The Bottom Line: The US stock market in February suffers a sharp decline, bonds gain and sustainable funds across asset classes drop an average -4.25%.

Market suffers sharp decline and ends the month of February with a decline of -8.23%

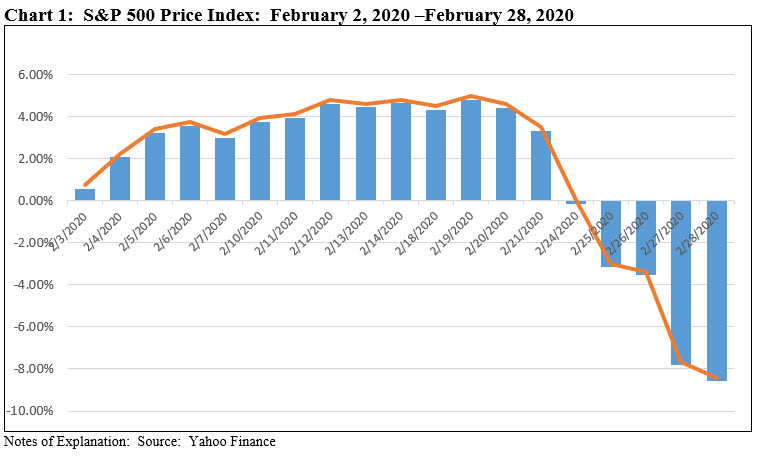

The US stock market at the end of February, based on the S&P 500, suffered the second-worst week since 1941 and one of the fastest 10% declines on record. After reaching a record high on February 19th and registering a year-to-date gain of 4.81%, stock markets and bond markets in the US became infected by the coronavirus as news spread that COVID-19, as the disease is now branded, spread past China to South Korea and Italy. Refer to Chart 1. This was followed by confusing reports than an American in California had contracted the virus without having been in contact with any apparent carrier from the affected areas. Reports of the carnivorous outbreak surfaced in mid-December when China alerted the World Health Organization of several cases of unusual pneumonia in Wuhan, but market reaction had been muted till the last week in February. By month-end, the S&P 500 closed with a total return decline of -8.23% while intermediate investment-grade bonds, as measured by the Bloomberg Barclays US Aggregate Bond Index ended the month higher with a gain of 1.8%.

The U.S. economy is predominantly driven by consumer spending, which accounts for approximately 70% of all economic growth, and consumer sentiment during this interval to-month end has remained strong. According to reporting in Barron’s, consumer confidence for the five-day period to February 27th per economists at Cornerstone Macroeconomics remained elevated. That said, uncertainty at month-end regarding the extent to which the virus will constrain global growth was forcing a reconsideration of 2020 profit expectations. While corporate 4th quarter 2019 earnings results were better than expected as they rose 1.6% versus the expected 2.1% decline based on S&P data, according to a report released by Goldman Sachs, US companies will generate no earnings growth in 2020 if the coronavirus becomes widespread. Smaller companies may be even more exposed, which may be behind a greater decline posted by the Russell 2000. The Index was down -8.42% in February and -11.36% year-to-date versus a decline of -8.27% for the S&P 500 over the same interval. Small growth companies delivered slightly better results as did large cap stocks versus their value qualified counterparts.

For the month, all sectors of the S&P 500 were down, with four sectors suffering double digit declines ranging from -10.0% registered by the Materials Sector to -17.79% posted by Energy stocks as Brent Crude posted a decline of -13.14% and an even more severe year-to-date drop of -23.45%. Financials were also down sharply, giving up -11.2%.

Overseas, the MSCI ACWI, ex USA (net) recorded a decline of -7.9% while emerging markets in Eastern Europe and Latin America ended the month lower. An exception was China which actually gained 0.97% according to the MSCI China Index while the broader MSCI Emerging Markets Asia Index gave up -2.86%.

A flight to safety drove down Treasury yields, with the 10-Year Treasury dropping to 1.13% on the last day of February, down from 1.51% at the end of the prior month and 1.88% at the start of the year. Longer dated treasuries gained 6.9% and AAA corporate bonds added 2.65% while corporate bonds rated single A gained 1.62%. Widening spreads left high yield corporate bonds down -1.41%.

