The Bottom Line: S&P 500 was up 4.38% in March while three of four sustainable securities-oriented indices posted excess returns and two fund indices outperformed.

S&P 500 expanded previous month’s gain to record a 4.38% increase in March while three of four sustainable securities-oriented indices post excess returns

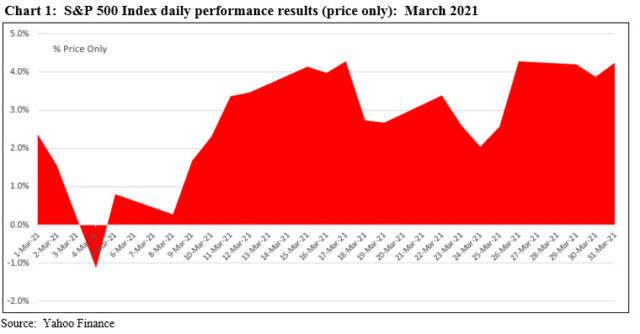

After giving up the 2.4% gain recorded on the first day of the month, the S&P 500 took eight days to recover and then advanced, with a short partial interruption, to register new index level highs. The broad-based index ended March just 27.11 points shy of reaching the 4,000 index level for the first time (which it did on April 1st). Refer to Chart 1. Concerns about the coronavirus pandemic receded due to tangible progress with the ongoing vaccine rollout while, at the same time, encouraging signs of an economic recovery and a positive earnings outlook gained traction. The S&P 500 added 4.38% on a total return basis, expanding on the 2.76% increase registered in February which offset the -1.01% decline in January, to end the quarter up 6.17%. The Dow Jones Industrial Average picked up 6.8% while the NASDAQ Composite managed to eke out a 0.5% gain and 3% over the first quarter. Value stocks outpaced growth stocks across the range of market caps by wide margins while small cap stocks lagged their large cap counterparts in March. Small caps still recorded strong gains in the first quarter, with the S&P 600 Small Cap Index achieving a total return of 18.2%. The Utilities sector scored a double digit gain of 10.5% while the Energy sector, up 2.8% in March and just ahead of the Information Technology sector that was up 1.7%, generated a gain of 30.9% during the first quarter.

Global and international markets lagged behind the US. The MSCI ACWI ex USA Index recorded a 1.3% gain in March and 3.6% increase for the first quarter. A higher 2.3% return was produced by the MSCI EAFE Index that benefited from the generally positive performance achieved by developed markets, including a 4.1% gain by Germany. Emerging markets posted a negative return, with the MSCI Emerging Markets Index dropping -1.5% while China gave up -6.3%.

Whereas short-term interest rates declined by one basis point in March, 10-year Treasury yields moved from 1.44% at the end of February to 1.74% at the end of March. The 30 bps increase was reflected in the performance of the Bloomberg Barclays US Aggregate Bond Index that gave up -1.3% and -3.4% in the first quarter as the same index recorded negative results in each of the first three months of the year.

Three of four non-overlapping equity-oriented ESG securities market indices outperformed in March; track record up to 1-year is mixed

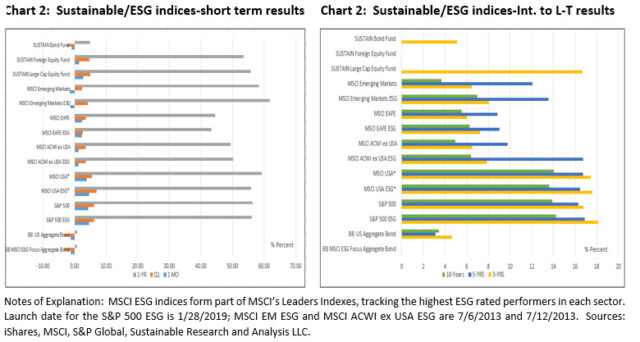

Three of four non-overlapping equity-oriented ESG securities market indices extending from large and mid-cap US only companies to some foreign markets, representing both developed as well as emerging market segments, eclipsed the performance of their underlying non-ESG benchmarks in March. The same number, but not the same three of four non-overlapping equity-oriented indices, outperformed for the entire first quarter while only two non-overlapping indices outperformed for the trailing twelve-month period. Refer to Chart 2 (left).

The exception in March was the MSCI ACWI ex USA ESG Leaders Index that trailed the MSCI ACWI ex USA by 2 basis points whereas the exceptions for the first quarter involved the S&P The 500 ESG Index that fell behind its underlying S&P 500 Index by 3 bps while the MSCI EAFE ESG Leaders Index trailed the underlying index by 92 bps.

