Markets take a breather in July: Domestic Sustainable Equity and Bond Indices beat conventional indices

After posting a gain of 7.0% in June, stocks as measured by the S&P 500 Index, took a breather in July to end the month up 1.4%. The Dow Jones Industrial Average and Nasdaq Composite each recorded gains of 1.12% and 2.15%, respectively. For both the S&P and Nasdaq indices, these were the smallest positive returns so-far this year, excluding the negative results of -6.4% and -7.79% recorded in May, even after stocks reached a new all-time high on July 26 just ahead of the Federal Reserve Bank’s decision on the last day of July to lower the target range for the federal funds rate to 2 to 2-1/4 percent. The rate cut was the first in 11 years, set against a backdrop of a strong labor market and moderate economic activity but prompted by the Federal Reserve Open Market Committee’s view that “sustained expansion of economic activity, strong labor market conditions, and inflation near the Committee’s symmetric 2 percent objective are the most likely outcomes, but uncertainties about this outlook remain.” In addition to concerns regarding the slowing economy led, for now, by a decline in business investment, exports and growth abroad, investor uncertainty focused on other economic and percolating geopolitical risks, including the continuing US/China trade tensions, slower growth in Europe and China, Boris Johnson’s appointment as Britain’s new prime minister and the possibility that the UK would leave the European Union without a BREXIT deal, and Iran strains. At the same time, US corporates looked set to deliver low single-digit earnings growth for the second quarter. Approximately three-quarters of companies that had reported earnings through the end of July, or about 60% of S&P 500 companies, have beaten analyst earnings estimates so far, although this was largely driven by share buybacks and, in part, reflects a lower hurdle after analysts had grown more pessimistic.

Returns for the month across sectors and asset classes ranged from a high of 5.11% to a low of -5.83% for the narrowest range of returns so far this year. Small-company stocks were up just 0.58% and while this segment has been losing momentum over the last three months it is still up 17.66% year-to-date while large caps are up 20.24%. Also in July, growth stocks outperformed value stocks.

In the fixed income markets, 10-year Treasury yields ended the month at 2.02%, 2 basis points (bps) higher relative to the prior month-end. 90-day Treasury yields remained inverted for the entire month, ending July 6 bps lower than the 10-year. The Bloomberg Barclays US Aggregate Index was up 0.22%. Long-dated and lower rated securities posted better returns relative to short-dated and highly rated bonds.

Outside the US, stocks didn’t perform as well. The MSCI ACWI ex USA NR Index was down -1.21%, dragged down by the performance of emerging market stocks. MSCI EAFE recorded a decline of -1.27% while China was lower -0.54%.

The Sustainable (SUSTAIN) Large Cap Equity Fund Index posted a gain of 1.74%, outperforming the S&P 500 by 30 bps