Sustainable funds, across all asset classes, give up an average -4.25%

The universe of 3,749 sustainable mutual funds and ETFS, now straddling a range from money market funds, fixed income funds, equity funds and also commodity funds, posted an average decline of -4.25%. In February, only 26% of sustainable funds delivered zero to positive rates of return while the range of returns extended from 11.7% recorded by the best performing thematic Invesco Solar ETF to a decline of -14.88% sustained by another thematic fund that integrates ESG, the Amplify Seymour Cannabis ETF. At the same time, the Sustainable (SUSTAIN) Large Cap Equity Fund Index, the Sustainable (SUSTAIN) Foreign Equity Large Cap Index and Sustainable (SUSTAIN) Bond Fund Index recorded returns of -7.89%, -6.97% and 1.46%, in that order. The two SUSTAIN equity fund indices outperformed their corresponding conventional indices while the SUSTAIN Bond Fund Index lagged behind.

Sustainable (SUSTAIN) Large Cap Equity Fund Index beats S&P 500 by 34 basis points

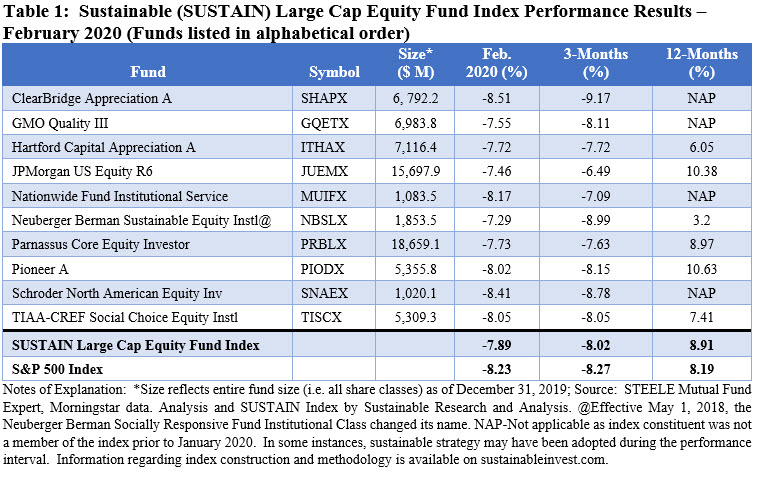

After trailing the conventional index for the last five months, the SUSTAIN Large Cap Equity Fund Index eclipsed the S&P 500 in February by 34 bps with a return of -7.89%. Eight of the ten funds tracked in the index posted results that exceeded the S&P 500, led by the Neuberger Berman Sustainable Equity Institutional Shares that registered a decline of -7.29%. Like the two leading funds in the bond and foreign equity SUSTAIN indices covered below, the Neuberger fund employs a combination of sustainable strategies, including ESG integration, negative screening (exclusions), impact investing and investee engagement. Refer to Table 1.

