Summary

- The SUSTAIN Equity Fund Index declined -0.18% in a Volatile April, trailing the performance of the S&P 500 by 56 basis points.

- U.S. stocks gain in April but investment-grade bonds post -0.74% decline.

- Three constituent SUSTAIN funds generated positive results in April.

- Energy gains in April had a muted effect on SUSTAIN funds due to the limited exposure to his sector.

- Sustainable bond funds posted negative results in April as well as year-to-date but outperform the Bloomberg Barclays U.S. Aggregate Bond Index.

SUSTAIN Equity Fund Index Declined -0.18% in a Volatile Month, Trailing the Performance of the S&P 500 by 56 basis points

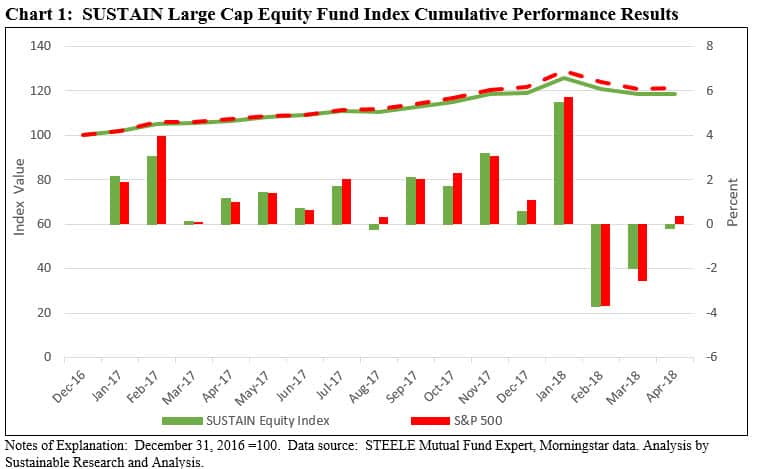

The SUSTAIN Large Cap Equity Fund Index, which tracks the total return performance of the ten largest actively managed large-cap U.S. equity oriented mutual funds that employ a sustainable investing strategy beyond absolute reliance on exclusionary practices, posted a slim decline of -0.18% in April versus a positive total return of 0.38% for the S&P 500 Index and 0.57% recorded by the Dow Jones Industrial Average (DJIA). By giving up some momentum in April, however, the SUSTAIN Index now also lags the S&P 500 Index on a year-to-date basis. The level of underperformance over the trailing 12-month interval has expanded slightly to 227 basis points (bps) as the SUSTAIN Index generated an 11.0% gain versus an increase of 13.3% for the S&P 500 Index. Refer to Chart 1.

U.S. stocks Gained in April but Investment-Grade Bonds post -0.74% Decline

Overall, market returns were mixed in April. On the one hand, companies posted solid earnings as they benefited from the economy but even more so from the cuts in the U.S. corporate tax rates that bolstered earnings as a result of the federal tax reform package that went into effect at the end of last year. At the same time, stocks faced headwinds from higher interest rates, inflation fears, and geopolitical concerns, including uncertainty about a global trade war. Inflation fears picked up some momentum, and while short-term rates remain for now in a range of 1.5% to 1.75% with no expectation for another rate hike in May, the yield on the 10-year Treasury note moved up to 3.03% on April 25th, the highest closing level since December 31, 2013 when the yield hit 3.04%.

As noted earlier, the S&P 500 Index eked out a slim total return gain of 0.38%, which was not enough to offset the losses sustained during the previous two months. On a year-to-date basis, the index is down -0.38%. Fixed income investors did not do as well. The broad-based Bloomberg Barclays U.S. Aggregate Bond Index gave up -0.74% due to buffeting from rising interest rates, reversing the gain of +0.64% achieved in March. On a year-to-date basis, investment grade bonds are down -2.19%. Crude oil prices, which, in turn, factored into energy stock prices, were up 6.97% while the Energy sector gained 8.51% and led all 11 of the S&P 500 sectors. Utilities and Health Care posted gains of 4.28% and 2.62%, respectively. At the other end of the range were Consumer Staples, Industrials and Information Technology, which gave up -1.92%, -1.77% and -1.70%, respectively. European, Asian and Far East stocks, as measured by the MSCI EAFE Index (net), gained 2.28%. In general, value stocks outperformed growth stocks while small companies finished the month ahead of large-cap stocks.