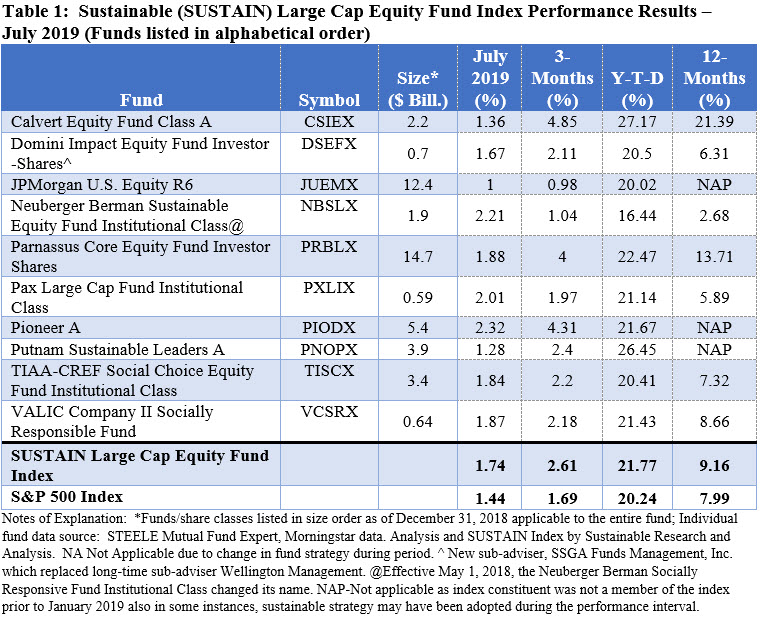

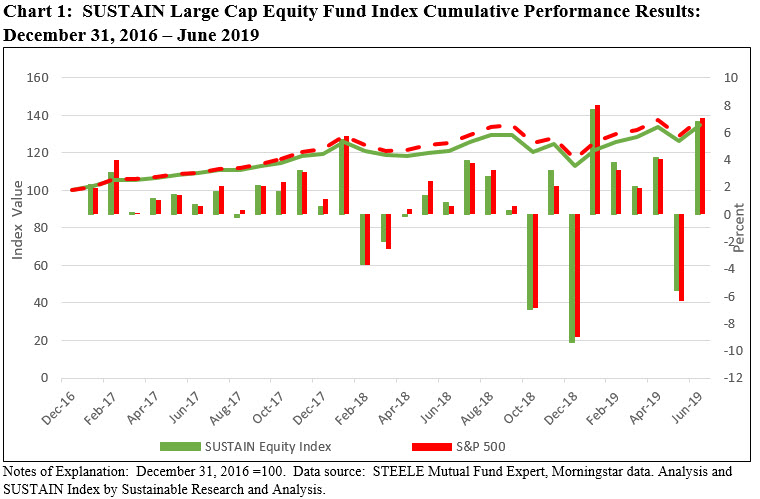

The Sustainable (SUSTAIN) Large Cap Equity Fund Index posted a gain of 1.74% and outperformed the S&P 500 Index by 30 bps, as seven of the 10 funds that comprise the benchmark beat the performance of the S&P 500 Index in July. This was the fifth time this year that the SUSTAIN Index outperformed the S&P 500 that now also leads on a year-to-date basis 21.77% versus 20.24%. The SUSTAIN Equity Index leads the S&P 500 over the trailing 12-months by an even wider margin of 1.17%. Refer to Table 1 and Chart 1.

The SUSTAIN Equity Index was lifted higher by the performance of eight funds that posted July total return results ranging from 1.67% to 2.32%. The best performing of these funds were each displaying large cap blend strategies, starting with the $5 billion Pioneer Fund A. The fund was 92.4% invested in US stocks, 5.34% in non-US stocks and the remaining 2.26% was held in cash. About 70% of the fund’s assets were allocated to the technology (19.77%), consumer cyclical 17.66%), financial services (17.12%) and the healthcare (15.02%) sectors while the top three holdings were over-weighted in AT&T (5.29%), Facebook Inc. (5.06%) and Home Depot (4.81%). The second best performer in July was the smaller $1.9 billion Neuberger Berman Sustainable Equity Fund Institutional. The fund managed to deliver favorable July results even with a 15.33% exposure to non-US stocks and overweighting in the Healthcare sector that was down -0.74% in July. Another fund that also pushed above 2.0% in July was the $685.6 million Pax Large Cap Fund Institutional. Refer to Table 1.

At the other end of the range were the JPMorgan US Equity Fund R6 and Putnam Sustainable Leaders Fund A, two funds that re-branded themselves by adopting a formal ESG integration approach. They returned 1.0% and 1.28%, respectively.

The Sustainable (SUSTAIN) Bond Fund Index posted a gain of 0.28%, eclipsing the performance of the Bloomberg Barclays US Aggregate Index by 0.06%

