The Bottom Line: Renewable and clean energy mutual funds and ETFs, performance leaders in July, should benefit from the just enacted Inflation Reduction Act (IRA).

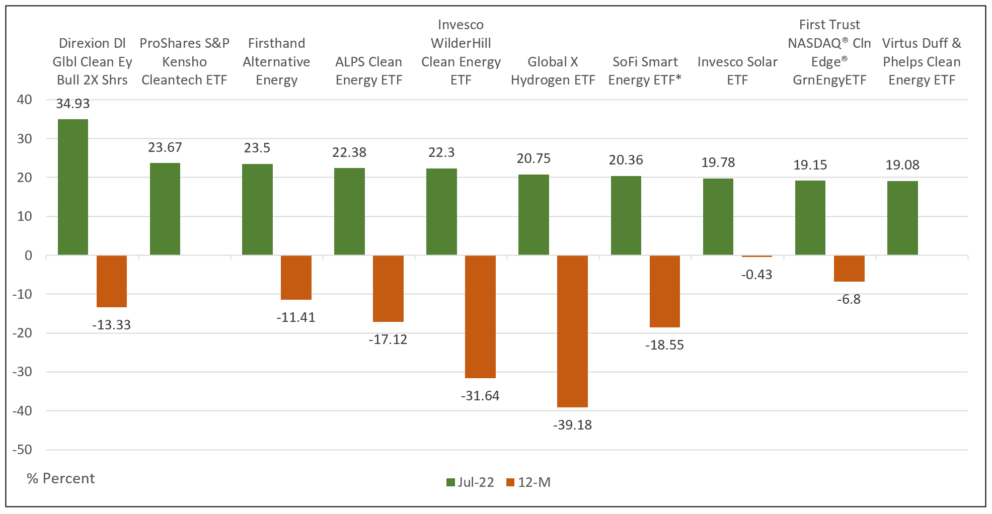

Performance of the top 10 mutual funds and ETFs: July 2022 and trailing 12-months (12-M) Notes of Explanation: *Name change from iClima Distributed Smart Energy ETF effective as of August 9, 2022. ProShares S&P Kensho Cleantech ETF and Virtus Duff & Phelps Clean Energy ETF were not in operation for the full trailing 12-M interval. Sources: Morningstar Direct, fund disclosures and Sustainable Research and Analysis LLC.

Notes of Explanation: *Name change from iClima Distributed Smart Energy ETF effective as of August 9, 2022. ProShares S&P Kensho Cleantech ETF and Virtus Duff & Phelps Clean Energy ETF were not in operation for the full trailing 12-M interval. Sources: Morningstar Direct, fund disclosures and Sustainable Research and Analysis LLC.

Observations:

- The universe of active and passively managed sustainable mutual funds and ETFs as defined by Morningstar, a total of 1,343 funds as of July 31, 2022, posted an average return of 6.50%. Sustainable equity funds gained 8.34% while fixed income funds added 2.33%.

- Leading in the performance rankings for the month were all renewable thematic energy funds that benefited from concerns over climate change and the anticipated passage of the Inflation Reduction Act (IRA). IRA, which was signed into law by President Joe Biden on August 16, is a major piece of legislation that does more to cut fossil fuel use and fight climate change than any previous legislation in the US. The main thrust of the bill is the $369 billion provision toward clean energy assets and technologies over the next decade. The IRA provides tax credits reducing the cost to deploy new wind and solar assets, acquire new electric and hybrid vehicles, and invest in renewables and clean energy technologies, including clean hydrogen production and carbon capture and storage (CCS). These provisions, according to the Rhodium Group, are likely to reduce carbon emissions 37% to 41% below 2005 levels by 2030.

- The top ten performing funds in July, posting an average return of 22.8%, were all thematic-oriented renewable energy funds pursuing various strategies from clean and alternative energy generally to more targeted or strategies such as solar and hydrogen power. Top holdings, based on latest reported positions held, include Enphase Energy (ENPH), a Freemont California-based company that develops, manufactures and sells solar micro-inverters, energy generation monitoring software and battery energy storage products, primarily for residential customers. ENPH is followed by First Solar, Inc. (FSLR), a manufacturer of solar panels, and a provider of utility-scale PV power plants and supporting services that include finance, construction, maintenance and end-of-life panel recycling, Plug Power Inc. (PLUG), an American company engaged in the development of hydrogen fuel cell systems that replace conventional batteries in equipment and vehicles powered by electricity, and Solar Edge Technologies (SEDG), an Israeli company that develops and sells solar inverters for photovoltaic arrays, energy generation monitoring software, battery energy storage products, as well as other related products and services to residential, commercial and industrial customers. Only two funds hold Tesla (TSLA)

- Returns ranged from a high of 34.93% posted by the $5.3 million leveraged Direxion Daily Global Clean Energy Bull 2X ETF (KLNE) to 19.08% recorded by the Virtus Duff & Phelps Clean Energy ETF (VCLN), another small fund at $3.7 million.

- Reflecting the volatility of the segment, these outstanding July results were not enough to offset in their entirety the trailing average -17.3% returns registered by the eight more seasoned funds over the trailing 12-month interval to July 2022. That said, these funds and others in this category should benefit from spending under the Inflation Reduction Act (IRA).