Summary

- Market Summary: S&P 500 records best gain since January, up 3.72% as strong corporate earnings combined with the anticipation of robust economic growth in the second quarter lifted share prices pushed aside for now domestic political and geopolitical uncertainties, global trade war tensions as well as some potential domestic economic headwinds.

- SUSTAIN Equity Fund Index gained 3.93% in July, leading the S&P 500 for the third month in a row.

- SUSTAIN Bond Fund Indicator recorded an increase of 0.06% in July, beat the Bloomberg Barclays U.S. Aggregate Bond Index and expanding the year-to-date outperformance by 21 basis points.

Market Summary: S&P Records Best Gain Since January, Up 3.72%

While technology stocks were rattled by uneven and disappointing earnings reports, punctuated by Facebook’s (FB) biggest ever one-day 19% drop for a U.S.-listed company after the company reported slower-than-expected revenue growth in the second quarter, the S&P 500 Index recorded its best monthly gain since January, up 3.72%. In the process, the S&P 500 expanded its year-to-date and trailing 12-month gains to 6.47% and 16.24%, respectively. At the same time, intermediate investment-grade bonds, as measured by the Bloomberg Barclays US Aggregate Bond Index, eked out a slight gain of 0.02% even as intermediate and long-term interest rates rose. July’s positive bond results stand in contrast to the year-to-date decline of -1.59% and 12-month return of -0.8%.

In fact, profits for S&P 500 companies increased by an estimated 23.5% in the second quarter, according to data from Thomson Reuters, more than 2.5 times revenue growth in the same period. On the economic front, the Department of Labor reported at the end of the month that gross domestic product expanded 4.1% in the second quarter. While this was slightly below the 4.2% that economists were expecting, it was the highest rate in nearly four years. For the first quarter, growth was revised upward, to 2.2% from 2%. Consumer spending bounced back from the slowdown at the start of the year, business investment climbed and inflation also eased. At least for now, these positive factors discounted domestic political uncertainties that kicked up this month following President Trump’s NATO summit encounter and controversial meeting with Russian counterpart Vladimir Putin in Helsinki, geopolitical concerns, global trade war tensions as well as some potential domestic economic headwinds such as the potential for rising interest rates.

SUSTAIN Equity Fund Index Gained 3.93% in July, leading the S&P 500 Index for the Third Month in a Row

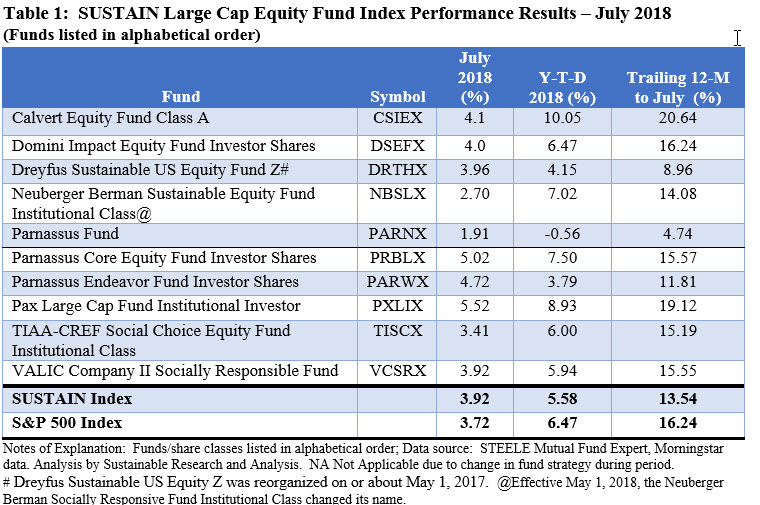

The SUSTAIN Large Cap Equity Fund Index, which tracks the total return performance of the ten largest actively managed large-cap U.S. equity oriented mutual funds that employ a sustainable investing strategy beyond absolute reliance on exclusionary practices, registered a gain of 3.92% in July. This compared to a total return increase for the S&P 500 Index of 3.93%, or a positive difference of 21 basis points. It’s the third month in a row for the outperformance of the SUSTAIN Index, with support this month from seven of the ten funds that exceeded the return posted by the S&P 500. By way of further comparison, the universe of 1,043 sustainable funds with performance for the full month, including mutual funds, exchange-traded funds (ETFs) and exchange-traded notes (ETNs) and their corresponding share classes, returns for the month of July averaged 2.14%. Refer to Table 1.

