Summary

- The S&P 500 Index eked out a narrow gain of 0.57% in September even as US stock markets reached all-time new highs. For the quarter, the index is up a strong 7.71%.

- On the other hand, investment-grade intermediate bonds closed the month lower, posting negative results of -0.66%. As measured by the Bloomberg Barclays US Aggregate Index, investment-grade intermediate bonds finished the quarter with a slight gain of 0.01% while year-to-date and trailing 12-month results ended lower at -1.60% and -1.22%, respectively. Longer-dated 30-year bonds were off 6.53% year-to-date.

- The SUSTAIN Equity Fund Index gained 0.27% in September and 7.11% in the third quarter, lagging behind the S&P 500 by 30 bps and 60 bps, respectively.

- In contrast to the performance of equity funds, intermediate-term investment grade sustainable bond funds outperformed the Bloomberg Barclays US Aggregate Index in September, albeit by a narrow margin of 5 basis points.

Buoyed by robust economic growth and strong corporate earnings, the S&P 500 Index eked out a narrow gain of 0.57% in September even as US stock markets reached all-time new highs

Performance in September across asset classes, geographic regions and styles covered a narrower 16% arc that ranged from a high of 6.85% posted by the price of Brent crude oil to a negative -9.1% recorded by the MSCI India Index. Within this range that saw more negative returns than positive and growth stocks outperforming value-oriented stocks, the S&P 500 Index eked out a narrow gain of 0.57% in September even as US stock markets reached all-time new highs. Sustainable funds and ETFs recorded an average drop of -0.37%. Sustainable funds and ETFs[1] recorded an average drop of -0.37%. Beyond the month of September, the S&P 500 recorded the best quarterly increase since 2013, up a strong 7.71%, buoyed by robust economic growth and strong corporate earnings. For the year-to-date and trailing 12-month intervals, the index produced strong gains of 9.94% and 16.11%, respectively. On the other hand, small company stocks, as measured by the Russell 2000, posted their second worst decline this year. The -2.4% September drop narrowed the year-to-date outperformance of small firms relative to large ones and given their declining relative performance differentials may be signaling a loss of momentum for small stocks.

Bonds also closed the month lower, posting negative results of -0.66% against a backdrop of rising yields due to increasing interest rates, continued optimism about the domestic economy and waning fears about the outlook outside the US. As measured by the Bloomberg Barclays US Aggregate Index, investment-grade intermediate bonds finished the quarter with a slight gain of 0.01% while year-to-date and trailing 12-month results ended lower at -1.60% and -1.22%, respectively. Longer dated 30-year bonds were off 6.53% year-to-date. Concurrently, some indexes around the globe have struggled with a slowdown in economic expansion and a stronger US dollar. The MSCI Emerging Markets Asia posted a decline of -1.69% while MSCI China recorded a loss of -1.4%. At the same time, the MSCI EAFE Index edged out the S&P 500 with a gain of 0.87% in September

The SUSTAIN Equity Fund Index gained 0.27% in September and 7.11% in the third quarter, lagging behind the S&P 500 by 30 bps and 60 bps, respectively

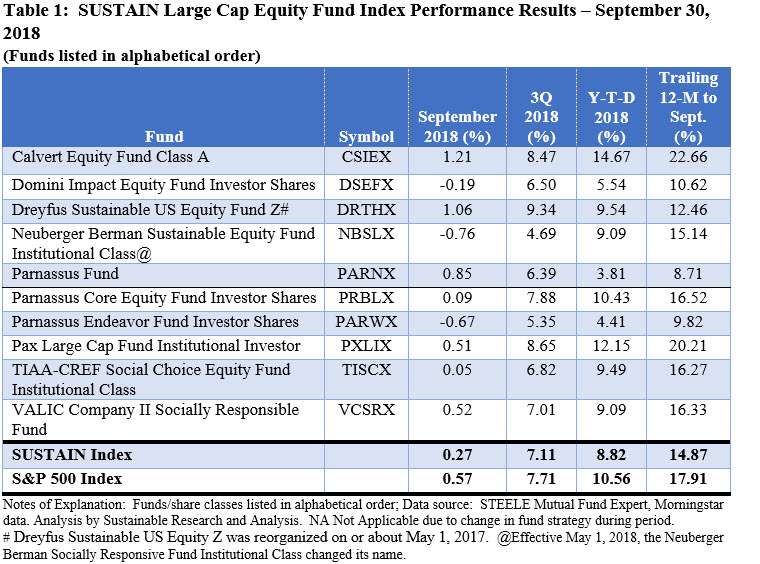

Against this backdrop, the SUSTAIN Large Cap Equity Fund Index, which tracks the total return performance of the ten largest actively managed large-cap U.S. equity oriented mutual funds that employ a sustainable investing strategy beyond absolute reliance on exclusionary practices, registered a gain of 0.27% in September and 7.11% in the third quarter 2018. This was 30 basis points behind the increase posted by the S&P 500 Index and 60 bps behind in the third quarter. Refer to Table 1.