As for fixed income, the Bloomberg Barclays MSCI US Aggregate ESG Focus Index, which posted a negative -1.25% in March, matched the performance of the underlying Bloomberg Barclays US Aggregate Bond Index. In the first quarter and trailing 1-year intervals, the ESG benchmark managed to draw out a narrow 2 bps and 4 bps differential.

While the relative performance record of equity-oriented ESG indices up to one-year is mixed, the intermediate to longer-term performance of the four MSCI ESG Leaders indices, covering the trailing 3, 5, and 10-year intervals, favors ESG indices. The widest positive variance was recorded by the MSCI ACWI ex USA ESG Leaders Index that over the trailing five years posted a return of 16.75%, for a positive differential of 6.99%. Refer to Chart 2 (right)

Foreign and bond actively managed sustainable mutual fund indices outperformed in March

Actively managed foreign equity and US bond funds eclipsed the performance of their non-ESG securities market benchmarks while US large cap equity funds trailed by a wide margin.

The Sustainable (SUSTAIN) Large Cap Equity Fund Index lagged by a wide 1.67% margin

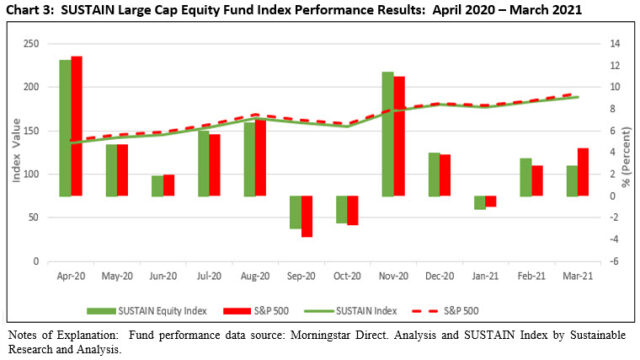

The Sustainable (SUSTAIN) Large Cap Equity Fund Index posted a gain of 2.71% but trailed behind the S&P 500 by 1.67%–the widest margin since the inception of the index as of December 2016. The SUSTAIN Index now also lags behind for the latest quarter, one-year and three-year intervals. Refer to Chart 3.

The funds-oriented index was hampered in the month of March as only three constituent funds outperformed the S&P 500. These funds included the GMO Quality III, ClearBridge Appreciation A and Parnassus Core Equity Investor Shares which gained 5.16%, 5.11% and 4.74%, respectively. But more importantly, the worst performing fund, the Eventide Gilead Fund I, was slammed in March. The fund registered a decline of -4.63%, shaving some 82 bps from the performance of the index. The fund’s heavy 36.5% weighting in technology companies, which lagged in March, detracted from the fund’s performance. Also creating a drag were top tech holdings such as Trade Desk Inc., CrowdStrike Holdings, and Five9 Inc. that together accounted for 14.1% of fund assets and dropped between 11% and 19% in March.

The Sustainable (SUSTAIN) Foreign Funds Index outperformed by 20 bps

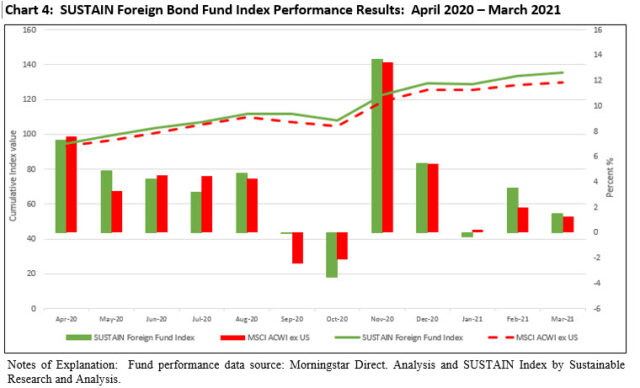

For the second consecutive month, the Sustainable (SUSTAIN) Foreign Funds Index outperformed the MSCI ACWI ex USA Index (Net), by 20 bps in March. Powered higher by the outperformance of five of the ten constituent funds that posted returns ranging from 2.4% to 3.89%, the SUSTAIN Index also excelled across the first quarter and trailing twelve months by 1.19% and 4.05%, in that order. Refer to Chart 4.

Leading the pack in March was the Templeton Foreign Fund A that recorded a gain of 3.89% while the Morgan Stanley Institutional International Advantage Fund I brought up the rear by posting a decline of -1.23%.