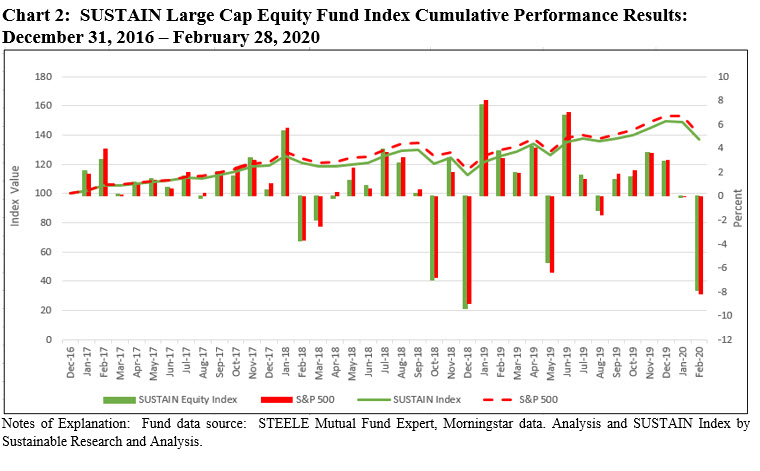

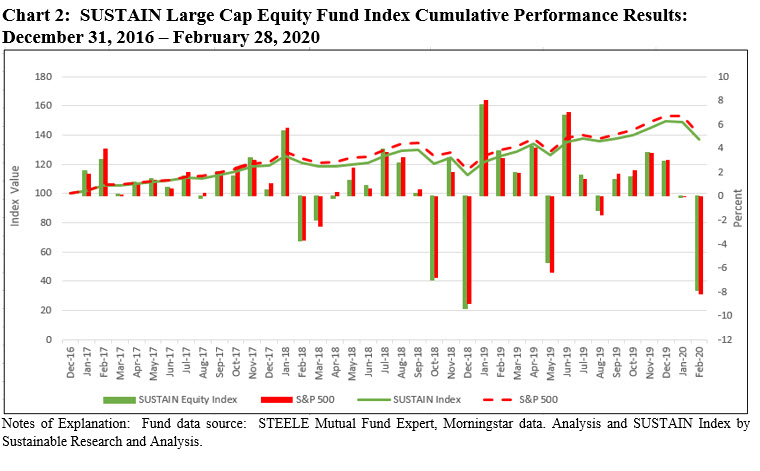

The SUSTAIN Large Cap Equity Fund Index is ahead of the S&P 500 since the start of the year and for the trailing 12-months. That said, it has fallen behind by 3.27% over the interval since inception as of December 31, 2016. Refer to Chart 2. Over that same time interval, the SUSTAIN Index has registered a total of ten monthly declines and it has lagged the S&P 500 in seven of those ten months.

Sustainable (SUSTAIN) Bond Fund Index lags behind the Bloomberg Barclays US Aggregate Bond Index by 34 basis points

