The Bottom Line: Putnam Investments announces rebranding of its RetirementReady funds effective later this year or early 2023, thereby expanding sustainable target date fund options.

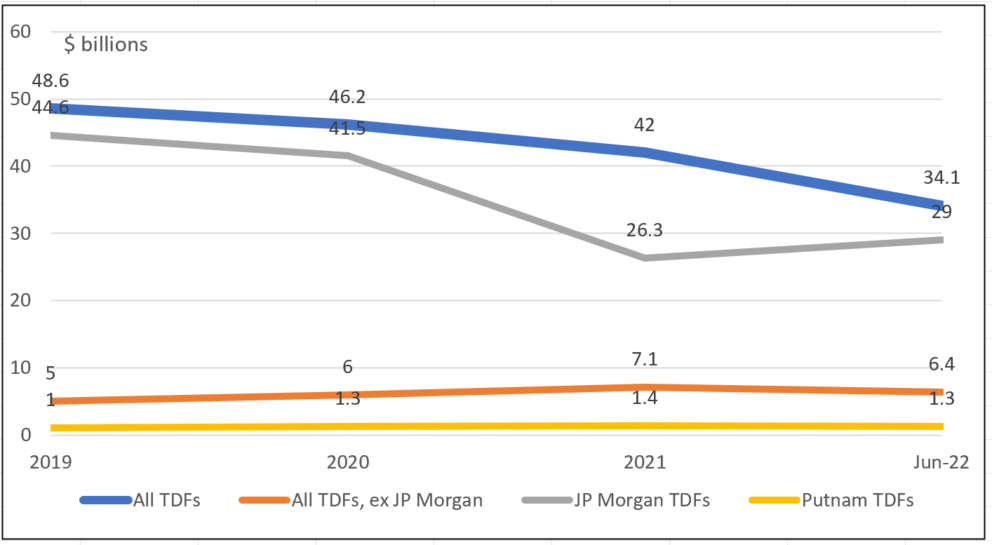

Assets of sustainable target date funds: 2019 – June 2022 Note of Explanation: All TDFs exclude Putnam’s RetirementReady funds. Data sources: Morningstar Direct and Sustainable Research and Analysis LLC.

Note of Explanation: All TDFs exclude Putnam’s RetirementReady funds. Data sources: Morningstar Direct and Sustainable Research and Analysis LLC.

Observations:

- Putnam Investments has become the latest firm to offer a sustainable target date mutual fund product, adding yet another option for sustainable investors by expanding to five the identified universe¹ of fund firms offering such products. This identified universe consists of 36 funds offering 131 share classes with explicit sustainable investing mandates based on prospectus language that manage $34.1 billion in combined net assets as of June 30, 2022 (excluding Putnam). The segment is dominated by J. P. Morgan’s $34.1 billion in SmartRetirement Fund assets that were rebranded as of December 23, 2021 via prospectus amendments to onboard the consideration of certain environmental, social and governance (ESG) factors in the investment process.

- On July 1, 2022 Putnan Investments amended the prospectus applicable to its Putnam RetirementReady funds, a series of 10 funds consisting of 88 share classes, with $1.3 billion in assets under management. Putnam will be rebranding its RetirementReady funds by changing the name of the funds as well as their investment strategies. Effective in the fourth quarter of 2022 or the first quarter of 2023, the funds’ names will change to Putnam Sustainable Retirement funds and the funds’ strategies by investing in Putnam Management-sponsored exchange-traded funds that focus on investments with positive sustainability or environmental, social and governance characteristics.

- The expanded identified universe of sustainable target date funds for retail and institutional investors now consists of funds offered by J.P. Morgan Investment Management, BlackRock, Natixis and GuideStone. These funds employ varying approaches to sustainable investing.

- Under the proposed (yet to be enacted) SEC enhanced disclosure guidelines applicable to certain investment advisers and investment companies about their ESG investment practices, the five target date funds would be classified as follows:

-JPMorgan SmartRetirement. Integration Fund. Subject to limited additional disclosures, focused on how the fund incorporates ESG factors into its investment selection process.

–BlackRock LifePath ESG Index, GuideStone Funds MyDestination, Natixis Sustainable Future and Putnam RetirementReady. ESG-Focused Fund. Subject to additional disclosures about how the fund focuses on ESG factors in its investment process.

¹Identified universe include funds researched by Sustainable Research and Analysis that have explicitly signified in their prospectus the adoption of sustainable investing practices. All underlying funds must, in turn, employ sustainable investing strategies to qualify.