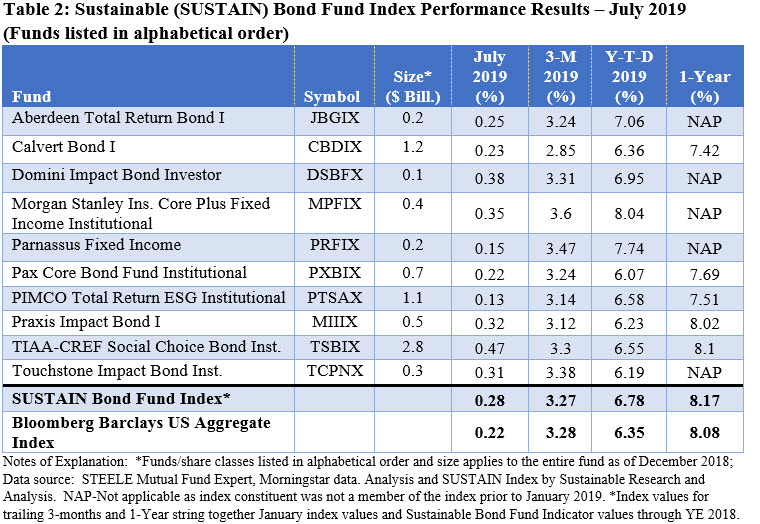

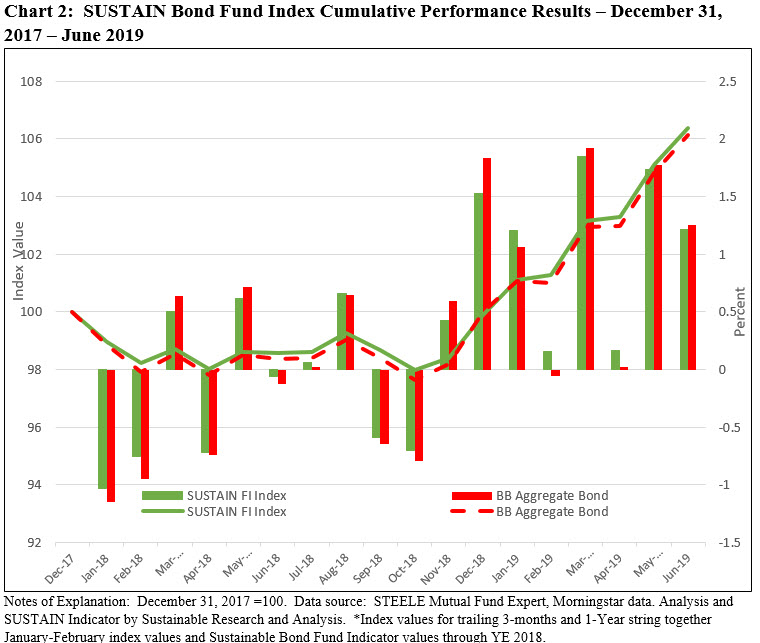

Sustainable bond funds, up 6.78% since the start of the year, also took a bit of a breather following back-to-back monthly returns in excess of 1%. Eight of the ten bond funds that comprise the index outperformed the Bloomberg Barclays US Aggregate Index to drive the entire SUSTAIN Bond Fund Index higher and beat by 6 bps the conventional bond index which posted a gain of 0.22%. The SUSTAIN Bond Fund Index is also ahead by 43 bps and 9 bps, respectively, on a year-to-date and trailing 12-months. Refer to Table 2 and Chart 2.

Leading the pack in July was the $4.0 billion TIAA-CREF Social Choice Bond Fund Institutional Shares that posted a gain of 0.47% or 9 bps ahead of the second best performing fund. The fund, which was more heavily invested in corporate bonds and reduced exposures to securitizations and government securities, likely benefited from its longer effective maturity of 9.01 years and BBB average credit quality.

Bringing up the rear are the PIMCO Total Return ESG Institutional Fund, up 0.13% and the Parnassus Fixed Income Fund, up 0.15%.

