The Bottom Line: Dow Jones survey reports that recent developments like the pandemic, the Ukraine conflict and the energy crisis are influencing sustainable investing practices.

0:00

/

0:00

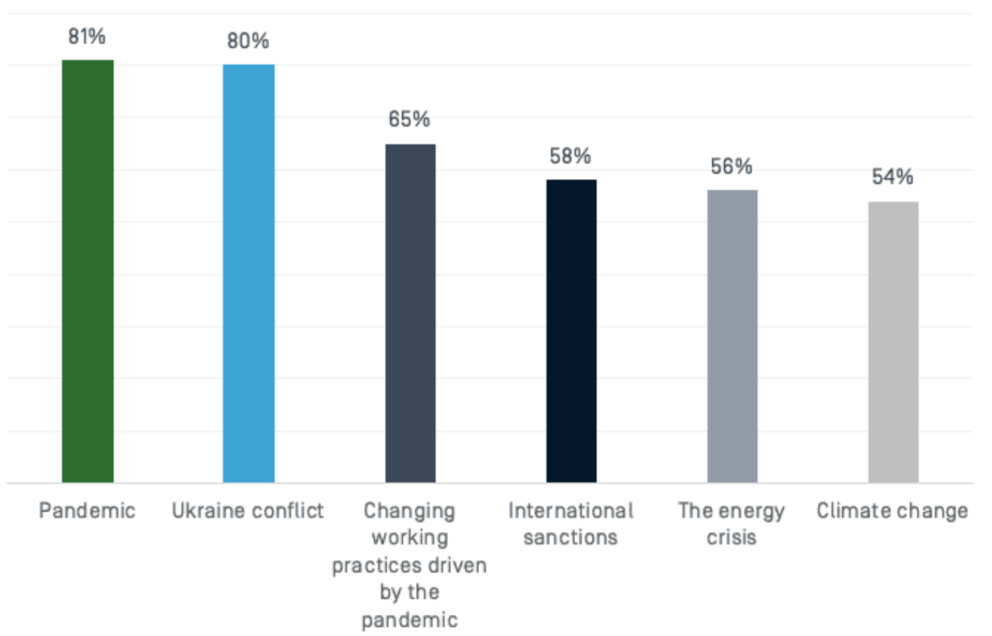

Developments impacting the strategic thinking of senior managers around ESG strategies

Notes of Explanation: Dow Jones collaborated with Coleman Parkes, a B2B market research specialist, to conduct this survey in April – May 2022 using phone to web methodology. They targeted 200 senior leaders in investment management firms with more than $750 billion in assets, in the UK and U.S. All participants had a role in sustainable investments. The responses above were to the question: How, if at all, have the following impacted your strategic thinking, especially around ESG strategies. Source: Dow Jones.

Notes of Explanation: Dow Jones collaborated with Coleman Parkes, a B2B market research specialist, to conduct this survey in April – May 2022 using phone to web methodology. They targeted 200 senior leaders in investment management firms with more than $750 billion in assets, in the UK and U.S. All participants had a role in sustainable investments. The responses above were to the question: How, if at all, have the following impacted your strategic thinking, especially around ESG strategies. Source: Dow Jones.

Observations:

- Released last month in conjunction with the launch of a new sustainability data set covering thousands of publicly traded companies, a survey conducted in April-May 2022 and published in September by Dow Jones, a News Co. affiliate, concluded that ESG investments are “projected to double in the next three years, accounting for 15% of all investments by 2025.” The survey targeted 200 senior leaders in investment management firms with more than $750 billion in assets in the US and the UK.

- The numerical conclusions are curious given that as recently as 2020 global sustainable assets reportedly reached $35.3 trillion in assets under management¹ and accounted for 35.9% of total assets under management. ESG investments along with negative/exclusionary screening practices are dominant and are not likely to double in the next three years. The puzzlement around the data is likely attributable to the lack of consensus around terms and definitions.

- Still, the survey notes that recent developments such as the pandemic, the Ukraine conflict, the energy crisis and climate change are accelerating the move towards more sustainable investing practices. At the same time, the absence of timely, relevant and trustworthy information and tools can challenge the growth trajectory.

- Recent top of mind developments, however, are likely to be playing an informing role rather than shifting long-term and more entrenched drivers of ESG investing in equities and fixed income that include risk management, client demand, regulations, and fiduciary responsibility. Alpha generation, another investment consideration, has begun to trail off in the last year. The above noted long-term drivers are also impacted by the often-cited lack of comparable and historical data.

¹Source: Global Sustainable investment Review 2020