February Results: S&P 500 up 3.21% while sustainable large cap equity funds gain 3.77%

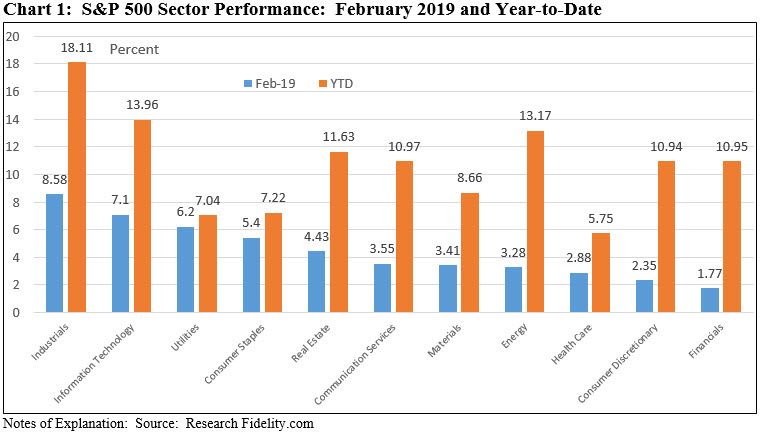

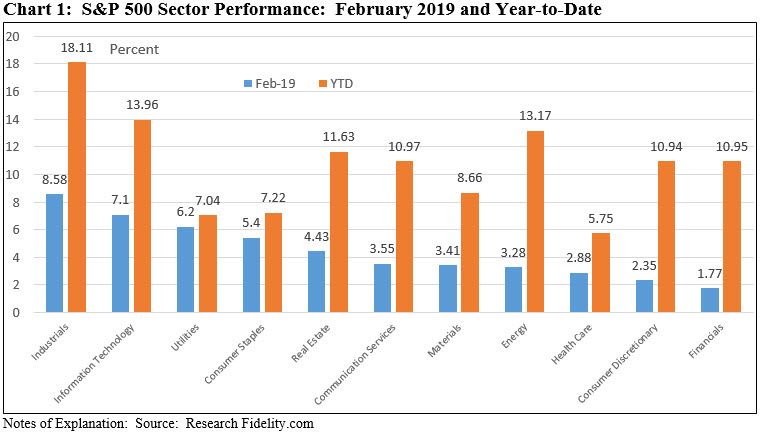

After posting a gain of 8.01% in January, the best monthly results since October 2015, the S&P 500 Index recorded another consecutive increase in February. The index added 3.21% and extended its year-to-date gain to 11%, thus erasing and exceeding December’s 9.2% decline. The NASDAQ Composite Index and the Dow Jones Industrial Average delivered even better results, posting gains of 3.60% and 4.03%, respectively. Fitting in within this range, sustainable large cap funds, as measured by the SUSTAIN Equity Fund Index, gained 3.77%. Growth stocks outperformed value stocks while small company stocks excelled, adding 5.2% for the month. Except for Latin America, most stock markets ended the month in the black, with total return results falling in the 2%-3% range while China registered a gain of 3.45%. Investment-grade intermediate bonds, as measured by the Bloomberg Barclays US Aggregate Index, gave up -0.06% as yields on 10-Year Treasuries rose 10 basis points (bps) from January 31st to end the month at 2.73%. Still, investor sentiment remains cautious with some positing that the 2019 rally is unjustified. The best two-month start to the year since 1987 was fueled by a more patient Federal Reserve Bank, better than expected corporate earnings and a lowering of US-China trade tensions that was confirmed before month-end when it was announced that the US was abandoning, for now, its threat to raise tariffs on $200 billion of Chinese goods that would have gone into effect on March 1. Again in February, all 11 industry sectors that make up the S&P 500 registered gains, ranging from a high of 8.58% recorded by Industrials to a low of 1.77% posted by Financials. Year-to-date, the same two sectors are up 18.11% and 10.95%, respectively. See Chart 1.

