The Bottom Line: Contemplated for close to 50 years, SEC Investor Advisory Committee recommends updating reporting requirements of issuers to include material, decision-useful ESG factors.

Recommendation to update reporting requirements to include material, decision-useful ESG factors supported by five reasons is greeted with some degree of skepticism

At the May 21, 2020 Investor Advisory Committee meeting of the SEC, the Investor-as-Owner Subcommittee submitted a recommendation to the SEC to consider “in earnest an effort to update the reporting requirements of SEC registered Issuers to include material, decision-useful ESG factors.” The subcommittee’s recommendation observed that while the SEC has been contemplating for close to 50 years whether ESG disclosures are material and should be incorporated into its integrated disclosure regime, the time has come for the SEC to address this issue. The Subcommittee recommends that this process should begin with a series of outreach efforts to investors, company filers subject to SEC rules and other market participants that could include roundtables, RFI and other actions on this topic and that the feedback from these actions/consultations would help the SEC staff to review and evaluate multiple options or approaches to updating the reporting requirements regarding material ESG issues. The submission was approved by the full 23-member Investor Advisory Committee at the same meeting, with some members voting against the recommendation and offering dissenting opinions. The submission, following a three-year review, was also greeted with some degree of skepticism by SEC Commissioner Hester M. Peirce. In prepared remarks, she acknowledged concerns about multiple ESG data providers bombarding issuers multiple information requests to produce assessments of questionable value. But she goes on to say that a new SEC disclosure framework for ESG information seems an “unnecessary response when our existing securities disclosure framework is very good at handling all types of material information. According to the SEC, which uses the U.S. Supreme Court definition, information is material if there is a substantial likelihood that a reasonable investor would consider the information in making an investment decision or if the information would significantly alter the total mix of available information. It remains to be seen what action, if any, is taken on the ESG recommendations by a philosophically divided 4-member SEC.

The Subcommittee delineated five reasons for its recommendation to include material, decision-useful ESG factors in issuer reporting

Contributing to the view that this is the right time to address the ESG reporting issue are factors such as the mainstreaming of sustainable, responsible and impact investment strategies and assets under management, the plethora of ESG data providers issuing ratings with very low correlations and extreme variations across different ESG ratings and the inundation of information requests directed at issuers that puts smaller issuers at a disadvantage. The five reasons delineated by the subcommittee for considering the reporting requirements of companies subject to SEC rules to include material, decision-useful ESG factors are, as follows:

-

- Investors require reliable, material ESG information upon which to base their investment and voting decisions. Trillions of dollars are invested in companies exposed to material ESG risks and opportunities. Systematic and consistent ESG disclosures are needed.

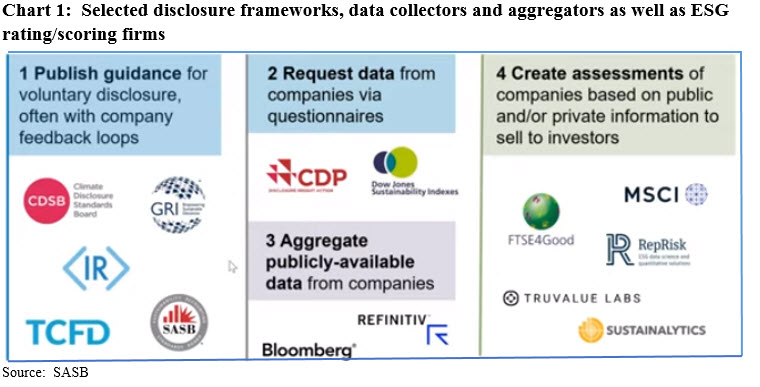

- Issuers should directly provide material information to the market relating to ESG issues used by investors to market investment and voting decisions. Both investors and third-party data providers should be able to rely on accurate, comparable and material information sourced directly to issuers upon which to base their analysis, and that there are consistent standards and oversight governing the disclosure of this data. Currently there is a patchwork of information in the mix and third-party data sources that are filling the void. Refer to Chart 1 for a limited display of some key participants in this information patchwork.

- Requiring material ESG disclosure will level the playing field between larger issuers with greater resources versus smaller issuers that are more resource constrained. To the extent that basic SEC reporting obligations would require a single standard of material, decision-useful information, as relevant to each Issuer, and based upon data that companies already use to make their business decisions, such an approach would level the playing field between large and small, well financed, and capital constrained issuers.

- Ensure the flow of capital to US markets and to US issuers of all sizes. Disclosure of ESG information directly by issuers will facilitate the flow of capital to US Issuers of all sizes from investors with or without ESG-related investment mandates. This will avoid redirecting capital to companies outside the US.

- The US should take the lead on disclosure of material ESG disclosure. In the event the SEC doesn’t take the lead, standards adopted by other jurisdictions will likely in time be imposed on US issuers.

It’s not a done deal: It remains to be seen what action, if any, is taken by the SEC in response to the recommendations

It remains to be seen what action, if any, is taken by the SEC in response to the recommendations now advanced by the full Investor Advisory Committee. Since the departure of Commissioner Robert Jackson Jr., a democrat, the current make-up of the four-member commission has a conservative tilt to it. While the four current commission members have been appointed by President Trump, two are political republican members, including Hester M. Peirce and Elad L. Roisman, one is a democrat, Allison Herren Lee, and the Chairman, Jay Clayton, is a political independent. In prepared remarks delivered at a November 7, 2019 committee meeting that he could not attend, SEC Chairman Clayton identified areas of interest that will likely continue to be explored by the Commission, namely how “E,” “S” and “G” data is used, “whether the use of the date reflect a change in investment approach, or is it an enhancement to your traditional approach? Is the use of such data designed to improve investment performance over a particular term, to screen certain activities, companies or industries to address a particular objective or policy, or a combination of these goals? And how do the underlying clients view and understand the asset manager’s use of such data?” At the same time, Commissioner Lee has advocated for better climate risk disclosures.