The Bottom Line: The SEC issued a request for comment on ESG in fund names but efforts to standardize sustainable investing terminology should come first.

SEC’s Request for Comment on Fund Names should be preceded by an effort to define and standardize sustainable investing terminology

In early March the SEC issued a Request for Comment (RFC) on Fund Names that seeks feedback on the “framework for addressing names of registered investment companies and business development companies that are likely to mislead investors about a fund’s investments and risks.” ESG funds is one of several targeted areas addressed by the RFC. The SEC is especially concerned about the possibility that investors could be misled or deceived by fund names when in fact names can have a significant impact on their investment decision. At the same time, fund names may be used as a marketing tool. Along with its uneasiness related to funds that rely on derivatives and other financial instruments for leverage, funds that use hybrid financial instruments as well as index funds, the SEC is also focusing on funds that require some degree of qualitative assessment, such as ESG funds. These concerns may be especially problematic in dealing with sustainable mutual funds and ETFs more generally during these early days when such funds are experiencing material gains in both the number of funds offered and assets under management while at the same time the terminology around sustainable investing strategies and approaches are still evolving. At this stage, amending the narrowly crafted fund naming rule may prove somewhat challenging due to the absence of commonly accepted terminology and definitions covering the various strategies or approaches that today comprise sustainable investing. In fact, in the absence of a voluntary industry led initiative to adopt standards, the SEC should spearhead an effort to define and standardize sustainable investing terms and definitions. At the same time, it would also serve the interest of investors to mandate minimum reporting and disclosure standards that address how sustainable investing strategies, to the extent that funds elect to adopt these, are affecting decision making as well as financial and non-financial outcomes as may be applicable.

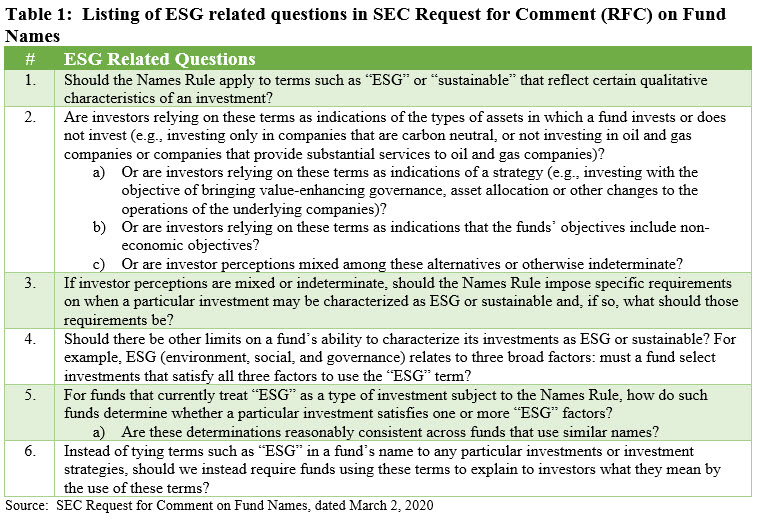

The application of the current fund naming rule is limited to type of investment, industry or geography

The current Name Rule links a fund’s name to a particular type of investment, industry or geographic focus and requires that 80% of the fund’s assets be invested in the type of investment, industry, country or geographic region suggested by its name. It also extends to fund distributions that qualify for Federal and state income tax exemptions. The rule, however, does not apply to fund names that describe a fund’s investment objective, strategy or policies. The SEC is seeking public comments by May 5, 2020 and, with regard to ESG funds, the SEC set out a series of six specific questions. Refer to Table 1.