On the last day of the month the Commerce Department released its fourth-quarter 2018 GDP numbers, reporting that the US economy moderated but expanded by a very solid 2.6%. Consumer spending, despite the sharp drop in December retail sales, led in the report, rising at a 2.8% annualized rate which is down from outsized rates of 3.5% and 3.8% in the prior two quarters but still more than respectable.

Barring any unexpected developments, the expansion, which began under President Obama, is projected to become the longest on record in July when the string of economic gains reaches 127 months. Still, economic momentum is slowing and Federal Reserve officials see a slowing trajectory with economic output growth of 2.3% expected in 2019, 2.0% in 2020 and 1.9% in 2021. It should be noted that the Trump Administration’s Fiscal Year (FY) 2020 budget proposal that was released on March 11th projects a rosier average real GDP growth of nearly 3% per over the following decade.

The Sustainable (SUSTAIN) Large Cap Equity Fund Index scored a 3.77% gain and managed to outperform the S&P 500 by 56 basis points

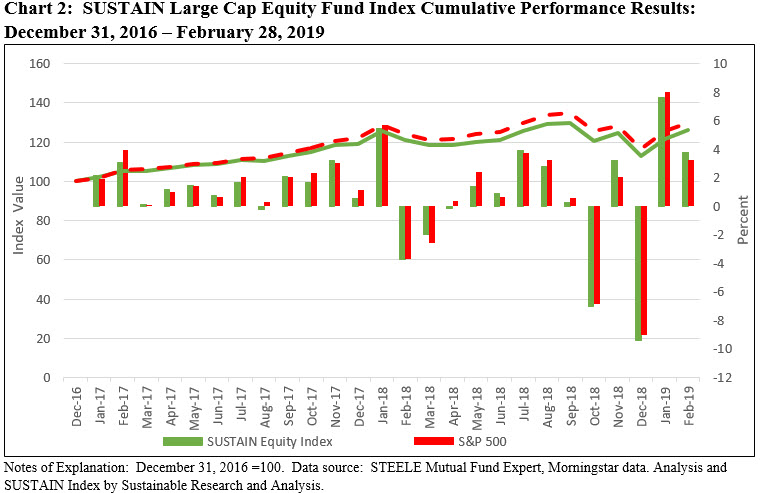

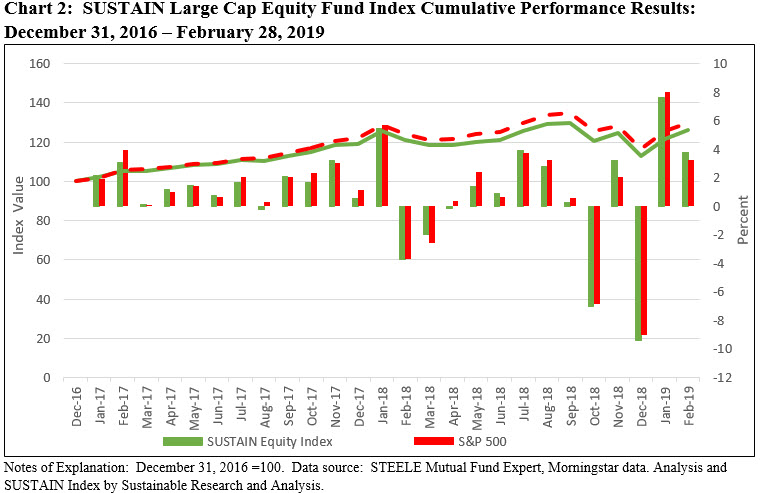

The Sustainable (SUSTAIN) Large Cap Equity Fund Index scored a 3.77% gain and managed to outperform the S&P 500 Index by 56 bps points as seven of the ten sustainable mutual fund index components posted results in excess of 3.21%. This was enough to offset last month’s trailing performance and push the index ahead of the S&P 500 on a year-to-date basis by 22 bps. Still, the SUSTAIN Index continues to lag the S&P 500 over the previous 3-months and 12-months by 19 bps and 58 bps, respectively. See Chart 2.

