Research and analysis to keep sustainable investors up to-date on a broad range of topics that include trends and developments in sustainable investing and sustainable finance, regulatory updates, performance results and considerations, investing through index funds and actively managed portfolios, asset allocation updates, expenses, ESG ratings and data, company and product news, green, social and sustainable bonds, green bond funds as well as reporting and disclosure practices, to name just a few.

A continuously updated Funds Directory is also available to investors. This is intended to become a comprehensive listing of sustainable mutual funds, ETFs and other investment products along with a description of their sustainable investing approaches as set out in fund prospectuses and related regulatory filings.

Many questions have surfaced in recent years regarding sustainable and ESG investing. Here, investors and financial intermediaries will find materials that describe the various approaches to sustainable investing and their implementation. While sustainable investing approaches vary and they have thus far defied universally accepted definitions, many practitioners agree that they fall into the following broad categories: Values-based investing, investing via exclusions, impact investing, thematic investments and ESG integration. In conjunction with each of these approaches, investors may also adopt various issuer engagement procedures and proxy voting practices. That said, sustainable investing approaches will continue to evolve.

In addition to periodic updates regarding sustainable investing and how this form of investing is evolving, investors and financial intermediaries interested in implementing a sustainable investing approach will also find source materials that cover basic investing themes as well as asset allocation tactics.

Thoughts and ideas targeting sustainable investing strategies executed through various registered and non-registered sustainable investment funds and products such as mutual funds, Exchange Traded Funds (ETFs), Exchange Traded Notes (ETNs), closed-end funds, Real Estate Investment Trusts (REITs) and Unit Investment Trusts (UITs). Coverage extends to investment management firms as well as fund groups.

Strong performance gains posted in 2021

Reversing November’s 0.69% decline, the S&P 500 Index gained 4.48% in December as markets quickly recovered in response to news reports from South Africa and the UK that the Omicron variant posed lower risks of severe disease. Even against a backdrop of future growth fears and projected central bank policy normalization, an expanding economy, lower…

Share This Article:

The Bottom Line: Strong market gains in December accompanied by higher volatility; at the same time, selected sustainable indices continue to outperform in the intermediate-to-long-term.

