U.S. stocks, as measured by the S&P 500 Index, ended the month of March up 1.94% while investment grade intermediate bonds, based on the Bloomberg Barclays US Aggregate Index end the month up 1.92% or just 4 basis points shy of equities

U.S. stocks, as measured by the S&P 500 Index, ended the month of March up 1.94%, adding to the strong gains achieved in January and February to record the best quarterly gain since 1988. The Nasdaq Composite posted an even better 2.17% while the Dow Jones Industrial Average eked out a small 0.17% gain. At the same time, large cap sustainable equity funds, as measured by the Sustainable Large Cap Equity Fund Index, posted an increase of 2.0%, eclipsing the S&P 500 by 0.06%. The US markets responded to a shift in the posture of the Federal Reserve Bank and other central banks to hold interest rates as well as to growing confidence that the US and China would reach an agreement on trade. This, given a backdrop of slowing consumer spending and income growth reflected in the downward revisions to gross-domestic product growth to 2.2% for the fourth quarter of 2018 and 2.9% for the full year. While still a bright spot globally, US economic concerns were reflected in the behavior of bond yields. The 10-year Treasury note, which started the month at 2.73% and dropped by 32 basis points to end at 2.41%, inverted relative to the 3-month-Treasury bills that closed March at 2.40%. This, combined with the strong 3.32% return achieved by AAA corporate bonds lifted the Bloomberg Barclays US Aggregate Bond Index (BB Index). The index ended the month with a gain of 1.92%, the best monthly result since January 2015 and just 4 basis points (bps) shy of the S&P 500. The BB Index surpassed the 1.85% increase registered by the Sustainable Bond Fund Index.

After logging strong results of 5.20% in February and 11.25% in January of this year, the momentum of small cap stocks was halted. Based on the performance of the Russell 2000 index, small cap stocks gave up -2.09% while growth stocks outperformed value stocks.

With the exception of Latin America, markets outside the US ended the month in the black but did not perform as well as the US market. The MSCI ACWI NR index posted a gain of 1.26% while MSCI EAFE ended higher, recording an increase of 0.63%. MSCI China gained 2.44% while Latin America was down 2.53%.

SUSTAIN Large Cap Equity Fund Index beats the S&P 500 for the second consecutive month

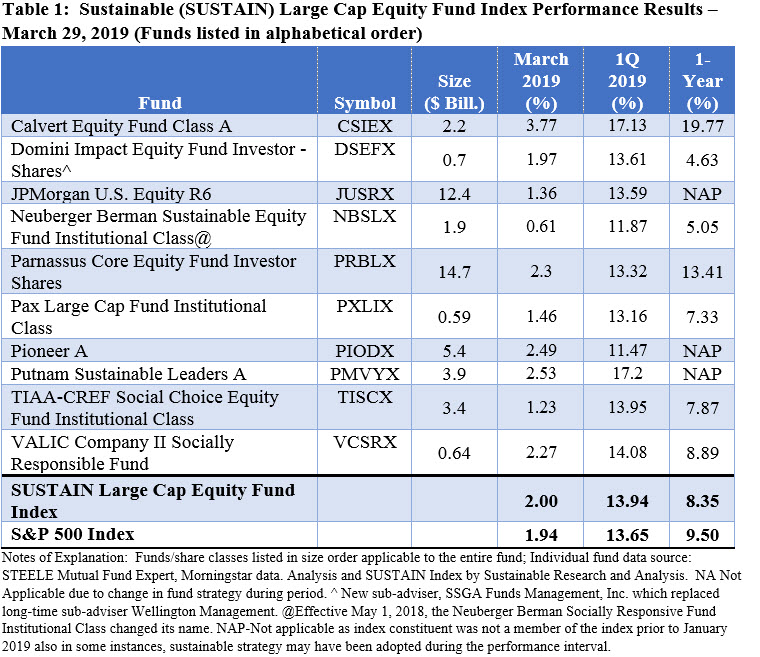

For the second consecutive month, the Sustainable (SUSTAIN) Large Cap Equity Fund Index exceeded the performance of the S&P 500, posting a gain of 2.00% or an excess return of 0.06%. Five funds beat the S&P 500 index in March with increases ranging from a low of 1.23% registered by TIAA-CREF Social Choice Equity Fund Institutional Shares, to a high of 3.77% recorded by Calvert Equity A. The same fund also posted strong gains in the first quarter and trailing 12-month periods, up 17.13% and 19.77%, respectively. This growth oriented fund that is sub-advised by Atlanta Capital Management and combines Calvert’s sustainable investing principles (See Funds Directory tab for details), applies a fundamental approach to investing, primarily in established large-cap stocks with a history of sustained earnings growth at a favorable price, not only eclipsed the results achieved by the other nine index constituents but also outperformed the S&P 500 by 3.48% and a whopping 10.27% in the first quarter and trailing 12-month period. The fund’s trailing 12-month results reflects a large distribution of returns across index members, from a low of 4.63% to a high of 19.77%. Refer to Table 1.