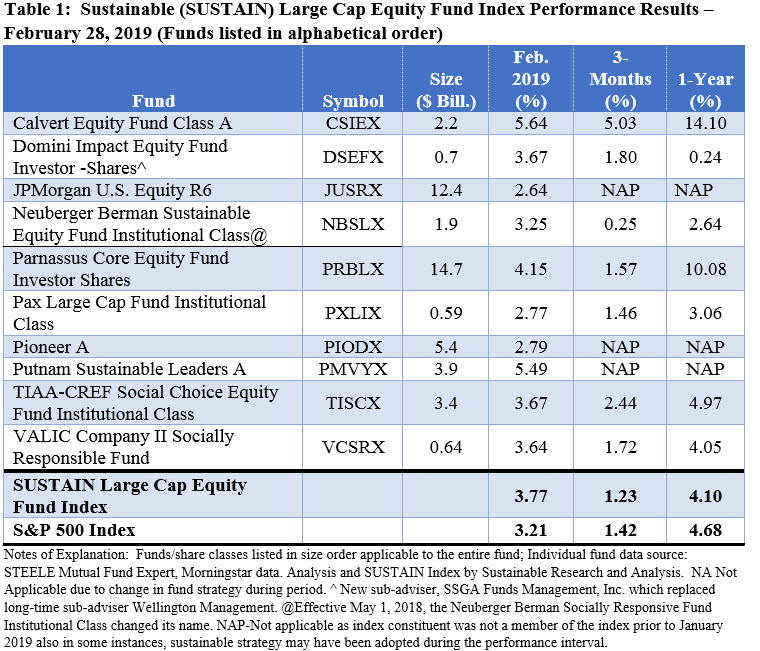

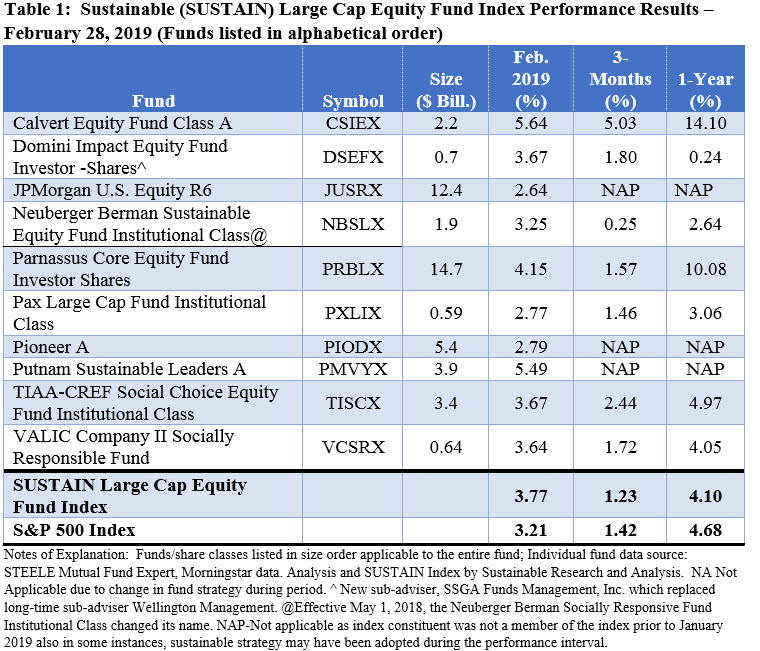

The leading constituent funds in February include Calvert Equity Fund Class A, up a strong 5.64% and a whopping two-month gain of 12.88%, Putnam Sustainable Leaders A, also up over 5% with a solid 5.49% gain, followed by Parnassus Core Equity Fund Investor Shares, up 4.15%. The two best performing funds benefited from the favorable performance of larger-cap growth-oriented stocks during the month as larger capitalization stocks in the S&P 500 outperformed value stocks by almost 2 to 1. Calvert Equity Fund, however, benefited from a number of above index allocations to stocks like Danaher Corp. (DHR), Alphabet Inc. (GOOG), Visa Inc. (V), Microsoft Corp. (MSFT) and Thermo Fisher Scientific (TMO) that, with the exception of Alphabet that was flat for the month, posted gains ranging from 6% to 15%. Together, the five holdings accounted for 23.3% of portfolio assets as of December 31, 2018. Moreover, all of the sectors in which the fund invested produced positive results, however, a zero weighting in Utilities which was the third best performing sector in February detracted from the fund’s overall performance. See Table 1.