Strong gains in December accompanied by higher volatility

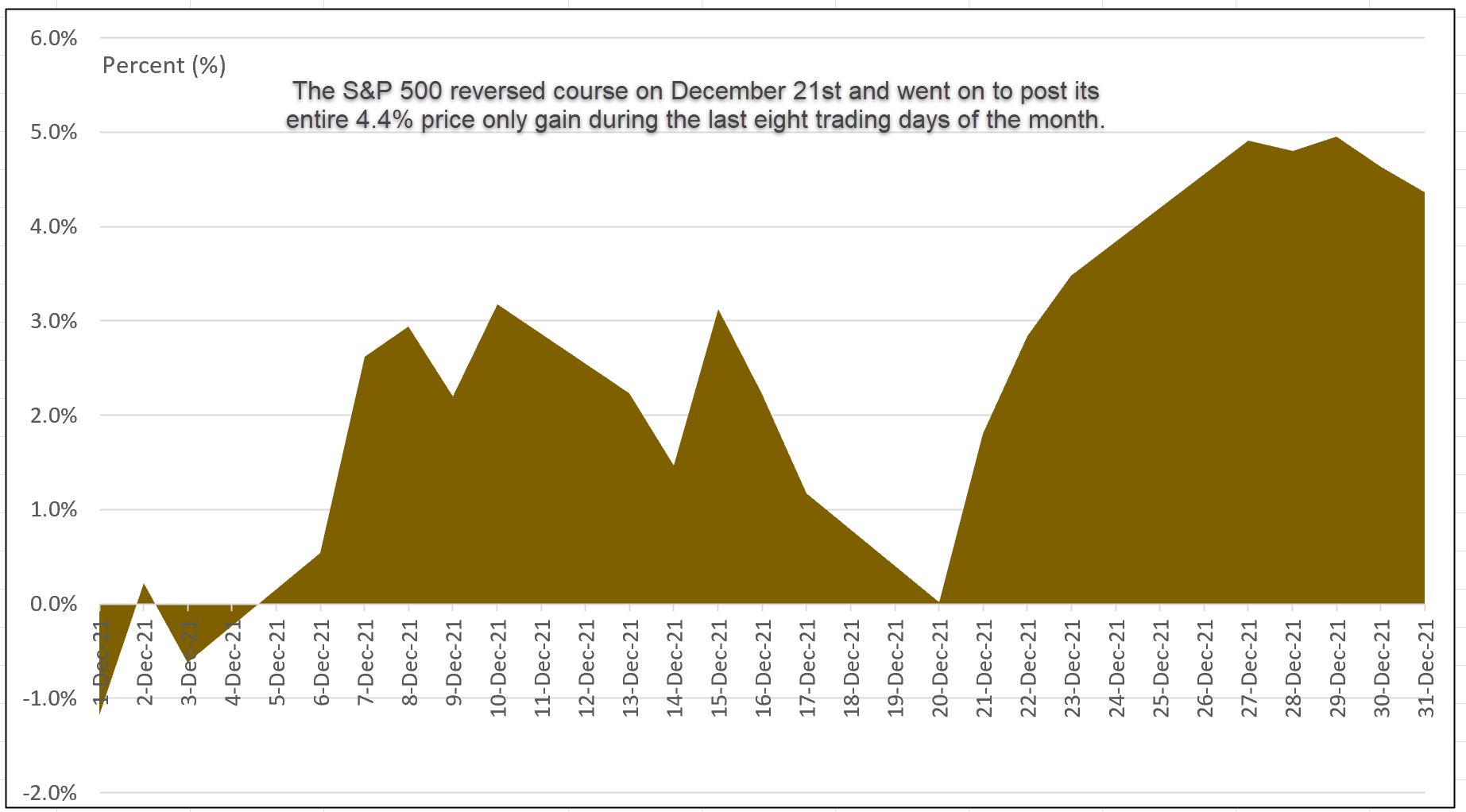

Reversing November’s 0.69% decline, the S&P 500 Index gained 4.48% in December as markets quickly recovered in response to news reports from South Africa and the UK that the Omicron variant posed lower risks of severe disease. Even against a backdrop of future growth fears and projected central bank policy normalization, an expanding economy, lower but still growing anticipated earnings and ultralow interest rates dominated investor sentiment and pushed the S&P 500 to record levels in December. The Dow Jones Industrial Average and the Nasdaq Composite added 5.53% and 0.74%, respectively, their divergence a reflection of a value tilt in December. But the month’s results were achieved with higher levels of volatility. The large cap index posted 11 declines during the month’s 22 trading days and gains realized starting on December 6th were erased by December 20th. In fact, the month’s gain was recorded during the last eight trading days to December 31st. Refer to Chart 1. For the month, 10 of the 11 sectors that make up the index gained, up from 2 last month and all 11 the month before that. Consumer Staples did the best for December, adding 9.95%, followed by Real Estate and Health Care, up 9.74% and 8.84%, respectively. Consumer Discretionary was the sole decliner for the month, falling 0.31%. Energy gained 2.93% in December but was up 47.74% for the year. Except for small cap growth stocks, large and mid-cap value stocks outperformed growth and large cap stocks managed a slight gain over small caps.

Chart 1: S&P 500 cumulative price performance-December 2021 Source: Yahoo finance/S&P Global

Source: Yahoo finance/S&P Global

Developed markets overseas outperformed. The MSCI World ex USA added 5.08% while the MSCI EAFE Index gained 5.12%. At the same time, the MSCI Emerging Markets Index registered a narrower increase of 1.88%, while the MSCI ACWI ex USA, that includes emerging markets, expanded by 4.13%.

Yields inched higher, ending the month at 1.52% for 10-year Treasuries while fixed income markets recorded declines. The Bloomberg US Aggregate Bond Index gave up 0.26%, the seventh monthly drop in 2021. For the quarter the index managed to stay positive, adding 0.01%, but recorded a decline of -1.54% for the year.