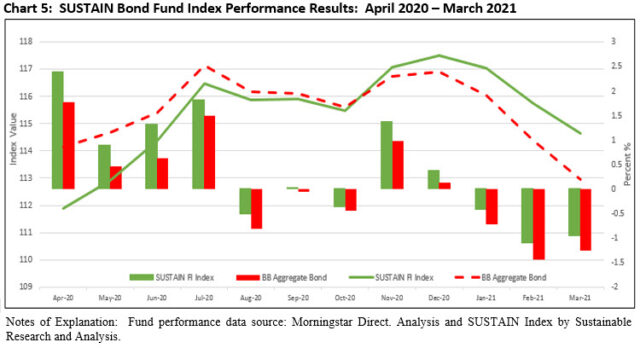

The Sustainable (SUSTAIN) Bond Funds Index outperformed for the 12th consecutive month

The Sustainable (SUSTAIN) Bond Funds Index dropped -0.95% in March but managed to outperform the Bloomberg Barclays US Aggregate Bond Index for the 12th consecutive month. The SUSTAIN Index benefited from the outperformance of nine of the ten constituent funds that beat the non-ESG oriented benchmark by as few as six bps but as many as 128 bps. The SUSTAIN Index continued its record of outperformance for the latest quarter, 12-months and trailing 3-year intervals, with excess results of 0.93%, 4.19% and 1.5%, respectively. Refer to Chart 5.

The leading fund was also the only fund in March to post a positive return. The Neuberger Berman Strategic Income Fund I registered a gain of 0.03% while the worst performance was recorded by the Goldman Sachs Core Fixed Income Fund P, down -1.23%.

S&P 500 gained 4.38% in March while some sustainable indices posted excess returns

The Bottom Line: S&P 500 was up 4.38% in March while three of four sustainable securities-oriented indices posted excess returns and two fund indices outperformed.

Share This Article:

The Bottom Line: S&P 500 was up 4.38% in March while three of four sustainable securities-oriented indices posted excess returns and two fund indices outperformed.

S&P 500 expanded previous month’s gain to record a 4.38% increase in March while three of four sustainable securities-oriented indices post excess returns

After giving up the 2.4% gain recorded on the first day of the month, the S&P 500 took eight days to recover and then advanced, with a short partial interruption, to register new index level highs. The broad-based index ended March just 27.11 points shy of reaching the 4,000 index level for the first time (which it did on April 1st). Refer to Chart 1. Concerns about the coronavirus pandemic receded due to tangible progress with the ongoing vaccine rollout while, at the same time, encouraging signs of an economic recovery and a positive earnings outlook gained traction. The S&P 500 added 4.38% on a total return basis, expanding on the 2.76% increase registered in February which offset the -1.01% decline in January, to end the quarter up 6.17%. The Dow Jones Industrial Average picked up 6.8% while the NASDAQ Composite managed to eke out a 0.5% gain and 3% over the first quarter. Value stocks outpaced growth stocks across the range of market caps by wide margins while small cap stocks lagged their large cap counterparts in March. Small caps still recorded strong gains in the first quarter, with the S&P 600 Small Cap Index achieving a total return of 18.2%. The Utilities sector scored a double digit gain of 10.5% while the Energy sector, up 2.8% in March and just ahead of the Information Technology sector that was up 1.7%, generated a gain of 30.9% during the first quarter.

Global and international markets lagged behind the US. The MSCI ACWI ex USA Index recorded a 1.3% gain in March and 3.6% increase for the first quarter. A higher 2.3% return was produced by the MSCI EAFE Index that benefited from the generally positive performance achieved by developed markets, including a 4.1% gain by Germany. Emerging markets posted a negative return, with the MSCI Emerging Markets Index dropping -1.5% while China gave up -6.3%.

Whereas short-term interest rates declined by one basis point in March, 10-year Treasury yields moved from 1.44% at the end of February to 1.74% at the end of March. The 30 bps increase was reflected in the performance of the Bloomberg Barclays US Aggregate Bond Index that gave up -1.3% and -3.4% in the first quarter as the same index recorded negative results in each of the first three months of the year.

Three of four non-overlapping equity-oriented ESG securities market indices outperformed in March; track record up to 1-year is mixed

Three of four non-overlapping equity-oriented ESG securities market indices extending from large and mid-cap US only companies to some foreign markets, representing both developed as well as emerging market segments, eclipsed the performance of their underlying non-ESG benchmarks in March. The same number, but not the same three of four non-overlapping equity-oriented indices, outperformed for the entire first quarter while only two non-overlapping indices outperformed for the trailing twelve-month period. Refer to Chart 2 (left).

The exception in March was the MSCI ACWI ex USA ESG Leaders Index that trailed the MSCI ACWI ex USA by 2 basis points whereas the exceptions for the first quarter involved the S&P The 500 ESG Index that fell behind its underlying S&P 500 Index by 3 bps while the MSCI EAFE ESG Leaders Index trailed the underlying index by 92 bps.