Leading the rear for the month was January’s best performing fund, J.P. Morgan US Equity R6, up 2.65% after posting an index beating 9.18% last month, followed by Pax Large Cap Fund Institutional Class, up 2.77% and Pioneer A, up 2.79%.

The Sustainable (SUSTAIN) Bond Fund Index gains 0.15% and beats the Bloomberg Barclays US Aggregate Index by 21 basis points

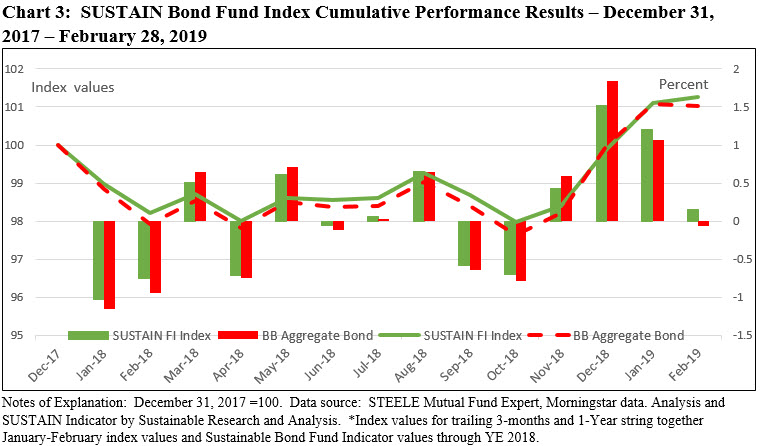

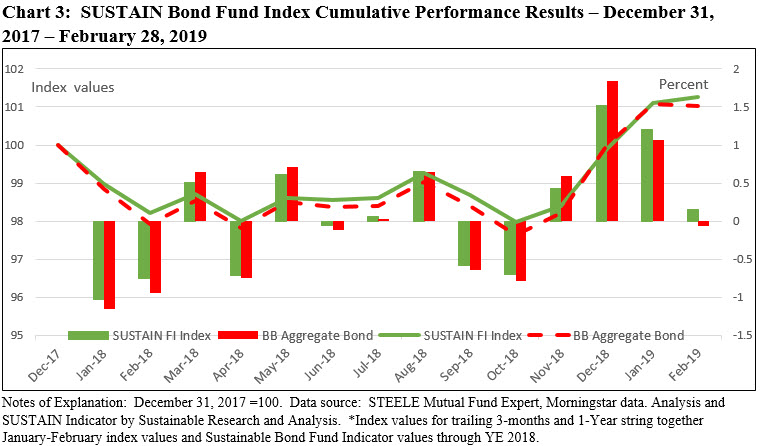

The Sustainable (SUSTAIN) Bond Fund Index posted its fourth consecutive positive total return while at the same time outperforming the Bloomberg Barclays US Aggregate Index by 21 basis points, having produced a gain of 0.15% versus the -0.06% result delivered by the conventional index. All ten index constituents outperformed the Bloomberg benchmark by a spread that ranged from .06% to 0.33%. The SUSTAIN Bond Index also managed to outperform the Bloomberg index over the trailing 3-months by five basis points but it lags over the trailing 12-months by seven basis points. See Chart 3.