Three Constituent SUSTAIN Funds Generated Positive Results in April

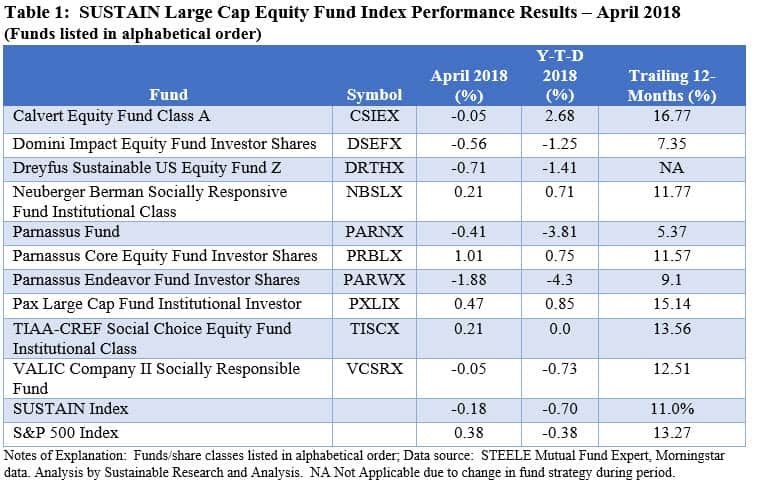

Three constituent funds that comprise the SUSTAIN Index generated positive results in April, ranging from a low of 0.21% delivered by TIAA-CREF Social Choice Equity Fund-Institutional Shares to a high of 1.01% attributable to Parnassus Core Equity-Investor Shares. The Parnassus Core Equity Fund benefited from its overweight exposure in the Health Care sector (20.13% versus 14.05% for the S&P 500) which was the third best performing sector in April. The fund also likely received a slight lift from its 1.12% position in Energy which was up 8.51% during the month. At the same time, its underweight position in Information Technology (13.82% versus 21.99% for the S&P 500) mitigated the impact of the sector’s underperformance during the same month. The fund also benefited from some of its top investments, including Praxair, Inc. (PX), CVS Health Corp. (CVS) and VF Corp. (VFC), each of which stood at between 4.23% and 4.84% of fund assets, that were up 5.7%, 12.2% and 9.11%, respectively, during the month.

At the other end of the range for April is the Parnassus Endeavor Fund-Investor Shares that posted a decline of -1.88%. This more concentrated $5.0 billion fund, also managed by Parnassus Investments, maintained an above index exposure to the Health Care sector which likely had a positive impact on the fund’s performance in April. At the same time, the fund didn’t benefit from the strong performance turned in by the Energy and Utilities sectors as the fund avoided these sectors entirely. Concentrated positions of 10.83% in Gilead Sciences Inc. (GILD) and 10.4% in Qualcomm Inc. (QCOM) and 5.32% in Allergan plc (AGN) pulled down the fund’s results as these stocks suffered losses during the month. Refer to Table 1.

Energy Gains in April have Muted Effect on SUSTAIN Funds

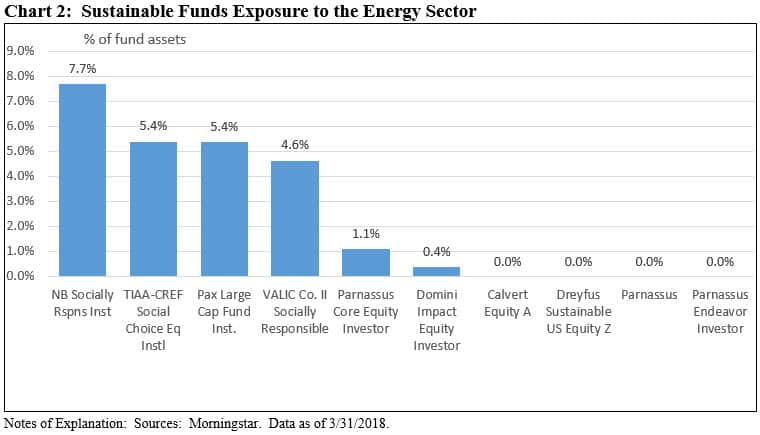

The strong 8.51% Energy sector gain in April had a muted effect on the cohort of sustainable funds that comprise the SUSTAIN Index due to the fact that some of the funds limit their exposures to fossil fuel and related companies that make up the Energy sector which represents 6.24% of the S&P 500 Index. In fact, 5 funds avoid the sector entirely or maintain exposures below 1%. These include Domini Impact Equity, Calvert Equity, Dreyfus Sustainable US Equity, Parnassus Fund and Parnassus Endeavor Equity. Refer to Chart 2.

