. Each of the five funds achieved positive results ranging from a low of 0.29% for the PIMCO Total Return ESG Institutional Fund to a high of 0.72% posted by Praxis Impact Bond I. Benefiting from declining interest rates that dropped by 13 basis points from 2.87% on the 10-year Treasury to 2.74% at the end of March, the five bond funds regained some ground after giving up an average -1.0% in January and -0.75% in February. Still, the gain in March was not sufficient to offset these results and the SUSTAIN Bond Fund Indicator remained in the red for the first quarter. It produced a loss of -1.24% versus -1.46% for the BBgBarc U.S. Aggregate Bond Index

The Sustainable (SUSTAIN) Bond Fund Indicator represents the total return performance of a cohort of five sustainable bond funds consisting of similarly managed funds that, like the equity index counterpart, employ sustainable investing strategies beyond absolute reliance on exclusionary practices that track the BBgBarc U.S Aggregate Bond Index.

Sustainableinvest.com

Benefits

Free access to regularly updated original research and analysis focused exclusively on sustainable finance and investing, providing investors with the guidance needed to make informed investment decisions that align with their personal values and financial goals while also contributing to the advancement of positive long-term environmental and social outcomes.

By offering financial support for our current work, either in the form of a one-time or regular contributions, you help to defray some of the costs associated with conducting our research and analysis as well as to maintain the www.sustainablest.wpengine.com website.

Helping us to expand our research capabilities and offerings over time to cover additional relevant topics geared to sustainable investors.

Sign up to free newsletters.

By submitting this form, you are consenting to receive marketing emails from: . You can revoke your consent to receive emails at any time by using the SafeUnsubscribe® link, found at the bottom of every email. Emails are serviced by Constant Contact