The best performing index component in July was the Pax Large Cap Fund-Institutional Shares that registered a gain of 5.52%. This result pushed the fund’s total return up to 8.93% for the 3-month interval and shifted its trailing 12-month performance to second place. The $688.5 million fund, dominated by institutional investors, maintained a growth tilt with sector exposures largely in line with the S&P 500, except for the Utilities sector in which the fund has zero exposure relative to a 2.90% weighting in the S&P 500. The fund benefited from the positive performance results in July posted by each of its top 5 holdings, including Microsoft (MSFT), Amazon (AMZN), Apple (APLE), Zoetis Inc. Class A (ZTS) and Home Depot Inc. (HOME). These holdings, which ranged in size from 3.29% to 4.94% of net assets, were over-weighted relative to the S&P 500 with the exception of Apple Inc. At the same time, the absence of a position in Facebook (FB) allowed the fund to avoid the biggest ever one-day 19% drop for a U.S.-listed company on July 26th after the firm reported slower-than-expected revenue growth in the second quarter. None of the funds that make up the SUSTAIN Index reported any investments in Facebook.

At the other end of the range, the $824.1 million Parnassus Fund added just 1.91%. The fund also brought up the rear in terms of trailing 12-month results. The Parnassus Fund, which excludes fossil fuels, invests across the capitalization spectrum with high conviction in approximately 40 holdings. Its 2.08% cash exposure combined with a roughly 8% allocation to non-US stocks likely detracted from performance as did the fund’s overweight position in the Real Estate sector, the only sector out of ten that posted a negative -0.88% return for the month of July.

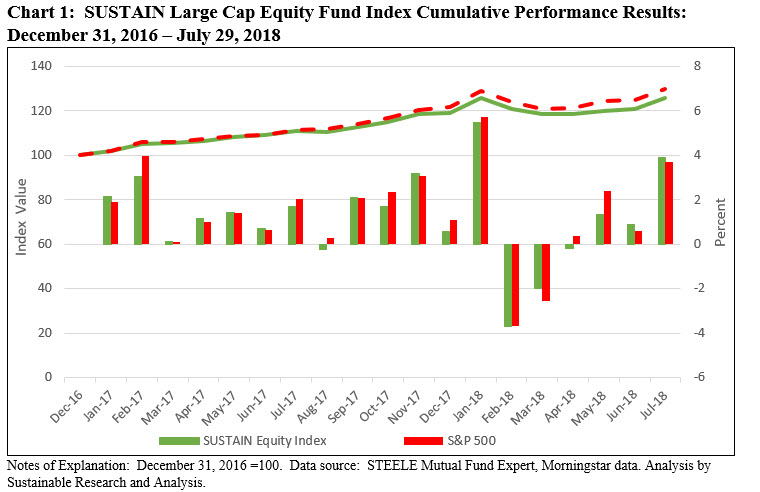

On a year-to-date and trailing 12-month basis SUSTAIN Index lagged the S&P 500 by 0.89% and 2.67%, respectively. During that longer interval, only two equity fund index members outperform the S&P 500 Index, namely the Calvert Equity Class A as well as the Pax Large Cap Fund-Institutional Shares. A third fund, the Domini Impact Equity Fund Investor Shares, matched the performance of the index. Refer to Chart 1.

SUSTAIN Bond Fund Indicator Recorded an Increase of 0.06% in July and Beat the Bloomberg Barclays U.S. Aggregate Bond Index