Sustainable Bond Funds Posted Negative Results in April as well as Year-To-Date but Outperformed the Bloomberg Barclays U.S. Aggregate Bond Index

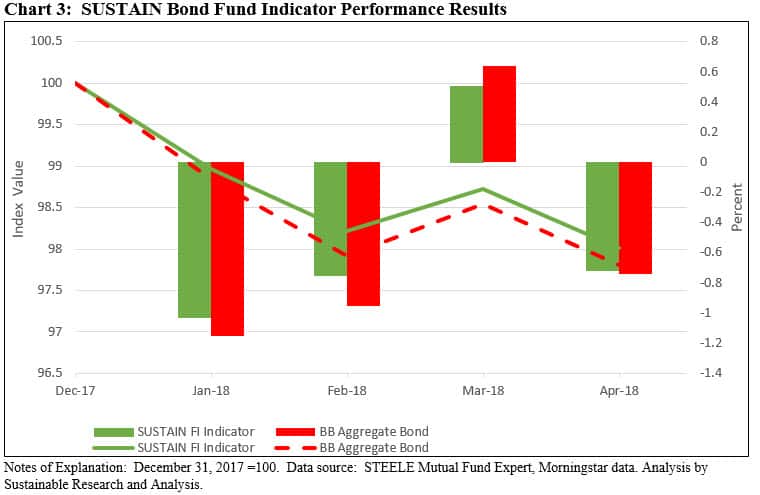

Sustainable investment-grade U.S. oriented bond funds that comprise the Sustainable (SUSTAIN) Bond Fund Indicator, extended their year-to-date declines, registering a negative -0.72% total return in April and -1.95% since the start of the year. Still, the results exceeded the performance of the Bloomberg Barclays U.S. Aggregate Bond Index which recorded declines of -0.74% in April and -2.19% year-to-date. So far this year, the SUSTAIN Bond Fund Indicator has been outperforming the Bloomberg Barclays U.S. Aggregate Bond Index during the down months but lagging in the single up month of March. Refer to Chart 4.

Each of the five funds that comprise the Sustainable (SUSTAIN) Bond Fund Indicator turned in negative results, but three funds managed to outperform the Bloomberg Barclays U.S. Aggregate Bond Index with total returns ranging from a low of -0.95% posted by PIMCO Total Return ESG-Institutional Shares to a high of -0.53% registered by Calvert Bond-I Shares. The Calvert Bond Fund-I Shares continued to benefit from its security selection within investment grade corporates, allocation to out of index asset-backed securities and yield curve positioning that benefited from an underweighting to the front end of the yield curve as the yield curve flattened. The fund is down -1.62% year-to-date, exceeding the Bloomberg Barclays U.S. Aggregate Bond Index by 57 basis points. The PIMCO Total Return ESG Fund-Institutional Shares, which adopted a strategy of integrating environmental, social and governance (ESG) factors into its investment strategy effective as of January 1, 2017, is lagging its index peers not only in April but also year-to-date.

The Sustainable (SUSTAIN) Bond Fund Indicator represents the total return performance of a cohort of five sustainable bond funds consisting of similarly managed funds that, like the equity index counterpart, employ sustainable investing strategies beyond absolute reliance on exclusionary practices that track the Bloomberg Barclays U.S Aggregate Bond Index. The five funds include: Calvert Bond-I Shares, Pax Core Bond Fund-Institutional Shares, PIMCO Total Return ESG-Institutional Shares, Praxis Impact Bond Fund-I Shares and TIAA-CREF Social Choice Bond Fund-Institutional Shares.