Calvert A was followed by Putnam Sustainable Leaders A that gained 2.53% and Pioneer A, up 2.49%. Putnam Sustainable Leaders A was also the leading fund in the first quarter with its gain of 17.20%, exceeding the S&P 500 by 3.55%.

As noted earlier, five funds underperformed the S&P 500 Index, posting returns ranging from 0.61% to 1.46%. The lowest of these was the $2.0 billion Neuberger Berman Sustainable Equity Fund Institutional Fund that posted a 0.61% return. Performance for this large cap blended equity fund suffered from the fund’s 11.72% exposure to Europe (as of 2/28/2019) as well as underweighting in the Technology sector and overweighting in Health Care which ended the month up a mere 0.35%.

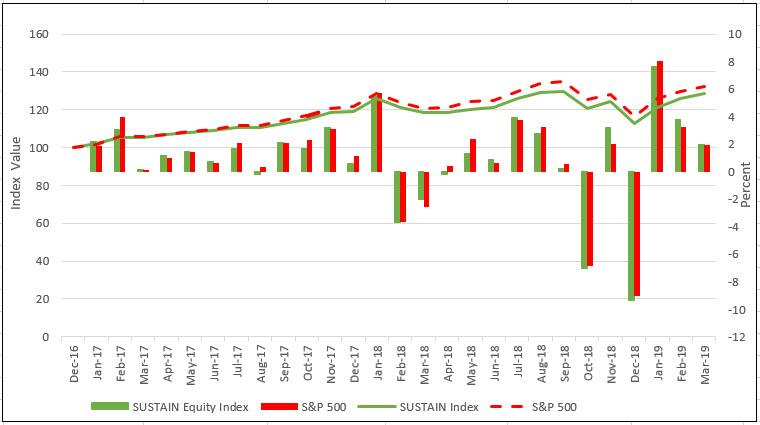

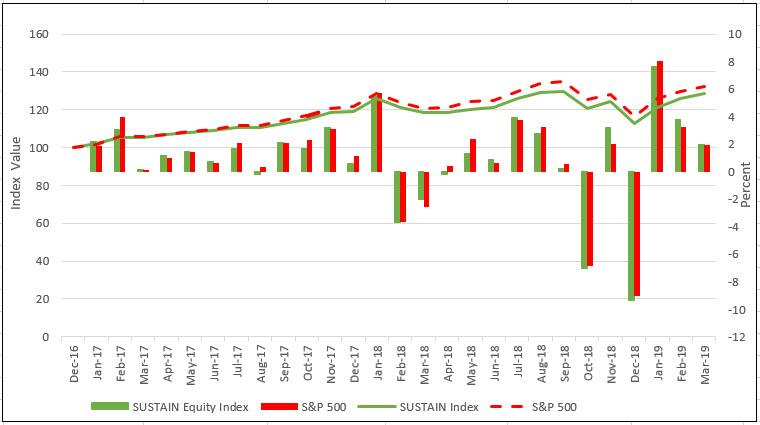

Since its inception as of December 31, 2016 the SUSTAIN Large Cap Equity Fund Index continues to trail the S&P 500 by almost 3.9%, with an average gap between the two benchmarks based on cumulative performance since its inception registering 2.58%. Refer to Chart 1.

Chart 1: SUSTAIN Large Cap Equity Fund Index Cumulative Performance Results: December 31, 2016 – March 29, 2019

DeclNotes of Explanation: December 31, 2016 =100. Data source: STEELE Mutual Fund Expert, Morningstar data. Analysis and SUSTAIN Index by Sustainable Research and Analysis.

Declining yields and the strong performance of highly rated corporate bonds lifted the performance of the SUSTAIN Bond Fund Index, but it failed to beat the conventional BB index.