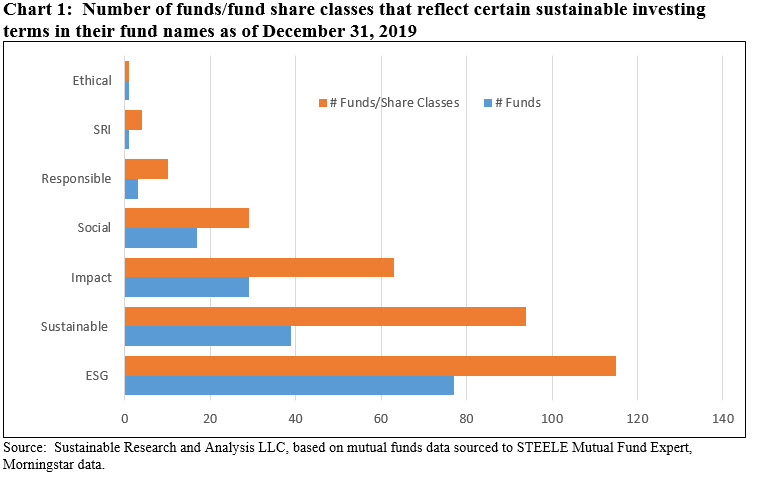

Sustainable investing terms in fund names: ESG references in fund names dominate

According to the SEC, 291 funds incorporate one of the following seven terms in their names: “ESG,” “Clean,” “Environmental,” “Impact,” “Responsible,” “Social” or “Sustainable.” This is based on EDGAR data that at the end of 2007 stood at 65 funds.

Research conducted by Sustainable Research and Analysis indicates that the number stands at 164 mutual funds and ETFs and 323 funds/share classes as of year-end 2019. A slightly modified array of key search terms, including “ESG,” “Social,” “Impact,” “Sustainable,” “SRI,” “Responsible” and “Ethical” turns up 167 funds and 316 funds/share classes. By far, the largest number of fund names, a total of 77 corresponding to 115 funds/share classes, reference ESG. See Chart 1. That said, a large universe of funds have in the last two years been re-branded to reflect the adoption of ESG strategies without reflecting this approach in their names.

Sustainable investing funds have grown dramatically: 3,460 funds/share classes and $1.6 trillion at year-end 2019

In the last two years in particular, the number of sustainable investment funds, both mutual funds and ETFs expanded dramatically from 772 funds/share classes at the end of 2017 to 3,460 funds/share classes at the end of 2019, for a total of 977 funds. Assets under management also ticked up dramatically, growing from $350.4 billion to $1.6 trillion, for an increase of $1.3 trillion or 539%. Much of this growth is attributable to the re-branding of existing funds that have formally adopted one or more sustainable investing approaches or strategies. These include five strategies that are commonly captured under the umbrella term of sustainable investing and include values-based investing, negative screening or exclusions, ESG integration, impact investing as well as thematic investing. The implementation of one or more of these approaches may also involve some form of investee engagement and proactive proxy voting practices.

The majority of rebranded funds have modified their prospectus language to reflect the adoption of ESG integration strategies in particular but their fund names were not modified. For example, in September 2019 J.P. Moran Asset Management re-branded 36 funds representing 163 share classes with $359.8 billion in assets by adopting ESG integration language in the applicable fund prospectuses. None of these funds refer to ESG in the fund names. These funds are not alone, as there are also funds that employ one of more sustainable investing strategies without explicit reference to such strategies in their fund names. Many funds offered by Calvert Investment Management fall into this category. On the other hand, funds that include ESG or some other commonly used term in their name fail to capture the full scope of the strategies employed by the fund. For example, Natixis offers a series of target date funds called the Future Sustainable Funds. In this instance, the sustainable investing approach refers to ESG integration, thematic investing as well as the exclusion of specific types of investments. On the other hand, the Goldman Sachs International Equity ESG Fund integrates ESG in the form of a supplemental analysis alongside its traditional fundamental, bottom up financial analysis while also excluding certain companies, such as gambling and tobacco, coal and weapons and engages in an active dialogue with investee companies to foster best corporate governance practices. The fund’s name only references its core strategy.

Effort needed to define and standardize sustainable investing terminology

As it stands today, the absence of generally accepted definitions and standards is sowing confusion in the minds of investors, regulators and managers. A revised Name Rule seeking to tag funds that are formally pursuing a sustainable investing strategy and wish to position themselves as such would be a useful first step if it were also accompanied by a voluntary industry-wide effort to adopt standardized sustainable investing terminology and a commitment to provide supplemental disclosures that addresses how sustainable investing strategies are affecting decision making as well as financial and non-financial outcomes. In the absence of a voluntary industry led initiative to adopt such standards, the SEC should spearhead such efforts.