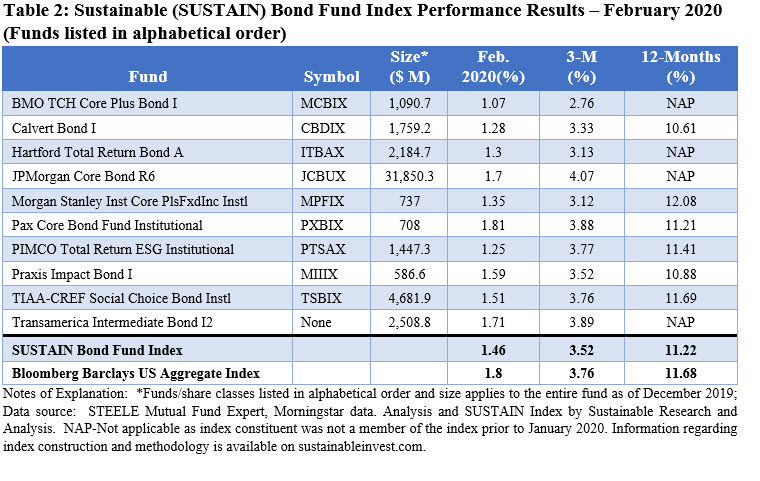

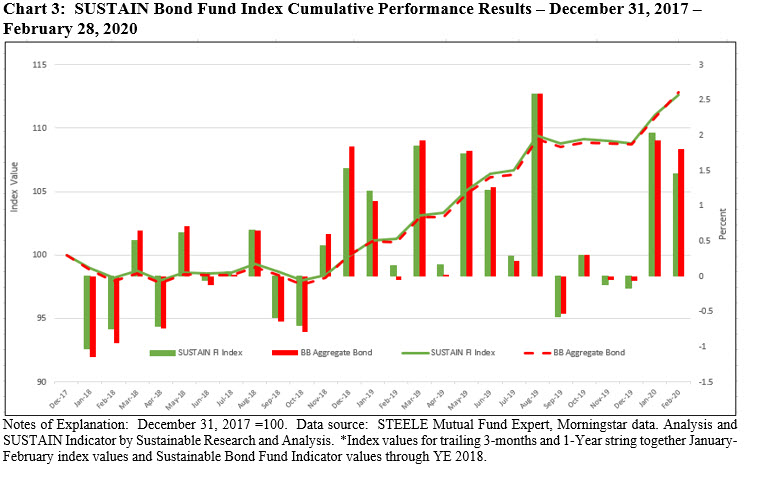

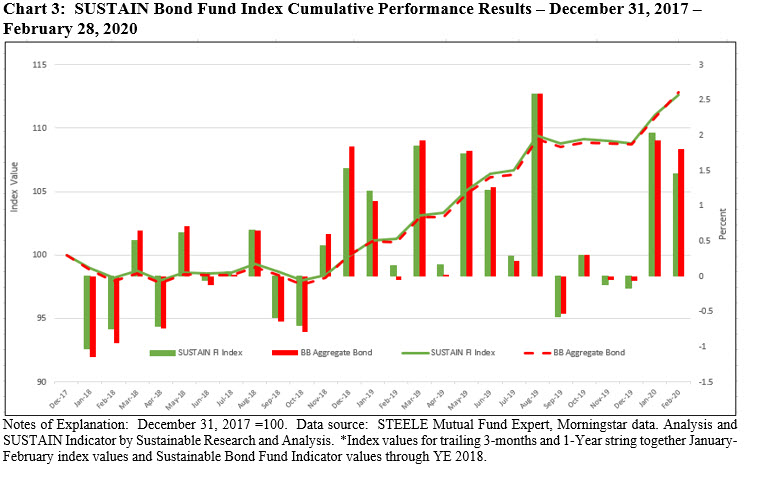

The SUSTAIN Bond Fund Index, up 1.5% versus 2.03% the previous month, recorded its sixth best monthly gain since inception as of December 31, 2017. Still, this was not enough to overtake the Bloomberg Barclays US Aggregate Bond Index that added 1.8%. All but one fund index member beat the conventional bond benchmark. The Pax Core Bond Fund Institutional Shares gained 1.81% and beat the next best performing fund by 10 bps. Refer to Table 2.

The SUSTAIN Bond Fund Index now lags on a year-to-date basis and over the trailing twelve months. While it had been outpacing the Bloomberg Barclays US Aggregate Bond Index since its inception, the SUSTAIN index on a cumulative basis since inception is now also lagging since December 2018 by 18 bps. Refer to Chart 3.

Sustainable (SUSTAIN) Foreign Equity Fund Index beats MSCI ACWI, ex USA (Net) Index by 94 bps

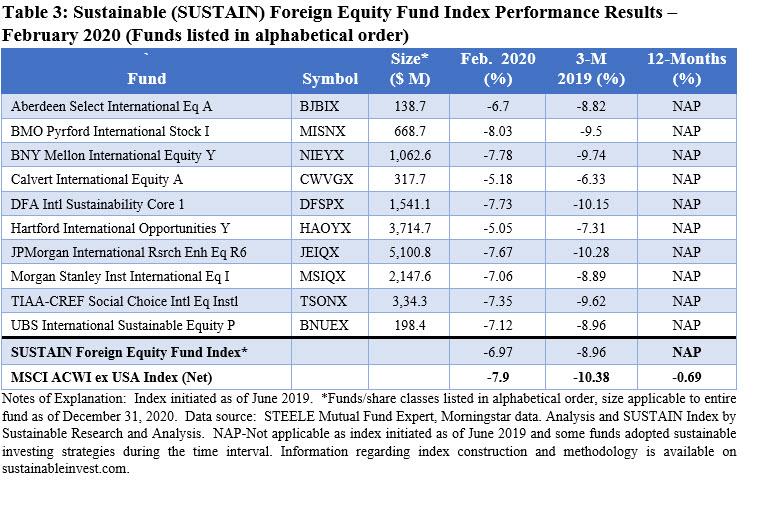

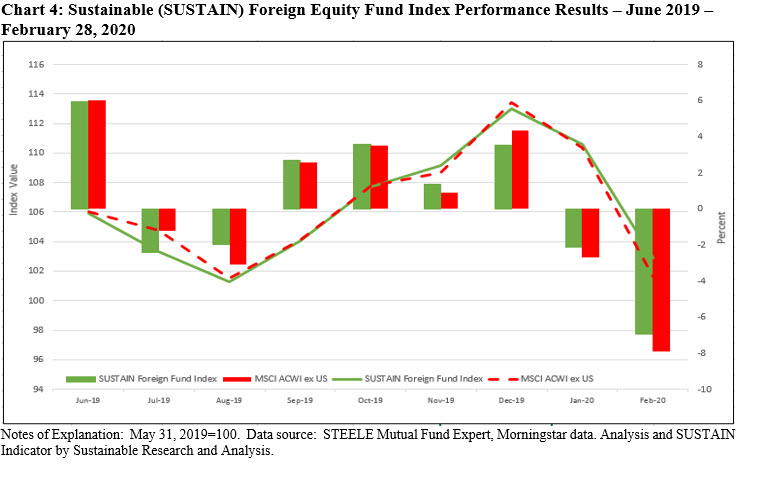

The SUSTAIN Foreign Equity Fund Index was bolstered by the performance of all but one constituent that beat the conventional benchmark. Refer to Table 3. While registering a decline of -6.97%, the SUSTAIN Foreign Equity Fund Index nevertheless beat the MSCI ACWI, ex USA (Net) by 94 bps. While the index has only been tracked since June 2019, this was nevertheless the worst monthly performance followed by a -2.4% decline in July of last year.

With its -5.18% total return, the Calvert International Equity Fund A was the best performing fund in February. The fund integrates ESG and this strategy is combined with exclusions, impact and engagement initiatives.