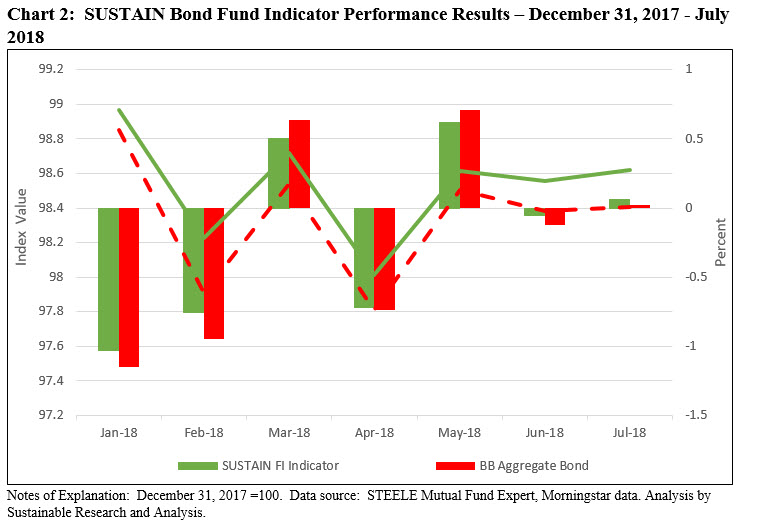

Sustainable investment-grade U.S. oriented bond funds that comprise the Sustainable (SUSTAIN) Bond Fund Indicator recorded a gain of 0.06% in July, advancing beyond the 0.02% increase posted by the Bloomberg Barclays U.S. Aggregate Bond Index and expanding the year-to-date outperformance relative to the non-sustainable bond funds benchmark by 21 basis points. Refer to Chart 2.

The positive July results were achieved against a back-drop of strong economic conditions and slightly rising intermediate and long-term interest rates during which time 10-year Treasury’s gained 11 bps to end the month at 2.96%. The PIMCO Total Return ESG Institutional Fund posted the best results with a gain of 0.21%. Still, on a year-to-date and trailing 12-month basis this $1.1 billion fund is down -1.64% and -0.9%, respectively. Three of the five funds that make up the SUSTAIN Bond Fund Indicator delivered positive results for the month. In addition to PIMCO, these include: Calvert Bond I (0.11%) and TIAA-CREF Social Choice Bond Fund Institutional (0.13%).

The Sustainable (SUSTAIN) Bond Fund Indicator represents the total return performance of a cohort of five sustainable bond funds consisting of similarly managed funds that, like the equity index counterpart, employ sustainable investing strategies beyond absolute reliance on exclusionary practices that track the Bloomberg Barclays U.S Aggregate Bond Index.

SUSTAIN Large Cap Equity Fund Index Up 3.93% in July 2018, Leading S&P 500 by 21 bps

Summary Market Summary: S&P 500 records best gain since January, up 3.72% as strong corporate earnings combined with the anticipation of robust economic growth in the second quarter lifted share prices pushed aside for now domestic political and geopolitical uncertainties, global trade war tensions as well as some potential domestic economic headwinds. SUSTAIN Equity Fund…

Share This Article:

Summary

Market Summary: S&P Records Best Gain Since January, Up 3.72%

While technology stocks were rattled by uneven and disappointing earnings reports, punctuated by Facebook’s (FB) biggest ever one-day 19% drop for a U.S.-listed company after the company reported slower-than-expected revenue growth in the second quarter, the S&P 500 Index recorded its best monthly gain since January, up 3.72%. In the process, the S&P 500 expanded its year-to-date and trailing 12-month gains to 6.47% and 16.24%, respectively. At the same time, intermediate investment-grade bonds, as measured by the Bloomberg Barclays US Aggregate Bond Index, eked out a slight gain of 0.02% even as intermediate and long-term interest rates rose. July’s positive bond results stand in contrast to the year-to-date decline of -1.59% and 12-month return of -0.8%.

In fact, profits for S&P 500 companies increased by an estimated 23.5% in the second quarter, according to data from Thomson Reuters, more than 2.5 times revenue growth in the same period. On the economic front, the Department of Labor reported at the end of the month that gross domestic product expanded 4.1% in the second quarter. While this was slightly below the 4.2% that economists were expecting, it was the highest rate in nearly four years. For the first quarter, growth was revised upward, to 2.2% from 2%. Consumer spending bounced back from the slowdown at the start of the year, business investment climbed and inflation also eased. At least for now, these positive factors discounted domestic political uncertainties that kicked up this month following President Trump’s NATO summit encounter and controversial meeting with Russian counterpart Vladimir Putin in Helsinki, geopolitical concerns, global trade war tensions as well as some potential domestic economic headwinds such as the potential for rising interest rates.

SUSTAIN Equity Fund Index Gained 3.93% in July, leading the S&P 500 Index for the Third Month in a Row

The SUSTAIN Large Cap Equity Fund Index, which tracks the total return performance of the ten largest actively managed large-cap U.S. equity oriented mutual funds that employ a sustainable investing strategy beyond absolute reliance on exclusionary practices, registered a gain of 3.92% in July. This compared to a total return increase for the S&P 500 Index of 3.93%, or a positive difference of 21 basis points. It’s the third month in a row for the outperformance of the SUSTAIN Index, with support this month from seven of the ten funds that exceeded the return posted by the S&P 500. By way of further comparison, the universe of 1,043 sustainable funds with performance for the full month, including mutual funds, exchange-traded funds (ETFs) and exchange-traded notes (ETNs) and their corresponding share classes, returns for the month of July averaged 2.14%. Refer to Table 1.