The S&P 500 registered the third consecutive strong year with a gain of 28.71%

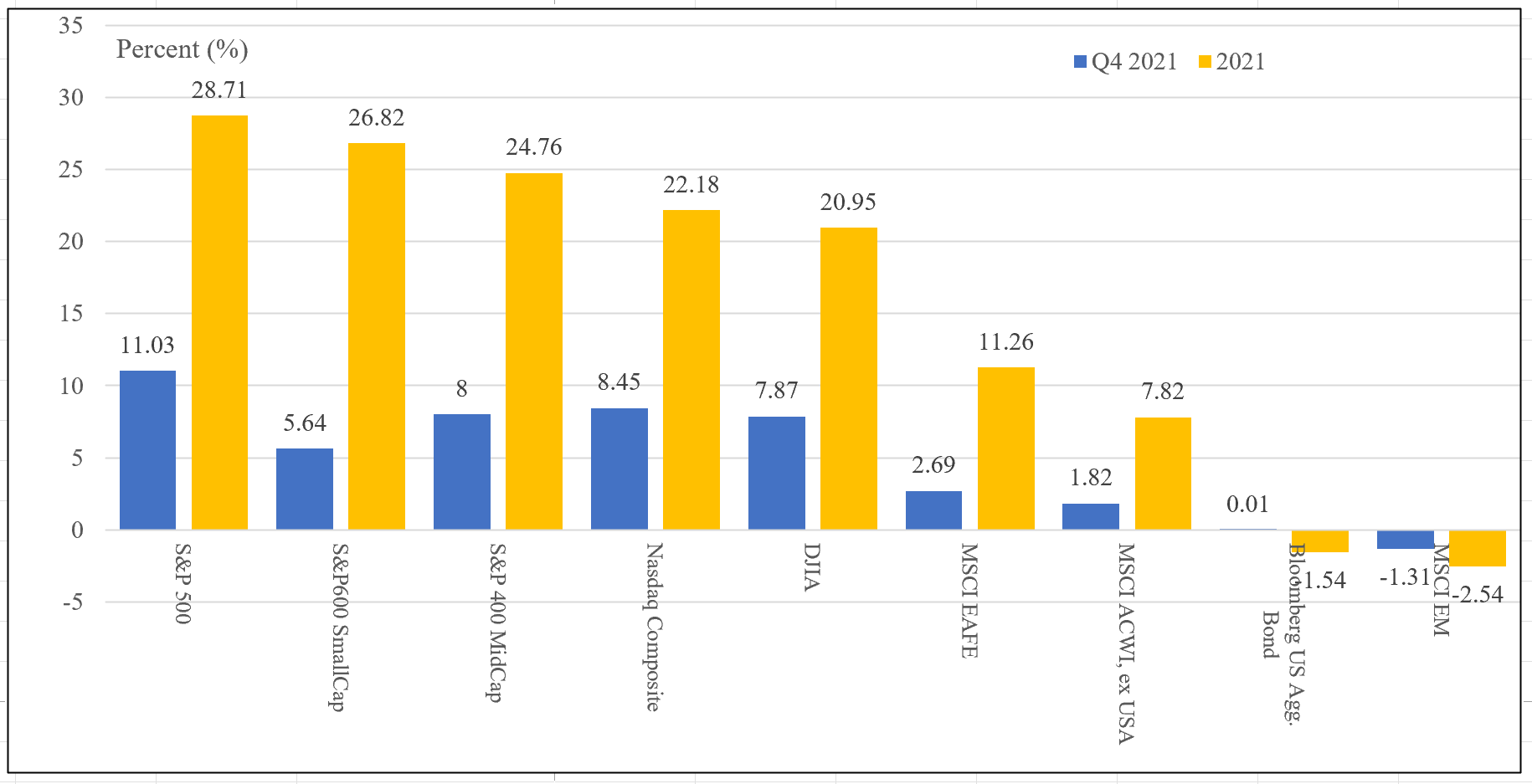

The S&P 500 gained 11.03% in the fourth quarter of the year and 28.71% for the full year. The index also registered a total of 70 new closing highs. This followed two very strong years during which the large cap index gained 18.4% and 31.49%. Refer to Chart 2 for a summary of returns attributable to selected securities market indices.

Chart 2: Total returns for selected securities market indices in 2021 and Q4 2021 Notes of Explanation: Data source: Morningstar Direct. Analysis and SUSTAIN Index by Sustainable Research and Analysis.

Notes of Explanation: Data source: Morningstar Direct. Analysis and SUSTAIN Index by Sustainable Research and Analysis.

Lower economic growth projections, reduced corporate earnings, looming interest rate increases, inflation concerns, and an unpredictable Omicron are among the concerns facing securities markets as we head into 2022.

