The Bottom Line: Money market funds are benefiting from rising interest rates and offer investors a safe haven from declines in stock and bond prices.

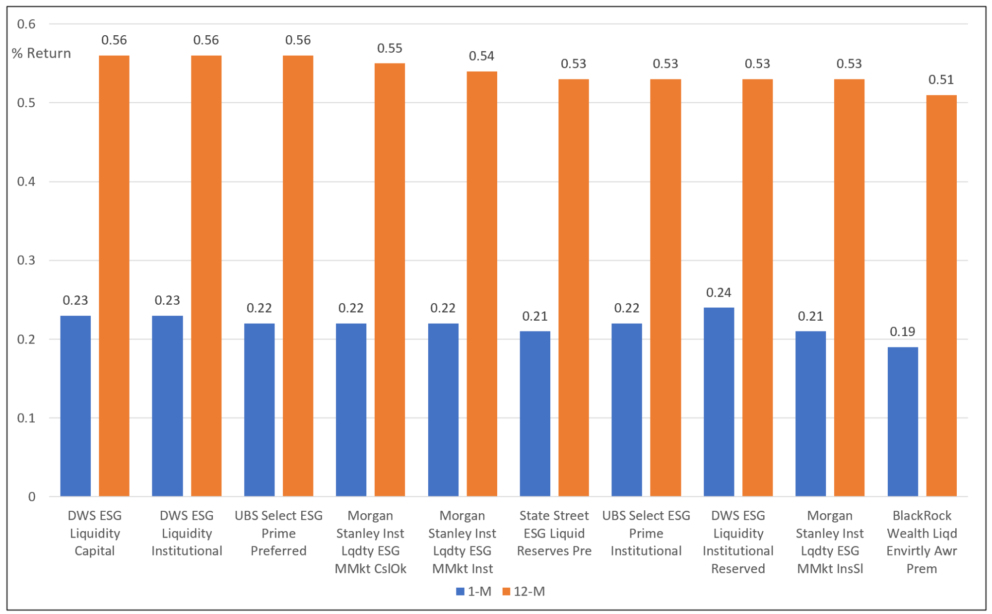

Total return performance of leading sustainable money market funds: 1- and 12-months Notes of Explanation: Total return performance arrayed based on trailing 12-month results through August 31, 2022, posted by the top 10 performing money market funds, including their share classes. Source: Morningstar Direct.

Notes of Explanation: Total return performance arrayed based on trailing 12-month results through August 31, 2022, posted by the top 10 performing money market funds, including their share classes. Source: Morningstar Direct.

Observations:

- Sustainable mutual funds and ETFs, a total of 1,345 funds at the end of August according to Morningstar, recorded an average return of -3.37% in August and -15.34% for the trailing twelve months. Of these, only 42 funds posted positive results over the trailing twelve months. Within this segment, 20 funds, or almost 50%, were sustainable prime money market funds that were also just about the only sustainable funds to post positive returns in August. These are very conservatively managed funds that invest in short-term government, corporate and other similar obligations but do not seek to maintain a constant net asset value.

- The average returns of sustainable money market funds began to tick up in mid-March of this year when the Federal Reserve announced its first-rate hike of this inflation fighting cycle with a 25-basis point interest rate increase. The central bank took its federal funds rate up to a range of 3%-3.25% on September 21, 2022, the highest it has been since early 2008, following the third consecutive 75 basis point rate hike.

- Since the first-rate hike, the average total return performance of sustainable money market funds has risen from -0.01 in March to 0.18% in August. Returns are expected to rise along with higher rates since Fed officials signaled the intention of continuing to hike rates until the federal funds level hits a “terminal rate,” or end point, of 4.6% in 2023. In the meantime, money market funds offer investors positive returns (unadjusted for inflation) and shelter from volatile market conditions that have impacted stocks as well as bonds due to surging inflation, central bank responses, the continuing war in the Ukraine and concerns that global economies are heading into a slowdown.

- For the trailing twelve-month interval, returns ranged from a low of 2 bps recorded by the BlackRock Wealth Liquidity Environmentally Aware Investment Fund C to a high of 56 bps achieved by the DWS ESG Liquidity Capital Fund. This $569.4 million fund managed by DWS Investment Management Americas, Inc., a unit of DWS, evaluates securities based on a variety of ESG considerations and seeks to identify and invest in ESG leaders within industry-and region-specific peer groups. The fund is largely geared to institutional investors but can be accessed via financial intermediaries.