Securities and Exchange Commission (SEC) issued interpretive guidance on an investment adviser’s fiduciary duties regarding proxy voting

On August 21, by a vote of 3 to 2, the Securities and Exchange Commission (SEC) issued interpretive guidance on an investment adviser’s fiduciary duties with respect to voting of proxies for client accounts. Coincidently, the SEC guidance was issued two days after the Business Roundtable published a revised Statement on the Purpose of a Corporation that emphasizes a balanced commitment to all stakeholders, including customers, employees, suppliers, communities as well as shareholders. The SEC release, which does not change the law or create a new regulatory regime but rather reiterates longstanding SEC rules and positions, discusses, among other matters, the ability of investment advisers to establish a variety of different voting arrangements with their clients and matters they should consider when they use the services of a proxy advisory firm. In addition, the SEC issued an interpretation that proxy voting advice provided by proxy advisory firms generally constitutes a “solicitation” under the federal proxy rules and it provided related guidance about the application of the proxy antifraud rule to proxy voting advice. The SEC explained that the guidance applies to advisers particularly where they use the services of a proxy advisory firm. Some commentators are positing that the new guidance was designed to reign in the power of proxy voting firms such as Institutional Shareholder Services (ISS) and Glass Lewis, which according to some estimates, share about 97% of the market, and at the same time impede shareholder proposals that favor environmental (E), social (S) and related governance (G) issues in particular. As these have been gaining in number and favorable voting outcomes in recent years, there has been push back against proxy firms and investment advisers. Greater scrutiny of decisions made by proxy firms is expected to require that these organizations step up their processes and procedures and provide improved transparency as to their policies and methodologies. Also, proxy voting practices at investment management firms will likely result in additional due diligence on their part. In either case, the SEC guidance could lead to an increase in costs related to proxy voting practices. Future SEC proxy related initiatives aside, the proxy guidance, in our view, is not likely to diminish the trends in favor of shareholder proposals and voting outcomes related to environmental and social issues.

The SEC guidance was published in the Federal Register in a question and answer format that provides examples to help facilitate compliance, and discusses, among other things:

• How an adviser and client, in establishing their relationship, may agree upon the scope of the adviser’s authority and responsibilities to vote proxies on behalf of that client;

• Steps an adviser, who has assumed voting authority on behalf of clients, could take to demonstrate it is making voting determinations in a client’s best interest and in accordance with the adviser’s proxy voting policies and procedures; and

• Considerations that an adviser should take into account if it retains a proxy advisory firm to assist it in discharging its proxy voting duties.

The SEC, which expects to also in the near future to consider the submission and resubmission thresholds for shareholder proposals and proposed rule amendments to address proxy advisory firms’ reliance on the proxy solicitation exemptions in Exchange Act Rule 14a-2(b), stated that advisers should review their policies and procedures in light of the guidance in advance of next year’s proxy season and direct any questions to the Division of Investment Management staff for consideration.

Sustainable investing gains traction

As sustainable investing continues to gain traction, especially among institutional investors, shareholder engagement and proxy voting practices are establishing themselves as important anchors in the tool kit of the sustainable investing arsenal for both investment managers and various asset owners such as public pension funds, endowments, foundations, insurance companies and sovereign wealth funds. In time, this may also trickle down to individual investors. This development could lead to further clarification of voting arrangements with clients in a way designed to stimulate scrutiny and voting on the important E, S and G topics. Additional scrutiny in the light of the new guidance could potentially lead to the refinement and improved crafting of E, S and G proposals to make these even more compelling and lead to a great number of favorable votes. Some support from corporations is also expanding. As noted below, more companies are stepping up their stakeholder initiatives and showcasing their sustainability approaches through sustainability reports and proxies.

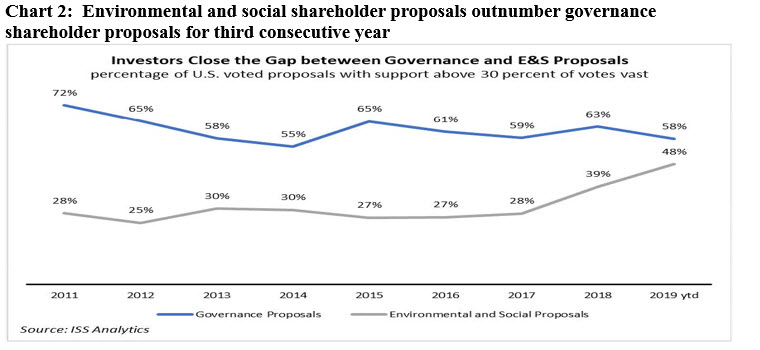

According to EY “proxy disclosures around how companies are creating broader long-term value for their employees, communities and society are rapidly growing. Since 2016, the number of Fortune 100 companies using the proxy to highlight their commitment to corporate sustainability and citizenship has more than doubled. Most leading companies now use the proxy to highlight the company’s approach to environmental sustainability, people and culture, community investment and social impact.” Refer to Chart 1. This is likely to accelerate further given the adoption of the Business Roundtable Statement of the Purpose of the Corporation as well as various other stakeholder initiatives.

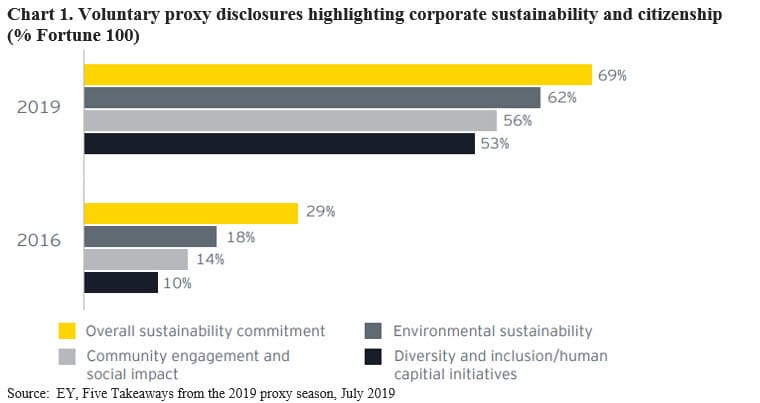

Environmental and social issues in particular are also gaining traction. Based on data compiled by ISS Analytics through early June when about 70% of the Russell 3000 annual general meetings expected during the calendar year have taken place, for the third consecutive year the number of shareholder proposals filed in the US related to E and S issues surpassed the number of shareholder proposals related to governance issues; and through early June about 48% received support above 30% of votes cast.

Further, companies are also more prone to engage with proponents and satisfy their requests in relation to environmental and social disclosure targets compared to a few years ago. This is reflected in the continuation of trends observed in 2018 via the percentage of E&S proposals that have been withdrawn through early June 2019. These have reached record levels with almost half the proposals withdrawn by their sponsors. Refer to Chart 2.