The SUSTAIN Foreign Equity Fund Index also leads the conventional index since the start of the year, posting a -8.96% versus -10.38% as well as since inception as of June 2019 over which interval it is ahead 2.9% versus 1.6%. Refer to Chart 4.

For details regarding the sustainable mutual fund indices, their construction methodology, index constituents and their sustainable investing strategies, refer to the Sustainable (SUSTAIN) Indices Construction Methodology document.

[1] While the definition of sustainable investing continues to evolve, this refers to a range of overarching investing approaches or strategies that encompass values-based investing, negative screening (exclusions), thematic and impact investing, environmental, social and governance (ESG) integration, company engagement and proxy voting. These are not mutually exclusive.

SUSTAIN Equity Indices Led in February 2020 while Bonds Lagged

The Bottom Line: The US stock market in February suffers a sharp decline, bonds gain and sustainable funds across asset classes drop an average -4.25%. Market suffers sharp decline and ends the month of February with a decline of -8.23%

Share This Article:

The Bottom Line: The US stock market in February suffers a sharp decline, bonds gain and sustainable funds across asset classes drop an average -4.25%.

Market suffers sharp decline and ends the month of February with a decline of -8.23%

The US stock market at the end of February, based on the S&P 500, suffered the second-worst week since 1941 and one of the fastest 10% declines on record. After reaching a record high on February 19th and registering a year-to-date gain of 4.81%, stock markets and bond markets in the US became infected by the coronavirus as news spread that COVID-19, as the disease is now branded, spread past China to South Korea and Italy. Refer to Chart 1. This was followed by confusing reports than an American in California had contracted the virus without having been in contact with any apparent carrier from the affected areas. Reports of the carnivorous outbreak surfaced in mid-December when China alerted the World Health Organization of several cases of unusual pneumonia in Wuhan, but market reaction had been muted till the last week in February. By month-end, the S&P 500 closed with a total return decline of -8.23% while intermediate investment-grade bonds, as measured by the Bloomberg Barclays US Aggregate Bond Index ended the month higher with a gain of 1.8%.

The U.S. economy is predominantly driven by consumer spending, which accounts for approximately 70% of all economic growth, and consumer sentiment during this interval to-month end has remained strong. According to reporting in Barron’s, consumer confidence for the five-day period to February 27th per economists at Cornerstone Macroeconomics remained elevated. That said, uncertainty at month-end regarding the extent to which the virus will constrain global growth was forcing a reconsideration of 2020 profit expectations. While corporate 4th quarter 2019 earnings results were better than expected as they rose 1.6% versus the expected 2.1% decline based on S&P data, according to a report released by Goldman Sachs, US companies will generate no earnings growth in 2020 if the coronavirus becomes widespread. Smaller companies may be even more exposed, which may be behind a greater decline posted by the Russell 2000. The Index was down -8.42% in February and -11.36% year-to-date versus a decline of -8.27% for the S&P 500 over the same interval. Small growth companies delivered slightly better results as did large cap stocks versus their value qualified counterparts.

For the month, all sectors of the S&P 500 were down, with four sectors suffering double digit declines ranging from -10.0% registered by the Materials Sector to -17.79% posted by Energy stocks as Brent Crude posted a decline of -13.14% and an even more severe year-to-date drop of -23.45%. Financials were also down sharply, giving up -11.2%.

Overseas, the MSCI ACWI, ex USA (net) recorded a decline of -7.9% while emerging markets in Eastern Europe and Latin America ended the month lower. An exception was China which actually gained 0.97% according to the MSCI China Index while the broader MSCI Emerging Markets Asia Index gave up -2.86%.

A flight to safety drove down Treasury yields, with the 10-Year Treasury dropping to 1.13% on the last day of February, down from 1.51% at the end of the prior month and 1.88% at the start of the year. Longer dated treasuries gained 6.9% and AAA corporate bonds added 2.65% while corporate bonds rated single A gained 1.62%. Widening spreads left high yield corporate bonds down -1.41%.

Sustainable funds, across all asset classes, give up an average -4.25%

The universe of 3,749 sustainable mutual funds and ETFS, now straddling a range from money market funds, fixed income funds, equity funds and also commodity funds, posted an average decline of -4.25%. In February, only 26% of sustainable funds delivered zero to positive rates of return while the range of returns extended from 11.7% recorded by the best performing thematic Invesco Solar ETF to a decline of -14.88% sustained by another thematic fund that integrates ESG, the Amplify Seymour Cannabis ETF. At the same time, the Sustainable (SUSTAIN) Large Cap Equity Fund Index, the Sustainable (SUSTAIN) Foreign Equity Large Cap Index and Sustainable (SUSTAIN) Bond Fund Index recorded returns of -7.89%, -6.97% and 1.46%, in that order. The two SUSTAIN equity fund indices outperformed their corresponding conventional indices while the SUSTAIN Bond Fund Index lagged behind.

