Chart of the Week – January 8, 2024

The Bottom Line: Notwithstanding a challenging year, sustainable fixed income mutual funds and ETFs ended the year with $46.7 billion, benefiting from positive cash inflows. Sustainable mutual funds and ETFs Y-O-Y changes in net assets and number of funds Notes of Explanation: Sources: Morningstar Direct, Sustainable Research and Analysis LLC. Observations: Bolstered by the […]

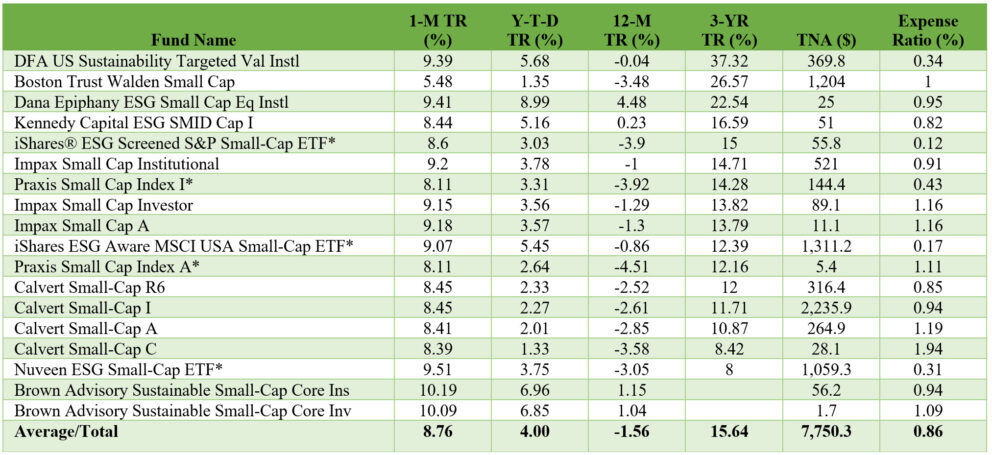

Investing ideas-Small cap funds

The Bottom Line: After rallying recently, sustainable small-cap mutual funds and ETFs may still have upside potential, but the number of investment options is limited. Selected sustainable small cap funds: Performance results to November 30, 2023, net assets and expense ratios Notes of Explanation: Funds listed in descending order based on 3-year trailing […]

Chart of the Week – December 18, 2023

The Bottom Line: Across 76 investment categories as defined by Morningstar, sustainable Technology funds delivered the top total return in November 2023—an average of 13.7%. Top and bottom three investment fund categories by November 2023 average total return results Notes of Explanation: Top and bottom three investment fund categories arrayed based on November […]

Chart of the Week – December 11, 2023

The Bottom Line: Lower turnover ratios are recorded by sustainable US equity funds relative to their conventional counterparts and should be factored into investment decisions. Turnover ratios for US equity mutual funds and ETFs as of November 30, 2013 Notes of Explanation: Turnover ratios calculated for active and passively managed mutual funds and […]

Chart of the Week – December 4, 2023

The Bottom Line: Top yielding funds posted 12-month trailing yields ranging between 7.5% and 13.3%, but corresponding total rates of return can be much lower. Highest yielding sustainable mutual funds and ETFs: Trailing 12-M yields and total returns to October 31, 2023 Notes of Explanation: Trailing 12-month yields (listed in descending order (but exclude KraneShares […]

Chart of the Week – November 27, 2023

The Bottom Line: Average size of newly launched sustainable ETFs has been significantly larger than mutual funds in 2023, offering investors the benefit of scale. Net assets of top 10 newly listed (2023) sustainable mutual funds and ETFs: October 31, 2023 Notes of Explanation: Net assets as of October 31, 2023. Mutual fund assets combine […]

Chart of the Week – November 20, 2023

The Bottom Line: Lineup and assets of the top 10 managers of sustainable funds have experienced some but limited changes since the start of year. Net assets attributable to the top 10 sustainable mutual fund and ETF managers: December 31, 2022, and October 31, 2023 Notes of Explanation: Net assets as of December 31, […]

Chart of the Week – November 13, 2023

The Bottom Line: Investors in sustainable taxable mutual funds and ETFs exhibited a level of stickiness during a very challenging six-month period for fixed income. Net assets of sustainable taxable and municipal bond funds: May 31, 2013 – October 31, 2013 Notes of Explanation: Bond funds include mutual funds and ETFs. Source: Morningstar Direct, Sustainable […]