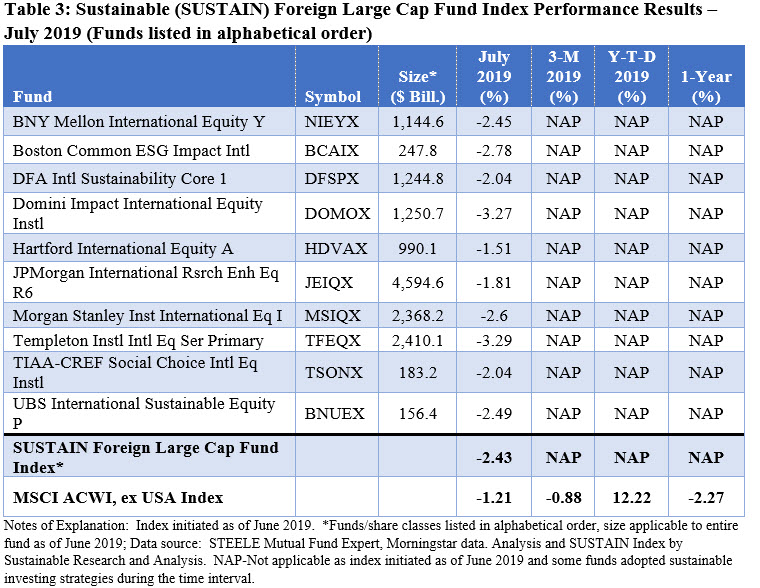

Sustainable (SUSTAIN) Foreign Equity Fund Index recorded a -2.43% decline and lagged by 1.22% behind the MSCI ACWI, ex USA Index

Launched only as of June 30, 2019, the 10 sustainable foreign funds index lagged the MSCI ACWI, ex USA for the second consecutive month. None of the index members matched the performance of the conventional index as their results ranged from -1.51% to -3.29%. The two funds that limited their declines to less than 2% included the $979.9 million Hartford International Equity Fund A, sub-advised by Wellington Management, which gave up -1.51%, and the much larger $3.4 billion JP Morgan International Research Enhanced Equity Fund R6 that posted a decline of -1.81%. Over the short two month interval, the SUSTAIN Foreign Fund Index trails the MSCI ACWI, ex USA Index by 1.22%. Refer to Table 3.

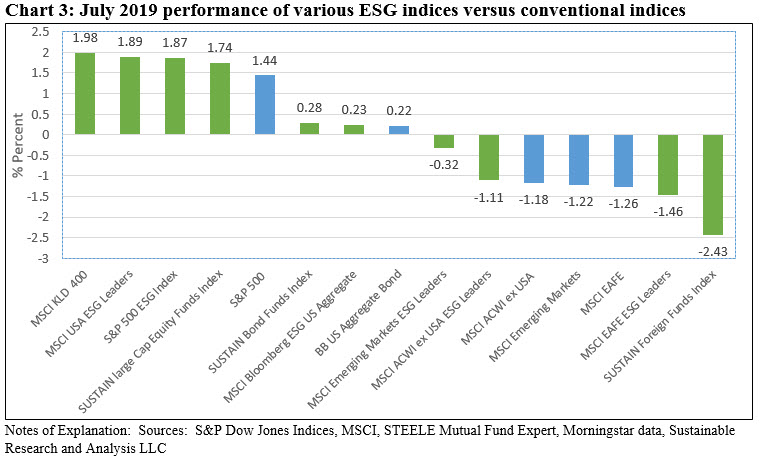

Performance of ESG indices in July versus non-ESG Indices: Clear wins in July for sustainable equities and bonds, including mutual funds; SUSTAIN Foreign Funds Index and MSCI EAFE ESG Index lag

US Equities-Sustainable US equities and the SUSTAIN Large Cap Fund Index outperformed the conventional S&P 500 Index. Refer to Chart 3.

Fixed Income-The MSCI Bloomberg ESG US Aggregate Index and SUSTAIN Bond Fund Index led in the month of July by a margin of one and six bps. Refer to Chart 3.

Foreign Equities-The MSCI ACWI, ex USA ESG Leaders eclipsed the performance of the equivalent conventional index while the SUSTAIN Foreign Fund Index lagged. This was also the case for MSCI Emerging markets ESG Index that outperformed the MSCI Emerging Markets Index. On the other hand, the MSCI EAFE ESG lagged its non-ESG counterpart. Refer to Chart 3.