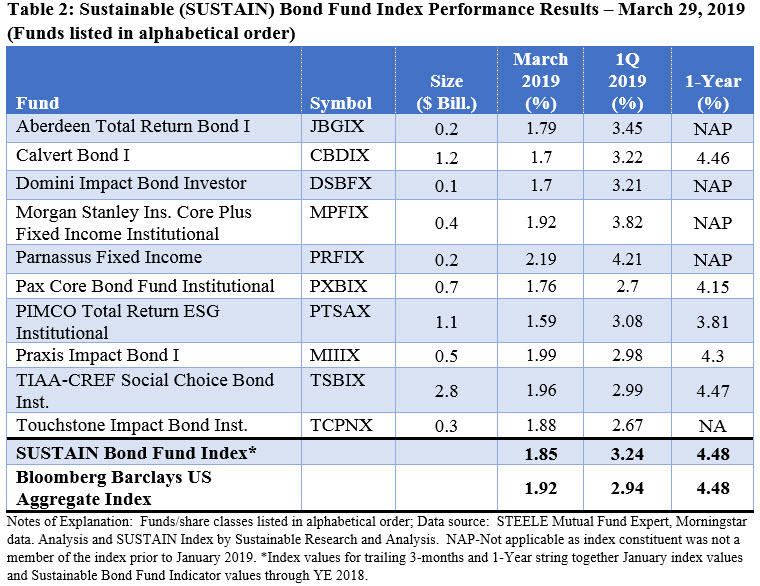

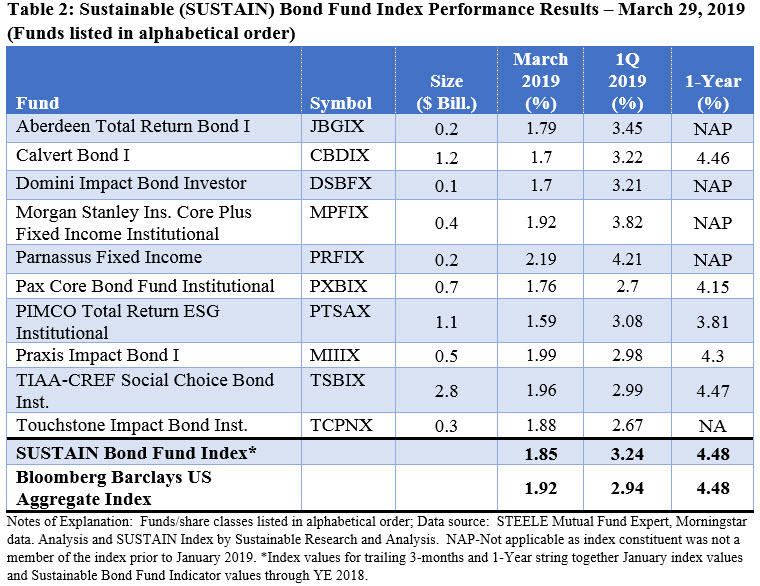

Declining yields and the strong performance of highly rated corporate bonds lifted the performance of the Sustainable (SUSTAIN) Bond Fund Index that registered a gain of 1.85%. This bested the next highest monthly increase of 1.52% reached in December 2018 and led the index to post the highest gain since the benchmark was first calculated as of December 31, 2017. Still, only three funds managed to exceed the performance of the Bloomberg Barclays US Aggregate Index that ended the month up 1.92% and this, in turn, led to the 7 basis points of underperformance.

The best performing index constituent was also one of the smallest, the $113 million Parnassus Fixed Income Fund that recorded an increase of 2.19% and also led the pack in the quarter and trailing 12-month intervals with outstanding gains of 4.21% and 4.79%, respectively. While its 5.63% position in cash detracted from performance, the fund benefited from its longer weighted average maturity which stood at 8.77 years versus the Bloomberg Barclays US Aggregate Index at 7.86 years. The fund also benefited from its high credit quality and, in particular, overweighting of highly rated corporate bonds and underweighting in securitized debt as AAA rated corporate bonds posted a gain of 3.32% versus high yield bonds that came in at 0.94%. Refer to Table 2.

At the other end of the range was the $1.2 billion PIMCO Total Return ESG Institutional Fund, the largest of the 10 funds that comprise the index. The fund gained 1.59%, falling behind its benchmark by 33 basis points, largely due to its shorter 3.71 years weighted average maturity and heavier reliance on securitized debt. Still the fund outperformed its BB Index benchmark in the first quarter but also lags for the trailing 12-months with a return of 3.81%.