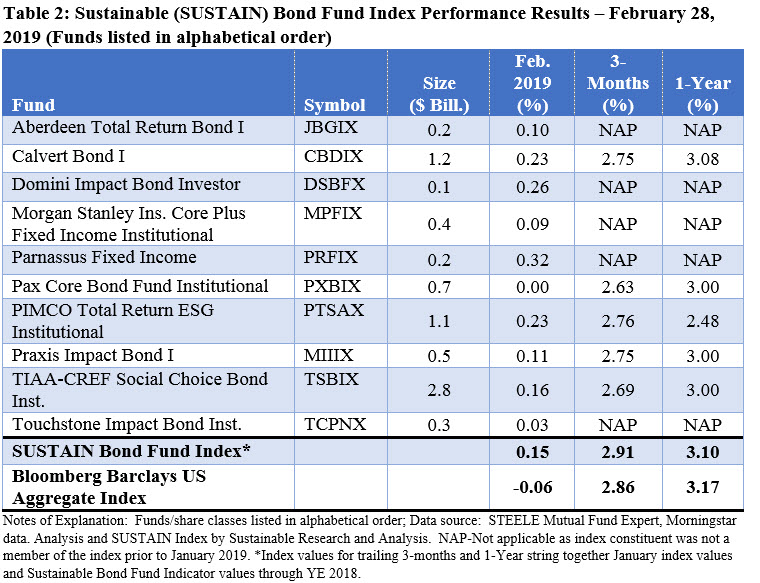

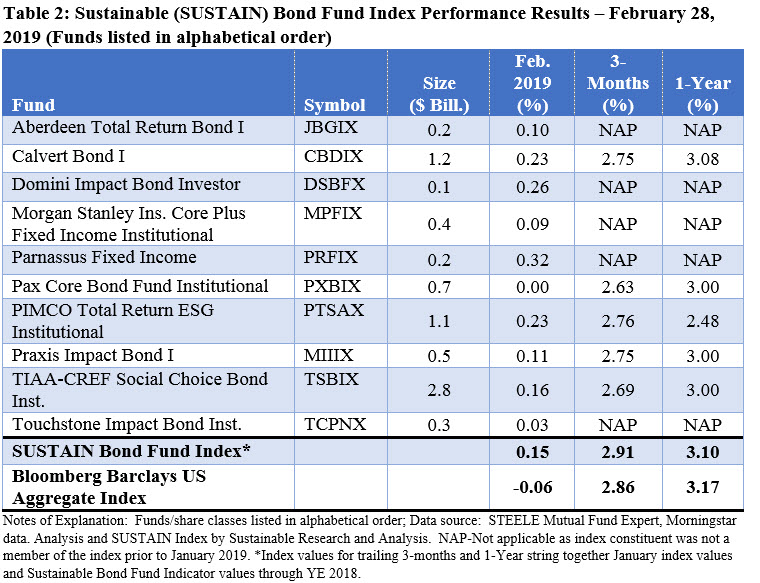

The leading funds in February included Parnassus Fixed Income, up 0.32%, Domini Impact Bond Investor, up 0.26% and Calvert Bond I as well as PIMCO Total Return ESG Institutional, both up 0.23%. The performance of Parnassus Fixed Income was likely boosted due to its 6.06% cash position along with a high exposure to mid-to-lower investment grade corporate debt obligations, at about 72% of fund assets, during a month when Corporate A credits were up 0.12% versus -0.72% posted by AAA corporate credits. The fund maintained a BBB average credit quality and its duration stood at 6.27, slightly higher than the duration maintained by some of the funds that trailed their index constituent counterparts. See Table 2.

At the other end of the range were Pax Core Bond Fund Institutional, posting a flat 0.0% total return, followed by Touchstone Impact Bond Institutional and Morgan Stanley Institutional Core Plus Fixed Income Institutional, up 0.03% and 0.09%, respectively.

The universe of esg mutual funds and ETFs across all fund types gain an average 2.52%

Sustainable funds across all fund types, a total of 1,440 mutual funds and ETFs with performance results for the entire month of February, posted an average total return gain of 2.52%. Results ranged from a high of 10.46% recorded by the Zevenbergen Genea Institutional Fund, to a low of -2.73% generated by the iPath Global Carbon ETN. The Zevenbergen Genea Fund invests in innovative transformational businesses at an emerging stage, oftentimes near the company’s initial public offering, that are also evaluated on the basis of ESG risks. iPath is a highly volatile thematic exchange trade note (ETN) that provides exposure to the global price of carbon by referencing the price of carbon emissions credits from the world’s major emissions related mechanisms. Equity and all equity related funds added an average of 3.02% in February and 11.47% on a year-to-date basis while fixed income funds, including taxable and municipal investment vehicles gained an average of 0.54% and 2.37% since the start of the year.