SUSTAIN Equity Fund Index Performance: A Decline by 0.18% in April while Trailing S&P 500 Index

Summary The SUSTAIN Equity Fund Index declined -0.18% in a Volatile April, trailing the performance of the S&P 500 by 56 basis points. U.S. stocks gain in April but investment-grade bonds post -0.74% decline. Three constituent SUSTAIN funds generated positive results in April. Energy gains in April had a muted effect on SUSTAIN funds due to the…

Share This Article:

Summary

SUSTAIN Equity Fund Index Declined -0.18% in a Volatile Month, Trailing the Performance of the S&P 500 by 56 basis points

The SUSTAIN Large Cap Equity Fund Index, which tracks the total return performance of the ten largest actively managed large-cap U.S. equity oriented mutual funds that employ a sustainable investing strategy beyond absolute reliance on exclusionary practices, posted a slim decline of -0.18% in April versus a positive total return of 0.38% for the S&P 500 Index and 0.57% recorded by the Dow Jones Industrial Average (DJIA). By giving up some momentum in April, however, the SUSTAIN Index now also lags the S&P 500 Index on a year-to-date basis. The level of underperformance over the trailing 12-month interval has expanded slightly to 227 basis points (bps) as the SUSTAIN Index generated an 11.0% gain versus an increase of 13.3% for the S&P 500 Index. Refer to Chart 1.

U.S. stocks Gained in April but Investment-Grade Bonds post -0.74% Decline

Overall, market returns were mixed in April. On the one hand, companies posted solid earnings as they benefited from the economy but even more so from the cuts in the U.S. corporate tax rates that bolstered earnings as a result of the federal tax reform package that went into effect at the end of last year. At the same time, stocks faced headwinds from higher interest rates, inflation fears, and geopolitical concerns, including uncertainty about a global trade war. Inflation fears picked up some momentum, and while short-term rates remain for now in a range of 1.5% to 1.75% with no expectation for another rate hike in May, the yield on the 10-year Treasury note moved up to 3.03% on April 25th, the highest closing level since December 31, 2013 when the yield hit 3.04%.

As noted earlier, the S&P 500 Index eked out a slim total return gain of 0.38%, which was not enough to offset the losses sustained during the previous two months. On a year-to-date basis, the index is down -0.38%. Fixed income investors did not do as well. The broad-based Bloomberg Barclays U.S. Aggregate Bond Index gave up -0.74% due to buffeting from rising interest rates, reversing the gain of +0.64% achieved in March. On a year-to-date basis, investment grade bonds are down -2.19%. Crude oil prices, which, in turn, factored into energy stock prices, were up 6.97% while the Energy sector gained 8.51% and led all 11 of the S&P 500 sectors. Utilities and Health Care posted gains of 4.28% and 2.62%, respectively. At the other end of the range were Consumer Staples, Industrials and Information Technology, which gave up -1.92%, -1.77% and -1.70%, respectively. European, Asian and Far East stocks, as measured by the MSCI EAFE Index (net), gained 2.28%. In general, value stocks outperformed growth stocks while small companies finished the month ahead of large-cap stocks.

Three Constituent SUSTAIN Funds Generated Positive Results in April

Three constituent funds that comprise the SUSTAIN Index generated positive results in April, ranging from a low of 0.21% delivered by TIAA-CREF Social Choice Equity Fund-Institutional Shares to a high of 1.01% attributable to Parnassus Core Equity-Investor Shares. The Parnassus Core Equity Fund benefited from its overweight exposure in the Health Care sector (20.13% versus 14.05% for the S&P 500) which was the third best performing sector in April. The fund also likely received a slight lift from its 1.12% position in Energy which was up 8.51% during the month. At the same time, its underweight position in Information Technology (13.82% versus 21.99% for the S&P 500) mitigated the impact of the sector’s underperformance during the same month. The fund also benefited from some of its top investments, including Praxair, Inc. (PX), CVS Health Corp. (CVS) and VF Corp. (VFC), each of which stood at between 4.23% and 4.84% of fund assets, that were up 5.7%, 12.2% and 9.11%, respectively, during the month.