Three of seven selected sustainable securities market indices outperformed

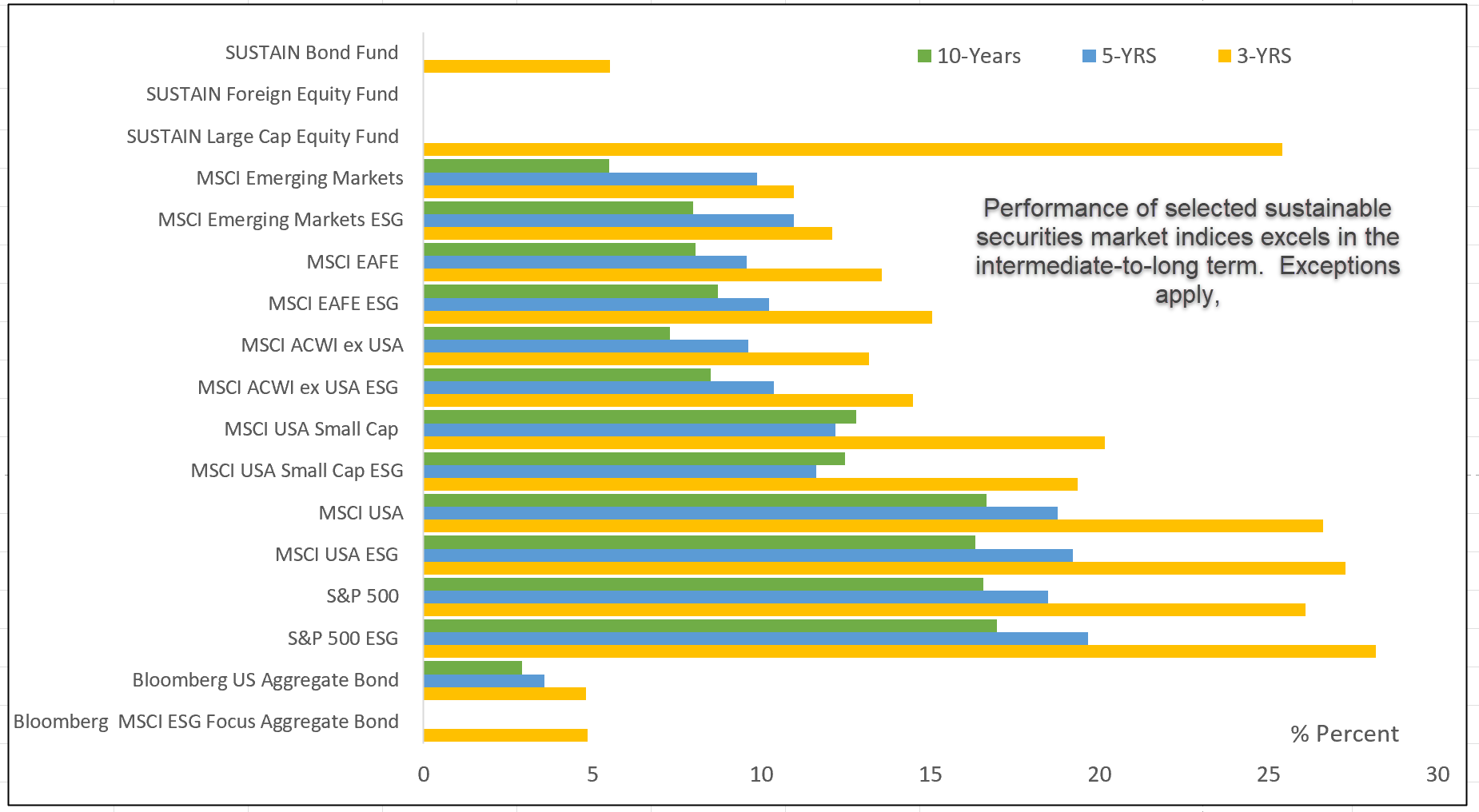

Only three of seven selected sustainable securities market indices outperformed their conventional counterparts in December. On the other hand, sustainable securities market indices, excepting the MSCI USA Small Cap ESG Leaders Index that has been a consistent laggard over the three-to-ten-year intervals, continue to outperform conventional counterparts in the intermediate to long-term. Another exception is the MSCI USA ESG Leaders Index that underperformed by a narrow margin over the trailing 10-year. Refer to Chart 3.

Chart 3: Selected sustainable indices intermediate and long-term total return performance results to December 31, 2021 Notes of Explanation: MSCI equity indices are the Leaders indices. Blanks indicate performance results are not available. Intermediate and long-term results include 3-5-and 10-year returns that are expressed as average annual returns. MSCI USA Small Cap returns are price only. Sources: MSCI, S&P Global, Sustainable Research and Analysis LLC.

Notes of Explanation: MSCI equity indices are the Leaders indices. Blanks indicate performance results are not available. Intermediate and long-term results include 3-5-and 10-year returns that are expressed as average annual returns. MSCI USA Small Cap returns are price only. Sources: MSCI, S&P Global, Sustainable Research and Analysis LLC.