Just three of the ten funds that comprise the SUSTAIN Equity index outperformed the S&P 500 while four funds outperformed the index in the third quarter. Calvert Equity Class A led with a strong gain of 1.21%, followed by the Dreyfus Sustainable US Equity Z shares, up 1.06%, and Parnassus Fund, up 0.85%. Calvert has been a consistent outperformer and is the only SUSTAIN index member to eclipse the S&P 500 fund in each of the four time intervals under consideration in the last year. In fact, the fund has outperformed the S&P 500 in eight of the last 12-months. That said, the Dreyfus Sustainable US Equity Fund Z shares has been gaining momentum and it has exceeded the performance of the S&P 500 during each of the last four-months. The fund, which was reorganized as of May 1, 2017 and in August dropped one of its supporting portfolio managers (refer to SUSTAIN Equity Index Gains 1.35% in May but Lags S&P 500 by Almost 1.1%), now ranks as the best of ten SUSTAIN index fund performers in the third quarter with its gain of 9.34%. The fund has been benefiting from increased positions in relatively defensive industry groups, such as pharmaceutical developers and utilities, while also moving the fund’s sector allocations to positions more closely approximating those of the S&P 500. Still, the fund maintained above index exposures to firms like Microsoft Corp. (MSFT), Apple, Inc. (AAPL) and Alphabet Inc. A (GOOGL) which accounted for 7.47%, 5.81% and 5.36% of fund assets, respectively, as of August 31, 2018.

At the other end of the performance range for the month are three funds that each posted negative results in September. The first of these, the Neuberger Berman Sustainable Equity Fund Institutional Class, dropped -0.76% in September while also posting the lowest return for the quarter of 4.69%. The fund has been hampered by its non-US stock exposure, which stood at 12.54%. Also detracting from performance have been the fund’s overweight position in Financial Services, the worst performing sector in September, down -3.35%, and its underweight position in technology stocks. The second fund, the Parnassus Endeavor Fund which invests in a limited number of high conviction large-capitalization companies that represent Parnassus’ clearest expression of ESG investing, returned -0.67% in September and 5.35% in the third quarter. The fund’s below benchmark 12-month performance stands in contrast to the impressive performance achieved over the previous 3, 5 and 10-year intervals. It also stands in contrast to the same fund group’s Parnassus Fund that turned in the third best SUSTAIN Equity Index results in September, up 0.85%. The third fund, Domini Impact Equity Fund Investor Shares was down -0.19%. In early September Domini announced that effective December 1, 2018 State Street Global Advisors will be replacing Wellington Management Company, the fund’s subadvisor since May 2009.

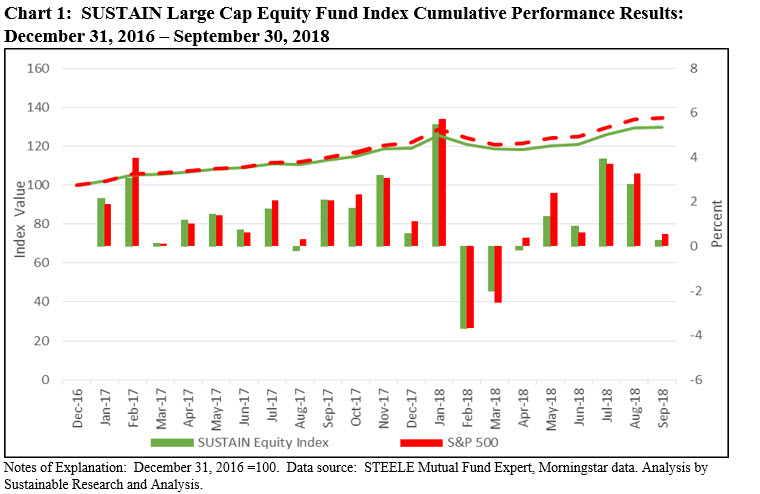

The SUSTAIN Equity Fund Index is up 8.82% on a year-to-date basis and has posted a strong 14.87% total return over the preceding 12-month period. While two index members, namely Calvert Equity A and Pax Large Large Cap Fund Institutional shares eclipse the S&P 500 during the two-time intervals, the SUSTAIN index tails the S&P 500 by expanding margins of 1.74% and 3.04%, respectively. Since the inception of the index as of December 31, 2016, the negative variation stands at 5.02%. Refer to Chart 1.