SUSTAIN equity and bond fund indexes outperform in Feb. 2019, up 3.77% & 0.15%

February Results: S&P 500 up 3.21% while sustainable large cap equity funds gain 3.77% After posting a gain of 8.01% in January, the best monthly results since October 2015, the S&P 500 Index recorded another consecutive increase in February. The index added 3.21% and extended its year-to-date gain to 11%, thus erasing and exceeding December’s…

Share This Article:

February Results: S&P 500 up 3.21% while sustainable large cap equity funds gain 3.77%

After posting a gain of 8.01% in January, the best monthly results since October 2015, the S&P 500 Index recorded another consecutive increase in February. The index added 3.21% and extended its year-to-date gain to 11%, thus erasing and exceeding December’s 9.2% decline. The NASDAQ Composite Index and the Dow Jones Industrial Average delivered even better results, posting gains of 3.60% and 4.03%, respectively. Fitting in within this range, sustainable large cap funds, as measured by the SUSTAIN Equity Fund Index, gained 3.77%. Growth stocks outperformed value stocks while small company stocks excelled, adding 5.2% for the month. Except for Latin America, most stock markets ended the month in the black, with total return results falling in the 2%-3% range while China registered a gain of 3.45%. Investment-grade intermediate bonds, as measured by the Bloomberg Barclays US Aggregate Index, gave up -0.06% as yields on 10-Year Treasuries rose 10 basis points (bps) from January 31st to end the month at 2.73%. Still, investor sentiment remains cautious with some positing that the 2019 rally is unjustified. The best two-month start to the year since 1987 was fueled by a more patient Federal Reserve Bank, better than expected corporate earnings and a lowering of US-China trade tensions that was confirmed before month-end when it was announced that the US was abandoning, for now, its threat to raise tariffs on $200 billion of Chinese goods that would have gone into effect on March 1. Again in February, all 11 industry sectors that make up the S&P 500 registered gains, ranging from a high of 8.58% recorded by Industrials to a low of 1.77% posted by Financials. Year-to-date, the same two sectors are up 18.11% and 10.95%, respectively. See Chart 1.

On the last day of the month the Commerce Department released its fourth-quarter 2018 GDP numbers, reporting that the US economy moderated but expanded by a very solid 2.6%. Consumer spending, despite the sharp drop in December retail sales, led in the report, rising at a 2.8% annualized rate which is down from outsized rates of 3.5% and 3.8% in the prior two quarters but still more than respectable.

Barring any unexpected developments, the expansion, which began under President Obama, is projected to become the longest on record in July when the string of economic gains reaches 127 months. Still, economic momentum is slowing and Federal Reserve officials see a slowing trajectory with economic output growth of 2.3% expected in 2019, 2.0% in 2020 and 1.9% in 2021. It should be noted that the Trump Administration’s Fiscal Year (FY) 2020 budget proposal that was released on March 11th projects a rosier average real GDP growth of nearly 3% per over the following decade.

The Sustainable (SUSTAIN) Large Cap Equity Fund Index scored a 3.77% gain and managed to outperform the S&P 500 by 56 basis points

The Sustainable (SUSTAIN) Large Cap Equity Fund Index scored a 3.77% gain and managed to outperform the S&P 500 Index by 56 bps points as seven of the ten sustainable mutual fund index components posted results in excess of 3.21%. This was enough to offset last month’s trailing performance and push the index ahead of the S&P 500 on a year-to-date basis by 22 bps. Still, the SUSTAIN Index continues to lag the S&P 500 over the previous 3-months and 12-months by 19 bps and 58 bps, respectively. See Chart 2.