Sustainable investment funds post an average gain of 11.5% in December

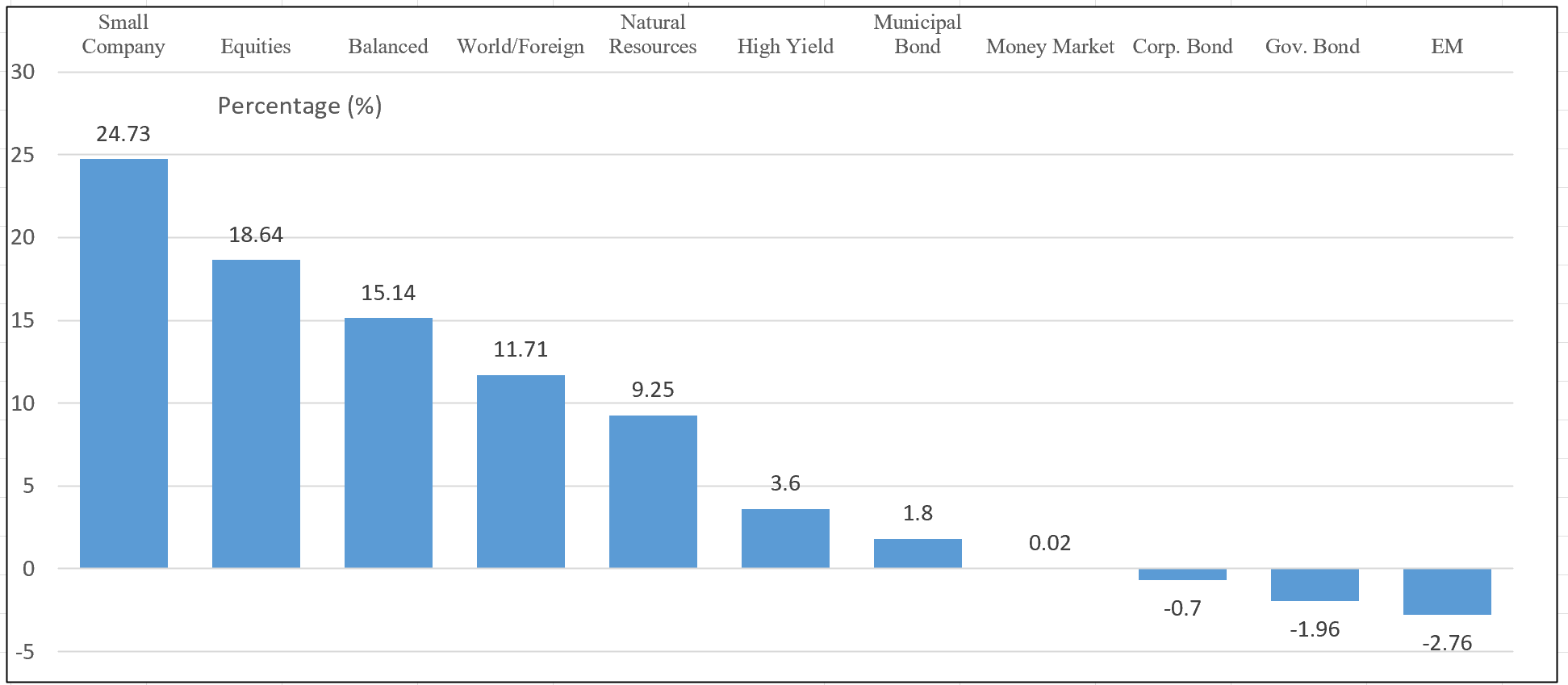

Sustainable mutual funds and ETFs across all asset classes ranging from money market funds to equity funds turned in low double digit performance results in 2021, recording an average gain of 11.5%. Returns varied considerably, however, by asset class and security type. These ranged from -2.76% recorded by diversified emerging market funds to a high of 24.73% achieved by small company stock funds. Refer to Chart 4.

Chart 4: Average total returns for selected fund investment categories-2021 Notes of Explanation: Fund performance data source: Morningstar Direct.

Notes of Explanation: Fund performance data source: Morningstar Direct.

Sustainable (SUSTAIN) fund indices-Summary

Two of the three Sustainable (SUSTAIN) fund indices lagged their conventional benchmark counterparts in December, both tracking equity funds. For the calendar year period, however, the reverse was true as two of the three SUSTAIN indices beat their conventional counterparts. Sustainable bond funds in particular outperformed by a wide 1.34% margin and show a propensity to outperform in the intermediate term. Whether that’s sourced to their sustainable mandates or not is more difficult to tease out.