Sustainable (SUSTAIN) Large Cap Equity Fund Index beats S&P 500 by 34 basis points

After trailing the conventional index for the last five months, the SUSTAIN Large Cap Equity Fund Index eclipsed the S&P 500 in February by 34 bps with a return of -7.89%. Eight of the ten funds tracked in the index posted results that exceeded the S&P 500, led by the Neuberger Berman Sustainable Equity Institutional Shares that registered a decline of -7.29%. Like the two leading funds in the bond and foreign equity SUSTAIN indices covered below, the Neuberger fund employs a combination of sustainable strategies, including ESG integration, negative screening (exclusions), impact investing and investee engagement. Refer to Table 1.

The SUSTAIN Large Cap Equity Fund Index is ahead of the S&P 500 since the start of the year and for the trailing 12-months. That said, it has fallen behind by 3.27% over the interval since inception as of December 31, 2016. Refer to Chart 2. Over that same time interval, the SUSTAIN Index has registered a total of ten monthly declines and it has lagged the S&P 500 in seven of those ten months.

Sustainable (SUSTAIN) Bond Fund Index lags behind the Bloomberg Barclays US Aggregate Bond Index by 34 basis points

The SUSTAIN Bond Fund Index, up 1.5% versus 2.03% the previous month, recorded its sixth best monthly gain since inception as of December 31, 2017. Still, this was not enough to overtake the Bloomberg Barclays US Aggregate Bond Index that added 1.8%. All but one fund index member beat the conventional bond benchmark. The Pax Core Bond Fund Institutional Shares gained 1.81% and beat the next best performing fund by 10 bps. Refer to Table 2.

The SUSTAIN Bond Fund Index now lags on a year-to-date basis and over the trailing twelve months. While it had been outpacing the Bloomberg Barclays US Aggregate Bond Index since its inception, the SUSTAIN index on a cumulative basis since inception is now also lagging since December 2018 by 18 bps. Refer to Chart 3.

Sustainable (SUSTAIN) Foreign Equity Fund Index beats MSCI ACWI, ex USA (Net) Index by 94 bps

The SUSTAIN Foreign Equity Fund Index was bolstered by the performance of all but one constituent that beat the conventional benchmark. Refer to Table 3. While registering a decline of -6.97%, the SUSTAIN Foreign Equity Fund Index nevertheless beat the MSCI ACWI, ex USA (Net) by 94 bps. While the index has only been tracked since June 2019, this was nevertheless the worst monthly performance followed by a -2.4% decline in July of last year.

With its -5.18% total return, the Calvert International Equity Fund A was the best performing fund in February. The fund integrates ESG and this strategy is combined with exclusions, impact and engagement initiatives.

The SUSTAIN Foreign Equity Fund Index also leads the conventional index since the start of the year, posting a -8.96% versus -10.38% as well as since inception as of June 2019 over which interval it is ahead 2.9% versus 1.6%. Refer to Chart 4.

For details regarding the sustainable mutual fund indices, their construction methodology, index constituents and their sustainable investing strategies, refer to the Sustainable (SUSTAIN) Indices Construction Methodology document.

[1] While the definition of sustainable investing continues to evolve, this refers to a range of overarching investing approaches or strategies that encompass values-based investing, negative screening (exclusions), thematic and impact investing, environmental, social and governance (ESG) integration, company engagement and proxy voting. These are not mutually exclusive.

Sustainableinvest.com

Benefits

Free access to regularly updated original research and analysis focused exclusively on sustainable finance and investing, providing investors with the guidance needed to make informed investment decisions that align with their personal values and financial goals while also contributing to the advancement of positive long-term environmental and social outcomes.

By offering financial support for our current work, either in the form of a one-time or regular contributions, you help to defray some of the costs associated with conducting our research and analysis as well as to maintain the www.sustainablest.wpengine.com website.

Helping us to expand our research capabilities and offerings over time to cover additional relevant topics geared to sustainable investors.

Sign up to free newsletters.

By submitting this form, you are consenting to receive marketing emails from: . You can revoke your consent to receive emails at any time by using the SafeUnsubscribe® link, found at the bottom of every email. Emails are serviced by Constant Contact