Intermediate-term investment grade sustainable bond funds outperformed the Bloomberg Barclays US Aggregate Index in September by 5 basis points

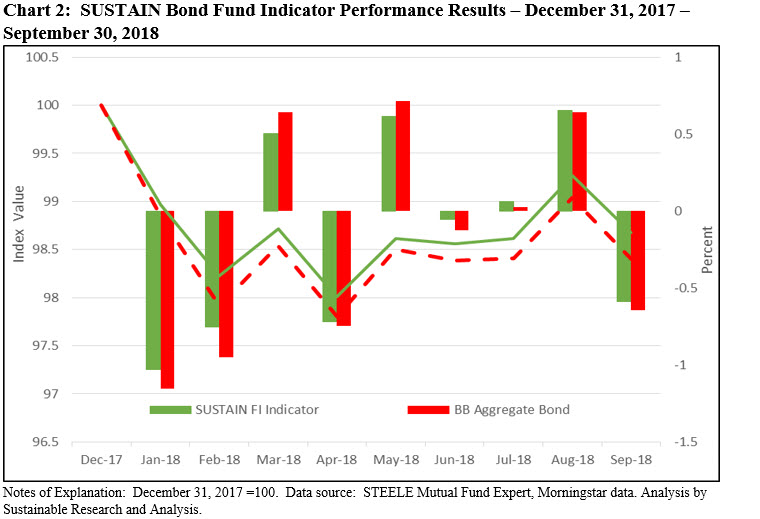

In contrast to the relative performance of equity funds, intermediate-term investment grade sustainable bond funds outperformed the Bloomberg Barclays US Aggregate Index in September, albeit by a narrow margin of 5 basis points. The SUSTAIN Bond Fund Indicator posted a decline of -0.59% in September versus -0.64% generated by the Bloomberg Barclays U.S. Aggregate Index. Against a backdrop of rising yields due to increasing interest rates, continued optimism about the domestic economy and waning fears about the outlook outside the US investment-grade intermediate bonds negotiated an about face versus last month’s 0.64% gain. Refer to Chart 2.

Extending the time frame beyond the latest month, the SUSTAIN Bond Fund Indicator also outperformed the Bloomberg Barclays index in the third quarter, year-to-date and 12-month intervals. The results achieved by both benchmarks over the last twelve months, however, are negative.

Calvert Bond I sustained the narrowest loss in September and led in the nine-month and 12-month periods. This $1.1 billion intermediate-term fund maintained an average effective duration of 5.08 and BBB average credit quality, with about 43% of assets invested in corporate bonds and 32.3% in securitized bonds, mainly asset backed securities and 18.84% in US government securities.

PIMCO Total Return ESG Institutional led in the third-quarter, however, the $1.1 billion fund trails the other four funds that make up the SUSTAIN Bond Fund Indicator over the preceding 12 months. Relative to Calvert, the fund maintained a lower average effective duration of 4.09 given the firm’s view that the risk of rising inflation remains. Also, while investment-grade corporate credit exposure was roughly in line, the PIMCO fund was overweight agency MBS Pass-Through securities that stood at around 53% versus Calvert’s 0.52%.

The Sustainable (SUSTAIN) Bond Fund Indicator represents the total return performance of a cohort of five sustainable bond funds consisting of similarly managed funds that, like the equity index counterpart, employ sustainable investing strategies beyond absolute reliance on exclusionary practices that track the Bloomberg Barclays U.S Aggregate Bond Index. These include: Calvert Bond I, Pax Core Bond Fund International, PIMCO Total Return ESG Institutional, Praxis Impact Bond I and TIAA-CREF Social Choice Bond Institutional.

[1] Representing 1,091 sustainable funds, ETFs and ETNs with performance data for the entire month of September.