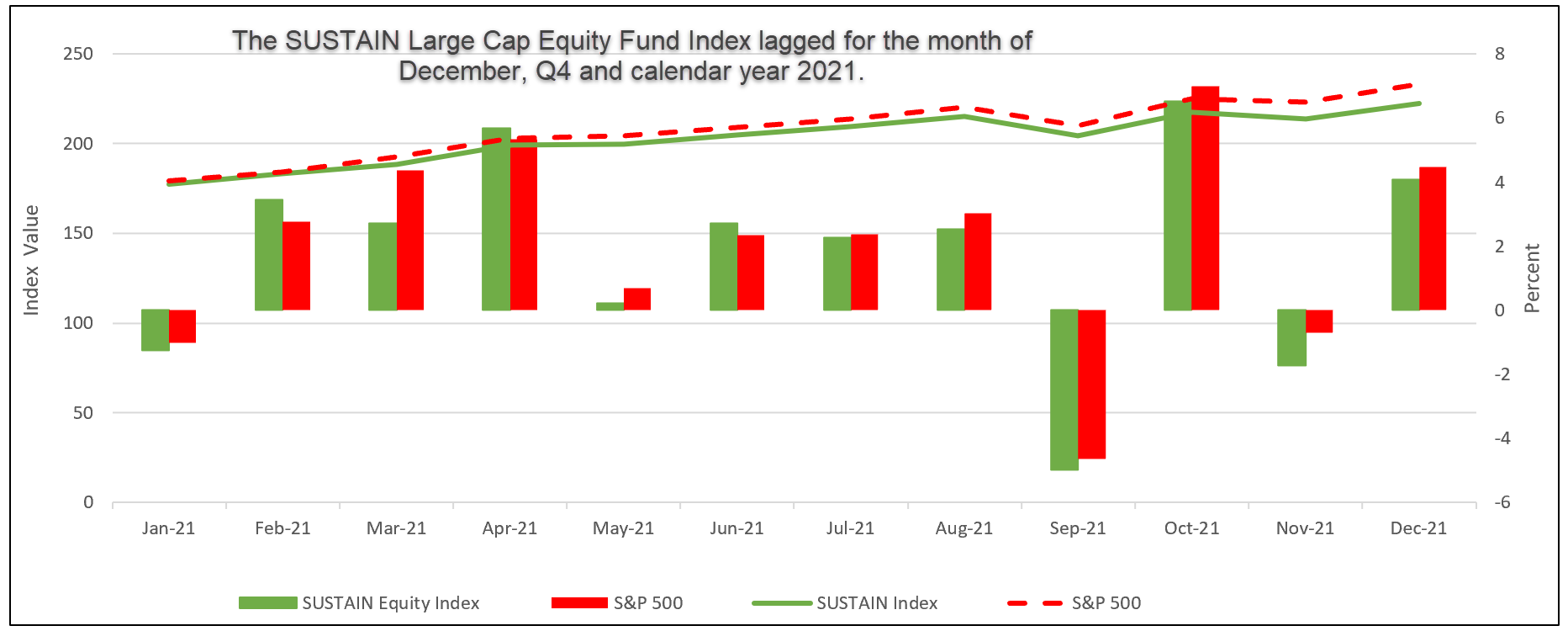

Sustainable (SUSTAIN) Large Cap Equity Fund Index registered a 4.1% increase

The Sustainable (SUSTAIN) Large Cap Equity Fund Index added 4.1% in December but lagged its conventional counterpart, the S&P 500, by 0.40%. Marking the fifth consecutive underperformance month, the index also fell behind in the fourth quarter and calendar year intervals. Refer to Chart 5.

Four of the ten constituent funds produced results that exceeded the S&P 500’s 4.48% total return in December, and one fund in particular, the GMO Quality III Fund (GQETX) blew out the lights with a gain of 10.42%.

Chart 5: SUSTAIN Large Cap Equity Fund Index performance results: 1/1/2021 – 12/31/2021 Notes of Explanation: Fund performance data source: Morningstar Direct. Analysis and SUSTAIN Index by Sustainable Research and Analysis.

Notes of Explanation: Fund performance data source: Morningstar Direct. Analysis and SUSTAIN Index by Sustainable Research and Analysis.