Markets Take a Breather in July; 2 of 3 SUSTAIN Fund Indices Outperform

Markets take a breather in July: Domestic Sustainable Equity and Bond Indices beat conventional indices After posting a gain of 7.0% in June, stocks as measured by the S&P 500 Index, took a breather in July to end the month up 1.4%. The Dow Jones Industrial Average and Nasdaq Composite each recorded gains of 1.12%…

Share This Article:

Markets take a breather in July: Domestic Sustainable Equity and Bond Indices beat conventional indices

After posting a gain of 7.0% in June, stocks as measured by the S&P 500 Index, took a breather in July to end the month up 1.4%. The Dow Jones Industrial Average and Nasdaq Composite each recorded gains of 1.12% and 2.15%, respectively. For both the S&P and Nasdaq indices, these were the smallest positive returns so-far this year, excluding the negative results of -6.4% and -7.79% recorded in May, even after stocks reached a new all-time high on July 26 just ahead of the Federal Reserve Bank’s decision on the last day of July to lower the target range for the federal funds rate to 2 to 2-1/4 percent. The rate cut was the first in 11 years, set against a backdrop of a strong labor market and moderate economic activity but prompted by the Federal Reserve Open Market Committee’s view that “sustained expansion of economic activity, strong labor market conditions, and inflation near the Committee’s symmetric 2 percent objective are the most likely outcomes, but uncertainties about this outlook remain.” In addition to concerns regarding the slowing economy led, for now, by a decline in business investment, exports and growth abroad, investor uncertainty focused on other economic and percolating geopolitical risks, including the continuing US/China trade tensions, slower growth in Europe and China, Boris Johnson’s appointment as Britain’s new prime minister and the possibility that the UK would leave the European Union without a BREXIT deal, and Iran strains. At the same time, US corporates looked set to deliver low single-digit earnings growth for the second quarter. Approximately three-quarters of companies that had reported earnings through the end of July, or about 60% of S&P 500 companies, have beaten analyst earnings estimates so far, although this was largely driven by share buybacks and, in part, reflects a lower hurdle after analysts had grown more pessimistic.

Returns for the month across sectors and asset classes ranged from a high of 5.11% to a low of -5.83% for the narrowest range of returns so far this year. Small-company stocks were up just 0.58% and while this segment has been losing momentum over the last three months it is still up 17.66% year-to-date while large caps are up 20.24%. Also in July, growth stocks outperformed value stocks.

In the fixed income markets, 10-year Treasury yields ended the month at 2.02%, 2 basis points (bps) higher relative to the prior month-end. 90-day Treasury yields remained inverted for the entire month, ending July 6 bps lower than the 10-year. The Bloomberg Barclays US Aggregate Index was up 0.22%. Long-dated and lower rated securities posted better returns relative to short-dated and highly rated bonds.

Outside the US, stocks didn’t perform as well. The MSCI ACWI ex USA NR Index was down -1.21%, dragged down by the performance of emerging market stocks. MSCI EAFE recorded a decline of -1.27% while China was lower -0.54%.

The Sustainable (SUSTAIN) Large Cap Equity Fund Index posted a gain of 1.74%, outperforming the S&P 500 by 30 bps

The Sustainable (SUSTAIN) Large Cap Equity Fund Index posted a gain of 1.74% and outperformed the S&P 500 Index by 30 bps, as seven of the 10 funds that comprise the benchmark beat the performance of the S&P 500 Index in July. This was the fifth time this year that the SUSTAIN Index outperformed the S&P 500 that now also leads on a year-to-date basis 21.77% versus 20.24%. The SUSTAIN Equity Index leads the S&P 500 over the trailing 12-months by an even wider margin of 1.17%. Refer to Table 1 and Chart 1.

The SUSTAIN Equity Index was lifted higher by the performance of eight funds that posted July total return results ranging from 1.67% to 2.32%. The best performing of these funds were each displaying large cap blend strategies, starting with the $5 billion Pioneer Fund A. The fund was 92.4% invested in US stocks, 5.34% in non-US stocks and the remaining 2.26% was held in cash. About 70% of the fund’s assets were allocated to the technology (19.77%), consumer cyclical 17.66%), financial services (17.12%) and the healthcare (15.02%) sectors while the top three holdings were over-weighted in AT&T (5.29%), Facebook Inc. (5.06%) and Home Depot (4.81%). The second best performer in July was the smaller $1.9 billion Neuberger Berman Sustainable Equity Fund Institutional. The fund managed to deliver favorable July results even with a 15.33% exposure to non-US stocks and overweighting in the Healthcare sector that was down -0.74% in July. Another fund that also pushed above 2.0% in July was the $685.6 million Pax Large Cap Fund Institutional. Refer to Table 1.