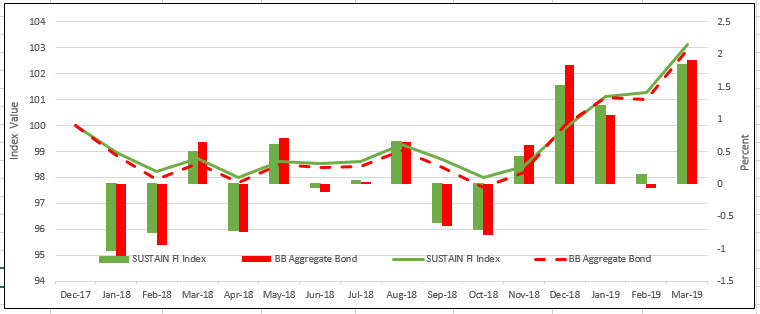

Benefiting from its 6 bps excess return this month, the SUSTAIN Bond Fund Index reflected a gain of 4.48% for the trailing 12-month period, equivalent to the BB Index, and it has pulled ahead by 7 bps based on its cumulative performance since its inception as of December 31, 2017. Refer to Chart 2.

SUSTAIN equity and bond fund indexes post gains of 2.0% and 1.85% in March

U.S. stocks, as measured by the S&P 500 Index, ended the month of March up 1.94%, adding to the strong gains achieved in January and February to record the best quarterly gain since 1988. The Nasdaq Composite posted an even better 2.17% while the Dow Jones Industrial Average eked out a small 0.17% gain. At…

Share This Article:

U.S. stocks, as measured by the S&P 500 Index, ended the month of March up 1.94% while investment grade intermediate bonds, based on the Bloomberg Barclays US Aggregate Index end the month up 1.92% or just 4 basis points shy of equities

U.S. stocks, as measured by the S&P 500 Index, ended the month of March up 1.94%, adding to the strong gains achieved in January and February to record the best quarterly gain since 1988. The Nasdaq Composite posted an even better 2.17% while the Dow Jones Industrial Average eked out a small 0.17% gain. At the same time, large cap sustainable equity funds, as measured by the Sustainable Large Cap Equity Fund Index, posted an increase of 2.0%, eclipsing the S&P 500 by 0.06%. The US markets responded to a shift in the posture of the Federal Reserve Bank and other central banks to hold interest rates as well as to growing confidence that the US and China would reach an agreement on trade. This, given a backdrop of slowing consumer spending and income growth reflected in the downward revisions to gross-domestic product growth to 2.2% for the fourth quarter of 2018 and 2.9% for the full year. While still a bright spot globally, US economic concerns were reflected in the behavior of bond yields. The 10-year Treasury note, which started the month at 2.73% and dropped by 32 basis points to end at 2.41%, inverted relative to the 3-month-Treasury bills that closed March at 2.40%. This, combined with the strong 3.32% return achieved by AAA corporate bonds lifted the Bloomberg Barclays US Aggregate Bond Index (BB Index). The index ended the month with a gain of 1.92%, the best monthly result since January 2015 and just 4 basis points (bps) shy of the S&P 500. The BB Index surpassed the 1.85% increase registered by the Sustainable Bond Fund Index.

After logging strong results of 5.20% in February and 11.25% in January of this year, the momentum of small cap stocks was halted. Based on the performance of the Russell 2000 index, small cap stocks gave up -2.09% while growth stocks outperformed value stocks.

With the exception of Latin America, markets outside the US ended the month in the black but did not perform as well as the US market. The MSCI ACWI NR index posted a gain of 1.26% while MSCI EAFE ended higher, recording an increase of 0.63%. MSCI China gained 2.44% while Latin America was down 2.53%.

SUSTAIN Large Cap Equity Fund Index beats the S&P 500 for the second consecutive month

For the second consecutive month, the Sustainable (SUSTAIN) Large Cap Equity Fund Index exceeded the performance of the S&P 500, posting a gain of 2.00% or an excess return of 0.06%. Five funds beat the S&P 500 index in March with increases ranging from a low of 1.23% registered by TIAA-CREF Social Choice Equity Fund Institutional Shares, to a high of 3.77% recorded by Calvert Equity A. The same fund also posted strong gains in the first quarter and trailing 12-month periods, up 17.13% and 19.77%, respectively. This growth oriented fund that is sub-advised by Atlanta Capital Management and combines Calvert’s sustainable investing principles (See Funds Directory tab for details), applies a fundamental approach to investing, primarily in established large-cap stocks with a history of sustained earnings growth at a favorable price, not only eclipsed the results achieved by the other nine index constituents but also outperformed the S&P 500 by 3.48% and a whopping 10.27% in the first quarter and trailing 12-month period. The fund’s trailing 12-month results reflects a large distribution of returns across index members, from a low of 4.63% to a high of 19.77%. Refer to Table 1.