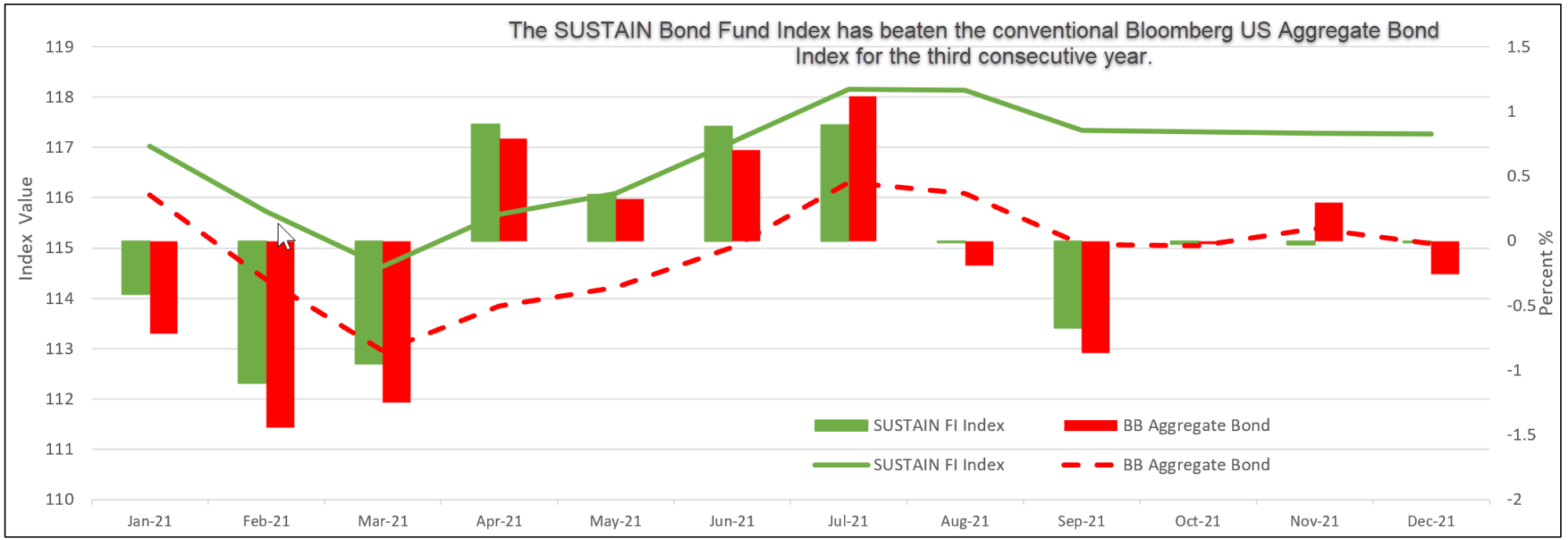

Sustainable (SUSTAIN) Bond Fund Index posts a narrow -0.013 decline

The Sustainable (SUSTAIN) Bond Fund outperformed the Bloomberg US Aggregate Bond Index in December by a narrow margin of 0.24%. While the index lagged in the last quarter of the year, it closed the year down -0.20% versus a -1.54% decline for the conventional index. This is the third consecutive year of outperformance recorded by the SUSTAIN Bond Fund Index. Refer to Chart 6.

The SUSTAIN Bond Fund Index was lifted by the performance results of seven of the ten index constituents that outperformed the conventional Bloomberg US Aggregate Bond Index. The best performer in December was the Neuberger Berman Strategic Income Fund I (NSTLX), up 0.94%.

Chart 6: SUSTAIN Bond Fund Index performance results: 1/1/2021 – 12/31/2021 Notes of Explanation: Fund performance data source: Morningstar Direct. Analysis and SUSTAIN Index by Sustainable Research and Analysis.

Notes of Explanation: Fund performance data source: Morningstar Direct. Analysis and SUSTAIN Index by Sustainable Research and Analysis.