At the other end of the range were the JPMorgan US Equity Fund R6 and Putnam Sustainable Leaders Fund A, two funds that re-branded themselves by adopting a formal ESG integration approach. They returned 1.0% and 1.28%, respectively.

The Sustainable (SUSTAIN) Bond Fund Index posted a gain of 0.28%, eclipsing the performance of the Bloomberg Barclays US Aggregate Index by 0.06%

Sustainable bond funds, up 6.78% since the start of the year, also took a bit of a breather following back-to-back monthly returns in excess of 1%. Eight of the ten bond funds that comprise the index outperformed the Bloomberg Barclays US Aggregate Index to drive the entire SUSTAIN Bond Fund Index higher and beat by 6 bps the conventional bond index which posted a gain of 0.22%. The SUSTAIN Bond Fund Index is also ahead by 43 bps and 9 bps, respectively, on a year-to-date and trailing 12-months. Refer to Table 2 and Chart 2.

Leading the pack in July was the $4.0 billion TIAA-CREF Social Choice Bond Fund Institutional Shares that posted a gain of 0.47% or 9 bps ahead of the second best performing fund. The fund, which was more heavily invested in corporate bonds and reduced exposures to securitizations and government securities, likely benefited from its longer effective maturity of 9.01 years and BBB average credit quality.

Bringing up the rear are the PIMCO Total Return ESG Institutional Fund, up 0.13% and the Parnassus Fixed Income Fund, up 0.15%.

Sustainable (SUSTAIN) Foreign Equity Fund Index recorded a -2.43% decline and lagged by 1.22% behind the MSCI ACWI, ex USA Index

Launched only as of June 30, 2019, the 10 sustainable foreign funds index lagged the MSCI ACWI, ex USA for the second consecutive month. None of the index members matched the performance of the conventional index as their results ranged from -1.51% to -3.29%. The two funds that limited their declines to less than 2% included the $979.9 million Hartford International Equity Fund A, sub-advised by Wellington Management, which gave up -1.51%, and the much larger $3.4 billion JP Morgan International Research Enhanced Equity Fund R6 that posted a decline of -1.81%. Over the short two month interval, the SUSTAIN Foreign Fund Index trails the MSCI ACWI, ex USA Index by 1.22%. Refer to Table 3.

Performance of ESG indices in July versus non-ESG Indices: Clear wins in July for sustainable equities and bonds, including mutual funds; SUSTAIN Foreign Funds Index and MSCI EAFE ESG Index lag

US Equities-Sustainable US equities and the SUSTAIN Large Cap Fund Index outperformed the conventional S&P 500 Index. Refer to Chart 3.

Fixed Income-The MSCI Bloomberg ESG US Aggregate Index and SUSTAIN Bond Fund Index led in the month of July by a margin of one and six bps. Refer to Chart 3.

Foreign Equities-The MSCI ACWI, ex USA ESG Leaders eclipsed the performance of the equivalent conventional index while the SUSTAIN Foreign Fund Index lagged. This was also the case for MSCI Emerging markets ESG Index that outperformed the MSCI Emerging Markets Index. On the other hand, the MSCI EAFE ESG lagged its non-ESG counterpart. Refer to Chart 3.

Sustainableinvest.com

Benefits

Free access to regularly updated original research and analysis focused exclusively on sustainable finance and investing, providing investors with the guidance needed to make informed investment decisions that align with their personal values and financial goals while also contributing to the advancement of positive long-term environmental and social outcomes.

By offering financial support for our current work, either in the form of a one-time or regular contributions, you help to defray some of the costs associated with conducting our research and analysis as well as to maintain the www.sustainablest.wpengine.com website.

Helping us to expand our research capabilities and offerings over time to cover additional relevant topics geared to sustainable investors.

Sign up to free newsletters.

By submitting this form, you are consenting to receive marketing emails from: . You can revoke your consent to receive emails at any time by using the SafeUnsubscribe® link, found at the bottom of every email. Emails are serviced by Constant Contact