Calvert A was followed by Putnam Sustainable Leaders A that gained 2.53% and Pioneer A, up 2.49%. Putnam Sustainable Leaders A was also the leading fund in the first quarter with its gain of 17.20%, exceeding the S&P 500 by 3.55%.

As noted earlier, five funds underperformed the S&P 500 Index, posting returns ranging from 0.61% to 1.46%. The lowest of these was the $2.0 billion Neuberger Berman Sustainable Equity Fund Institutional Fund that posted a 0.61% return. Performance for this large cap blended equity fund suffered from the fund’s 11.72% exposure to Europe (as of 2/28/2019) as well as underweighting in the Technology sector and overweighting in Health Care which ended the month up a mere 0.35%.

Since its inception as of December 31, 2016 the SUSTAIN Large Cap Equity Fund Index continues to trail the S&P 500 by almost 3.9%, with an average gap between the two benchmarks based on cumulative performance since its inception registering 2.58%. Refer to Chart 1.

Chart 1: SUSTAIN Large Cap Equity Fund Index Cumulative Performance Results: December 31, 2016 – March 29, 2019

DeclNotes of Explanation: December 31, 2016 =100. Data source: STEELE Mutual Fund Expert, Morningstar data. Analysis and SUSTAIN Index by Sustainable Research and Analysis.

Declining yields and the strong performance of highly rated corporate bonds lifted the performance of the SUSTAIN Bond Fund Index, but it failed to beat the conventional BB index.

Declining yields and the strong performance of highly rated corporate bonds lifted the performance of the Sustainable (SUSTAIN) Bond Fund Index that registered a gain of 1.85%. This bested the next highest monthly increase of 1.52% reached in December 2018 and led the index to post the highest gain since the benchmark was first calculated as of December 31, 2017. Still, only three funds managed to exceed the performance of the Bloomberg Barclays US Aggregate Index that ended the month up 1.92% and this, in turn, led to the 7 basis points of underperformance.

The best performing index constituent was also one of the smallest, the $113 million Parnassus Fixed Income Fund that recorded an increase of 2.19% and also led the pack in the quarter and trailing 12-month intervals with outstanding gains of 4.21% and 4.79%, respectively. While its 5.63% position in cash detracted from performance, the fund benefited from its longer weighted average maturity which stood at 8.77 years versus the Bloomberg Barclays US Aggregate Index at 7.86 years. The fund also benefited from its high credit quality and, in particular, overweighting of highly rated corporate bonds and underweighting in securitized debt as AAA rated corporate bonds posted a gain of 3.32% versus high yield bonds that came in at 0.94%. Refer to Table 2.

At the other end of the range was the $1.2 billion PIMCO Total Return ESG Institutional Fund, the largest of the 10 funds that comprise the index. The fund gained 1.59%, falling behind its benchmark by 33 basis points, largely due to its shorter 3.71 years weighted average maturity and heavier reliance on securitized debt. Still the fund outperformed its BB Index benchmark in the first quarter but also lags for the trailing 12-months with a return of 3.81%.

Benefiting from its 6 bps excess return this month, the SUSTAIN Bond Fund Index reflected a gain of 4.48% for the trailing 12-month period, equivalent to the BB Index, and it has pulled ahead by 7 bps based on its cumulative performance since its inception as of December 31, 2017. Refer to Chart 2.

Sustainableinvest.com

Benefits

Free access to regularly updated original research and analysis focused exclusively on sustainable finance and investing, providing investors with the guidance needed to make informed investment decisions that align with their personal values and financial goals while also contributing to the advancement of positive long-term environmental and social outcomes.

By offering financial support for our current work, either in the form of a one-time or regular contributions, you help to defray some of the costs associated with conducting our research and analysis as well as to maintain the www.sustainablest.wpengine.com website.

Helping us to expand our research capabilities and offerings over time to cover additional relevant topics geared to sustainable investors.

Sign up to free newsletters.

By submitting this form, you are consenting to receive marketing emails from: . You can revoke your consent to receive emails at any time by using the SafeUnsubscribe® link, found at the bottom of every email. Emails are serviced by Constant Contact