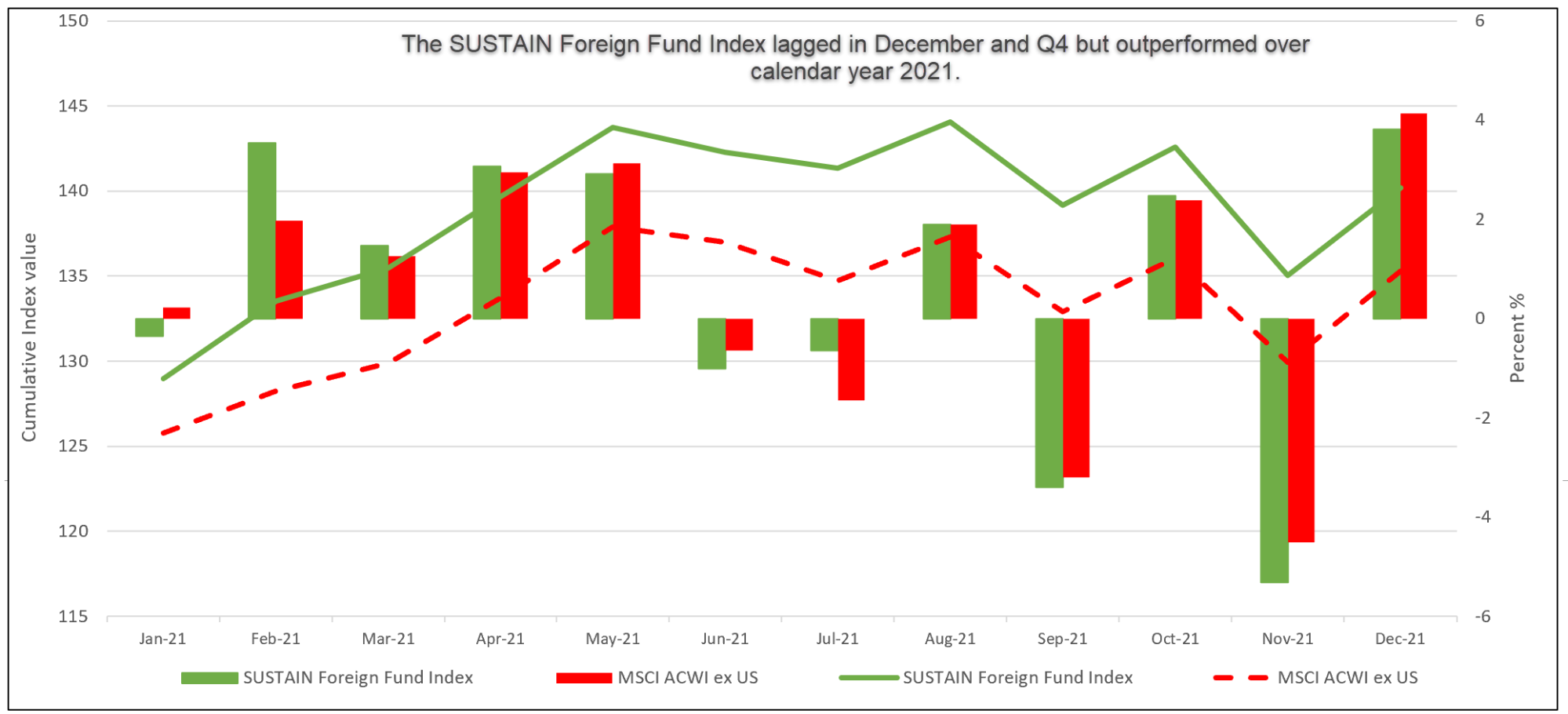

Sustainable (SUSTAIN) Foreign Fund Index gains 3.81%

The Sustainable (SUSTAIN) Foreign Fund Index fell behind the MSCI ACWI, ex USA, Index in December and the fourth quarter, but managed to outperform by 47 bps for the full year.

Five of the ten constituent funds beat the MSCI ACWI, ex USA, Index, with the JPMorgan International Research Enhanced Equity Fund R6 (JEIQX) leading the pack with a 5.41% gain. Refer to Chart 7.

Chart 7: SUSTAIN Foreign Fund Index performance results: 1/1/2021– 12/31/2021 Notes of Explanation: Fund performance data source: Morningstar Direct. Analysis and SUSTAIN Index by Sustainable Research and Analysis.

Notes of Explanation: Fund performance data source: Morningstar Direct. Analysis and SUSTAIN Index by Sustainable Research and Analysis.

Sustainableinvest.com

Benefits

Free access to regularly updated original research and analysis focused exclusively on sustainable finance and investing, providing investors with the guidance needed to make informed investment decisions that align with their personal values and financial goals while also contributing to the advancement of positive long-term environmental and social outcomes.

By offering financial support for our current work, either in the form of a one-time or regular contributions, you help to defray some of the costs associated with conducting our research and analysis as well as to maintain the www.sustainablest.wpengine.com website.

Helping us to expand our research capabilities and offerings over time to cover additional relevant topics geared to sustainable investors.

Sign up to free newsletters.

By submitting this form, you are consenting to receive marketing emails from: . You can revoke your consent to receive emails at any time by using the SafeUnsubscribe® link, found at the bottom of every email. Emails are serviced by Constant Contact