The leading constituent funds in February include Calvert Equity Fund Class A, up a strong 5.64% and a whopping two-month gain of 12.88%, Putnam Sustainable Leaders A, also up over 5% with a solid 5.49% gain, followed by Parnassus Core Equity Fund Investor Shares, up 4.15%. The two best performing funds benefited from the favorable performance of larger-cap growth-oriented stocks during the month as larger capitalization stocks in the S&P 500 outperformed value stocks by almost 2 to 1. Calvert Equity Fund, however, benefited from a number of above index allocations to stocks like Danaher Corp. (DHR), Alphabet Inc. (GOOG), Visa Inc. (V), Microsoft Corp. (MSFT) and Thermo Fisher Scientific (TMO) that, with the exception of Alphabet that was flat for the month, posted gains ranging from 6% to 15%. Together, the five holdings accounted for 23.3% of portfolio assets as of December 31, 2018. Moreover, all of the sectors in which the fund invested produced positive results, however, a zero weighting in Utilities which was the third best performing sector in February detracted from the fund’s overall performance. See Table 1.

Leading the rear for the month was January’s best performing fund, J.P. Morgan US Equity R6, up 2.65% after posting an index beating 9.18% last month, followed by Pax Large Cap Fund Institutional Class, up 2.77% and Pioneer A, up 2.79%.

The Sustainable (SUSTAIN) Bond Fund Index gains 0.15% and beats the Bloomberg Barclays US Aggregate Index by 21 basis points

The Sustainable (SUSTAIN) Bond Fund Index posted its fourth consecutive positive total return while at the same time outperforming the Bloomberg Barclays US Aggregate Index by 21 basis points, having produced a gain of 0.15% versus the -0.06% result delivered by the conventional index. All ten index constituents outperformed the Bloomberg benchmark by a spread that ranged from .06% to 0.33%. The SUSTAIN Bond Index also managed to outperform the Bloomberg index over the trailing 3-months by five basis points but it lags over the trailing 12-months by seven basis points. See Chart 3.

The leading funds in February included Parnassus Fixed Income, up 0.32%, Domini Impact Bond Investor, up 0.26% and Calvert Bond I as well as PIMCO Total Return ESG Institutional, both up 0.23%. The performance of Parnassus Fixed Income was likely boosted due to its 6.06% cash position along with a high exposure to mid-to-lower investment grade corporate debt obligations, at about 72% of fund assets, during a month when Corporate A credits were up 0.12% versus -0.72% posted by AAA corporate credits. The fund maintained a BBB average credit quality and its duration stood at 6.27, slightly higher than the duration maintained by some of the funds that trailed their index constituent counterparts. See Table 2.

At the other end of the range were Pax Core Bond Fund Institutional, posting a flat 0.0% total return, followed by Touchstone Impact Bond Institutional and Morgan Stanley Institutional Core Plus Fixed Income Institutional, up 0.03% and 0.09%, respectively.

The universe of esg mutual funds and ETFs across all fund types gain an average 2.52%

Sustainable funds across all fund types, a total of 1,440 mutual funds and ETFs with performance results for the entire month of February, posted an average total return gain of 2.52%. Results ranged from a high of 10.46% recorded by the Zevenbergen Genea Institutional Fund, to a low of -2.73% generated by the iPath Global Carbon ETN. The Zevenbergen Genea Fund invests in innovative transformational businesses at an emerging stage, oftentimes near the company’s initial public offering, that are also evaluated on the basis of ESG risks. iPath is a highly volatile thematic exchange trade note (ETN) that provides exposure to the global price of carbon by referencing the price of carbon emissions credits from the world’s major emissions related mechanisms. Equity and all equity related funds added an average of 3.02% in February and 11.47% on a year-to-date basis while fixed income funds, including taxable and municipal investment vehicles gained an average of 0.54% and 2.37% since the start of the year.

Sustainableinvest.com

Benefits

Free access to regularly updated original research and analysis focused exclusively on sustainable finance and investing, providing investors with the guidance needed to make informed investment decisions that align with their personal values and financial goals while also contributing to the advancement of positive long-term environmental and social outcomes.

By offering financial support for our current work, either in the form of a one-time or regular contributions, you help to defray some of the costs associated with conducting our research and analysis as well as to maintain the www.sustainablest.wpengine.com website.

Helping us to expand our research capabilities and offerings over time to cover additional relevant topics geared to sustainable investors.

Sign up to free newsletters.

By submitting this form, you are consenting to receive marketing emails from: . You can revoke your consent to receive emails at any time by using the SafeUnsubscribe® link, found at the bottom of every email. Emails are serviced by Constant Contact