As for fixed income, the Bloomberg Barclays MSCI US Aggregate ESG Focus Index, which posted a negative -1.25% in March, matched the performance of the underlying Bloomberg Barclays US Aggregate Bond Index. In the first quarter and trailing 1-year intervals, the ESG benchmark managed to draw out a narrow 2 bps and 4 bps differential.

While the relative performance record of equity-oriented ESG indices up to one-year is mixed, the intermediate to longer-term performance of the four MSCI ESG Leaders indices, covering the trailing 3, 5, and 10-year intervals, favors ESG indices. The widest positive variance was recorded by the MSCI ACWI ex USA ESG Leaders Index that over the trailing five years posted a return of 16.75%, for a positive differential of 6.99%. Refer to Chart 2 (right)

Foreign and bond actively managed sustainable mutual fund indices outperformed in March

Actively managed foreign equity and US bond funds eclipsed the performance of their non-ESG securities market benchmarks while US large cap equity funds trailed by a wide margin.

The Sustainable (SUSTAIN) Large Cap Equity Fund Index lagged by a wide 1.67% margin

The Sustainable (SUSTAIN) Large Cap Equity Fund Index posted a gain of 2.71% but trailed behind the S&P 500 by 1.67%–the widest margin since the inception of the index as of December 2016. The SUSTAIN Index now also lags behind for the latest quarter, one-year and three-year intervals. Refer to Chart 3.

The funds-oriented index was hampered in the month of March as only three constituent funds outperformed the S&P 500. These funds included the GMO Quality III, ClearBridge Appreciation A and Parnassus Core Equity Investor Shares which gained 5.16%, 5.11% and 4.74%, respectively. But more importantly, the worst performing fund, the Eventide Gilead Fund I, was slammed in March. The fund registered a decline of -4.63%, shaving some 82 bps from the performance of the index. The fund’s heavy 36.5% weighting in technology companies, which lagged in March, detracted from the fund’s performance. Also creating a drag were top tech holdings such as Trade Desk Inc., CrowdStrike Holdings, and Five9 Inc. that together accounted for 14.1% of fund assets and dropped between 11% and 19% in March.

The Sustainable (SUSTAIN) Foreign Funds Index outperformed by 20 bps

For the second consecutive month, the Sustainable (SUSTAIN) Foreign Funds Index outperformed the MSCI ACWI ex USA Index (Net), by 20 bps in March. Powered higher by the outperformance of five of the ten constituent funds that posted returns ranging from 2.4% to 3.89%, the SUSTAIN Index also excelled across the first quarter and trailing twelve months by 1.19% and 4.05%, in that order. Refer to Chart 4.

Leading the pack in March was the Templeton Foreign Fund A that recorded a gain of 3.89% while the Morgan Stanley Institutional International Advantage Fund I brought up the rear by posting a decline of -1.23%.

The Sustainable (SUSTAIN) Bond Funds Index outperformed for the 12th consecutive month

The Sustainable (SUSTAIN) Bond Funds Index dropped -0.95% in March but managed to outperform the Bloomberg Barclays US Aggregate Bond Index for the 12th consecutive month. The SUSTAIN Index benefited from the outperformance of nine of the ten constituent funds that beat the non-ESG oriented benchmark by as few as six bps but as many as 128 bps. The SUSTAIN Index continued its record of outperformance for the latest quarter, 12-months and trailing 3-year intervals, with excess results of 0.93%, 4.19% and 1.5%, respectively. Refer to Chart 5.

The leading fund was also the only fund in March to post a positive return. The Neuberger Berman Strategic Income Fund I registered a gain of 0.03% while the worst performance was recorded by the Goldman Sachs Core Fixed Income Fund P, down -1.23%.

Sustainableinvest.com

Benefits

Free access to regularly updated original research and analysis focused exclusively on sustainable finance and investing, providing investors with the guidance needed to make informed investment decisions that align with their personal values and financial goals while also contributing to the advancement of positive long-term environmental and social outcomes.

By offering financial support for our current work, either in the form of a one-time or regular contributions, you help to defray some of the costs associated with conducting our research and analysis as well as to maintain the www.sustainablest.wpengine.com website.

Helping us to expand our research capabilities and offerings over time to cover additional relevant topics geared to sustainable investors.

Sign up to free newsletters.

By submitting this form, you are consenting to receive marketing emails from: . You can revoke your consent to receive emails at any time by using the SafeUnsubscribe® link, found at the bottom of every email. Emails are serviced by Constant Contact