The SUSTAIN Equity Fund Index Gained 0.27% in September but Lags S&P 500

Summary The S&P 500 Index eked out a narrow gain of 0.57% in September even as US stock markets reached all-time new highs. For the quarter, the index is up a strong 7.71%. On the other hand, investment-grade intermediate bonds closed the month lower, posting negative results of -0.66%. As measured by the Bloomberg Barclays US…

Share This Article:

Summary

Buoyed by robust economic growth and strong corporate earnings, the S&P 500 Index eked out a narrow gain of 0.57% in September even as US stock markets reached all-time new highs

Performance in September across asset classes, geographic regions and styles covered a narrower 16% arc that ranged from a high of 6.85% posted by the price of Brent crude oil to a negative -9.1% recorded by the MSCI India Index. Within this range that saw more negative returns than positive and growth stocks outperforming value-oriented stocks, the S&P 500 Index eked out a narrow gain of 0.57% in September even as US stock markets reached all-time new highs. Sustainable funds and ETFs recorded an average drop of -0.37%. Sustainable funds and ETFs[1] recorded an average drop of -0.37%. Beyond the month of September, the S&P 500 recorded the best quarterly increase since 2013, up a strong 7.71%, buoyed by robust economic growth and strong corporate earnings. For the year-to-date and trailing 12-month intervals, the index produced strong gains of 9.94% and 16.11%, respectively. On the other hand, small company stocks, as measured by the Russell 2000, posted their second worst decline this year. The -2.4% September drop narrowed the year-to-date outperformance of small firms relative to large ones and given their declining relative performance differentials may be signaling a loss of momentum for small stocks.

Bonds also closed the month lower, posting negative results of -0.66% against a backdrop of rising yields due to increasing interest rates, continued optimism about the domestic economy and waning fears about the outlook outside the US. As measured by the Bloomberg Barclays US Aggregate Index, investment-grade intermediate bonds finished the quarter with a slight gain of 0.01% while year-to-date and trailing 12-month results ended lower at -1.60% and -1.22%, respectively. Longer dated 30-year bonds were off 6.53% year-to-date. Concurrently, some indexes around the globe have struggled with a slowdown in economic expansion and a stronger US dollar. The MSCI Emerging Markets Asia posted a decline of -1.69% while MSCI China recorded a loss of -1.4%. At the same time, the MSCI EAFE Index edged out the S&P 500 with a gain of 0.87% in September

The SUSTAIN Equity Fund Index gained 0.27% in September and 7.11% in the third quarter, lagging behind the S&P 500 by 30 bps and 60 bps, respectively

Against this backdrop, the SUSTAIN Large Cap Equity Fund Index, which tracks the total return performance of the ten largest actively managed large-cap U.S. equity oriented mutual funds that employ a sustainable investing strategy beyond absolute reliance on exclusionary practices, registered a gain of 0.27% in September and 7.11% in the third quarter 2018. This was 30 basis points behind the increase posted by the S&P 500 Index and 60 bps behind in the third quarter. Refer to Table 1.

Just three of the ten funds that comprise the SUSTAIN Equity index outperformed the S&P 500 while four funds outperformed the index in the third quarter. Calvert Equity Class A led with a strong gain of 1.21%, followed by the Dreyfus Sustainable US Equity Z shares, up 1.06%, and Parnassus Fund, up 0.85%. Calvert has been a consistent outperformer and is the only SUSTAIN index member to eclipse the S&P 500 fund in each of the four time intervals under consideration in the last year. In fact, the fund has outperformed the S&P 500 in eight of the last 12-months. That said, the Dreyfus Sustainable US Equity Fund Z shares has been gaining momentum and it has exceeded the performance of the S&P 500 during each of the last four-months. The fund, which was reorganized as of May 1, 2017 and in August dropped one of its supporting portfolio managers (refer to SUSTAIN Equity Index Gains 1.35% in May but Lags S&P 500 by Almost 1.1%), now ranks as the best of ten SUSTAIN index fund performers in the third quarter with its gain of 9.34%. The fund has been benefiting from increased positions in relatively defensive industry groups, such as pharmaceutical developers and utilities, while also moving the fund’s sector allocations to positions more closely approximating those of the S&P 500. Still, the fund maintained above index exposures to firms like Microsoft Corp. (MSFT), Apple, Inc. (AAPL) and Alphabet Inc. A (GOOGL) which accounted for 7.47%, 5.81% and 5.36% of fund assets, respectively, as of August 31, 2018.

