The Bottom Line: UK-based investment management firm Schroders global institutional investor study finding regarding sustainable investing offers observations that are equally valid for retail investors.

Schroders releases results of its fifth annual global institutional investor study

Last week Schroders, the UK based investment manager, released the results of its fifth institutional investor study that analyzes the investment perspectives of 750 global institutional investors on such topics as the investment landscape, private assets and sustainable investing. Conducted in February and March of 2021, these global institutional investors are collectively responsible for $26.8 trillion in assets, or roughly about 26% of global institutional assets¹. These include corporate and public pension plans, insurance companies, official institutions, private banks, endowments and foundations located throughout the world. The findings are instructive and reveal a common thread with observations that are equally relevant for retail investors, namely a desire for clarity and transparency regarding fund objectives as well as results, concerns about greenwashing and performance or outcomes as well as an appetite for environmental and other thematic funds. (Refer to selected findings below sourced to Schroders Institutional Investors Study 2021). Addressing these challenges by fund management firms offering mutual funds and ETFs will also overcome similar challenges and concerns troubling retail investors in a way that hinders their investments in sustainable fund options. In fact, the unprecedented growth in the number of sustainable funds and assets under management, largely due the re-branding of existing funds, has contributed to confusion and an increasingly common misunderstanding on the part of stakeholders regarding the meaning of sustainable investing in the absence of a universally accepted definition of same. To ensure continued growth and development in the sustainable investing sector and to avoid future disappointments on the part of investors and potentially litigation, the asset management industry is encouraged to consider and adopt standardized definitions, create an accepted mutual fund/ETF product classification framework and step up reporting and disclosure practices². Otherwise, regulatory bodies, such as the SEC, are likely to step in to address these areas of concern.

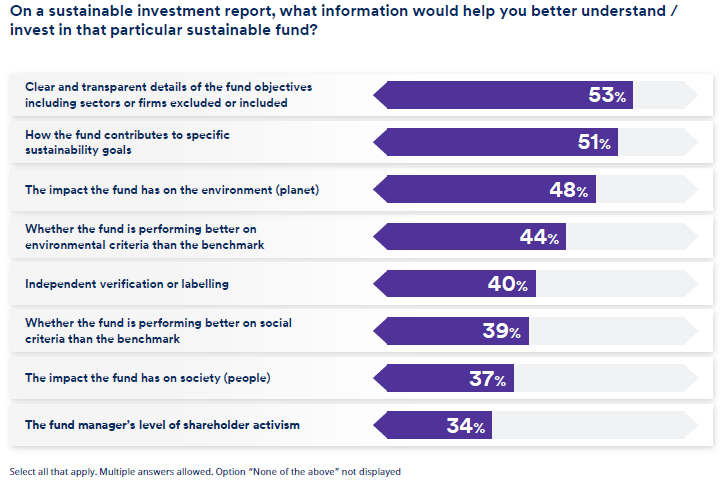

Issue #1: Clarity and transparency

53% of respondents seek clear and transparent details of the fund objectives including sectors or firms excluded or included. Information regarding outcomes is also desirable.

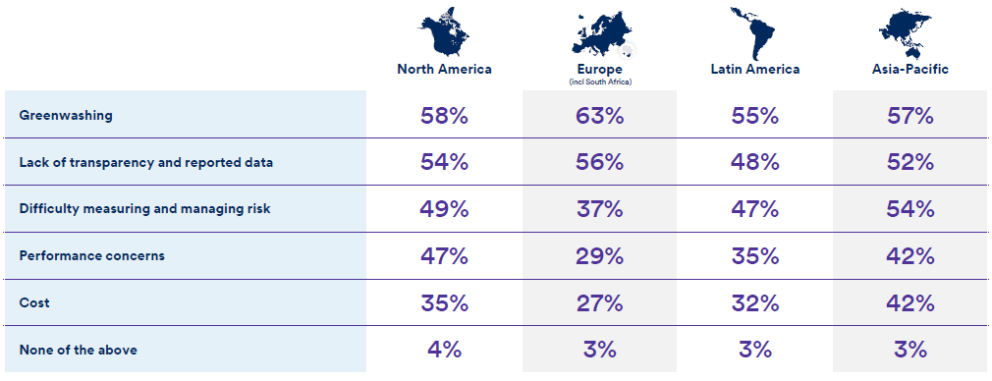

Issue #2: Challenges of investing in sustainable investments

Concerns regarding greenwashing range from 63% in Europe to 55% by Latin American respondents. While greenwashing is not defined, in the context of sustainable investing it is generally defined to mean intentionally conveying false or misleading information regarding the sustainable investing practices of a fund and its outcomes. This is an issue that has been exacerbated by the rapid growth and development of sustainable funds previously cited.

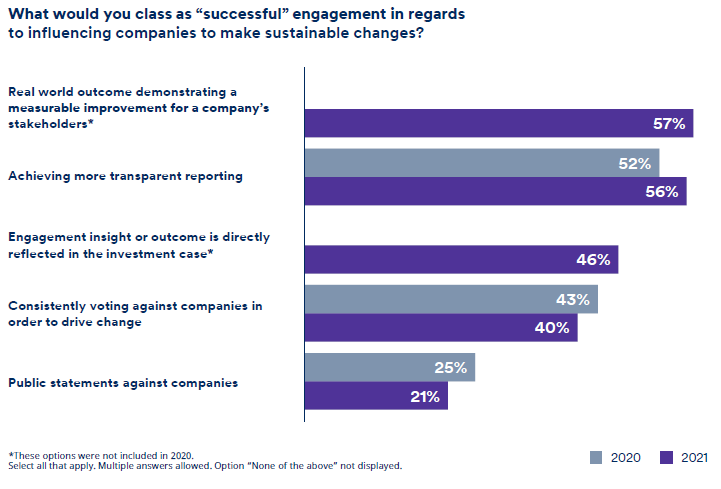

Issue #3: Investors desire to achieve positive outcomes

In the case of impact through engagements with issuers, 57% of respondents would consider real world outcomes demonstrating a measurable improvement for a company’s shareholders.

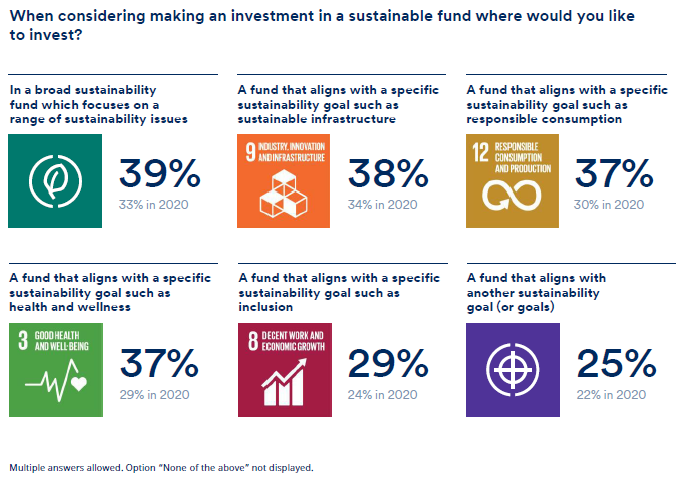

Issue #4 Appetite for environmental and other thematic funds

47% of respondents highlight a preference for a sustainability fund that aligns with environmental issues (not shown) and between 37% to 39% say they would like to invest in funds focused on a range of sustainability issues, sustainable infrastructure, responsible consumption and health and wellness.