The best performing index component in July was the Pax Large Cap Fund-Institutional Shares that registered a gain of 5.52%. This result pushed the fund’s total return up to 8.93% for the 3-month interval and shifted its trailing 12-month performance to second place. The $688.5 million fund, dominated by institutional investors, maintained a growth tilt with sector exposures largely in line with the S&P 500, except for the Utilities sector in which the fund has zero exposure relative to a 2.90% weighting in the S&P 500. The fund benefited from the positive performance results in July posted by each of its top 5 holdings, including Microsoft (MSFT), Amazon (AMZN), Apple (APLE), Zoetis Inc. Class A (ZTS) and Home Depot Inc. (HOME). These holdings, which ranged in size from 3.29% to 4.94% of net assets, were over-weighted relative to the S&P 500 with the exception of Apple Inc. At the same time, the absence of a position in Facebook (FB) allowed the fund to avoid the biggest ever one-day 19% drop for a U.S.-listed company on July 26th after the firm reported slower-than-expected revenue growth in the second quarter. None of the funds that make up the SUSTAIN Index reported any investments in Facebook.

At the other end of the range, the $824.1 million Parnassus Fund added just 1.91%. The fund also brought up the rear in terms of trailing 12-month results. The Parnassus Fund, which excludes fossil fuels, invests across the capitalization spectrum with high conviction in approximately 40 holdings. Its 2.08% cash exposure combined with a roughly 8% allocation to non-US stocks likely detracted from performance as did the fund’s overweight position in the Real Estate sector, the only sector out of ten that posted a negative -0.88% return for the month of July.

On a year-to-date and trailing 12-month basis SUSTAIN Index lagged the S&P 500 by 0.89% and 2.67%, respectively. During that longer interval, only two equity fund index members outperform the S&P 500 Index, namely the Calvert Equity Class A as well as the Pax Large Cap Fund-Institutional Shares. A third fund, the Domini Impact Equity Fund Investor Shares, matched the performance of the index. Refer to Chart 1.

SUSTAIN Bond Fund Indicator Recorded an Increase of 0.06% in July and Beat the Bloomberg Barclays U.S. Aggregate Bond Index

Sustainable investment-grade U.S. oriented bond funds that comprise the Sustainable (SUSTAIN) Bond Fund Indicator recorded a gain of 0.06% in July, advancing beyond the 0.02% increase posted by the Bloomberg Barclays U.S. Aggregate Bond Index and expanding the year-to-date outperformance relative to the non-sustainable bond funds benchmark by 21 basis points. Refer to Chart 2.

The positive July results were achieved against a back-drop of strong economic conditions and slightly rising intermediate and long-term interest rates during which time 10-year Treasury’s gained 11 bps to end the month at 2.96%. The PIMCO Total Return ESG Institutional Fund posted the best results with a gain of 0.21%. Still, on a year-to-date and trailing 12-month basis this $1.1 billion fund is down -1.64% and -0.9%, respectively. Three of the five funds that make up the SUSTAIN Bond Fund Indicator delivered positive results for the month. In addition to PIMCO, these include: Calvert Bond I (0.11%) and TIAA-CREF Social Choice Bond Fund Institutional (0.13%).

The Sustainable (SUSTAIN) Bond Fund Indicator represents the total return performance of a cohort of five sustainable bond funds consisting of similarly managed funds that, like the equity index counterpart, employ sustainable investing strategies beyond absolute reliance on exclusionary practices that track the Bloomberg Barclays U.S Aggregate Bond Index.

Sustainableinvest.com

Benefits

Free access to regularly updated original research and analysis focused exclusively on sustainable finance and investing, providing investors with the guidance needed to make informed investment decisions that align with their personal values and financial goals while also contributing to the advancement of positive long-term environmental and social outcomes.

By offering financial support for our current work, either in the form of a one-time or regular contributions, you help to defray some of the costs associated with conducting our research and analysis as well as to maintain the www.sustainablest.wpengine.com website.

Helping us to expand our research capabilities and offerings over time to cover additional relevant topics geared to sustainable investors.

Sign up to free newsletters.

By submitting this form, you are consenting to receive marketing emails from: . You can revoke your consent to receive emails at any time by using the SafeUnsubscribe® link, found at the bottom of every email. Emails are serviced by Constant Contact