At the other end of the performance range for the month are three funds that each posted negative results in September. The first of these, the Neuberger Berman Sustainable Equity Fund Institutional Class, dropped -0.76% in September while also posting the lowest return for the quarter of 4.69%. The fund has been hampered by its non-US stock exposure, which stood at 12.54%. Also detracting from performance have been the fund’s overweight position in Financial Services, the worst performing sector in September, down -3.35%, and its underweight position in technology stocks. The second fund, the Parnassus Endeavor Fund which invests in a limited number of high conviction large-capitalization companies that represent Parnassus’ clearest expression of ESG investing, returned -0.67% in September and 5.35% in the third quarter. The fund’s below benchmark 12-month performance stands in contrast to the impressive performance achieved over the previous 3, 5 and 10-year intervals. It also stands in contrast to the same fund group’s Parnassus Fund that turned in the third best SUSTAIN Equity Index results in September, up 0.85%. The third fund, Domini Impact Equity Fund Investor Shares was down -0.19%. In early September Domini announced that effective December 1, 2018 State Street Global Advisors will be replacing Wellington Management Company, the fund’s subadvisor since May 2009.

The SUSTAIN Equity Fund Index is up 8.82% on a year-to-date basis and has posted a strong 14.87% total return over the preceding 12-month period. While two index members, namely Calvert Equity A and Pax Large Large Cap Fund Institutional shares eclipse the S&P 500 during the two-time intervals, the SUSTAIN index tails the S&P 500 by expanding margins of 1.74% and 3.04%, respectively. Since the inception of the index as of December 31, 2016, the negative variation stands at 5.02%. Refer to Chart 1.

Intermediate-term investment grade sustainable bond funds outperformed the Bloomberg Barclays US Aggregate Index in September by 5 basis points

In contrast to the relative performance of equity funds, intermediate-term investment grade sustainable bond funds outperformed the Bloomberg Barclays US Aggregate Index in September, albeit by a narrow margin of 5 basis points. The SUSTAIN Bond Fund Indicator posted a decline of -0.59% in September versus -0.64% generated by the Bloomberg Barclays U.S. Aggregate Index. Against a backdrop of rising yields due to increasing interest rates, continued optimism about the domestic economy and waning fears about the outlook outside the US investment-grade intermediate bonds negotiated an about face versus last month’s 0.64% gain. Refer to Chart 2.

Extending the time frame beyond the latest month, the SUSTAIN Bond Fund Indicator also outperformed the Bloomberg Barclays index in the third quarter, year-to-date and 12-month intervals. The results achieved by both benchmarks over the last twelve months, however, are negative.

Calvert Bond I sustained the narrowest loss in September and led in the nine-month and 12-month periods. This $1.1 billion intermediate-term fund maintained an average effective duration of 5.08 and BBB average credit quality, with about 43% of assets invested in corporate bonds and 32.3% in securitized bonds, mainly asset backed securities and 18.84% in US government securities.

PIMCO Total Return ESG Institutional led in the third-quarter, however, the $1.1 billion fund trails the other four funds that make up the SUSTAIN Bond Fund Indicator over the preceding 12 months. Relative to Calvert, the fund maintained a lower average effective duration of 4.09 given the firm’s view that the risk of rising inflation remains. Also, while investment-grade corporate credit exposure was roughly in line, the PIMCO fund was overweight agency MBS Pass-Through securities that stood at around 53% versus Calvert’s 0.52%.

The Sustainable (SUSTAIN) Bond Fund Indicator represents the total return performance of a cohort of five sustainable bond funds consisting of similarly managed funds that, like the equity index counterpart, employ sustainable investing strategies beyond absolute reliance on exclusionary practices that track the Bloomberg Barclays U.S Aggregate Bond Index. These include: Calvert Bond I, Pax Core Bond Fund International, PIMCO Total Return ESG Institutional, Praxis Impact Bond I and TIAA-CREF Social Choice Bond Institutional.

[1] Representing 1,091 sustainable funds, ETFs and ETNs with performance data for the entire month of September.

Sustainableinvest.com

Benefits

Free access to regularly updated original research and analysis focused exclusively on sustainable finance and investing, providing investors with the guidance needed to make informed investment decisions that align with their personal values and financial goals while also contributing to the advancement of positive long-term environmental and social outcomes.

By offering financial support for our current work, either in the form of a one-time or regular contributions, you help to defray some of the costs associated with conducting our research and analysis as well as to maintain the www.sustainablest.wpengine.com website.

Helping us to expand our research capabilities and offerings over time to cover additional relevant topics geared to sustainable investors.

Sign up to free newsletters.

By submitting this form, you are consenting to receive marketing emails from: . You can revoke your consent to receive emails at any time by using the SafeUnsubscribe® link, found at the bottom of every email. Emails are serviced by Constant Contact