At the other end of the range for April is the Parnassus Endeavor Fund-Investor Shares that posted a decline of -1.88%. This more concentrated $5.0 billion fund, also managed by Parnassus Investments, maintained an above index exposure to the Health Care sector which likely had a positive impact on the fund’s performance in April. At the same time, the fund didn’t benefit from the strong performance turned in by the Energy and Utilities sectors as the fund avoided these sectors entirely. Concentrated positions of 10.83% in Gilead Sciences Inc. (GILD) and 10.4% in Qualcomm Inc. (QCOM) and 5.32% in Allergan plc (AGN) pulled down the fund’s results as these stocks suffered losses during the month. Refer to Table 1.

Energy Gains in April have Muted Effect on SUSTAIN Funds

The strong 8.51% Energy sector gain in April had a muted effect on the cohort of sustainable funds that comprise the SUSTAIN Index due to the fact that some of the funds limit their exposures to fossil fuel and related companies that make up the Energy sector which represents 6.24% of the S&P 500 Index. In fact, 5 funds avoid the sector entirely or maintain exposures below 1%. These include Domini Impact Equity, Calvert Equity, Dreyfus Sustainable US Equity, Parnassus Fund and Parnassus Endeavor Equity. Refer to Chart 2.

Sustainable Bond Funds Posted Negative Results in April as well as Year-To-Date but Outperformed the Bloomberg Barclays U.S. Aggregate Bond Index

Sustainable investment-grade U.S. oriented bond funds that comprise the Sustainable (SUSTAIN) Bond Fund Indicator, extended their year-to-date declines, registering a negative -0.72% total return in April and -1.95% since the start of the year. Still, the results exceeded the performance of the Bloomberg Barclays U.S. Aggregate Bond Index which recorded declines of -0.74% in April and -2.19% year-to-date. So far this year, the SUSTAIN Bond Fund Indicator has been outperforming the Bloomberg Barclays U.S. Aggregate Bond Index during the down months but lagging in the single up month of March. Refer to Chart 4.

Each of the five funds that comprise the Sustainable (SUSTAIN) Bond Fund Indicator turned in negative results, but three funds managed to outperform the Bloomberg Barclays U.S. Aggregate Bond Index with total returns ranging from a low of -0.95% posted by PIMCO Total Return ESG-Institutional Shares to a high of -0.53% registered by Calvert Bond-I Shares. The Calvert Bond Fund-I Shares continued to benefit from its security selection within investment grade corporates, allocation to out of index asset-backed securities and yield curve positioning that benefited from an underweighting to the front end of the yield curve as the yield curve flattened. The fund is down -1.62% year-to-date, exceeding the Bloomberg Barclays U.S. Aggregate Bond Index by 57 basis points. The PIMCO Total Return ESG Fund-Institutional Shares, which adopted a strategy of integrating environmental, social and governance (ESG) factors into its investment strategy effective as of January 1, 2017, is lagging its index peers not only in April but also year-to-date.

The Sustainable (SUSTAIN) Bond Fund Indicator represents the total return performance of a cohort of five sustainable bond funds consisting of similarly managed funds that, like the equity index counterpart, employ sustainable investing strategies beyond absolute reliance on exclusionary practices that track the Bloomberg Barclays U.S Aggregate Bond Index. The five funds include: Calvert Bond-I Shares, Pax Core Bond Fund-Institutional Shares, PIMCO Total Return ESG-Institutional Shares, Praxis Impact Bond Fund-I Shares and TIAA-CREF Social Choice Bond Fund-Institutional Shares.

Sustainableinvest.com

Benefits

Free access to regularly updated original research and analysis focused exclusively on sustainable finance and investing, providing investors with the guidance needed to make informed investment decisions that align with their personal values and financial goals while also contributing to the advancement of positive long-term environmental and social outcomes.

By offering financial support for our current work, either in the form of a one-time or regular contributions, you help to defray some of the costs associated with conducting our research and analysis as well as to maintain the www.sustainablest.wpengine.com website.

Helping us to expand our research capabilities and offerings over time to cover additional relevant topics geared to sustainable investors.

Sign up to free newsletters.

By submitting this form, you are consenting to receive marketing emails from: . You can revoke your consent to receive emails at any time by using the SafeUnsubscribe® link, found at the bottom of every email. Emails are serviced by Constant Contact